Ctrip’s Established Order and New Frontier

![]() 11/21 2025

11/21 2025

![]() 403

403

Written by | Wu Kunyan

Edited by | Wu Xianzhi

Industries that are the most heavily standardized often face the greatest challenges in meeting non-standard new demands. Take department stores, for instance, which once dominated the retail sector. Their standardized supply chains and branded shelves were disrupted by the non-standard offerings of e-commerce and content platforms.

This generational shift is extremely difficult to reverse, with its pace inversely related to the scarcity of standardized supply, as seen in the service-oriented tourism industry. Despite increasing competition, market leader Ctrip remains steadfast.

On November 18, Ctrip released its third-quarter financial report for 2025, showing net operating revenue reaching RMB 18.3 billion, a 16% year-on-year increase. Adjusted EBITDA (excluding investment gains) reached RMB 6.3 billion.

Over the past few years, we've seen numerous emerging players attempting to break through the established order from various angles: Meituan captured the low-tier hotel market, which traditional Online Travel Agencies (OTAs) struggled to penetrate due to cost structure issues; content platforms focused on consumer entry points and pre-sale experiences; and Fliggy, a platform-model player, concentrated on the flexibility of organized supply.

Each approach has, to some extent, disrupted the industry's past centralized organizational supply, causing Ctrip headaches for a while. However, they failed to strike at its core—the supply side's "inertia of being organized," such as reliance on traffic and evaluation systems. A more significant factor lies in consumers being "locked in" by the platform's one-stop consumption chain.

In the past two years, both sides of the old model have started to change. Hotel groups have continuously expanded their channels and independent customer acquisition capabilities, accelerating their "decoupling" from centralized organizations. Consumers, driven by personalized travel needs, have begun to pursue non-standard products and experiences, self-deconstructing the consumption chain.

Amidst these changes, Ctrip has increasingly shifted its development focus to overseas incremental markets, while its domestic actions have tended toward defense.

Secondary Segmentation of Traffic

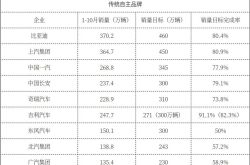

The emergence of new distribution forms has led to a "wolf is coming" narrative that played out two years ago. However, due to factors such as low online penetration and overall excess hotel supply, the supply side was slow to adapt, and the new entrants overextended themselves. The financial report shows that Ctrip's accommodation reservation revenue for this quarter increased by 18% year-on-year to RMB 8 billion.

With new signals continuously emerging, Ctrip will face a second round of challenges from these new entrants.

The most obvious differences from the previous round are threefold: On the demand side, the continuous emergence of personalized new travel methods is fragmenting the entire travel experience more and more; on the supply side, after entering a phase of excess following the 2023 recovery stimulus, the industry as a whole has begun to self-optimize, such as through direct sales, customer acquisition, user and content management, etc.; on the platform side, the battle between food delivery and instant retail has introduced new traffic sources to the industry.

Douyin's (TikTok's sister app in China) short videos and livestreams are turning travel decisions into spontaneous actions rather than preset tasks; Xiaohongshu's (Little Red Book) community content continues to capture search mindshare while slowly altering the excitation-transaction chain; Fliggy and Meituan naturally attract traffic in the cross-selling arena of local life.

The sales push by some players during the peak travel season is just one aspect. A report released by Douyin shows that from October 1st to October 7th, sales of various accommodation group-buying deals increased by more than 50% year-on-year. Fliggy also released battle reports, showing that during the National Day holidays, its platform's fulfilled Gross Merchandise Volume (GMV) increased by 48% year-on-year, global hotel room nights increased by 78%, and the number of service users increased by 30%.

They overlap in specific paths, such as providing traffic and commission-free services to the supply side, while using cost-effectiveness as a hook for the user side. However, having learned from initial failures due to fulfillment issues, they have begun to reorganize their supply fulfillment forms.

Douyin has chosen to open its ecosystem, attracting Ctrip-affiliated platform entities to set up shop, with transactions and after-sales handled by the platform. This alleviates losses caused by verification on the platform side while reducing merchant risks. Fliggy has jumped on the big consumption bandwagon, with the hundreds of millions of traffic surging in from flash sales giving it the ability to corral lower-tier supply.

A bigger risk comes from the demand side. Taking Xiaohongshu as an example, its monthly active users interested in tourism surpassed 100 million in 2024, with 1.6 billion travel-related searches occurring monthly on average. Driven by personalized demands, users no longer solely start their travel searches from OTAs, naturally ceding distribution capabilities to other platforms and giving them the opportunity to seize the front end of the demand generation chain.

Accompanying the dispersion of demand is the normalization of multi-platform purchases. Users might book hotels on Ctrip, purchase scenic spot tickets or packages on Fliggy, and buy local entertainment on Meituan, fragmenting the travel chain.

Reflected in financial indicators is that while Ctrip maintains high growth rates in single segments, its integrated tourism and vacation segment shows slowing growth. The financial report shows that with continuous international product expansion, Ctrip's tourism and vacation business increased by only 3% year-on-year this quarter, signaling a slowdown in integrated and packaged tourism products.

The Fire and Ice of Inbound and Outbound Travel

Capital expenditures indicate a company's development direction. For Ctrip, which needs to maintain high profits over the long term to reinvest in supply construction, the flow of expenses represents where it perceives incremental growth.

The financial report shows that Ctrip's sales and marketing expenses for this quarter increased by 23% year-on-year and 26% quarter-on-quarter to RMB 4.2 billion, with the incremental spending primarily used for international expansion. As early as the first quarter of this year, management publicly stated that sales expenses are expected to remain under long-term pressure to deepen Trip.com's position in the Asia-Pacific market.

Ctrip's globalization layout has undergone a noticeable shift in focus, reflected in its investment portfolio, with its assets and investment directions gradually shifting from Europe, before the black swan event, to the Asia-Pacific region.

Since 2015, Ctrip has successively acquired UK-based aviation platform Travelfusion, travel search website Skyscanner, Dutch airline ticket sales service provider Travix, etc. Since 2023, Ctrip has made few acquisitions, with its moves basically confined to Southeast Asia, such as the Ctrip Asia Livestream Center, which was unveiled in August last year and began radiating outward this year.

Focusing on the Asia-Pacific region for overseas expansion offers two obvious advantages: geographically, it is closer to home, making it an ideal destination with relatively low travel costs. Data shows that China has been the top source market for Vietnam, Thailand, Malaysia, and other countries for three consecutive years.

Southeast Asia has "sprinted" into the mobile internet era, with mobile devices as the primary transaction scene and a rapidly growing online penetration rate, representing structural advantages. In contrast, mature markets mostly have their supply organized by offline travel agencies, relying on webpage SEO optimization for online presence. The market characteristics of Southeast Asia have spared Ctrip from a significant portion of cost-side pressure.

Ctrip's stable investments have also yielded stable growth in this context. Among the platform's 60% year-on-year growth in international bookings, the Asia-Pacific region contributed the most. In contrast, Europe, which Ctrip initially targeted for internationalization, has more to say, as it may slow down the overall profit performance of cross-border travel after Ctrip establishes a competitive advantage.

As mentioned earlier, Trip.com's growth in Southeast Asia largely stems from mobile devices, with 70% of its orders in the region coming from mobile. In contrast, the European market presents a different picture: In the third quarter, international flight capacity has recovered to 88% of 2019 levels, with the significant difference from six months ago being that the capacity recovery is concentrated in Europe.

An international ground handler told Photon Planet that when the tourism market fully recovered in 2023, the recovery in the European market significantly lagged behind that of the Asia-Pacific region.

"International airlines found it difficult to compete with domestic airlines on pricing, and flight openings were slow. Moreover, the product combinations of offline travel agencies lagged behind capacity, resulting in a prolonged lack of good supply in the European market."

It wasn't until the visa-free policies gradually opened up to various European countries in the first half of this year that there was a strong stimulus in inbound travel demand. The capacity recovery of international airlines accelerated, and travel agency products followed suit. As a mature tourism market, European tourists have strong purchasing power and high demands for service standardization and specialty tourism, representing an incremental market that cannot be ignored. To compete for this gradually recovering "emerging market," Ctrip needs to invest more resources than in the Asia-Pacific region.

Perhaps this is why, during the financial report conference call, HSBC specifically asked management about the impact of Google's changes to search advertising. Previously, Google's webpage ranking adopted the traditional SEM (Search Engine Marketing) format, namely PPC (Pay-Per-Click) for paid advertising and SEO (Search Engine Optimization) for organic ranking through operational improvements. Now, Google has introduced the Genemi model, reorganizing search results with AI, to some extent, subverting Ctrip's accumulation in meta-search engines.

Management did not directly respond to this question, instead brushing it off with the high growth in the Asia-Pacific region.

During the National Day holidays, European countries with visa-free policies, such as France, were among the important source countries for inbound tourism to China, with France seeing an approximately 40% increase in tourism orders to China compared to the same period last year. Even though Trip.com has achieved relatively stable advantages in the Asia-Pacific region, neglecting other areas is still not a viable option.

Weak Competition Is Still Competition

Dior, Prada, Louis Vuitton—these luxury brands that have entered the mainstream consciousness through social media often have decades or even centuries of history. Despite the rise and fall of eras, their survival and even status have not been threatened. The reason lies in the fact that luxury is an industry of strong trust, presenting a state of weak competition.

The logic of tourism is similar. User demand is low-frequency, and users are unwilling to frequently switch platforms for high-ticket, high-risk decisions. On the merchant side, suppliers (hotels, airlines, scenic spots) also prefer stable channels and long-term cooperation, unwilling to frequently switch to extremely costly distribution systems. Risk aversion on the demand side and deep dependence on the supply side have created Ctrip's current dominant position.

In 2019, Ctrip's founder, James Liang, once bluntly stated at a dinner that "the traffic model has passed." Indeed, except for Meituan, which has practically carved out the low-tier supply, platform-level players that once intended to "carve up" Ctrip were still in their infancy at the time.

Ctrip has never been concerned with the superficial activity of competition; as long as the industry's supply and demand structure has not undergone significant changes, Ctrip can remain unmoved. The problem lies in the fact that the structure has indeed changed in the past two years.

Take supply construction as an example: Traditional OTAs rely on strong control, extending control mechanisms such as price control, evaluation systems, and special and gold medal systems to ensure stability. If we abstract this into a balance scale, the demand side undoubtedly weighs more. In the latter half of the year, Ctrip rarely made a move, introducing a "bidirectional review" mechanism to maintain balance.

It is reported that this mechanism allows hotel operators to record instances where guests attempt to coerce or solicit improper benefits through negative reviews via the "Report Misconduct" button on the EBK order page. For guests with particularly egregious behavior, they can also be blacklisted. Appeals go through an AI intelligent risk control review + manual review process.

Platform economy models are diverse. If we liken malicious negative reviews to "refund-only" policies, Ctrip's move toward the supply side comes nearly two years later than e-commerce platforms.

Ji Qi, the founder of Huazhu Group, stated at the Huazhu Partner Conference that the biggest opportunity for China's hotel industry lies in supply-side reform. As the segment contributing the most to Ctrip's profits, the supply side's "independence" and self-upgrading demands have become strong enough to further deepen chain operations and membership construction.

The seeds for market transformation have already been planted, and ever since the "Qunar shock" of 2014, Ctrip could potentially encounter a fresh structural hurdle. This hurdle is propelled by shifts in the fundamental demand-supply dynamics. The key distinction lies in the fact that today's rivals are all colossal platforms, which Ctrip cannot overcome merely through capital-based strategies.

Even a weak competitive force remains a form of competition. As Ctrip attains a new profit zenith, propelled by capital gains, it simultaneously marks the commencement of a new cycle for Ctrip to re-evaluate and streamline its platform's inherent value.