TOP 10 Chip Leaders: Some Revel, Some Struggle

![]() 11/24 2025

11/24 2025

![]() 586

586

As 2025 enters its final quarter, the global semiconductor industry's growth has shifted from cyclical recovery to structural transformation. Two keywords dominate industry focus: AI and storage.

Tracing the industry's growth trajectory, the rise of these two sectors was foreshadowed in quarterly data.

01

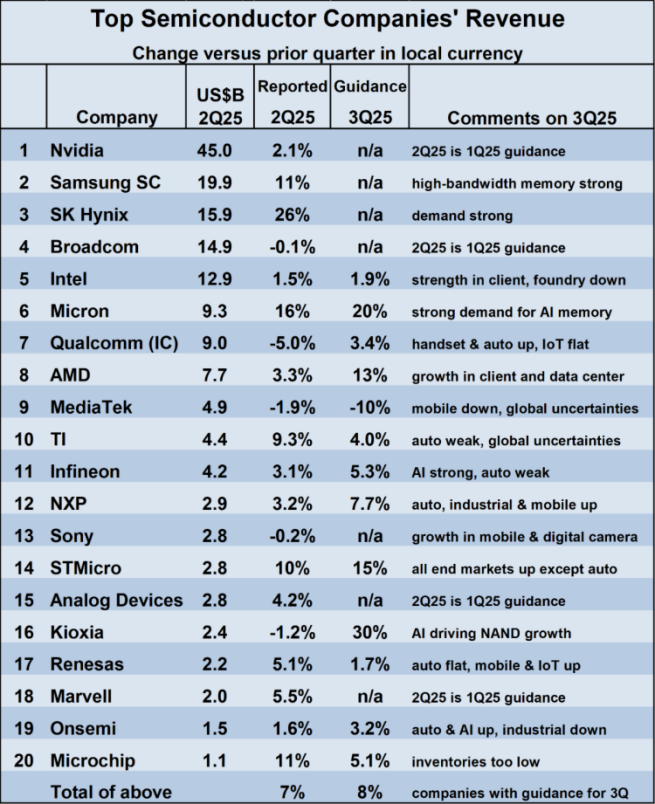

TOP 20 Chip Companies: Latest Rankings

According to WSTS data, the global semiconductor market reached $180 billion in Q2 2025, up 7.8% from Q1 2025 and 19.6% from Q2 2024. This marked the sixth consecutive quarter of over 18% YoY growth. Behind this robust expansion lies the beginning of structural differentiation. WSTS listed the top 20 semiconductor companies by revenue, excluding foundries like TSMC and firms producing semiconductors solely for internal use, such as Apple. The list includes companies selling devices on the open market.

Most companies saw steady revenue growth in Q2 2025 compared to Q1, with a weighted average increase of 7%.

Memory companies experienced the largest gains, with SK Hynix growing by 26%, Micron Technology by 16%, and Samsung by 11%—aligning with the "storage buzzword" mentioned earlier. This marked the first time Samsung and SK Hynix ranked in the TOP 3. Previously, in the 2024 global rankings, the top three chip companies were Nvidia, Samsung Electronics, and Intel, with SK Hynix appearing fourth.

Among non-memory companies, Microchip Technology (11%), STMicroelectronics (10%), and Texas Instruments (9.3%) saw the largest revenue increases.

Nearly all companies providing guidance expect healthy revenue growth in Q3 2025 compared to Q2. Memory companies again lead the pack, with Micron projecting a 20% increase and Kioxia anticipating a 30% rise. Both cited AI application demand as a key driver.

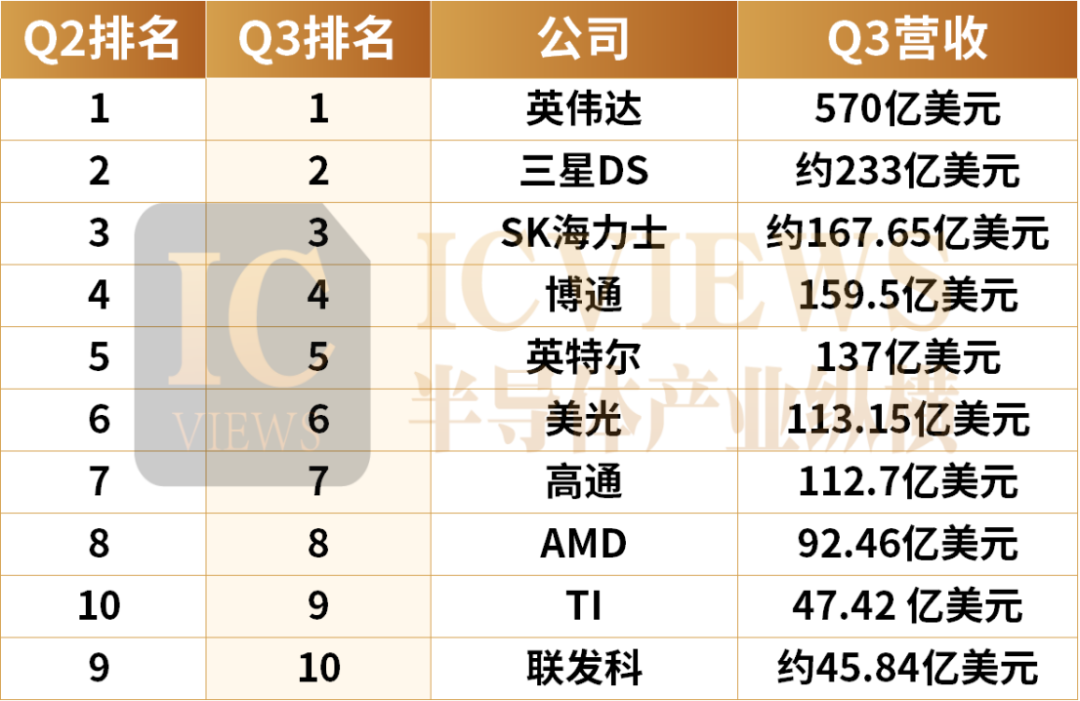

Building on the WSTS Q2 2025 TOP 20 semiconductor rankings, most chip giants have now unveiled their Q3 results as earnings disclosures conclude. Driven by the dual forces of AI computing power explosion and simultaneous growth in volume and price in the storage market, performance divergence among leading firms has intensified.

02

Q3 Earnings Reports Unveiled

Nvidia's revenue for Q3 FY2026 (ending October 26) hit a record $57 billion, far exceeding market estimates of $54.92 billion, with a 62% YoY and 22% QoQ increase.

Among its business lines, data centers remained the core growth driver. Revenue in this segment surpassed $50 billion for the first time, reaching $51.2 billion—easily topping analyst estimates of $49.09 billion—with a staggering 66% YoY and 25% QoQ surge, accounting for nearly 90% of total revenue.

Samsung Electronics also delivered a stronger-than-expected performance. Q3 consolidated sales reached KRW 86.06 trillion (~$60.6 billion), with operating profit soaring to KRW 12.16 trillion (~$8.56 billion), a 32.2% YoY spike. Its core Device Solutions (DS) division generated KRW 33.1 trillion (~$23.3 billion) in revenue, with storage sales—boosted by HBM3E and server SSDs—rising 19% QoQ. Memory business quarterly sales hit a record KRW 26.7 trillion.

SK Hynix also shone, with Q3 FY2025 operating revenue reaching KRW 24.4489 trillion (~$16.765 billion), a 39% YoY increase; operating profit hit KRW 11.3834 trillion, up 62% YoY; and net profit reached KRW 12.5975 trillion, a 119% YoY surge. Operating and net profit margins hit quarterly records of 47% and 52%, respectively.

Broadcom's Q3 FY2025 results (ending August 3, 2025) showed revenue of $15.95 billion, a 22% YoY increase, topping analyst expectations of $15.84 billion and the company's prior guidance of $15.8 billion—marking its highest Q3 revenue ever. Non-GAAP adjusted net profit reached $8.404 billion, a 37.3% YoY rise.

Intel's Q3 revenue hit $13.7 billion, a 3% YoY increase; net profit attributable to Intel reached $4.1 billion, compared to a net loss of $1.66 billion in the same period last year.

Micron's Q4 FY2025 revenue reached $11.315 billion, up 21.5% from $9.301 billion in the previous quarter and 46.0% from $7.75 billion YoY. GAAP net income for the quarter was $3.201 billion ($2.83 per diluted share); non-GAAP net income reached $3.469 billion ($3.03 per diluted share).

Qualcomm's Q4 FY2025 report (ending September 28) showed revenue of $11.27 billion, a 10% YoY increase from $10.244 billion, surpassing analyst expectations of $10.79 billion (LSEG). Affected by tax expenses, it reported a net loss of $3.117 billion, compared to net income of $2.92 billion YoY. On a non-GAAP basis, adjusted net profit reached $3.257 billion, a 7% YoY increase from $3.036 billion.

AMD's Q3 FY2025 report (ending September 27) showed revenue of $9.246 billion, a 36% YoY increase; net profit reached $1.243 billion, a 61% YoY surge.

MediaTek's Q3 2025 revenue reached NT$142.097 billion (~$4.584 billion), a 5.5% QoQ decline but a 7.8% YoY increase; net profit was NT$25.451 billion, a 9.3% QoQ and 0.5% YoY decrease.

TI's Q3 2025 results (ending September 30) showed revenue of $4.742 billion, a 14% YoY and 7% QoQ increase, topping market expectations of $4.65 billion; operating profit rose 7% YoY to $1.663 billion; and earnings per share increased 1% YoY to $1.48, surpassing market expectations of $1.49.

Infineon's Q3 report (ending June 30) showed revenue of €3.704 billion (~$4.274 billion) and profit of €668 million, with a margin of 18.0%. Q4 results are pending.

NXP's Q3 2025 financial results (ending September 28) showed revenue of $3.17 billion, a 2% YoY decline. GAAP gross margin was 56.3%, operating margin 28.1%, and diluted net profit per share $2.48. Non-GAAP gross margin was 57.0%, operating margin 33.8%, and diluted net profit per share $3.11.

Companies like Sony, STMicroelectronics, ADI, and Kioxia had minimal impact on the TOP 10 rankings and were not included in this statistics (Chinese term left untranslated for context). The author ranks the latest quarterly performance based on Q3 FY2025 results from the aforementioned companies.

Note: Rankings are based on publicly available financial data conversions; companies like Apple, which do not primarily sell devices, are excluded. Exchange rate fluctuations may cause minor discrepancies.

In Q3 2025, the global semiconductor industry sustained its H1 growth momentum, but the structure of growth drivers became more differentiated.

03

Four Hyper-Popular Companies Under AI and Storage Concepts

Nvidia: Unshakable AI Dominance

Nvidia founder and CEO Jensen Huang emphasized in the earnings report that sales of its latest-generation Blackwell architecture chips have "skyrocketed," with cloud service providers' GPU inventories depleted and demand for high-performance computing products far from saturated.

Today, Nvidia is transitioning from a "GPU supplier" to an "AI infrastructure operator." Through its powerful CUDA software ecosystem, AI Enterprise software stack, and Omniverse platform, Nvidia deeply binds developers and enterprise clients, aiming to capture a larger share of the AI market.

Nvidia expects Q4 revenue to further increase to $65 billion, significantly exceeding market expectations of $61.66 billion—underscoring robust AI computing demand.

The "Golden Duo" Driven by HBM

The most notable trend in Q3 2025 was high-bandwidth memory (HBM) becoming the primary growth engine for the storage market. As AI large model training demands continue to escalate for computing density, GPU-paired HBM3E and upcoming HBM4 have become standard in high-end AI chip systems.

Against this backdrop, Samsung and SK Hynix form the current "Golden Duo" of global HBM supply.

SK Hynix remains the absolute leader in the HBM market, holding roughly 60% global market share. Its HBM3E products are mass-shipping to Nvidia's H200/H300 platforms and have begun deliveries to AMD's MI350 series. During the earnings call, the company revealed that as of Q3-end, its HBM capacity utilization neared full load, with all new capacity through 2026 already pre-booked by clients.

Samsung is rapidly closing the gap. Unlike previous lags behind SK Hynix, Samsung's HBM products saw several developments this year: (1) In September, Economic Daily News reported that Samsung passed Nvidia's certification tests for its 12-layer HBM3E products. (2) HBM4 samples have been provided to clients for testing this year, with plans to commercialize HBM4 next year. (3) Market reports suggest Samsung is launching a aggressive pricing strategy—offering its 12-layer HBM3E chips at 30% below competitors' prices—to reclaim market share lost due to certification delays.

Micron holds a smaller HBM market share but entered Nvidia's supply chain earlier with its HBM3E products, bolstering its HBM influence. Meanwhile, Micron plans to mass-produce HBM4 in Q2 2026. Simultaneously, server SSD demand has surged. As AI inference workloads migrate to edges and enterprise data lake architectures upgrade, PCIe Gen5 SSD orders have spiked. Kioxia and Western Digital, absent from the TOP 10, will also benefit.

Broadcom: The Rise of a Stealth Champion

Broadcom's benefits from the AI wave are often underestimated, but it is one of the biggest winners in AI cluster networking. Its XGS-PON switch chips, PHY devices, and customized Tomahawk/Trident series are widely used in interconnection architectures between Meta, Microsoft Azure, and Google TPU.

Broadcom CEO Hock Tan revealed that Q3 AI semiconductor revenue surged 63% YoY to $5.2 billion, topping analyst expectations of $5.11 billion and accelerating from the previous quarter's 46% growth.

Compared to the rapid advances in AI and storage, the analog and microcontroller (MCU) sectors exhibit clear structural divergence.

Texas Instruments (TI) saw Q3 revenue rise 14% YoY, driven by robust demand in industrial automation, grid energy storage, and electric vehicle BMS (battery management systems).

However, TI's Q4 outlook shocked markets. The company stated that Q4 revenue is expected to fall between $4.22 billion and $4.58 billion, compared to analysts' average forecast of $4.5 billion; earnings per share are projected at approximately $1.26, well below market expectations of $1.39. This below-market guidance signals strong demand-side pressure.

STMicroelectronics' financial data also reveals signs of cooling, with multiple core operating metrics declining significantly YoY in Q3 2025.