Is Dongchedi flying solo, retracing the old path of Autohome?

![]() 06/14 2024

06/14 2024

![]() 608

608

The spiral of history continues to unfold.

@New Entropy Original

Author: Yingmu | Editor: Yiye

Founded for nearly seven years, Dongchedi is facing a significant transformation.

Recent news indicates that ByteDance's automotive business is currently planning to spin off and raise 800 million US dollars in financing. Subsequently, media disclosed that the financing party has been basically locked in, with Sequoia China leading the investment with an amount of 4-500 million US dollars. In addition, KKR and General Atlantic will also participate in Dongchedi's current round of financing, and based on the current scale, the overall valuation is approximately 3 billion US dollars.

The spin-off of Dongchedi actually had early signs. According to Tianyancha, at the end of 2023, Beijing Dongchedi Technology Co., Ltd., a related company of Dongchedi, underwent a business change, with the major shareholder changing from Toutiao Limited to Xiamen Dongchezu Technology Co., Ltd., holding 100% of the shares. In January of this year, third-party news revealed that Dongchedi-related employees would move to a newly established wholly-owned subsidiary, with the legal representative served by the strategic leader of Dongchedi, and a small portion of employees originally belonging to ByteDance would be the first to transfer their labor relations to the new company.

From a historical perspective, Dongchedi has always been a veteran of the ByteDance ecosystem. From the APP to the automotive channel in the Toutiao era, to the integration of multiple platforms such as Douyin and Xigua Video, Dongchedi has always played an important role as a content provider. The support from ByteDance is also one of Dongchedi's biggest competitive advantages.

However, as ByteDance's layout matures and Dongchedi enters the forefront of automotive vertical media, the relationship between the two has begun to become subtle. Especially at ByteDance's annual meeting in March 2023, CEO Liang Rubo clearly listed "information platform" and "e-commerce" as the main businesses. He said that ByteDance would focus on investing in these two types of businesses in the next year to "strengthen basic skills".

At the same time, within ByteDance, "the standards for establishing new business projects must be raised," and projects with unclear visions and outstanding values will be cut off. Liang Rubo believes that having too many projects will squeeze existing resources, requiring business teams to enhance their business awareness, focus on financial benefits, and use higher standards to measure whether certain projects are worth investing in. The superposition of investors' need for cash-out and ByteDance's accelerated efforts in AI have given Dongchedi's financing and listing considerable symbolic significance.

Independence, financing, and listing seem to be the key trends for Dongchedi's development in the near future, but according to the paths of Autohome and Yiche, Dongchedi still faces many challenges.

First, all automotive vertical media will face the issue of "balance between business and content fairness." When Dongchedi first launched in 2017, it differentiated itself from Autohome and Yiche by adopting the slogan "tell the truth," directly pointing out the old problem of automotive information websites being "recharged" by manufacturers and 4S stores. However, a "winter test" incident in 2023 made consumers and fans witness the embarrassment of being both a player and a referee. Criticisms from auto industry bigwigs like Yu Chengdong dealt an unprecedented blow to Dongchedi's reputation. When "telling the truth" faces recharge, how should business and objectivity be balanced?

The second challenge is traffic. For Dongchedi, the potential crisis of traffic in the future may come from two aspects. First, after independence, whether ByteDance will continue to tilt a large amount of low-cost traffic to Dongchedi. Second, internally, Dongchedi's IP value is currently in a decline.

A large number of automotive bloggers on Douyin have long been the target of Dongchedi's investment, but the content that Dongchedi itself can attract traffic is decreasing. Besides a repeatedly mentioned sales ranking and traditional strengths in evaluations, other content has not been outstanding. On the other hand, the discourse power of the new generation of automotive vertical media is undergoing a shakeup. The entry of founders like Lei Jun has enriched this ecosystem while taking away considerable traffic. The loss of power by traditional media professionals is also changing the new landscape. Recent incidents like the Yan Chuang incident have made people realize that the discourse power of traffic seems to be undergoing a change. What role should Dongchedi play for brand-new traffic stars?

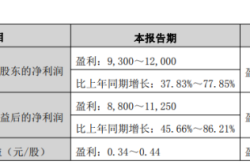

The biggest challenge may be the ceiling issue after listing. As a mature track, Autohome and Yiche have demonstrated almost all types of capital stories for Dongchedi. On December 11, 2013, Autohome rang the bell for its listing on the New York Stock Exchange, with an opening price of 30.16 US dollars, reaching a high of 115 US dollars in 2019. However, today, the stock price and market value have returned to the level of a decade ago. A price of 28 US dollars and a market value of 3.4 billion US dollars seem to be the ceiling of this industry.

With a similar plot, Yiche's ending was even more tragic, having to complete privatization and delist. From historical experience, Dongchedi, which benchmarks the above two players, does not seem to have much difference besides the support of Douyin. Therefore, today's valuation similar to Autohome (21.7 billion) has almost exhausted all imagination.

Dongchedi has fired the first shot of ByteDance's capitalization, but the uncertainty of whether it can surpass its predecessors remains significant.