The battle in the enterprise service market continues, with Feishu once again facing headwinds

![]() 06/18 2024

06/18 2024

![]() 641

641

Zhang Nan, a veteran of ByteDance, "flies against the wind" with Feishu.

@NewEntropy Original Author: Wang Siyuan, Editor: Yi Ye

The simple statement that "Zhang Nan's resignation is mainly due to personal reasons" has caused ripples on the calm surface of the enterprise service market, like a heavy bomb.

Three months ago, the anxious CEO of Feishu, Xie Xin, laid off over a thousand employees with a company-wide letter, but no executives were involved. Now, with the news of President Zhang Nan leaving Feishu, the market's attention has begun to focus on this sudden change.

It is understood that this adjustment was not officially announced in any way, but only synchronized internally within Feishu on a small scale. A source close to Feishu said that Zhang Nan's resignation is mainly due to personal reasons. Going forward, Zhang Nan will gradually transition to the role of a Feishu advisor.

In fact, there are signs of Zhang Nan's gradual withdrawal. At the beginning of 2024, Feishu's pre-sales and sales teams for large customers completed a round of integration, with most sales teams reporting to Feishu's Chief Commercial Officer, Lin Chan, who in turn reported to Zhang Nan. However, Zhang Nan's actual responsibilities have decreased, and he has gradually withdrawn from daily management affairs.

In a rapidly changing business world, every personnel change may herald a new trend in the industry. And Zhang Nan's departure adds new variables and limitless imagination to this "enterprise service Three Kingdoms battle" led by Feishu, DingTalk, and WeCom.

01 ByteDance's general retires, Feishu urgently needs a change of formation

Zhang Nan is a veteran employee of ByteDance. According to his resume, he joined ByteDance in 2014 and began building ByteDance's user growth system the same year, playing a crucial role in many of ByteDance's subsequent businesses.

In the second half of 2016, Zhang Nan began serving as the president of Xigua Video and led Xigua Video to become China's largest PUGC short video platform in just two years. In March 2020, he was transferred to Feishu and served as its president, responsible for Feishu's strategic planning and execution, product design, research and development, and commercial operations.

Zhang Nan was favored by Zhang Yiming at ByteDance mainly due to his expertise in data analysis and advertising placement. An informed source said that Zhang Nan has "made significant contributions" to the establishment of Douyin's advertising system and is highly valued by Zhang Yiming.

The background of Zhang Nan's transfer to Feishu was also when Feishu was at a critical stage of transforming from an internal product to external commercialization: the demand for home office and online teaching increased dramatically, and the domestic collaborative office market experienced a surge in users. DingTalk, WeCom, and Feishu were engaged in a "mixed battle".

However, when he first joined Feishu, Zhang Nan inherited the responsibilities of Xu Zhe, the head of Feishu's product side, overseeing Feishu's overall products and overseas commercialization efforts, while Feishu CEO Xie Xin was primarily responsible for domestic operations.

If we follow the initial expectations of ByteDance's executives for Feishu, globalization was a top priority, and the part handled by Zhang Nan was also highly anticipated. However, as the international situation underwent qualitative changes, Feishu's overseas expansion was hampered, and the business focus shifted back to the domestic market, with Zhang Nan's responsibilities also changing accordingly, working with Lin Chan to oversee Feishu's commercialization efforts.

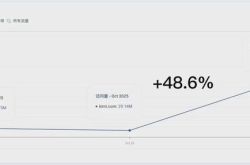

In February 2023, Feishu announced during an internal meeting that its 2022 ARR (Annual Recurring Revenue) reached $100 million, a 2.7-fold increase from 2021. This was the first time Feishu had disclosed its core business metrics since its inception. After experiencing a rather aggressive commercialization path from 2022 to 2023, Feishu faced increasing commercialization pressure, but even so, Zhang Nan still managed to double this figure to $200 million in 2023.

However, with the domestic SaaS market entering a downturn, such growth may be difficult to replicate in 2024. Especially this year, as Feishu "winters" along with ByteDance, relying on large-scale layoffs to reduce costs and increase efficiency to cope with market competition, it also means that scale reduction will become the main theme for Feishu in recent years.

However, during this sensitive period for Feishu, it also needs a stronger role internally to make adjustments. It is understood that ByteDance may arrange other senior management personnel to participate in the adjustment of Feishu's products in the future. This move is also in line with ByteDance's consistent style of stimulating organizational potential through personnel changes. However, in a limited market where the "Three Kingdoms battle" is being fought, Feishu's chances of winning are not high.

02 Enterprise service platform: Feishu is not a must-have choice

On ToB platforms for enterprise operations, meetings, instant messaging (IM), document sharing, etc., are high-frequency application scenarios, but these scenarios are inseparable from collaboration. Currently, among the three mainstream platforms, only WeChat and WeCom offer the natural internal and external communication advantage of mutual access between friends. With such a natural advantage, no matter how ToB applications develop, as long as they are related to collaboration, WeCom almost becomes the first choice.

In addition, as the entire industry is in the context of reducing costs and increasing efficiency, companies are more willing to pay for those truly necessary applications, especially those that can bring sustained growth. Both small and large companies need to purchase products to obtain corporate benefits, and each product will eventually face a soul-searching question: Why buy it at all? If I spend ten thousand, can the company earn back twenty thousand?

As for the refinement of internal management, there is currently a preference for lower-cost strategies. Within a limited budget, unless management bottlenecks seriously affect growth quality, growth is always the preferred investment direction.

In the United States, there is a term called "Dog Food," which means dog food. This expression is both vivid and cruel. Although dog food salesmen ostensibly provide food for dogs, they are actually marketing to dog owners.

Products can be divided into two types based on their unit prices: high decision-making costs and low decision-making costs. High decision-making cost products, such as purchasing cars and houses, require extensive preparatory work and service quality assurance in the early stages, involving a large number of labor-intensive industries. In the ToB market, almost all products fall into the category of high decision-making cost products, with a tool's price potentially reaching tens of thousands, hundreds of thousands, or even millions of dollars. Therefore, when making decisions, bosses pay more attention to the certainty of returns.

The ability of WeChat to "coerce users to command the princes" need not be elaborated. Even DingTalk, compared to Feishu, has many capabilities that can easily impress most bosses. For example, DingTalk's initial core management functions, such as "Ding" notifications via messages, text messages, phone calls, etc., coupled with attendance checking, are values that bosses can quickly understand and use to manage people at low cost. Being able to find people when needed and ensuring employees are at work are very concrete corporate benefits.

In contrast, Feishu's value proposition is too indirect. For example, OKRs are rarely understood by domestic enterprises, and many internet companies don't even understand KPIs. A company is a rational entity, completely different from a natural person. A company makes rational decisions, with efficiency and economic benefits as its core objectives. Therefore, DingTalk's "managing employees" is more popular than Feishu's "enabling employees to collaborate".

More objectively speaking, from the perspective of many small businesses, using office software is nothing more than utilizing basic functions such as attendance checking, clocking in, and payroll issuance. For large enterprises, employee collaboration is only a branch of work, and more important is effective "top-down" management. In other words, the extreme collaboration pursued by Feishu is not needed by many small businesses and is not the focus of attention for large enterprises.

Of course, while Feishu and DingTalk are more comprehensive in terms of enterprise management depth, it is difficult to shake the huge foundational advantage brought by WeChat's nationwide application. Currently, it is difficult for both Feishu and DingTalk's product forms to break through this situation, unless a disruptive new IM application emerges. After Feishu's massive layoffs and the departure of senior executives, where Feishu should "fly" next is even more noteworthy.

03 With adjustments, where should Feishu "fly"?

In fact, Feishu, which does not have a dominant ecosystem, has been making adjustments. In the past, with the support of ByteDance's "money power," Feishu filled its B-end shortcomings by acquiring office software such as ChaoXi Calendar, HeyPal Cloud, and Tower, and launched its own Office and People modules. At the beginning of the year, Xie Xin also stated in a company-wide letter that they would serve to B customers well and enhance AI capabilities to increase product competitiveness.

However, for ToB businesses, it doesn't matter who is the first to become high-end or who rushes forward the most aggressively. What matters most is who cleans up the battlefield last, survives, and continues to tidy up the mess.

In the domestic market, intense competition has become a norm among enterprises, and the core of competition in the enterprise service market revolves around product strength, ecological strength, and cost optimization. In such an environment, WeCom has chosen a more stable growth strategy, proceeding steadily without haste. Meanwhile, DingTalk is actively utilizing Feishu's strategic adjustment period to vigorously expand the market. Not only is it focusing on its own development, but it is also providing opportunities for service providers capable of undertaking medium to large-scale projects, unleashing new vitality in the market.

Feishu is currently at a critical stage of strategic adjustment, waiting for new signals in terms of key customer management, internal organizational structure, and ecological partnerships. During this process, Feishu needs to re-examine and adjust its strategy. It should be noted that for Feishu's ecological partners, they need to look for new growth opportunities outside of Feishu. This is not only a necessary path for Feishu's partners but also their inevitable choice under the current market environment.

However, it cannot be denied that Feishu does have a greater advantage in overseas markets, relying on ByteDance's overseas layout capabilities and the marketing network resources laid out in the early stage to extend new business forms, which may also be a new way for Feishu to break the deadlock. However, in this process, special attention needs to be paid to DingTalk and WeCom, as for these two platforms, Feishu's overseas expansion is an important strategic opportunity for them to focus on the domestic market and quickly reap the benefits.

From the perspective of the entire enterprise service market, the high-level changes at Feishu, the recruitment boom at DingTalk, and the laid-back attitude of WeCom, behind these events lies the opening of a new chessboard in the enterprise service market. In this chessboard, every participant is looking for their own position, and every move may affect the future of the entire ecosystem. As a "chaser," Feishu wants to meet the expectations of ByteDance's senior management and truly welcome a turnaround against the wind. Layoffs and blood transfusion may only be the first step. There is still much more Feishu needs to do, including exploring commercialization, reforming internal products, and continuing to expand its overseas advantages.