Returning to Steady State, Meituan Regains Its "Rhythm"

![]() 06/18 2024

06/18 2024

![]() 744

744

In the current era where incremental value is becoming increasingly precious, local life, which is a "high-frequency rigid demand," is seen by more internet companies as a must-compete market, even though it is a highly competitive business.

Over the past two years, the local life sector has been focused on the offensive and defensive situation between Meituan and Douyin, during which the aggressive posture of some new forces has also attracted attention. Xiaogu, the head of Kuaishou's local life business unit, said earlier this year that Kuaishou will launch a billion-level platform subsidy and 100 billion traffic in 2024 to create a new trend and incremental value for online service retail consumption.

However, after about two years of intense competition, there has been no dramatic climax or reversal. According to a report by "LatePost," in the first quarter of 2024, Douyin's life services (mainly composed of on-site dining, on-site comprehensive, and travel business) achieved over 100 billion yuan in sales before verification, while Meituan's on-site business sales remained stable at around 200 billion yuan for the past two quarters. Over the past six months, there has been no significant change in the market share of both parties.

Meituan, which has always been seen as the challenger and defender, is also breaking out of this inherent narrative framework.

Meituan's 2024 first-quarter financial report released on June 6 showed that its quarterly revenue reached 73.3 billion yuan, a year-on-year increase of 25%. After organizational restructuring, the revenue of the core local business segment reached 54.6 billion yuan, a significant year-on-year increase of 27%.

This performance is supported by the improvement in consumption during the Spring Festival and the favorable macro environment, as well as real-time feedback after business focus. On the one hand, it consolidates its advantages, and on the other hand, it integrates resources and strengthens business synergies. After organizational restructuring and business reorganization, the framework outlined by Meituan for local life is already clear enough and it is steadily moving forward at its own pace.

01. Multiple Extensions of the Fulfillment Moat

Market commentators often use terms like "saturation" and "oversupply" to describe some popular internet tracks, but they certainly do not include instant delivery.

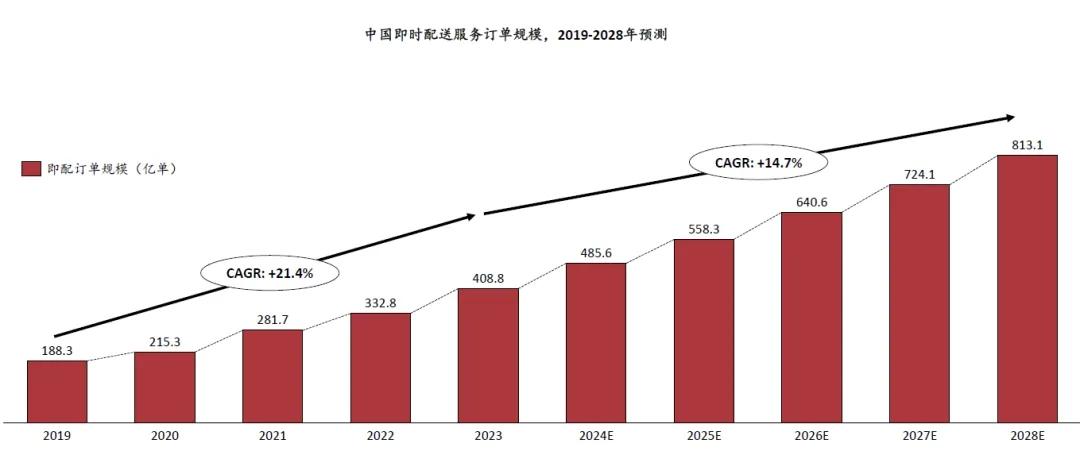

According to the "2023 China Instant Delivery Industry Trend White Paper" released by Frost & Sullivan, with the deepening of digital transformation in retail, it is expected that the online penetration rate of social consumer goods retail will increase to 35.3% by 2028, and the proportion of online channels for local retail will also continue to increase. Digital retail models such as instant retail and community group buying have an increasing demand for efficient intra-city logistics fulfillment.

In 2023, the order scale of China's instant delivery industry achieved relatively significant growth based on the recovery of catering services and retail, with the industry-wide order scale reaching about 40.88 billion orders, a year-on-year increase of 22.8%, and a compound annual growth rate of 21.4% over the past five years. The agency predicts that in the future, in addition to catering delivery scenarios, the trend of "everything delivered to your door" in instant retail will accelerate, bringing sustained growth momentum to the industry. It is expected to maintain an average annual growth rate of 14.7% over the next five years.

Source: Frost & Sullivan

Due to its early entry and deep foundation, whenever there is a comparison related to Meituan, comments always mention that the barriers formed by its fulfillment moat are challenges that competitors cannot avoid. Now, Meituan's fulfillment system and related businesses are still evolving, continuing to pull away from competitors and extending more possibilities in terms of cost-effectiveness and cross-business directions.

In this quarter, the number of annually active users of Meituan's takeout business increased to nearly 500 million, and the transaction frequency of medium-to-high-frequency users further increased year-on-year. At the same time, the number of instant delivery orders on the platform during the quarter increased by 28% year-on-year to 5.46 billion orders.

Thanks to new products grown from the fulfillment system, Meituan's takeout business is deeply exploring the direction of cost-effectiveness.

On the merchant side, Meituan's "brand satellite store" model has gradually become the preferred choice for chain catering brands to improve efficiency. In the past, the main theme of chain catering brands was "dine-in + takeout" dual-venue operation. With changes in consumption and market conditions, takeout has become a popular lifestyle, and brands have realized that quickly covering more takeout scenarios with a low-cost small store model is more conducive to enhancing brand comprehensive influence and operational efficiency.

At the 2024 China Chain Catering Summit held on April 8, Meituan Takeout explained the "brand satellite store" 10,000-store commission rebate plan, which specifically includes three supporting measures: 6-month commission rebate, over 100 million traffic support, and free AI location selection, product selection, and precise marketing services.

Takeout itself has a cost advantage over dine-in, and the platform's support, on the one hand, helps brands quickly pass through the new store ramp-up period through commission rebates and traffic倾斜, entering a positive cycle of traffic and orders; on the other hand, it provides technology and experience to optimize single products and predict risks in specific operating links, thereby further releasing profit margins. Platform data shows that as of the end of May this year, a cumulative total of 45 brands have opened over 560 brand satellite stores.

On the other hand, "Pinhaofan" targeting the low-price market has carved out a path of expanding quantity and increasing revenue with a logic similar to e-commerce bestsellers. It is worth noting that Pinhaofan is not just about low prices, but also about the social sharing and fission-like spread of "group buying," as well as SKU selection based on data analysis, making it a product that deeply explores demand-side potential.

The financial report mentioned that "Pinhaofan" has been expanded to more cities, and more and more branded merchants have joined. In the first quarter, the daily order peak of Meituan's "Pinhaofan" hit a new high.

Consumers' desire for product diversity has been filled by e-commerce platforms, but the demand for immediacy, which has not yet been fully satisfied, points to a promising business expansion direction. While cross-regional delivery has become a standard configuration of contemporary life, getting goods within 30 minutes is the mindset that Meituan Flash Delivery intends to capture for "everything delivered to your door".

The financial report shows that Meituan Flash Delivery's average daily order volume reaches 8.4 million, with significant year-on-year growth in both the number of annually active users and transaction frequency. More and more catering takeout users are becoming Meituan Flash Delivery users.

Meituan already has a solid fulfillment advantage in the catering takeout business, and the logic of Flash Delivery is to extend it to more local consumption scenarios, from "delivery to home" to gatherings, travel, holidays, nightlife, and more. The diversification of scenarios will further promote the diversification of category demand, not just food and beverages, but also daily necessities, fast-moving consumer goods, as well as clothing, beauty, and 3C digital products.

In January of this year, Meituan Flash Delivery entered into a cooperation with Decathlon. Currently, all Decathlon stores nationwide have been launched on Meituan, and over 80 sports with thousands of products have been integrated into Meituan's fastest 30-minute delivery logistics network.

With rich supply, "everything delivered to your door" will become a consumer trend and lifestyle. Meituan has higher expectations for its fulfillment system and is expanding its upper limit, which will be presented in a more visible manner in the future.

02. Systematic Operations, with "Cost-Effectiveness" Mindset as the Top Priority

In the internet field, "mindset" is an embodiment of an integrated marketing concept, emphasizing the delivery of consistent brand messages across all marketing channels and touchpoints, thereby forming a deep impression and consumption habit for brand/platform products and services. Coincidentally, Meituan's organizational restructuring and business adjustments are currently being optimized around "systematic capabilities".

Since the beginning of this year, Meituan has undergone several organizational restructuring, with the most significant change being the merger of the previously integrated Meituan platform, on-site business group, home delivery business group, and basic research and development platform into the "Core Local Business" segment, with Wang Puzhong serving as the CEO of Core Local Business.

Since 2017, Meituan has been dividing its business according to consumption scenarios, with the on-site and home delivery business groups operating in parallel. Organizational restructuring is often driven by "survival of the fittest" and adapting to environmental changes. Today, in the local life sector, the importance of ecological synergies is increasing.

We can see this synergy reflected at the strategic level from Meituan's recently promoted "Super Member" system.

Super Member is an upgraded version of Meituan's membership service launched last year, which adds more discounts and convenience on top of the original membership service. After a recent upgrade, the welfare systems for home delivery and on-site visits have also been connected, with benefits extending from takeout to on-site visits and travel.

Like the reinforcement of the fulfillment moat mentioned earlier, Super Member is also a move to amplify its own advantages. Meituan itself is the most comprehensive platform in the local life sector, with a wide range of business lines and deep experience accumulation in individual businesses, which is the prerequisite for it to launch a cross-business membership system.

In addition, the core attraction of membership lies in exchanging price discounts and value-added services for users' usage duration and repurchase frequency. A more advanced membership system can guide users to access the platform's cross-business service chain, thereby activating more consumption scenarios and extending traffic gains to the entire business line.

In the first-quarter financial report conference call, Meituan mentioned that the platform's future goal is to achieve a seamless solution from demand discovery to service completion, and the organizational structure changes are also aimed at ensuring infrastructure and core business synergies, integrating demand and supply sides. The performance of Meituan's offline consumption-related businesses in the first quarter has already shown that the strategic thinking is considering more diversification and multi-point synergies.

During the Spring Festival, many scenic restaurants, "Must-Eat List" restaurants, and high-quality merchants in lower-tier cities that cooperate with Meituan provided consumers with cost-effective package options through forms such as "special group buying," "live streaming," and "themed promotions".

In addition, Meituan has always attached great importance to promotional activities during key nodes, and live streaming events during holidays, whether official or store broadcasts, have made progress in regional coverage, frequency, and online-offline collaboration. Data shows that the average daily consumption scale of the life service industry during the Spring Festival holiday increased by 36% year-on-year, exceeding 155% compared to 2019.

Another benefit of popularizing the cost-effectiveness mindset is that it can form a synergy with emerging consumption trends. During this year's May Day holiday, concepts like "taste bud travel" and "county travel" were popular, and Meituan's presence was everywhere behind the consumption. In the first three days of the holiday, the number of national catering dine-in orders on Meituan increased by over 73% year-on-year, and the flow of tourists to small towns, lower-tier cities, and other niche destinations increased significantly during the holiday, with local life service consumption increasing by 37% year-on-year.

Returning to a more holistic perspective, the evolutionary pattern of fierce competition, numerous entrants, and homogenization is occurring in the local life sector. At this time, Meituan emphasizes business focus and systematic capabilities, which is also refining brand recognition and ensuring platform influence amidst the cacophony of voices.

And such strategic focus also reflects some industry trends: the competition in the second half of the local life sector may focus on who can do a good job of resource integration and mechanism utilization.

03. From Conception to Concreteness in the Future

When examining Meituan's future, we cannot ignore its resilience and innovative capabilities in the local life service sector. However, true industry depth is not only reflected in the celebration of success but also in a profound understanding of challenges and forward-looking thinking.

Healthy growth in the main business and imagination given by the second curve are probably the most ideal images of an internet company. Today, to talk about growth, going abroad is almost an indispensable element.

Meituan's first stop for global expansion is Hong Kong. According to the latest data from market research firm Measurable AI, since its launch in Hong Kong in May 2023, the market share of its Hong Kong takeout brand KeeTa has continued to increase, reaching 44% by March this year, leaping to the top in Hong Kong.

Meituan's approach in Hong Kong is a steady move. There have long been issues of high fulfillment costs and long delivery times for local takeout services, so locals prefer offline dining. Meituan's approach is very simple and direct, offering discounts despite cost pressures, and cultivating consumption habits by lowering the threshold for online ordering. After a year of operation, the results are visible, and the first battle has been victorious.

After internal evaluation, the next likely target for the sandbox will appear in the Middle East or Southeast Asia, two hotspots in the context of going abroad, with assessment criteria based on factors such as market openness, competition, scale, and penetration potential.

In a company-wide letter in February this year, Wang Xing indicated that drones and overseas businesses would report directly to him, thus implying the importance of these two businesses, representing the future look of Meituan.

Of course, Meituan's path to globalization is also a journey full of unknowns and variables. It requires not only adaptation to local markets but also insight and leadership in global consumption trends. In this process, it must be vigilant against the friction costs brought by cultural differences while also seizing the opportunities brought by technological progress, such as optimizing the supply chain, enhancing service personalization, and precision through big data and artificial intelligence.

Technological innovation is the key to Meituan's continued leadership, but it is also one of the greatest uncertainties. The rapid iteration of technology requires Meituan to continuously invest in research and development, which may put pressure on profitability in the short term. How Meituan finds a balance between maintaining technological leadership and maintaining financial stability will be an important criterion for measuring its strategic wisdom.

This requires Meituan to pay more attention to the synergies between businesses in the expansion of diversified businesses, avoiding ineffective dispersion of resources; while maintaining business breadth, it must also deepen business integration and specialization to ensure that each service can occupy a place in the market.

Fortunately, the competitive narrative that has lasted for about two years has faded, and as an industry leader, Meituan has ultimately returned to focusing on core values and expanding the upper limit of the industry.

Under the premise of a stable basic disk, exploring future development windows from new markets and technologies is also a manifestation of systematic thinking, and Meituan's current performance has already demonstrated the convincing aspect of such future concepts.

Meituan today is still the Meituan that shapes local life with itself as the measure.

*The title image and illustrations in the article are sourced from the internet.