What is the optimal solution for the most challenging 618 in history

![]() 06/18 2024

06/18 2024

![]() 682

682

Beyond price wars, a new trend in 618 competition.

As 618 draws to a close, people have discovered that this year's 618, like previous years, is also somewhat different.

What's the same is that platforms still choose not to disclose their transaction volumes for this year's 618. Behind the continuation of not releasing "big numbers," it is because after e-commerce consumption has passed the wild development stage, the expansion of numbers has become meaningless.

What's different is that the center of competition for the big promotion has quietly shifted from platform transaction volumes to the small certainties of more consumers. With various measures such as canceling pre-sales, implementing full discounts, and issuing various large-value coupons, major e-commerce platforms are striving to simplify processes and continuously emphasizing the value orientation of "returning to users".

Taking Tmall as an example, under the clear strategy of "user first" for the big promotion, on May 20th, during the first hour of Tmall 618 sales, 28 brands had transaction volumes exceeding 100 million, and 216 individual products had transaction volumes exceeding 10 million. On May 31st, the second wave of Tmall 618 sales began, and by 9 pm that evening, 185 brands had cumulative transaction volumes exceeding 100 million, and 11 brands had cumulative transaction volumes exceeding 1 billion.

Such a report card for the first half proves that this simple and direct 618 is impressing more consumers.

However, for merchants, many things that benefit consumer experience may not be entirely good. In this year's 618, e-commerce platforms and merchants not only need to achieve low prices but also ensure dual quality assurance for products and services, as well as multi-dimensional efforts in activity innovation and business strategies.

After all, pure low-price competition has never been sustainable. For consumers, only satisfying good products, good prices, and good service is truly meaningful.

Under the comprehensive consideration of more competitive factors, this 618 without much fanfare competition has instead turned into a competition between various e-commerce platforms for operational foundation and ecological accumulation, focusing on user-centric consumption experience. For merchants, whether they can keep up with the changing trends of competition and gain benefits from it also determines whether they can obtain more certain operating profits.

01 The 618 Beyond Low Prices

In terms of prices, to re-attract consumers' attention, this year's 618 e-commerce platforms have unanimously offered more direct discount methods.

Billion-yuan subsidies have become a standard configuration for platforms, and at the same time, in terms of low prices, each platform has also offered different discount strategies. Taobao launched a billion-yuan subsidy increase event, while Tmall introduced two major play methods: official discounts and cross-store full discounts. For the first time, the amounts of Tmall and Taobao products can be combined for full discounts during the big promotion period. JD.com focuses on low prices, proposing the promotional slogan of "both cheap and good"; Kuaishou announced a 1 billion red packet subsidy.

As the main tone of the big promotion, low prices and discounts remain unchanged.

However, compared to previous years, more changes beyond prices are also happening. In terms of the activity cycle, many e-commerce platforms have adjusted the pre-sale system that has been used for over a decade this year.

Taobao Group was the first to announce the cancellation of the official pre-sale stage for this year's Tmall 618, and the first wave of sales began directly on May 20th. Subsequently, multiple platforms followed suit, with JD.com's 618 big promotion starting on May 31st with spot sales, followed by special period, climax period, and encore period; Kuaishou E-commerce officially began "spot sales" starting on May 20th.

Amidst unchanged low prices and changing cycles, this year's 618 big promotion has obviously entered into more competitive dimensions. In fact, in addition to the beginning of changes in the pre-sale system, e-commerce platforms have been undergoing a period of change in recent years.

With the reshaping of the e-commerce landscape, the focus of e-commerce giants has shifted back to users. If the essence of the pre-sale system is to reduce the risks of the upstream supply chain during the early stages of e-commerce development, then canceling the pre-sale system is a need to pay more attention to consumers' shopping experience as e-commerce enters maturity.

In the era of stock market competition, platforms and merchants face the huge challenge of how to retain users. Judging from the current market trends, e-commerce platforms are beginning to incorporate strategies such as low prices, spot sales, shortened activity cycles, and enhanced value-added services for goods into their daily sales and promotional activities.

It is foreseeable that price, service, and user-centricity will also be key words in the e-commerce industry in 2024, and also the direction that all e-commerce platforms are focusing on. When the concept of "user first" becomes the focus, e-commerce platforms will reshape the interest patterns of platforms, merchants, and consumers.

In other words, platforms need to balance the interests of consumers and merchants: sacrificing consumer interests for merchant growth, or sacrificing merchant interests for improved consumer experience, are both unsustainable and undesirable.

Platforms need to explore such an answer, even if the process is not easy.

02 Experience Service Bonuses Become a New Trend

Interestingly, focusing on experience, Taobao proposed a complete closed loop connecting consumers, platforms, and merchants for this year's 618.

Previously, a survey conducted by the Beijing News with over 3,000 valid questionnaires for this year's 618 showed that the comprehensive shopping experience of "product power + price power + service power" is being prioritized by more consumers. Changes in supply and demand situations and consumption environments are forcing e-commerce platforms to prioritize user experience.

Last year, Wu Yongming internally proposed: "Every dollar spent on user experience has a higher ROI than acquiring new users." During a financial report conference call on February 7th of this year, he reiterated: "Returning to users is our strategic core. We will increase investment in users' core experiences and improve customers' shopping experiences."

As a result, Taobao and Tmall began a top-down transformation centered on "user first," and this year's 618 has become a centralized proving ground for the results of this transformation.

For consumer service, 88VIP benefits were comprehensively upgraded before 618. Building on the upgrade in April that allows unlimited returns with free shipping, in May, Taobao 88VIP benefits were further upgraded, allowing users to redeem cash red envelopes with points. With greater user benefits, the scale of 88VIP users has reached 35 million, representing a double-digit year-on-year growth.

In addition to 88VIP, Taobao has also successively launched a series of measures such as full-cycle price protection and providing shipping insurance to enhance consumers' shopping experience throughout the process. In addition to upgrading service benefits, adjusting around user experience has also become a focus of product updates on the eve of 618 as service bonuses become a new competitive trend.

First, in mid-May, Taobao underwent its most significant upgrade in seven years for the web version. Internally, a team with a complete organizational structure was established to be responsible for optimizing and upgrading Taobao's PC end, and the first iteration was completed on the eve of "618," introducing over 60 features from browsing to shopping to placing orders.

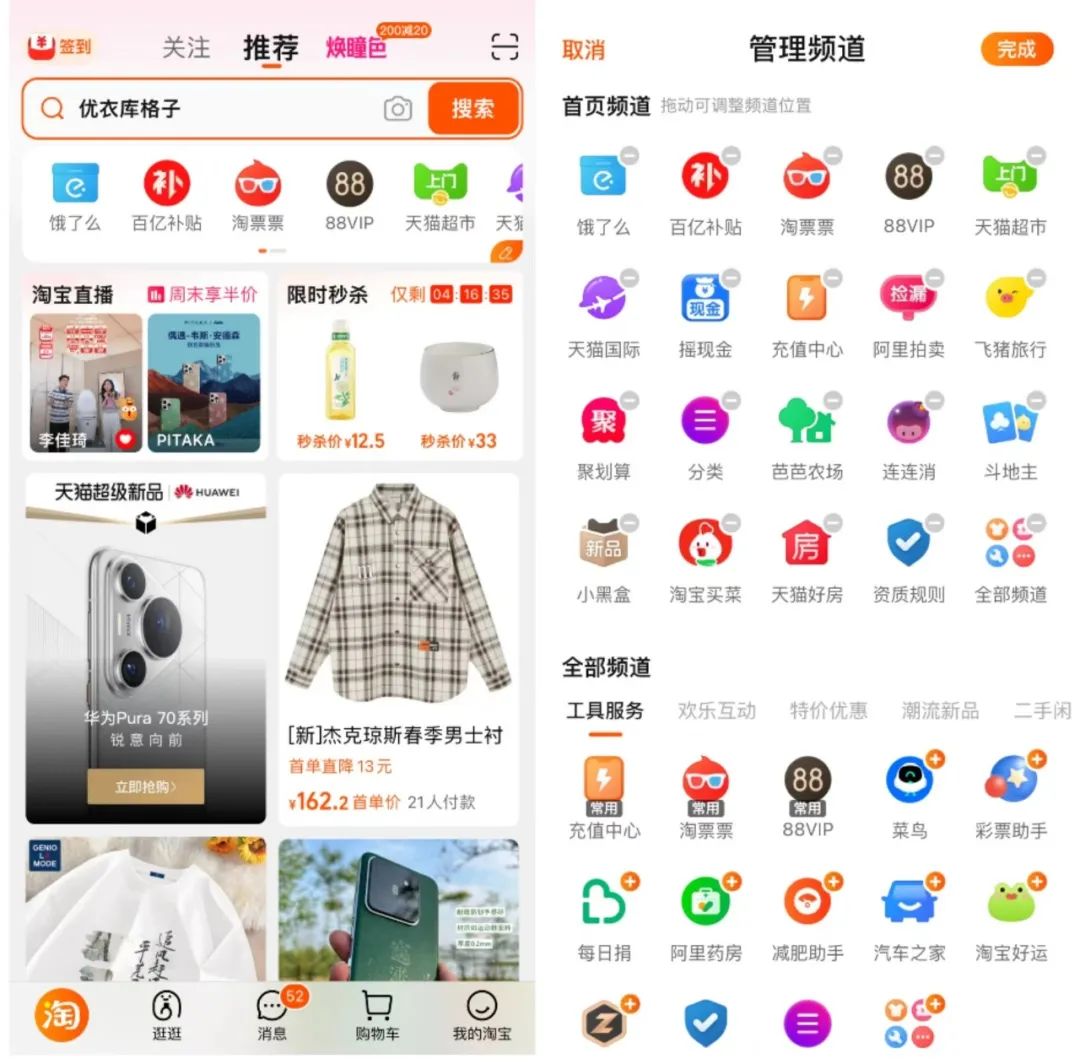

In addition to satisfying the needs of 100 million independent users who use the web version of Taobao, the "mainstream players" with 900 million monthly active users, Taobao Mobile, have also undergone significant changes.

In terms of interaction experience, the homepage sections have been greatly simplified, and users can also customize the quick access to the homepage based on different channel combinations, achieving a dual experience of simple and efficient page interaction.

In addition, Taobao has also made updates and optimizations in terms of startup speed and smoothness. The opening screen and jump experience are smoother, and in some details of browsing Taobao, such as when users are browsing stores and products, they are no longer disturbed by automatically playing sounds. Users can choose whether to enable the automatic playback function for videos and live streams based on their preferences, and they can even set a silent mode for Taobao during specific time periods, making it more user-friendly.

With the re-organization and launch of 88VIP benefits, the comprehensive upgrade of platform services, the revamping of the web version of Taobao, the re-optimization of the APP interface, and a series of platform measures, consumer experience has been effectively enhanced.

The new consumer experience has also begun to drive business benefits for merchants. For example, thanks to the upgrade of 88VIP benefits, as of May 21st, the average daily transaction volume of Taobao coupon merchants has increased by 41% year-on-year compared to last year's 618. One Taobao clothing merchant said that this year, driven by consumer coupons, their store's order volume has increased by 120% year-on-year.

In addition, under the strategy of prioritizing users, Taobao and Tmall have been fully integrated for the first time during the big promotion, making it simpler and more enjoyable for consumers to buy, and Taobao's small and medium-sized merchants have also benefited from enjoying the same activity benefits as Tmall merchants, gaining more growth bonuses.

According to relevant data, during this year's Tmall 618, Taobao's small and medium-sized merchants have seen a wave of rapid growth. As of May 21st, the average daily transaction volume of Taobao coupon merchants has increased by 41% year-on-year compared to last year's 618; many industries have seen numerous merchants with rapid growth in transactions, with over 370,000 small merchants achieving over 100% year-on-year growth on the first day of sales alone.

During the financial report conference call on May 14th, Wu Yongming evaluated the results of this transformation: "Our investment in price power and user experience has received positive feedback from consumers, and we have seen significant results and progress. The number of quarterly buyers and purchase frequency have grown strongly, driving double-digit strong growth in GMV, which also reflects the increasing consumer willingness and user trust on the platform."

Obviously, this consumer-centric transformation movement is also turning service into true business benefits for merchants. Under the coexistence of risks and opportunities, under user-centric decision-making, Taobao has become one of the first platforms to make changes and adjustments on the operational side.

03 The Optimal Solution for Merchant Operations

With better experience, merchants' businesses are also doing better, and this has begun to take shape. But to complete this closed loop, Taobao obviously wants to go further.

For merchants, a series of actions to incentivize merchants to provide a better experience have begun to emerge. During 618, some merchants and media revealed that Taobao is fully implementing a new scoring system - "Store Experience Score" and "Product Experience Index" - to replace the previous DSR (Taobao's previous seller service evaluation system). During the beta testing period, multiple merchants reported that after the recent improvement in experience scores, their store traffic began to increase significantly.

Such business results are not surprising. As early as in Taobao's externally released "Store Experience Score Specification," it has been clearly stated that "the higher the comprehensive store experience score, the better the search ranking results can be obtained." This means that store and product traffic will be directly linked to experience scores, and good service will directly bring new growth to merchants.

Moreover, Taobao is also testing the comprehensive application of experience scores in scenarios such as Taobao Mobile search, homepage "Guess You Like," Alimama-related advertising placements, and activity registration, achieving a direct drive where good service for front-end consumers equals good growth for back-end merchants.

By equating good service with good traffic, merchants will undoubtedly be more motivated to improve their service experience.

Over the past year, surrounding changes in the market competition environment, under the strategy of prioritizing users, compared to other platforms that often focus on user-side changes and adjustments, operational changes often lag behind. Taobao's changes pay more attention to the integration of consumption and operations, and changes on the user consumption side are often accompanied by updates to operational tools.

In fact, besides service experience, more changes are also happening.

Taking AI as an example, before the consumer-side 618, Taobao Ask launched an AI test for shopping MBTI, helping discover users' shopping personality traits and corresponding recommended products, creating personalized shopping lists; combined with the big promotion sales start, it enhances the discoverability and interactivity of the shopping guide.

On the operational side, the Taobao merchant AI tool Quick product official website also quietly went live before 618 and is open to Taobao and Tmall merchants for free.

According to the official website, Taobao Quick is a super productivity tool customized for e-commerce sellers, covering multiple sub-brands such as Zhitu, Zhiwen, and Zhishu, helping users achieve operational efficiency improvements in multiple scenarios such as selling point extraction, copywriting summarization, product image generation, and price force analysis.

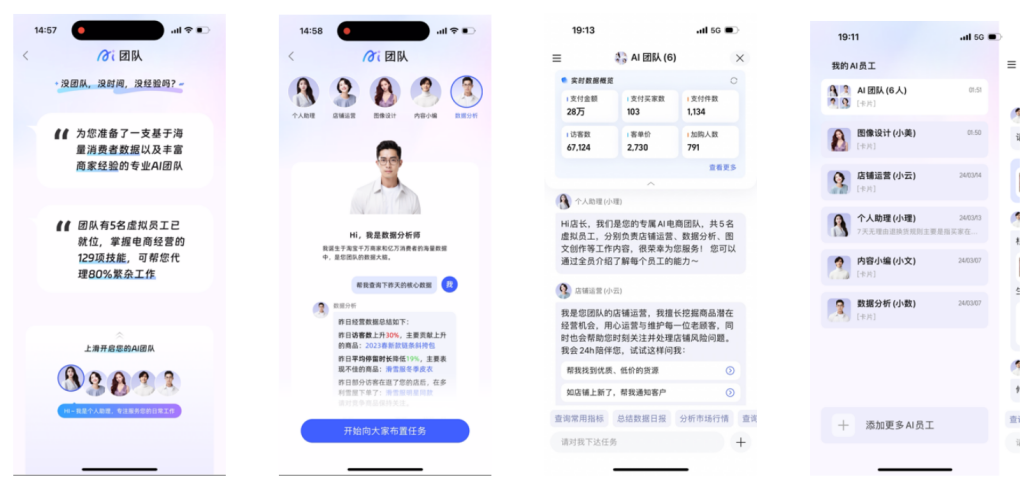

In addition, multiple merchants have stated that Taobao's Qianniu platform has launched an officially self-developed Agent - Quick Manager. This product integrates capabilities such as data analysis, graphic design, and store operations, and can act as an agent for merchants' daily operational operations. It has been in beta testing for several months for Taobao and Tmall merchants.

If the AI on the consumer side focuses on personalized experiences, then the core of AI tools on the operational side is cost reduction and efficiency enhancement. For example, during 618, Menghuwei, a Tmall pet health care products merchant, used Taobao Qianniu's "AI Smart Image" tool to generate images in 3 seconds, saving on the cost of pet model photos that used to cost 600 yuan and now only requires 1 yuan in electricity.

In addition to AI image generation cost reduction, the newly launched Alimama full-site promotion tool has become an effective weapon for merchants to leverage 618 sales explosions.

Data shows that tens of thousands of merchants achieved an average growth of 701% in guided transactions through full-site promotion on May 20th. Over 10,000 brands such as Midea, Lenovo, Gree, OPPO, and Dreame had over 30% of their single-item full-site promotion guided transactions. Among them, brands like Tineco, Dreame, and TCL achieved multiple single-item transactions exceeding 10 million.

Under this changing pace, benefits in areas such as private domains