Resubmitting to the Hong Kong Stock Exchange, Can Huizhangsuan Seize the Opportunity of AI+Finance and Taxation SaaS?

![]() 06/19 2024

06/19 2024

![]() 690

690

Since May, the Hong Kong IPO market has been thriving, with multiple companies achieving "zero break-even" on their listing day, with an average increase of approximately 30%. In June, there were even over 2,500 times oversubscribed new shares. The market's money-making effect has emerged, and investors' enthusiasm for new listings has increased accordingly, leading more and more domestic enterprises to seize the opportunity to list in Hong Kong.

Recently, Huizhangsuan, a leading provider of financial and taxation solutions for small, medium, and micro enterprises in China, updated its prospectus. Since submitting its initial prospectus at the end of June last year, Huizhangsuan has been striving to achieve a listing. According to Frost & Sullivan, the company is China's largest provider of financial and taxation solutions for small, medium, and micro enterprises from 2021 to 2023, based on total revenue.

So, what is blocking Huizhangsuan's path to listing? And what is the company's growth prospect?

Positioning in the blue ocean of small and medium B-end financial and taxation SaaS, caught in a development bottleneck

Finance and taxation are the lifeblood of enterprise operations, but managing finances and taxes is not an easy task.

According to The Paper, multiple listed companies have encountered tax supplementation this year, from the production suspension announcement of Bohui Co., Ltd. to the tax recovery of subsidiaries of Weiwei Co., Ltd. many years ago, to companies such as Shunhao Co., Ltd., Peking University Pharmaceutical Group Co., Ltd., Zangge Mining Co., Ltd., Hualin Securities Co., Ltd., and Lianjian Optoelectronics Co., Ltd.

These phenomena and expert opinions indicate that with economic development and continuous adjustment of tax policies, the demand for financial and taxation services continues to increase, and the financial and taxation service market is growing steadily.

It is worth mentioning that compared to listed companies that hire talent at high salaries in areas such as tax planning, financial analysis, and risk control, small and medium enterprises have a more urgent need for professional financial and taxation services, and they are also the main customer base of traditional financial and taxation companies.

Huizhangsuan accurately identified this entry point, mentioning in its prospectus that there are multiple common problems with traditional solutions for small and medium enterprises, such as the difficulty of balancing cost and quality. According to Frost & Sullivan, the annual cost of hiring financial and taxation professionals for small and medium enterprises is usually between RMB 100,000 and RMB 150,000 in 2023; and advanced service needs are not met, as traditional solution providers lack the necessary infrastructure to process and integrate data from different sources.

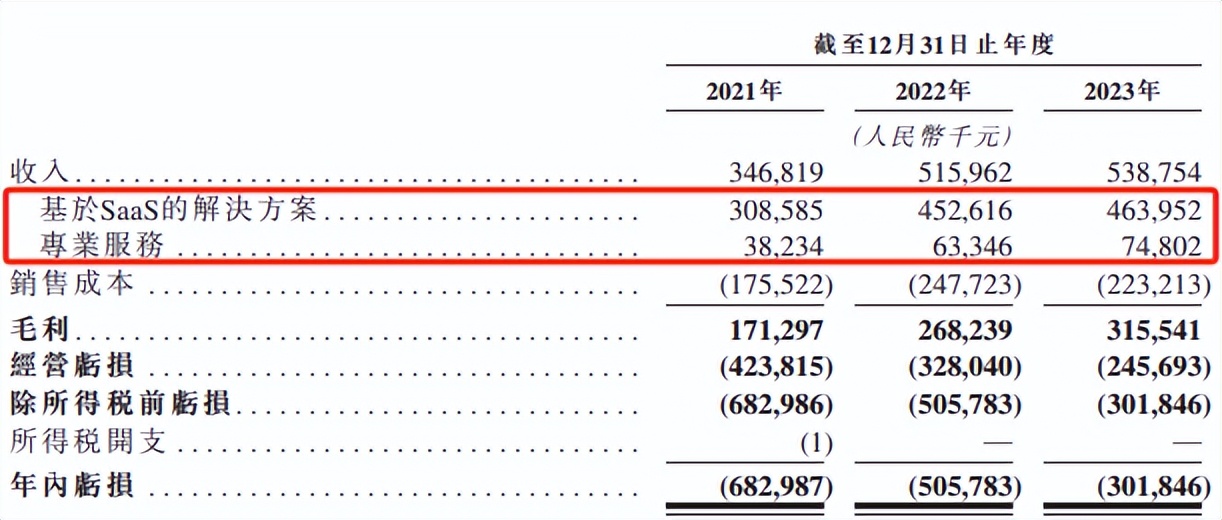

With increasing demand for unified strategic decision-making platform solutions among small and medium enterprises amidst fiscal and taxation management costs and digital dilemmas, Huizhangsuan provides comprehensive financial and taxation solutions covering accounting, invoicing, tax compliance, and integrated financial management, helping small and medium enterprises achieve comprehensive compliance. The prospectus shows that Huizhangsuan's revenue in 2021, 2022, and 2023 was RMB 347 million, RMB 516 million, and RMB 539 million, respectively.

In terms of revenue composition, Huizhangsuan's revenue mainly consists of SaaS-based solutions and professional service revenue. In 2023, revenue from SaaS-based solutions was RMB 464 million, accounting for 86%; revenue from professional services was RMB 74.8 million, accounting for 14%.

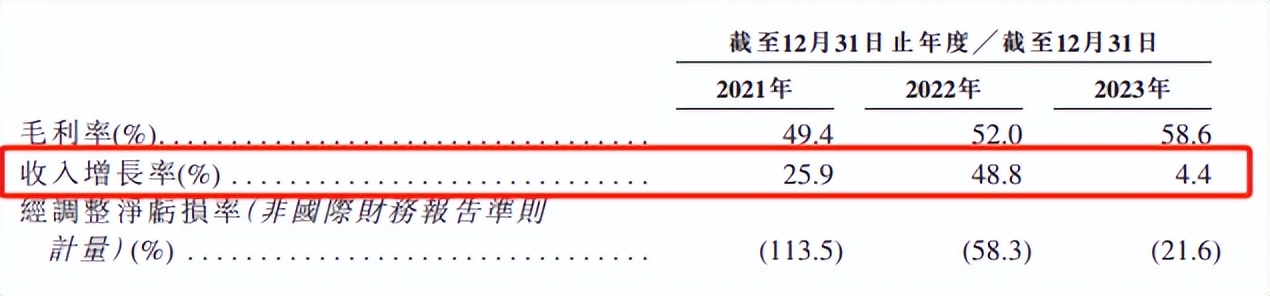

Overall, Huizhangsuan's revenue has maintained a growth trend, but we notice that the company's revenue growth rate in 2023 has slowed significantly compared to the previous year, with the revenue growth rate dropping from 48.8% to 4.4%.

The reasons for this slowdown in revenue growth may be related to the low market concentration and fierce competition. The small and medium enterprise financial and taxation service segment in China is highly fragmented and still in the early stages of digitization. As the largest solution provider in terms of revenue, Huizhangsuan's market share in 2023 was only 0.5%.

In the prospectus, the company mentioned facing competition from companies with different business models, including increasing challenges from free or anti-competitive low-cost service providers or providers offering features that the company does not provide, and previous customers who have paid for the company's services may instead choose to use free services from the company's competitors.

The slowdown in revenue growth also indicates that Huizhangsuan is facing growth challenges. This is closely related to its customer attributes, as small and medium B-end customers focus on the cost-effectiveness of products, emphasizing "convenience" and expecting flexibility in financial and taxation SaaS products.

So, can Huizhangsuan break through the development bottleneck?

Racing to list amidst losses, financial and taxation SaaS intelligence may open up growth space

Huizhangsuan's dilemma is not just slowing revenue growth.

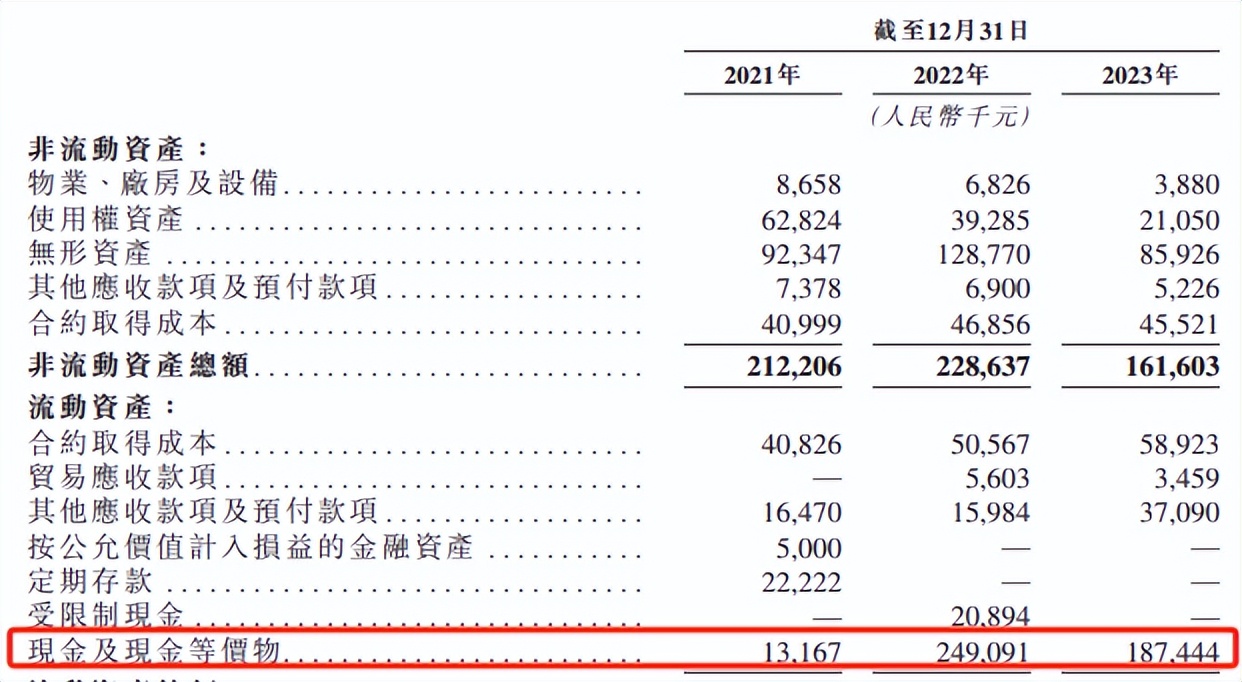

Due to fierce market competition and the company's continued investment in research and development, marketing, and other areas, Huizhangsuan still faces pressure on losses in recent years. In 2020, 2021, and 2022, the company's adjusted net losses were RMB 394 million, RMB 300 million, and RMB 117 million, respectively. Although the trend is narrowing year by year, cash flow is still relatively tight. As of December 31, 2023, Huizhangsuan held cash and cash equivalents of RMB 187 million.

At the same time, Huizhangsuan has failed to obtain external funding support. According to Tianyancha data, the company has undergone multiple rounds of financing, but after the last round of financing in 2021, the company has not received any further financing.

Source: Tianyancha

Amid various development difficulties, Huizhangsuan urgently needs to list on the Hong Kong Stock Exchange to obtain the funds needed for development, and primary market investors also need this channel to profit and exit.

The question is, what story can Huizhangsuan still tell the capital market?

We believe that SaaS+AI may be the company's imagination space.

In the past two years, with the emergence of ChatGPT, AI+SaaS has become the focus of industry exploration. This model is considered one of the fastest ways for AI to be applied on the B-end and generate actual benefits.

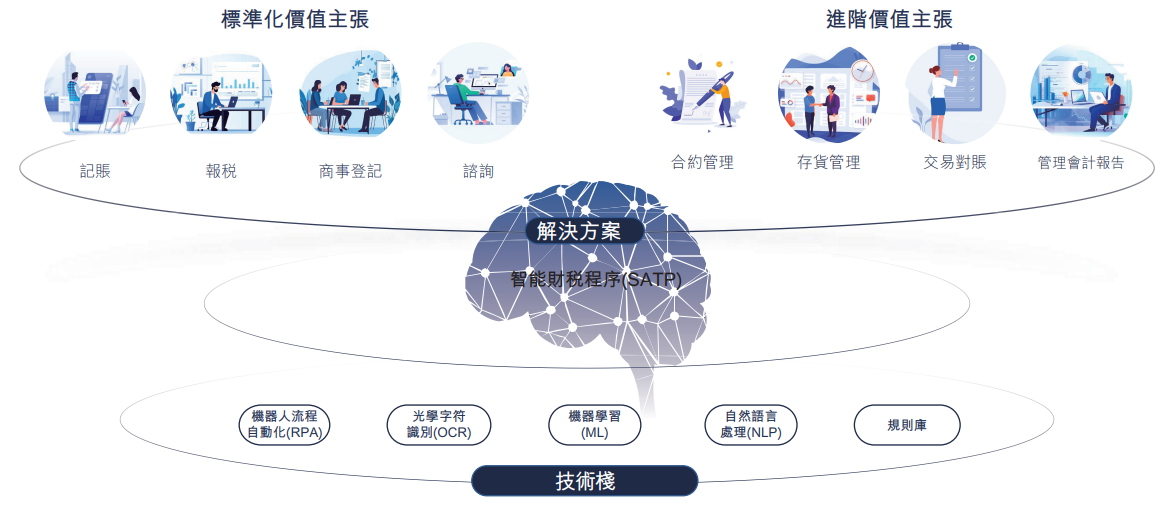

In the past, Huizhangsuan was one of the companies actively deploying "AI+". According to the prospectus, Huizhangsuan has developed a smart finance and taxation program (SATP system), which realizes intelligent and automated services through AI empowerment. Its unique machine learning model, as a key component of the company's core financial and taxation SaaS system, greatly improves the efficiency and accuracy of solutions.

In the prospectus, Huizhangsuan detailed a series of functions of the SATP system and its automation technology in simplifying bookkeeping and tax filing processes, enabling enterprises to improve operational efficiency.

By embracing intelligent technology, Huizhangsuan has achieved cost reduction on one hand. According to Frost & Sullivan, the cost of Huizhangsuan's solutions is significantly reduced by more than 60% compared to traditional solutions and more than 99% compared to internal employees. On the other hand, it has improved the flexibility of products and services, meeting the needs of small and medium enterprises and gaining high customer stickiness. In the most recent tax period from January to March 2024, the fully automated delivery rate for small and medium enterprise customers subscribing to Huizhangsuan's SaaS-based solutions was 86.6%.

Looking ahead, with the accumulation of business data and industry know-how, further exploring the empowerment of financial and taxation big models for business growth may be the key for Huizhangsuan to break through the deadlock. As of June 9, 2024, Huizhangsuan has processed over 312 million financial and taxation bills and accumulated approximately 262 million multi-dimensional model parameters related to the financial and taxation processes of small and medium enterprises, forming the largest parameter set in the industry, including orders, trade bills, invoices, bank receipts, bank statements, and other bills.

As one of the representative technologies of new productive forces, artificial intelligence is an important direction for the development of financial and taxation SaaS. In November 2023, the official WeChat public account of the Ministry of Finance released the "Basic Work Standards for Agency Accounting (Trial)" and "Opinions on Strengthening and Improving Agency Accounting Work in the New Era," encouraging localities to explore building an integrated small and medium enterprise management service platform covering financial and taxation consulting, business registration, financial services, and other businesses based on agency accounting services, and guiding agency accounting institutions to fully utilize big data, artificial intelligence, blockchain, and other technological means to select or build digital business management systems.

In the financial and taxation service industry, which is not highly digitized, Huizhangsuan's deployment of "AI+" still has the opportunity to emerge from the growth slowdown.

Source: Hong Kong Stock Research Community