Pinduoduo, Alibaba, Douyin: Fiery Competition for Low Prices and Shelf Space, Will the Final Chapter of E-commerce Be Retail Stocks at 10x PE?

![]() 07/03 2024

07/03 2024

![]() 680

680

Since the last e-commerce overview was released in the third quarter of last year, the e-commerce industry seems to have undergone many changes. However, looking back from then to now, the trend since the "Billion Subsidy" war continues, and there does not seem to be any disruptive changes in the valuations of companies or the relative strengths and weaknesses among several e-commerce companies.

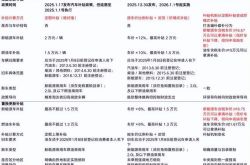

After the conclusion of the first half of 2024, looking back at the past six months, the current trends in our e-commerce industry are:

① At the level of stock prices and valuations, the stock price performance and valuation trends of JD.com, Alibaba, and Pinduoduo tend to synchronize. In the first half of 2024, stock prices barely moved, despite different performance results, and the PE valuation multiples in 2024 have all narrowed to within the range of 9x~13x.

② In terms of business, competition among platforms around low prices and consumer experience has become increasingly fierce, and in the process of mutual imitation, it has become increasingly homogenized.

③ Perhaps due to the narrowing of differences between platforms, Douyin and Pinduoduo, which lead in GMV growth, seem to have experienced a significant drop in GMV growth since 2024, according to some surveys. Meanwhile, JD.com and Alibaba, which lagged behind, seem to have shown a trend of GMV bottoming out and rebounding (though it is uncertain whether this can be sustained). The GMV growth rates among platforms also seem to be converging.

④ The trend of changes in monetization rates has an increasingly significant impact on the performance of e-commerce platforms. Different platforms may have different potential monetization rates due to their positioning and business models. However, there also seems to be a clear positive correlation between GMV growth rates and monetization rates.

⑤ In theory, the willingness to pay of white-label merchants seems to be higher than that of branded merchants. Therefore, the monetization rate center of Pinduoduo may be higher than that of Alibaba or JD.com.

⑥ The more sluggish overall consumption is, the more obvious the relative growth advantage of online channels becomes. Therefore, the e-commerce industry has room and ability to increase monetization overall.

⑦ However, with the convergence of competition and GMV growth rates, while the monetization rates of various e-commerce platforms fluctuate around their respective centers, the differences may also relatively narrow.

⑧ In the short to medium term, "immediate" shareholder returns are an important factor affecting capital preferences. In the past, the strength of repurchases has been significantly positively correlated with stock price performance, providing a solid support for e-commerce companies when their stock prices/valuations are significantly low.

⑨ Before cross-border businesses successfully achieve (at least initial) localized operations, we believe that the "noise" they generate is far greater than their impact on the group's overall valuation.

The following are the details of the main text:

I. Different Performance, but Converging Stock Price Performance

To understand the future, we need to start by reviewing the performance of the e-commerce sector since 2024.

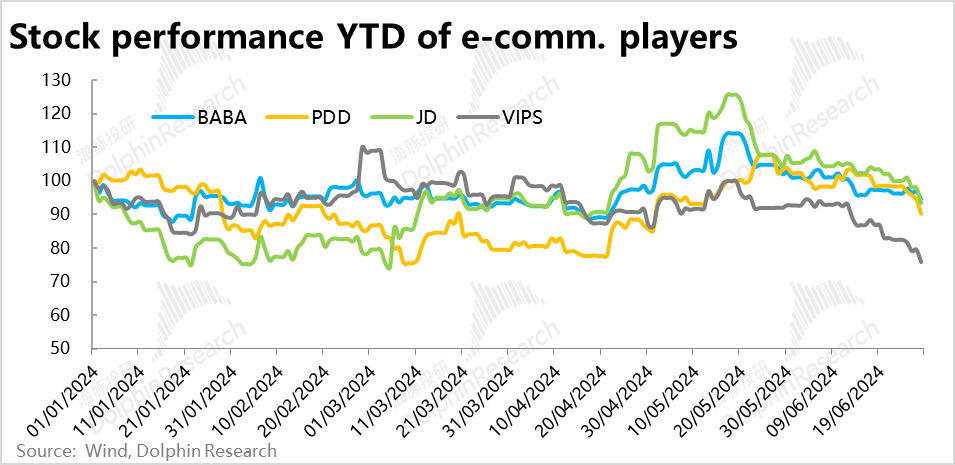

1. Stock Price Performance Tends to Converge

Firstly, from a results perspective: ① In terms of stock prices, the stock price performance of the 3+1 shelf-based e-commerce companies covered by Dolphin Investment Research, after half a year of fluctuations since 2024, the three large platforms have different fundamentals and strategic approaches, but their stock prices have converged, mostly "returning to the starting point" compared to the beginning of the year. Somewhat surprisingly, JD.com, which was consensus on having the weakest fundamentals, was once the leader, rebounding in April-May, while Pinduoduo, which had the strongest performance, underperformed for most of the year, still underperforming JD.com and Alibaba as of the end of the first half.

As for Vipshop, which performed relatively strongly last year, it significantly underperformed this year, with a decline of about 25% since the beginning of the year.

② In terms of valuation, from a vertical perspective over time, the "3+1" e-commerce companies have generally experienced a considerable degree of "passive valuation compression" compared to the beginning of the year. Referring to market expectations and our calculations, we can see that the overall profit growth rates of the three major e-commerce groups in 2024 are higher than the core business growth rates, mainly due to the reduction in losses in non-core businesses. However, the decline in the market capitalization of the three companies reflects that the market is not enthusiastic about the reduction in losses in Alibaba, JD.com, and Pinduoduo's non-core businesses, pricing them only based on the performance of their core businesses.

Across companies, although there is a quantitative difference in the expected profit growth rates of Pinduoduo and JD.com & Alibaba in 2024 (high double-digit vs. low single-digit), the valuations of the three major e-commerce platforms have significantly converged, mainly due to Pinduoduo's overall PE and core business PE contracting by about 40% and 30% respectively from the beginning of the year.

As a result, in terms of core business, the PE valuation range of the three leading players has narrowed from 10x~18x at the end of 2023 to about 9x~13x. This suggests that the market seems to believe that the differentiation (alpha) between e-commerce companies is dissipating, and all players will converge towards the industry average (beta), thus not willing to give higher valuations to any company (mainly Pinduoduo).

2. Performance Results are Not the Same

As for the performance level:

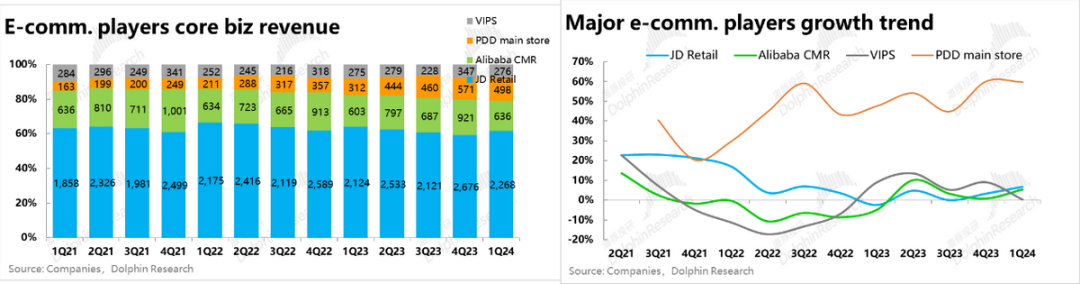

① In terms of revenue, there are both differences and commonalities in the growth trends of each company's core business. The difference lies in the fact that Pinduoduo maintains a unique high double-digit growth rate, and even under the increasingly fierce competition in the e-commerce industry, its revenue growth in the past two quarters has not been affected, but has instead increased.

The commonality is that after nearly no growth in the past two quarters, JD.com and Alibaba both rebounded to the mid-to-high single-digit range in the first quarter of this year. Although a single quarter is not sufficient to make a reliable judgment, it plants the possibility that after several quarters of strategic adjustments and investments in commodity prices and user services, JD.com and Alibaba have shown a positive trend in growth.

As for Vipshop, it may be due to the "collateral damage" of the giants' battle or the weakness in sales of its core category of clothing, showing a trend of slowing growth.

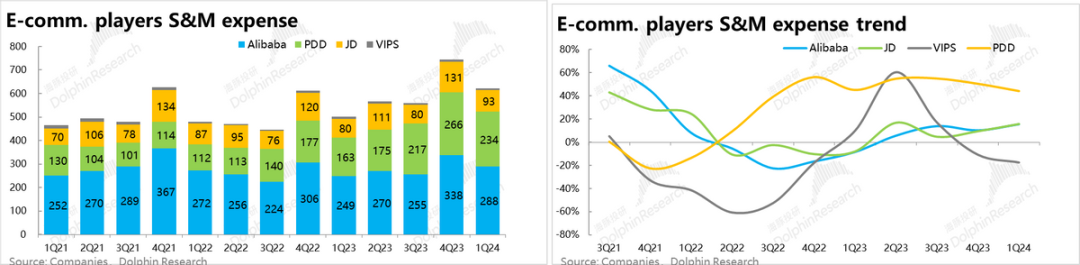

② Corresponding to the "intensification" of competition and the increased investment to regain growth, the marketing expenses of JD.com and Alibaba have also increased significantly in the past two quarters, with both increasing by about 16% in the first quarter. Although Pinduoduo's absolute growth in expenditures is still leading (over 40%), due to the reduction in Temu's investment and the main platform seemingly shifting to "profit priority," Pinduoduo's investment growth has been continuously decelerating in recent quarters.

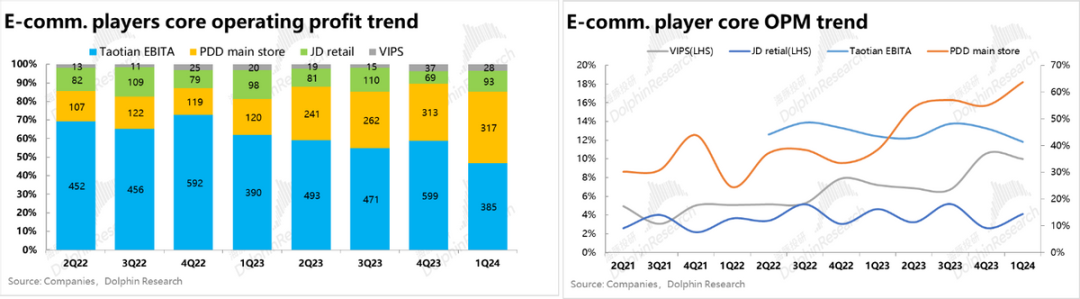

As a result, although JD.com and Alibaba have accelerated their growth, the cost is a low single-digit decline in operating profits from their core retail business.

In summary of the above review, we believe that the main focus is: although the performance levels are not the same, the stock price performance and valuations of Pinduoduo are clearly converging towards JD.com & Alibaba, and funds' preferences for the three major e-commerce companies are converging.

II. Will Tendency towards Homogenization be the Direction for E-commerce in the Future?

After reviewing the past stock prices and performance data of companies, which are already final and conclusive, what are the reasons behind these results? What can we learn about the evolution trends of the e-commerce industry from this?

1. Endless Internal Competition around Low Prices and Services

We believe that the first trend is that the competition among e-commerce companies around cost-effectiveness or consumer experience is becoming increasingly fierce, intense, and homogeneous. To a certain extent, some measures that seem unreasonable to ordinary people have even been taken.

① Low prices are still the first priority. Although it is difficult to quantitatively analyze how much the overall commodity prices of Taobao and JD.com have narrowed compared to Pinduoduo since last year. But as a consumer, one can feel the increased importance of Taobao, JD.com's billion subsidy, 9.9 free shipping, "xx" factory, and other low-priced, white-label commodity entry points; JD.com recently announced the restart of the Jingxi department, once again intending to penetrate the lower-tier market.

② The threshold for fulfillment has been lowered, and services have been upgraded. JD.com has lowered the free shipping threshold for non-members to 59 yuan. For member users, both JD.com and Taobao provide unlimited free delivery and door-to-door pickup; recently, Pinduoduo and Taobao have also announced free shipping activities in Xinjiang and Tibet;

③ Refund only: As one of Pinduoduo's controversial but special features, Alibaba and JD.com have also followed suit with the refund-only function for some products. Even though there is a possibility of being exploited, the platforms tend to please users.

④ Douyin has also entered the low-price battle: Even Douyin E-commerce, which has the largest source of traffic and the fastest growth rate in the industry, recently announced that it will strengthen its resource tilt towards low-priced or white-label goods. After the gradual diminishing of the dividends of live streaming and video modes, cost-effectiveness has also become an important direction for its development.

⑤ Pinduoduo launches automatic price adjustment: Perhaps in response to competition, it is reported that Pinduoduo recently launched an automatic price adjustment function that can compare the prices of products across the entire network and automatically adjust some merchants' product prices to the lowest price.

As can be seen, e-commerce platforms have entered a state where if a competitor has a certain function or service, they will quickly follow suit, even if these measures may damage the interests of the platform itself or merchants, or do not conform to their own positioning or the long-term interests of the industry.

2. The Changes and Importance of Monetization Rates are Becoming More Apparent

In addition to the increasing internal competition and homogenization, monetization rates have also become one of the most influential factors for e-commerce companies. For example, Dolphin Investment Research has noticed from multiple channels that Taobao continues to focus on grabbing users and growth with low prices as the main line, and on increasing the paid rate with the help of the entire station promotion, shifting its focus back to profits. There are repeated debates about which of these two directions takes precedence.

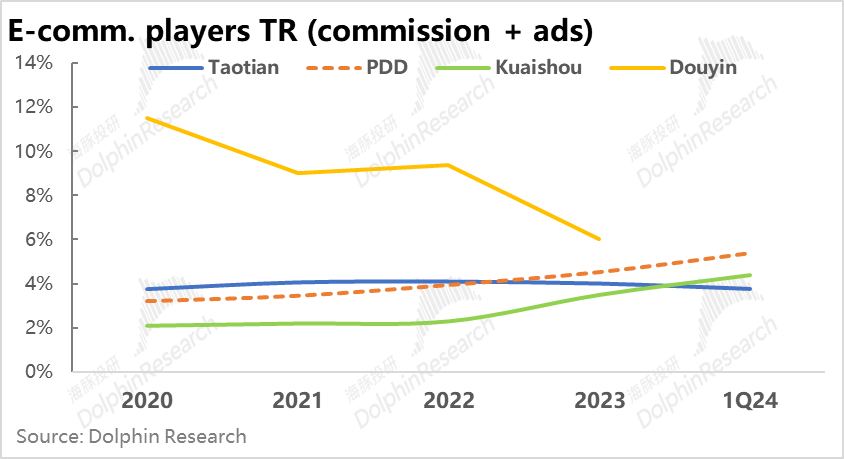

So how have the monetization rates of various e-commerce platforms actually changed? First, Pinduoduo has continuously broken market expectations since the second half of 2023. Although Temu has also contributed, the main reason is that the continuous increase in monetization rates has led to the continued growth of advertising revenue on the main platform far exceeding market expectations. Although e-commerce companies no longer disclose GMV data, and accurate monetization rates cannot be known, combining research and our calculations:

① Excluding the impact of Temu on the overall monetization rate and focusing only on Pinduoduo's main platform business, Pinduoduo's monetization rate increased by an average of 0.5pct per year between 2022 and 2023, and in 1Q24, the monetization rate increased by about 0.9pct compared to the average of the previous year, approaching 5.4% (other institutions have calculated it to be close to 6%). After entering 2024, the monetization rate began to accelerate.

② In contrast, Taobao Group's monetization rate calculated based on CMR has fluctuated between 4.0%~4.1% during the natural years of 2021~23 and has not increased significantly. However, in the first quarter of this year, perhaps due to support for small and medium-sized merchants, the average monetization rate actually decreased slightly by about 0.2pct to 3.8%.

③ As for Kuaishou and Douyin, two major content-based e-commerce platforms, referring to calculations from other channels, Douyin E-commerce's total monetization rate once reached over 10% in its early development stage (explosive growth phase), mainly due to the higher fees that need to be paid to live streamers. In recent years, it has been gradually declining, considering the industry's conventional level; Kuaishou had a lower monetization rate in its early development stage, but in recent years, as the platform has matured, its monetization rate has also gradually increased, reaching over 4% in the first quarter of this year, which is already a relatively high level in the industry.

Based on the different trends of monetization rates of different platforms as they develop, it can be seen that monetization rates are higher when the company is in its early development/rapid growth stage or when the platform is mature (with stable growth). However, Dolphin Investment Research believes that the logic behind this is actually consistent, essentially a trade-off between profitability and growth.

① In the high-growth stage, when e-commerce platforms can bring merchants a large number of new customers and above-average sales growth, merchants are willing to pay higher promotion fees for considerable growth space, so the platform can enjoy a higher monetization rate (such as Douyin). But the platform can also choose to suppress the monetization level to "cast a long line to catch a big fish" in order to further accelerate growth.

② In the mature stage, when the platform's growth has nearly reached a bottleneck and begun to slow down, it can shift to pursuing profits, actively increase the monetization level, and push up revenue and profit growth. For example, Pinduoduo and Kuaishou can be classified as such. In another scenario, the platform can also choose to actively reduce the monetization rate to attract merchants and users back to some extent, intending to regain growth. Alibaba, JD.com, and even Douyin belong to this category.

So facing the maturity of growth, why do different platforms make different choices between grabbing profits and grabbing growth? We believe that the difference may lie in whether the platform's stable growth rate stays at a higher or lower level after maturity, and whether the platform's fundamental barriers in its advantageous areas are solid.

In most past research on the e-commerce industry, judging the merits and demerits of e-commerce platforms is mostly from the perspective of users, generally measuring the value brought to consumers by the platform based on the framework of "saving > variety > quality = speed." Although in the context of "oversupply," many domestic industries have shifted from a "seller's market" to a "buyer's market," the relative importance of consumers is constantly increasing.

However, merchants are obviously an indispensable part of the three-party e-commerce system, and merchants are also the direct source of revenue and profits for the platform. From the perspective of merchants, what is the greatest value of e-commerce platforms? Dolphin Investment Research believes that, simply put, it is to bring merchants more suitable customers and assist them in obtaining the most profits, cash flow, or sales (different merchants may have different priorities). Merchants will be more willing to pay for it, thus enhancing the platform's monetization ability.

3. GMV Growth Rate, One of the Determining Factors of Monetization Rate?

The order of recent GMV growth of the head e-commerce platform is: Tiktok>Pinduoduo ≈ Kwai>Taotian ≈ JD. At present, the order of the liquidity rate of each platform is: Tiktok>Pinduoduo>Kwai>Taotian>JD. It can be seen that the order of the current platform's liquidity rate and GMV growth is roughly the same, showing a significant positive correlation. To some extent, it verifies the simple logic that platforms that can bring more sales/revenue/profit to merchants and have higher monetization ability.

However, the growth rate of GMV is clearly not the only factor affecting the platform's monetization ability. Even at close GMV growth rates, different business models and advantageous customer groups/merchants of the platform will naturally affect the center of the platform's monetization ability.

4. Is the willingness of white card merchants to pay actually higher?

Taking Pinduoduo as an example, in fact, when Pinduoduo's main website's monetization rate reached and exceeded Taotian's level last year, there were already voices in the market questioning Pinduoduo's potential to further increase its monetization rate. After all, on the one hand, Pinduoduo merchants have lower product prices and profit margins than brand merchants, but on the other hand, they have to bear higher purchase volume and commission costs than Taotian brand merchants. This is obviously not reasonable under simple logic. But the fact is that since the second half of 2023, Pinduoduo's monetization rate has not only exceeded Taotian's, but has not seen any bottlenecks, but has been accelerating.

The main reason for this misjudgment, we believe, is that the priority of demands varies among different merchants. We fabricate a brand merchant and a white label merchant, and imagine in our minds who is more willing to sacrifice profits and bear higher purchase volume costs in exchange for higher sales or revenue.

① For a mature and successful brand merchant, their demand for profit is more likely to be higher than sales. For example, luxury brands, the ultimate goal of brand merchants, are likely to prefer destroying inventory to protect profits, rather than choosing to lower prices to boost sales. And for brand merchants, it is highly likely that they have comprehensive sales channels, such as self operated stores, hypermarkets, etc., and online channels are not indispensable. In fact, it is not uncommon for brand merchants to voluntarily announce their withdrawal from e-commerce platforms in order to maintain the omnichannel pricing system.

② For white card merchants, cash flow/sales are more likely to be a higher priority demand. We believe one of the reasons is that the cash flow pressure on white label merchants is more tight, and at least sufficient sales/revenue needs to be ensured first to cover the cost of continuing production. Otherwise, regardless of the amount of profit, the survival of businesses becomes a problem. Moreover, since white label merchants are defined as lacking brand effects, their own sales channels are unclear, and their reliance on 3P sales channels (such as e-commerce platforms) is likely to be higher.

It can be seen that compared to branded merchants, white label merchants are more willing to sacrifice profits and increase buying volume in exchange for sales and revenue, and they also rely more on 3P sales channels (such as e-commerce). Therefore, we believe that Pinduoduo's positioning as a white label merchant/product primarily gives the platform a higher liquidity center, and even at similar scales or growth rates, Pinduoduo's liquidity rate is likely to be higher than that of JD or Alibaba.

5. Is the convergence after differentiation an inevitable trend?

However, although we believe that Pinduoduo's liquidity ratio may be higher horizontally compared to Taotian and JD.com. But compared vertically and internally, as we inferred earlier, there is also a positive correlation between the rise and fall of the realization rate and the change in GMV growth rate. This leads to a new problem.

Although there is no relatively reliable source of information on the GMV growth rate of Pinduoduo in the market, there are significant differences in estimates across different channels. However, according to Dolphin Investment Research, some leading institutions predict that Pinduoduo's GMV growth rate in the first quarter of this year will be less than 25%, and their expectations for growth in the following quarters of this year are even lower than 20%.

Based on the previous text, we have found that the competition in e-commerce is becoming increasingly competitive (especially in the low price or consumer first race of Pinduoduo), and the differences between different platforms tend to narrow. At the same time, there are signs of recovery in GMV growth for JD.com and Alibaba in 1Q. Although the counterattacks from Alibaba and JD.com have really been effective, and whether institutions have accurately judged the GMV growth rate of Pinduoduo, we are currently unable to provide a definitive judgment. But under simple logic, it is not impossible for Pinduoduo's subsequent GMV growth rate to return to the industry average level, and it can be said that it is reasonable. After all, as your competitors become more imitative of you and players become more similar, business performance tends to converge rather than diverge.

Therefore, although we are not sure if Pinduoduo's current liquidity rate has reached its higher central level, if the GMV growth rate returns, it at least means that the liquidity rate cannot deviate significantly from its own level. When the growth of GMV and liquidity returns to normal, it is only natural that the valuations of various e-commerce companies tend to be consistent.

picture

6. Enhancing the confidence of monetization - Is the superiority of online channels more apparent?

Although different platforms may have different growth rates in their own monetization rates in the future, we believe that there is potential for further overall improvement of the liquidity center in the entire e-commerce industry.

On the one hand, after Pinduoduo, Alibaba, Kwai and other companies are also promoting advertising tools such as full site push. These advertising tools are the help platform for change to enhance the control over the proportion of free/paid traffic, and help to increase the proportion of paying merchants (other merchants use full site push, while the traffic of merchants using traditional tools or non paying merchants decreases passively). According to research, as of this year, Pinduoduo, the pioneer of "full site promotion", still accounts for over 50% of free traffic in 1Q, and the company is reported to further increase the proportion of paid traffic. The promotion of similar tools across the entire site provides a tool foundation for the platform to improve its monetization rate in the future.

From the perspective of the industry as a whole, the domestic zero growth rate in the first quarter was 4.7%, and it further dropped to 2% -3% from March to May. In contrast, the physical retail growth rate of online channels reached 11.6% in 1Q, far ahead of the overall social zero growth rate, and the growth rate from April to May is still nearly 10% or higher. The proportion of online physical retail to the overall social zero, which was temporarily backfired during the offline recovery last year, has continued to rise steadily in the past 24 years, with a year-on-year increase of about 2%.

As overall consumption becomes more sluggish, the relative growth advantage of online channels becomes more prominent. Due to the increasing difficulty in selling through other channels, the value and scarcity of online channels as one of the few channels that is easier to sell to merchants are also more apparent. Due to this scarcity, the monetization ability of e-commerce platforms for merchants has also increased significantly. In other words, as long as the relative growth advantage of online channels can still be maintained, online channels have the confidence to improve their monetization rate.

3、 What are the highlights of the endless internal competition in China

1. Shareholder returns are equally (more) important

In the first part of this article, it can be seen from JD's stock price performance leading the e-commerce industry in the past six months that under the current overall low valuation, the performance of e-commerce companies' stock prices is not even largely determined by fundamentals. In fact, the amount of "immediate" shareholder returns has become a very important factor affecting the short-term performance of stock prices.

It can be seen that both JD.com and Alibaba have significantly increased their repurchase efforts in the first quarter of 2024, especially with JD.com's 1Q24 quarterly repurchase amount exceeding the total repurchase amount in any previous year. However, Vipshop saw a significant decrease in buybacks in the first quarter of this year, almost to zero, after generous buybacks in 2022-23. As for Pinduoduo, there was no repurchase at all.

From this, it can be seen that the ranking of repurchase intensity is generally related to the stock price ranking in the first half of this year, with JD>Alibaba>Vipshop>Pinduoduo. Verified the market's emphasis on immediate shareholder returns.

Looking ahead, it can be seen that Alibaba currently has the most abundant unused repurchase quota, accounting for about 16% of the total market value, while JD.com and Vipshop each account for about 7% of their own market value (and it is not ruled out that further growth of repurchase quotas is possible). From this perspective, whenever the valuation of companies such as JD.com, Alibaba, and Vipshop drops to a level that the company believes is significantly lower, it is the company's buyback that provides the most support to protect investors from downward risk. In other words, investors don't have to worry too much about the downward risk of the electric trademark, but rather look at the probability and space for upward movement.

However, in order to meet the foreign exchange funding pressure brought by the repurchase, JD and Alibaba recently announced the issuance of convertible bonds, which has reduced the value of the repurchase and lowered investors' favorable impression of the company. For specific details, please refer to our discussion in another article, and we will not repeat the discussion here.

2. The initial results of going out to sea, but the cross-border model is just a process, and the end point is only localization?

In addition to its core domestic business, there has been an increasing trend of e-commerce platforms going global recently, but the market's enthusiasm for this is not as enthusiastic as when Temu first started in 23 years. According to recent performance indicators, Alibaba International Group's revenue growth rate has remained above 40% for the past four quarters. According to our calculations, Temu's contribution to revenue in the latest quarter has reached over 30% of Pinduoduo's total revenue, indicating that overseas business has clearly achieved good results in creating new sources of growth for the group. However, based on the performance of related company stock prices, the market may not be as enthusiastic.

On the one hand, it is natural that the poor performance of domestic business still suppresses the overall valuation of the group. However, as mentioned in our earlier discussion on cross-border e-commerce business:

① On the one hand, cross-border e-commerce is subject to regulation by overseas governments, and to put it bluntly, being suppressed is an almost certain question of when, rather than whether. After the Tiktok incident sparked widespread market concerns about domestic companies going overseas to the United States, the EU has recently positioned Temu as a "super large online platform", indicating that Temu may also receive more attention from regulatory agencies in the future.

② On the other hand, Amazon has started to launch semi custodial services in China, attempting to expand Amazon's supply of low-priced goods in the country and accelerating cross-border fulfillment speed through Amazon's globally leading self owned logistics. To some extent, apart from the pricing power still belonging to the merchant, there is no significant difference from Temu's model. Although we cannot yet determine whether Amazon will invest a lot of resources and effort in this business, it is at least an additional potential enemy for domestic cross-border e-commerce. This also confirms our previous inference that low-priced domestic sources of goods do not constitute unbreakable barriers or advantages, and overseas platforms can also have a large number of domestic sources of goods. Cross border platforms are more critical in controlling overseas customer sources.

③ We believe that in order for cross-border e-commerce to truly succeed and achieve the vision of creating a new "xx", breaking away from the limitations of "cross-border" on customer groups and product categories, and achieving localized supply and operation is the only way for cross-border e-commerce to "leap over the dragon's gate".

In response to this, Temu has also launched a semi custodial model with a clever nature, which breaks the category restrictions of small package direct mail and further improves performance efficiency by absorbing inventory goods that cross-border merchants have already transported overseas. But the new question is, how much can the remaining inventory of overseas merchants be? What unique value can Temu provide compared to local channels for merchants who have the ability to complete cross-border transportation on their own? So, we believe that Temu's current semi custody model of absorbing existing overseas inventory is only a temporary solution, or rather a trial operation stage. To complete localization transformation in the future, setting up a transit warehouse model may be an unavoidable choice. Therefore, heavier and higher operating costs, as well as how to compete with overseas local channels, may also be unavoidable issues.

picture

Therefore, Dolphin Investment Research still maintains its previous view on overseas business. Only when the initial localization transformation of cross-border business is completed, and it is proven that there are some difficult to replicate advantages when facing domestic overseas channels, may overseas business truly affect the overall valuation of the group.