Avoiding Weaknesses and Highlighting Strengths, Liu Qiangdong Revisits "Jingxi"

![]() 07/07 2024

07/07 2024

![]() 664

664

After a year of "low-price competition," the actions of major e-commerce platforms in the first half of 2024 are gradually becoming clearer.

In July, JD.com's Jingxi business, which targets low-price mindsets, underwent changes again, with the new name being "Jingxi Self-operated."

Currently, Jingxi Self-operated has begun to attract merchants in low-tier cities, offering a full-managed model for white-label merchants, where the merchants are responsible for production, and the platform undertakes the merchants' operations, logistics, after-sales services, and earns a price difference from the goods.

According to 36kr, despite Jingxi Self-operated following the previous "Jingxi" layout and still targeting low prices and lower-tier markets, the main assessment metrics for Jingxi Self-operated currently are helping JD.com acquire more new users from the lower-tier markets and improving new user retention rates. In essence, JD.com's primary goal with this move is to further leverage its own logistics infrastructure capabilities to penetrate deeper into these markets and expand its competitive advantage.

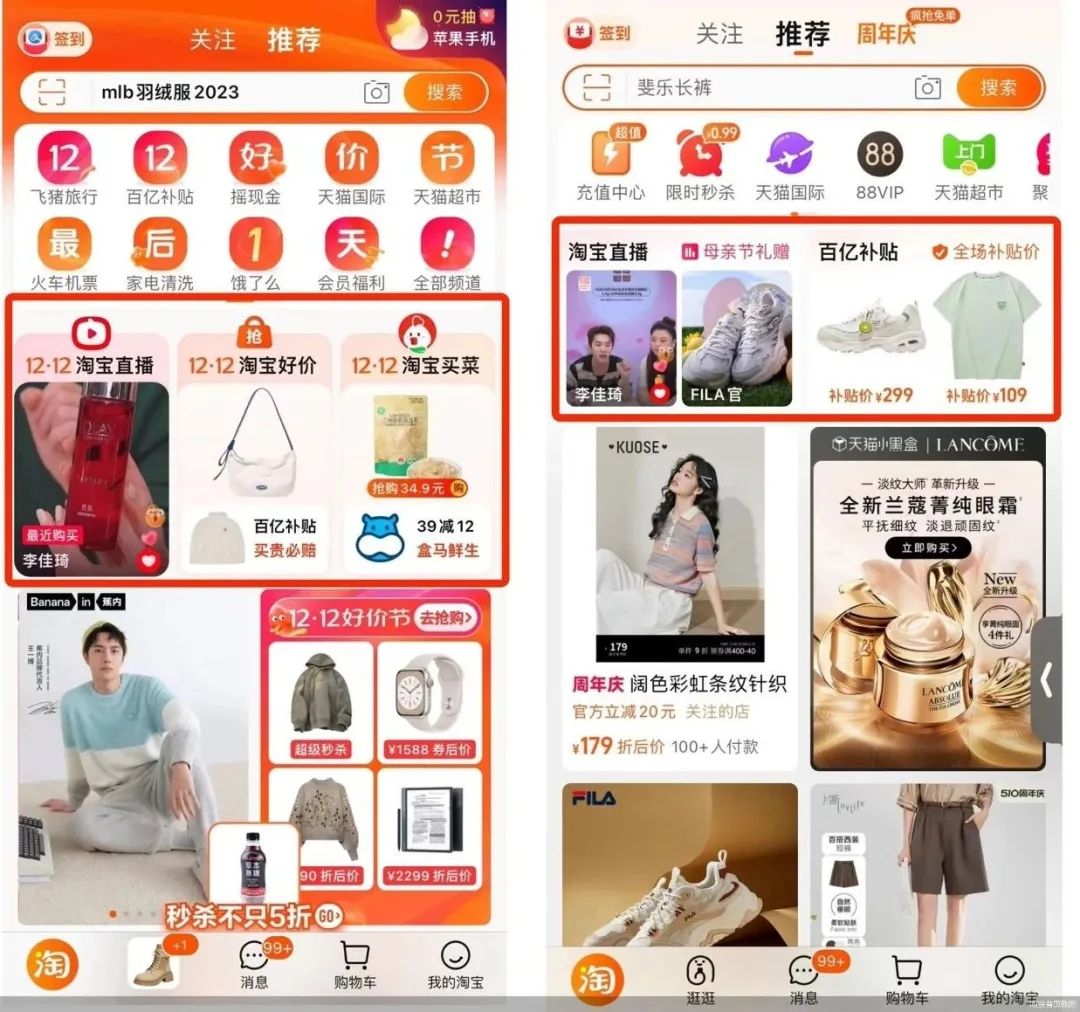

Compared to JD.com, the layouts of other major e-commerce platforms in the first half of 2024 are completely different. For example, Taobao redesigned its homepage before the 618 promotion, intending to deepen its advantage in active shopping mindsets within the Taobao app; Douyin removed functions like video-linked stores to further optimize its content ecosystem; while Kuaishou and Douyin's user overlap continues to decrease, they are continuing to increase their focus on local life...

These adjustments, large or small, all indicate that e-commerce platforms have gained a deeper understanding of their own strengths. After JD.com's previous exploration following the trend, it has once again focused its attention on its greatest strength.

01. Three Attitudes towards Content from Cat, Dog, and Douyin

For e-commerce platforms like Douyin and Taobao that do not invest in offline infrastructure, the only dimension that can continue to compete in the future is user attention, i.e., platform content.

Content is Douyin's biggest strength in e-commerce, and from its series of functional adjustments in the first half of the year, its biggest anxiety is also content.

After all, the decline of every top content platform in each era comes from the impact of content platforms with superior models, such as Tianya, Tieba, and Zhihu. So we can see that Douyin App has been adjusting its content model this year, even at the expense of letting its e-commerce system give way to content.

On May 14, Douyin removed the functions of "Automatically Add Showcase" and "Attach Showcase to Posted Videos," preventing merchants from adding showcases to popular videos later; on June 20, Douyin also removed the function of attaching videos to stores. This function was not long-running, and merchants who rely on it probably belong to the same category as those mentioned above.

In the previous article "From Price War to Content War, Douyin and Taobao Converge in 2024," Xinlipai believes that Douyin is further "expelling" the content of these "stealing traffic" merchants from the Douyin App itself.

However, this does not mean that Douyin does not value its e-commerce system. On the contrary, Douyin App aims to continue cultivating users' passive shopping mindset under a high-quality content system, forming a virtuous cycle of better content and products. Meanwhile, the Douyin Mall version, which has an active shopping mindset, serves as a supplement, and merchants with low content capabilities may be "driven" to the Douyin Mall version.

Unlike Douyin, Taobao's biggest advantage in its e-commerce system is its active shopping mindset. In fact, Taobao does not lack traffic entry points, and its largest traffic entry point is users' original online shopping habits. In particular, Taobao excels in categories like clothing, bags, cosmetics, and daily necessities, where decision-making requires less upfront research and relies more on users directly comparing product styles and prices on the shopping app to make a purchase decision.

A woman's wardrobe never has a "most beautiful" item, only "more beautiful" ones. When a user sees a suitable style, Taobao will push more suitable styles based on clicks. This means that users can directly bypass the content platform to see reviews and come straight to the Taobao app, where they cannot stop scrolling. Such user habits have been cultivated by Taobao before the emergence of content e-commerce.

This is Taobao's hidden strength compared to other e-commerce platforms and even Douyin's content e-commerce platform. This strength may not have been taken seriously by Taobao in the past, but as e-commerce competition evolves, Taobao is now putting this strength of commoditizing content on the table.

Taking Taobao's content redesign before the 618 promotion as an example, while simplifying the layout, it allocated more homepage space to dual waterfall streams of product recommendations. At the same time, the revamped Taobao also saw significant personalization improvements in its recommendation mechanism. To ensure that users have the motivation to keep scrolling, product previews in the waterfall stream will become more content-driven, such as more refined first images and simpler product preview titles, equivalent to a full-product version of Xiaohongshu.

However, unlike Douyin's robust content system and Taobao's commoditized content model, JD.com's current content system and its e-commerce system are difficult to integrate. Especially for JD.com's main category of 3C digital products, such high-research goods tend to prompt users to complete their research on other content platforms before placing orders on platforms like JD.com. In other words, JD.com's main category is not suitable for in-app content layout.

This is why, as shelf e-commerce platforms, Taobao's commoditized content works well, while JD.com's contentization is satisfactory at best. Although JD.com announced in the first half of the year its three must-win battles in content ecology, open ecology, and instant retail, and pledged to invest 1 billion yuan in cash and 1 billion yuan in traffic to attract influencers and agencies, from the current progress, especially in terms of content layout, it seems more like a follow-the-trend business supplement in an era where every platform is doing content.

In comparison, JD.com seems to attach higher importance to "Jingxi Self-operated." According to relevant sources, "JD.com's senior management attaches great importance to this model and has confidence in it, often guiding it personally." In other words, JD.com also realizes that competing in areas where other platforms excel is not as good as continuing to cultivate its unique strengths.

02. JD.com Crosses the River by Feeling for Meituan

JD.com's biggest advantage is its logistics infrastructure, which neither Douyin nor Taobao have been cultivating in recent years.

It goes without saying that Douyin's business model avoids heavy offline asset investment, while Taobao's direct way to intervene in its logistics system is through Cainiao, which essentially provides e-commerce supply chain solutions and serves logistics companies and online shopping platform users.

Most internet giants are unwilling to invest in offline infrastructure but want to become technology and information arms dealers for infrastructure, which is a consensus among most such companies globally. Platforms that can layout their own offline infrastructure from the start can avoid getting caught up in the competition with these information arms dealers. JD.com and Meituan are among the few platforms with this advantage.

Currently, the differences brought about by whether or not to invest in infrastructure are gradually overshadowing other aspects. From 2023, platforms like Douyin and Kuaishou besieged Meituan in local life, but they still ended up with a disjointed layout compared to Meituan. At least in terms of local life, the advantage of infrastructure still overshadows price and content.

With "Jingxi Self-operated" on the agenda, JD.com is also returning to its comfort zone in the e-commerce sector.

In fact, JD.com's exploration of "Jingxi" can be traced back to 2019, when it was known as JD Pinpgou. JD.com's layout for "Jingxi" was based on six mobile channels including WeChat and QQ, both with hundreds of millions of users. Through high-quality and cost-effective goods and social gameplay, it stimulated users to share and multiply, enabling merchants to attract low-cost traffic and convert users. It provided users with a new social shopping experience of "saving for a new life."

In short, it was a low-price group-buying model based on social platform fission, targeting Pinduoduo. However, according to relevant sources, the business development did not meet expectations.

Currently, it seems that JD.com has realized the key to why this business did not meet expectations, which is that the layout of offline infrastructure did not keep pace with the business layout in the下沉 market at the time. Hence, there is now "Jingxi Self-operated," which attracts merchants in low-tier cities, offering a full-managed model for white-label merchants. Its fundamental purpose is to achieve consumption segmentation within the JD.com app.

Platforms with such infrastructure advantages do share many similarities. For example, JD.com and Meituan both follow a model of strong infrastructure + strong active shopping mindset + consumption segmentation within the app + weak content.

For example, Meituan's self-owned delivery riders and store operation outsourcing model are already mature, and the operation services for takeout merchants are essentially full-managed, where merchants only need to open a store and prepare food, while the rest of the platform operations and fulfillment can be handed over to Meituan and third parties. Also, Meituan's short videos and live streaming are still in the蓄力 stage, similar to JD.com's content section.

Meituan's "Pinhao Fan" model, which started pilot testing in 2022, is similar to JD.com's Jingxi in its early stages. Through "popular meal recommendations + group ordering + unified delivery," it enables users to place orders centrally, merchants to prepare meals centrally, and riders to deliver centrally, reducing costs for users, merchants, and delivery riders while improving overall delivery efficiency through economies of scale.

Although this model initially followed the trend of Pinduoduo, like Jingxi, with the support of its own infrastructure, JD.com's Jingxi Self-operated and Meituan's Pinhao Fan both achieve consumption segmentation within their respective platforms.

More importantly, the main businesses of these two infrastructure platforms are in different sectors, so JD.com and Meituan can learn from each other while largely avoiding direct competition.

03. Conclusion

In the early stages of e-commerce development, we generally believed that super-shelves like JD.com and Taobao represented all the imagination of e-commerce business at that time; later, the rise of Pinduoduo made price a key factor; and now, content has become the only dimension that these platforms without infrastructure can compete on, and Taobao's biggest competitor in the future may become the Douyin Mall version.

From competing in service, information integration capabilities, to price, and now content, it is because these are all games that pure information technology arms dealers can participate in. JD.com and Meituan, as both information technology arms dealers and infrastructure builders, have a different advantage.

After 2023, Meituan is clearly not afraid of the impact of these pure information technology arms dealers, and JD.com has also returned to its comfort zone.

However, perhaps what they need to consider more is the overlapping part of their main businesses - instant retail.

*Images in the article and the title image are sourced from the internet.