The Takeout Wars Rage On: Meituan, Taobao, and JD.com Navigate Awkward Terrain

![]() 07/15 2025

07/15 2025

![]() 704

704

The surge in consumer appetite and the avalanche of "wool orders" printing out of merchants' machines have together witnessed this unprecedented takeout frenzy.

According to QuestMobile data, as of May 2025, the monthly active user base of the instant retail app industry centered around "high-efficiency instant services" has reached 551 million, with traffic growth outpacing that of comprehensive e-commerce apps.

Image source: QuestMobile

And this is just data from before June. As we all know, Taobao Flash Buy only officially entered the fray in May, followed by Meituan Flash Buy leveraging the 618 shopping festival, and Ali announcing the integration of Ele.me and Fliggy into Ali's China e-commerce business group. Leading up to the "Saturday Order Rush Incident" in early July, chips were pushed onto the table batch after batch, and the atmosphere grew hotter and hotter.

Such competition may persist for quite some time. According to "LatePost," Ali is attempting to create another promotional festival called "Super Saturday" after "Double 11" and "618," which will involve the entire population. This implies that there will be similar ultra-low-price order rush activities every Saturday for the next 100 days.

So last weekend, the "same-stage boxing match" was staged once again.

Meituan was the first to release its battle report, with daily instant retail orders exceeding 150 million as of 23:36 on July 12. One of Meituan's main promotional strategies this round was a plethora of "free purchase" vouchers, mostly redeemable for chain brand meals, with tea and coffee accounting for the majority, requiring customers to pick up in-store.

The battle report released by Taobao Flash Buy in conjunction with Ele.me on the morning of July 14, in addition to announcing that daily order volume had once again surpassed 80 million, specifically noted that this figure did not include pick-up and free purchases.

Image source: Taobao official account

As the gunpowder smell grows thicker, we can still observe the overall situation and possible trends with the help of three stable value anchors: the benefits brought by takeout traffic; whether the accompanying investment is within a reasonable range; and most importantly, when the transition from food delivery to non-food delivery will truly be completed, allowing instant retail to take center stage.

01. Inspiration from the "Commercial War"

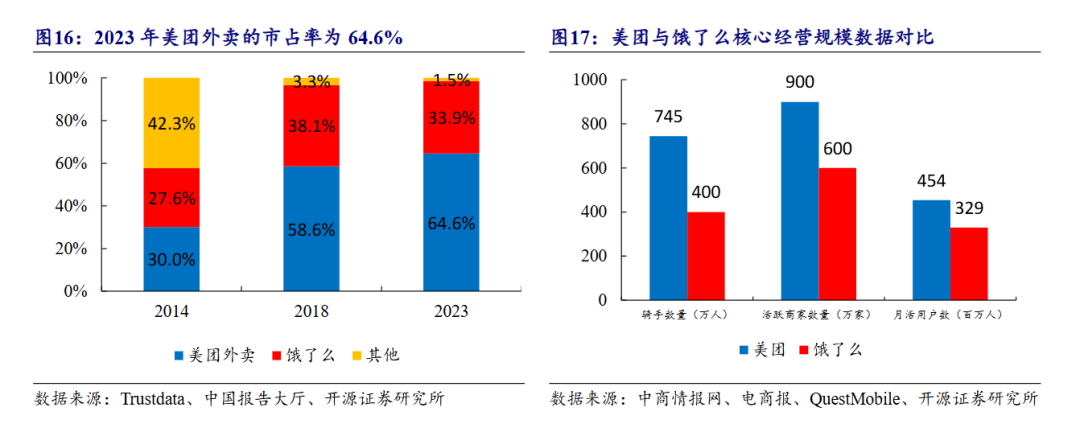

For a long time, Ele.me was at a disadvantage in its rivalry with Meituan. Since Ali completed its full acquisition of Ele.me in 2018 and integrated it into Ali's local lifestyle service system, the market had been in a relatively stable competitive period of "duopoly with a 70-30 split" until early 2025. Meituan continued its "retail + technology" strategy, while Ele.me intentionally contracted and focused its operations on first- and second-tier cities to improve efficiency.

Image source: Kaiyuan Securities

As a result, Taobao Flash Buy disrupted the stable competitive state that had lasted for years in just two months, making everyone realize that this is no longer a conventional commercial war but will tangibly affect the future market landscape.

On the Saturday of July 5, Meituan's takeout and Meituan Flash Buy's battle report showed that as of 22:54, Meituan's instant retail orders for the day had exceeded 120 million (of which over 100 million were food orders). This figure was refreshed to 150 million the next Saturday (July 12).

Data released by Taobao Flash Buy in conjunction with Ele.me on the morning of July 7 showed that their daily order volume exceeded 80 million; non-food orders exceeded 13 million; and Taobao Flash Buy's daily active users exceeded 200 million. The increase in daily order data is very noticeable. At the beginning of its launch in May, its daily order volume was still 10 million, reaching 40 million by the end of May. This figure doubled on July 5, and the latest battle report on July 14 also mentioned that the daily order volume had once again surpassed 80 million, setting a new high.

Another detail is that the collaboration between Taobao Flash Buy and Ele.me, including the subsequent official integration of Ele.me and Fliggy into Ali's China e-commerce business group, seems more like a "spur-of-the-moment" strategic acceleration, a 1+1 inspiration under the pressure of "commercial warfare".

And the driving force behind all this lies in the fact that takeout has become an ultra-efficient means of attracting traffic.

QuestMobile data shows that in the month following the launch of the "Taobao Flash Buy" business, the activity of Taobao App users increased significantly during the meal peak hours of 11am-12pm and 5pm-6pm, with increases of 1.6% and 0.9%, respectively.

Similarly, the year-on-year data for May for JD.com and Meituan's respective apps also showed an increase in the proportion of active users during meal peak hours. Among them, JD.com, which only entered the takeout business this year, showed a more pronounced year-on-year change, with increases of 4.1% and 1.9% during lunchtime and evening, respectively.

Image source: QuestMobile

Against the backdrop of rising online customer acquisition costs, there is also a high degree of overlap among e-commerce platforms' users, and the difficulty of acquiring public domain traffic is obvious to all. Therefore, e-commerce platforms especially need to leverage the high-frequency and rigid demand characteristics of takeout to cover untapped populations.

According to a 2023 statistic from iiMedia Research, 32.78% of consumers order takeout 5-10 times a week (an average of 1-2 times a day), accounting for the highest proportion. Moreover, the conversion efficiency of takeout consumption is also higher, with the entire link of [open - browse - order] being much simpler than [open - search - evaluate - add to cart - pay].

Based on this, if Taobao Flash Buy's announced 50 billion subsidy plan in early July is understood as part of Ali's overall e-commerce business marketing expenditure, the logic is basically sound. E-commerce platforms spend tens of billions of marketing dollars each year on various social media and content platforms. Currently, the advantages of takeout customer acquisition are first, efficiency, as analyzed earlier; and second, less risk of diversion, with traffic directly aggregated by the takeout portal integrated by the platform and not diluted by third-party channels such as mini-programs.

But after all, a huge amount of real money has been invested in subsidies, and the foreseeable pressure of profit damage is also there.

A recent research report by Goldman Sachs estimates that Ali's food delivery business will incur a loss of 41 billion yuan in the coming year, JD.com will lose 26 billion yuan, and Meituan's EBIT (earnings before interest and taxes) will decline by 25 billion yuan. The report also suggests that this round of competition will last longer, expected to peak in investment in September this year, with a potential turning point in the second half of the year.

However, the huge investment is not the problem. In the face of the vision of instant retail, burning money has already become the most basic "entry ticket," and not being absent is the key.

02. Winner-Takes-All and Being Painted into a Corner

Takeout is the "traffic attractor" of instant retail, and the tea and coffee category is the "traffic attractor" of takeout.

With doubled subsidies, the proportion of tea and coffee in takeout orders on various platforms has increased significantly, hinting at a deeper issue: Will consumers' price expectations be excessively raised?

This has already been fully demonstrated in the context of e-commerce. First, long-term low-price promotions can affect consumers' perception of product value, and frequent discounts can easily lower their "price reference point." When the traffic attractors return to their original prices or attempt to promote profitable products, they may not be able to stimulate the same amount of purchasing intent.

Furthermore, long-term promotions can cultivate consumers' habit of stockpiling goods. This has been digested as a "strategic waiting" shopping habit against the backdrop of frequent e-commerce promotions, where consumers lock in categories with high demand and fast consumption and only make bulk purchases during promotional activities.

Even takeout, which focuses on immediate needs, has now developed similar "wool-pulling" tactics. Consumers can lock in products such as raw dumplings, raw wontons, and ice cream that can be stored frozen; if the vouchers they receive are not fully used, they can also schedule delivery for the next day to avoid wasting any discounts.

So when the subsidy activities of various platforms frequently hit the trending topics, we can also see some merchants voicing their pressures on social media.

For brand merchants with offline stores, takeout may be the ideal path to attract dine-in customers and increase private domain conversions. After all, due to the existence of platform commissions and delivery fees, takeout profits are considered inferior to dine-in profits as an "industry consensus." Last year, "Bawang Chaji charging packaging fees per cup" hit the trending topics and sparked a wide-ranging discussion, essentially because the brand was balancing profits through other fee points. This is also why many tea brands currently price their takeout orders about 1 yuan higher than orders placed through mini-programs.

Under normal circumstances, an excessively large proportion of takeout orders will inevitably erode profits to some extent. When promotional activities are in full swing, platforms need to balance the interests of all parties.

Data as of July 14

We mentioned a similar viewpoint in a previous article: "Buying users with money" does not require too much technical or operational ability, but the truth will come out when it comes to "retreating." When continuously increasing subsidies raise user expectations higher and higher, and this state persists for longer, the difficulty of the next step in attracting traffic – accommodating the return of traffic to daily operations – will also increase.

The diffusion path from food delivery to non-food delivery actually has a traceable pattern.

Food delivery represents a basic inventory with high leakage rates and high consumption frequency, which then extends to categories with high immediacy (fresh produce), low portability (rice, oil, flour, etc.), and unexpected consumption (medicine). This is a relatively ideal and smooth transition.

We can also see an emphasis on non-food categories, merchants, and stores in the platform battle reports. For example, the latest data released by Taobao Flash Buy mentions that the order volume of over 260,000 non-food stores increased by more than 100% month-on-month, with orders for rice, oil, flour, and noodles increasing by 335% and household cleaning supplies by 324%.

The bright categories largely coincide with the above logic, but it is still too early to say that instant retail has smoothly taken over the massive traffic from takeout. For reference, Ele.me covered 4.5 million merchants in 2024.

Including the inclusion of some traditional e-commerce categories (such as clothing, shoes, and hats) in instant retail, whether they will encounter the same concerns about online and offline channel allocation as food merchants is a relatively later issue.

As the Saturday boxing matches continue throughout the summer vacation, in the first stage of heating up traffic, it is imperative to determine a winner.

03. Written at the End

Competition, of course, also brings incentives, especially when all current participants are committed to becoming "comprehensive service platforms," which requires them not to have obvious shortcomings.

For example, after JD.com launched the "Quality Dine-in" banner, Meituan introduced the "Dine-in Store" label function in May and continued to increase subsidies for "bright kitchens." In July, Meituan announced the launch of the "Raccoon Canteen" business and plans to invest in the construction of 1,200 such centralized "bright kitchen" takeout kitchens nationwide over the next three years. A series of actions are intended to shed the negative label of "ghost takeout".

Overall, the major segments of local life – food delivery, instant retail, travel, and accommodation – all three platforms currently engaged in fierce competition have their own layouts. Even Pinduoduo, which has been "isolated" in the community group buying segment, also had news in June that it plans to start experimenting with self-built commodity warehouses in first-tier cities to support the expansion of its instant retail business.

Each party has taken an "all-in" stance. The longer the battle lines are drawn and the higher the sunk costs, the more unbearable the possible result of "or nothing" becomes.

For now, all parties can only wait anxiously for the turning point to arrive.

*The title image and images in the text are sourced from the internet.