What information does Amazon's 2024 Semi-Annual Product Selection Report convey?

![]() 07/24 2024

07/24 2024

![]() 505

505

Recently, Amazon Global Selling released its 2024 Semi-Annual "Global E-commerce Consumption Trends and Product Selection Insights Report" (hereinafter referred to as "the Report"), based on data analysis from Amazon's Business Opportunities Explorer and Product Selection Compass, two free product selection tools, providing insights into new consumption trends in the US, Europe, and Japanese markets from a global perspective. Under the trend of brand globalization, more and more merchants are focusing on the global market, but while facing a larger market space, they are also confronted with more unfamiliar markets.

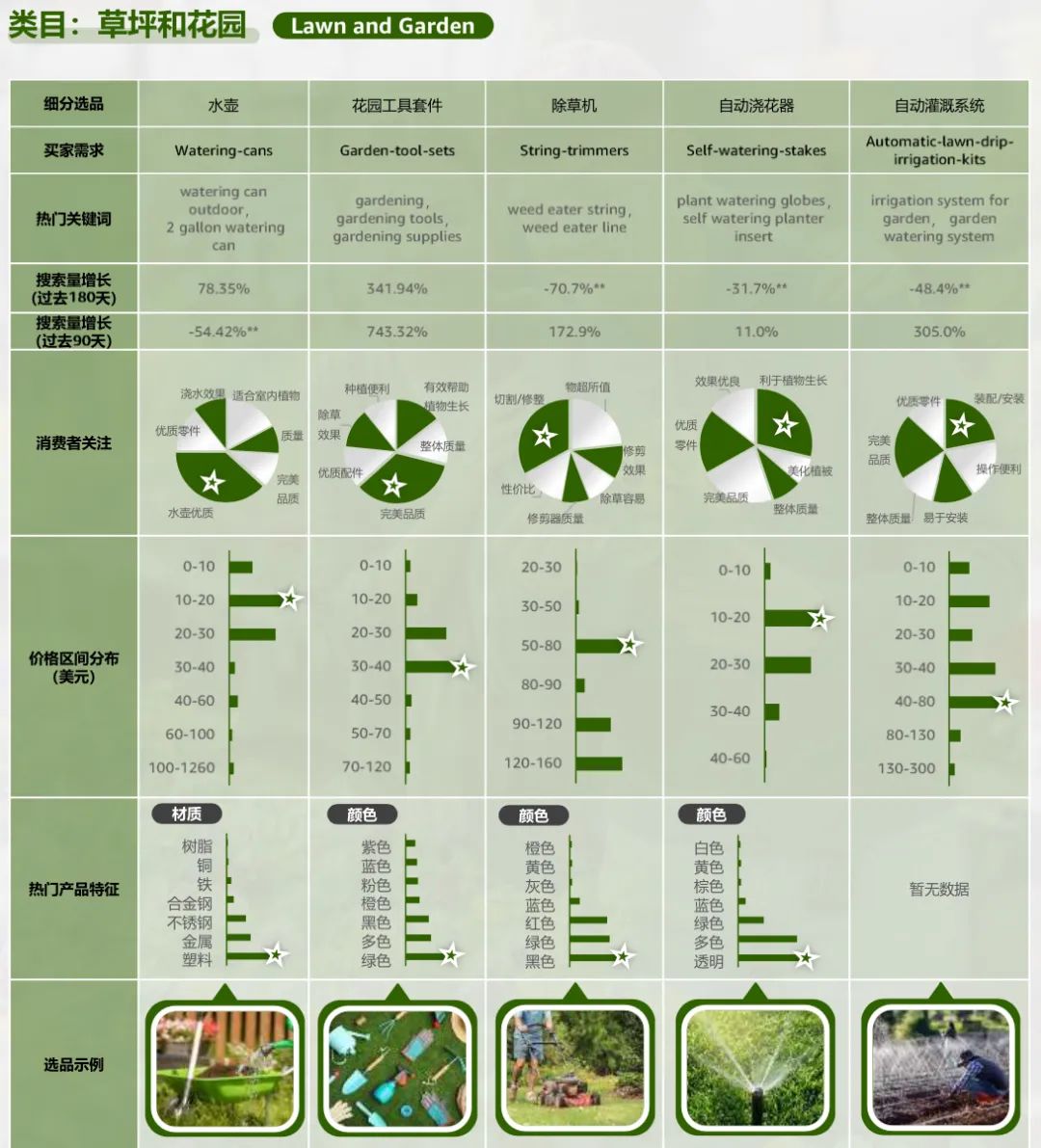

The lack of understanding of overseas consumer demand is currently the biggest pain point for Chinese enterprises going overseas. To stand out in fierce competition, not only exquisite production technology is required but also a series of matching core capabilities. For overseas merchants, seeking new market demands and creating differentiated products are the keys to success. Based on insights into the consumption trends of hundreds of millions of active users worldwide, Amazon's Report reveals six major global consumption trends: the demand for comprehensive gardening products from "seed to garden," the trend of "soft experiences" in hardcore technology, new business opportunities in paying for "emotional value," the pursuit of a "silent journey" experience, increasing attention to sleep issues, and the transformation of outdoor lifestyles towards "living elsewhere." The North American market is the largest in the global gardening activities market, with an average annual spending of $616 per household on lawn and gardening activities. The report reveals that young groups represented by millennials have become an important consumer force in the American gardening market, with higher willingness and amplitude of spending compared to older households. The aesthetic gardening trend is well-suited for propagation through social media, injecting new youth vitality and opportunities into the gardening market, making North America's gardening market highly potential for e-commerce development. The report also provides valuable multi-dimensional data references from a detailed product selection perspective, such as a 743.32% increase in search volume for garden tool kits in the past 90 days, with green models priced at $30-40 being the most popular.

Image Source: Amazon's 2024 Semi-Annual "Global E-commerce Consumption Trends and Product Selection Insights Report"

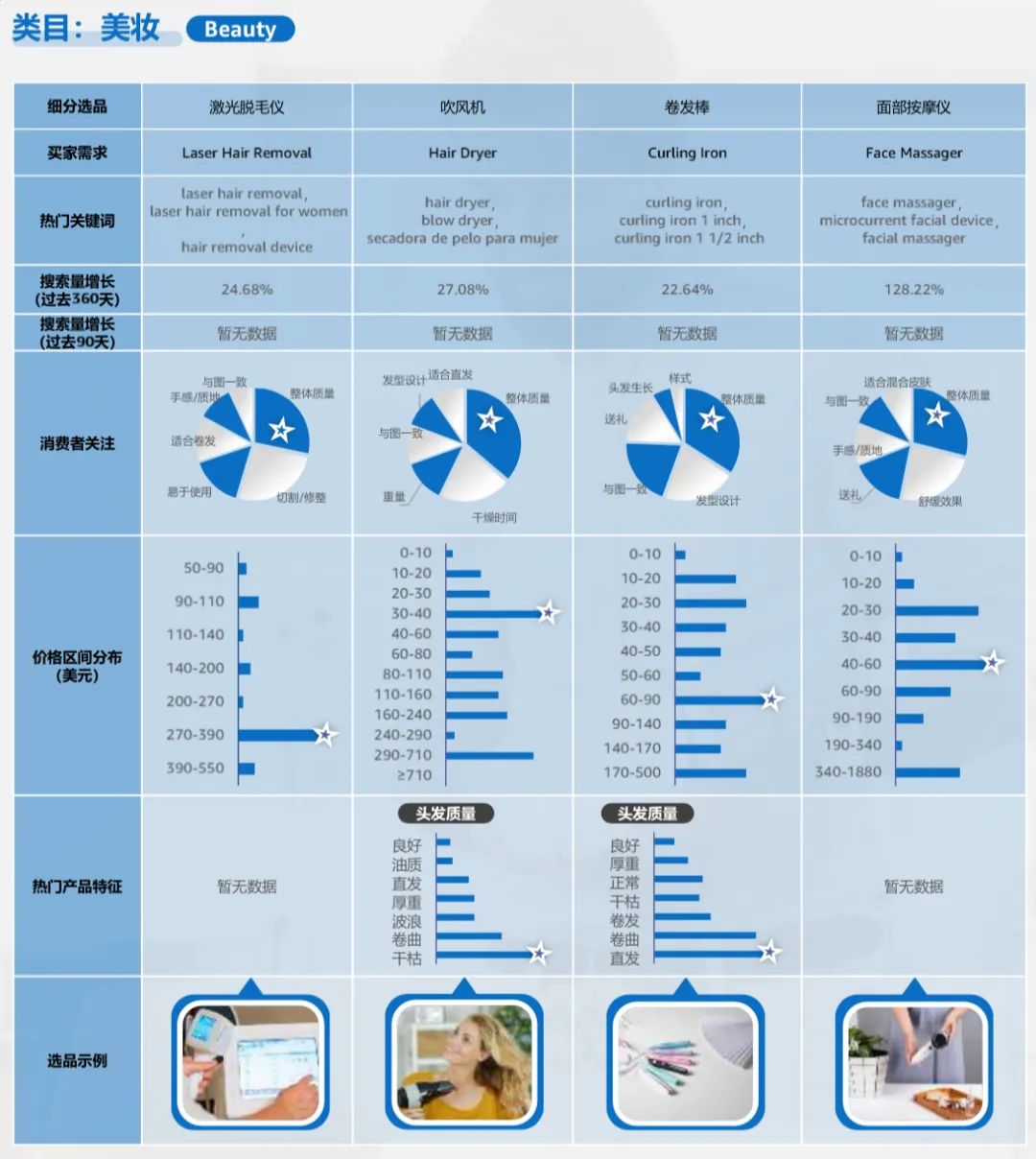

In addition to gardening, the US market also accounts for the largest share of the global consumer electronics market. The Report points out that North American consumers' pursuit of technology products goes beyond functionality, also considering the entertainment experience value and gradually rising user experience of consumer technology. In the past 360 days, search volumes for products focusing on detailed needs such as facial beauty devices and dog grooming vacuums have increased by more than 100%, and search volumes for neck massagers have also increased by over 85%.

Similarly, for products like hair dryers and curling irons, the Report also provides more detailed data, such as that people with dry hair and straight hair are the main buyers of such products, allowing merchants to target their marketing efforts towards core consumers and aim for the largest market space.

Image Source: Amazon's 2024 Semi-Annual "Global E-commerce Consumption Trends and Product Selection Insights Report"

Compared to the North American market, Europe has many small countries with strong dispersion, and consumer demand differs more easily among different countries. Therefore, using the platform to find products that meet local demand is the fastest and most convenient way. The Report notes that emotional value creates new business opportunities in the European market, with products or services that uplift emotions and awaken positive feelings, as well as product designs that emphasize emotional elements, attracting European consumers.

Image Source: Amazon's 2024 Semi-Annual "Global E-commerce Consumption Trends and Product Selection Insights Report"

Similarly, the pursuit of health permeates all aspects of European life. Beyond emotions, consumers also focus on health in different scenarios. The Report points out that people increasingly want to escape the noise of technology-driven life, and quiet journeys have a significant impact on health. Silent travel requires quiet tools to assist, making tools that create a serene environment, low-noise designs, noise-cancelling equipment, and low-tech products crucial. In the Japanese market, health is also a key consideration, with sleep deprivation being particularly prominent globally. Consumers expect to improve sleep conditions through lifestyle changes, sleep environments, optimized bedding, technological aids, care, and seeking expert help. The 10-minute outdoor theory also works in Japan. The Report notes that compared to specific outdoor activities, moving one's home outdoors for a day of relaxation, dining, entertainment, and cultural experiences is becoming increasingly popular. Faced with the vast differences between different markets, Amazon's Report provides a macro guide. Only by deeply studying the characteristics of different markets and strengthening innovation and brand building can Chinese merchants truly excel in product selection. Therefore, effectively utilizing the data from the "Report" for analysis can help Chinese businesses further capture global consumer trends.

Most of the data and consumption trend analysis in this Report come from Amazon's Product Selection Compass and Business Opportunities Explorer tools. For Chinese sellers on Amazon, these two product selection tools are not unfamiliar. The Business Opportunities Explorer can sort search volumes from the past 360 days or 90 days in descending order to identify potential markets with high search volumes, helping sellers find popular search terms, search volumes and growth, number of items sold, number of most-clicked items, average prices, total reviews, and other data in various market segments, allowing merchants to understand consumer search and purchase habits at specific time nodes and capture unmet buyer needs and competitive product information. The Product Selection Compass provides merchants with a certain predictive role, leveraging Amazon's big data analysis and AI algorithms to analyze product sales and page views over the past 12 months/6 months/30 days across more than 600 data dimensions, judging seasonal changes in product demand and supply. It can provide merchants with important information such as search volume, clicks, and popular search keywords in target markets, down to detailed category data including sales volume, purchase conversion ratios, price ranges, colors, materials, advertising expenditures, and more. Amazon's hundreds of millions of active consumers and comprehensive market coverage make these data accurately reflect consumer market trends, making them extremely valuable for Chinese sellers. In the era of high-quality overseas expansion, the model of extensive growth is no longer sustainable. For Chinese merchants to achieve long-term development, they must have a strong global vision. However, effectively entering any new market is never easy, and the lack of understanding of consumer markets is the first obstacle for many Chinese enterprises going overseas. However, by effectively utilizing the data tools and information provided by cross-border e-commerce platforms, the path for Chinese manufacturing to go overseas can become clearer. For example, EMEET, a Shenzhen-based company and an Amazon seller, initially launched a 1080P HD camera, but the team used Amazon's Business Opportunities Explorer to discover that overall traffic and industry trends were shifting towards ultra-high definition. In response, EMEET immediately launched a 4K camera product, seizing the opportunity for office equipment upgrades. After a year, this product has become the company's top 5 in sales, with over 20,000 global user reviews across all channels.

EMEET's audio-video combo set

At the same time, leveraging the digital advantages and mature product functions of cross-border e-commerce can also bridge the distance and information gap in foreign trade, making up for shortcomings while fully leveraging the efficiency and flexibility of Chinese SMEs to efficiently meet the changing demands of niche markets, enabling them to effectively enter international markets.

Practically speaking, for Chinese enterprises with natural advantages in manufacturing and supply chains, effectively utilizing front-line data from global markets can make good products more in line with the market logic of different markets, further enabling them to have a "good market." Anxi is the birthplace of rattan and iron crafts, and Quanjixing (Xiamen) Supply Chain Co., Ltd. is a typical overseas merchant in Anxi's rattan and iron industry belt, with mature technical accumulation and supply chain capabilities. When first entering the cross-border e-commerce industry, they led product development based on traditional foreign trade experience without fully referencing market data to face the changing demands of overseas markets, leading to pain in the initial stages of transformation.

Quanjixing's iron art products

Later, Quanjixing established a dedicated product selection research team to handle cross-border e-commerce product selection. On the one hand, they researched what products could match their existing craftsmanship and explored new product types. On the other hand, they used Amazon's customer review tools to analyze consumer evaluations and iterate products based on areas where buyers were dissatisfied or inconvenienced, achieving zero-distance communication with the consumer market.

In addition, Quanjixing also opened Amazon Business based on industry attributes, connecting with overseas bulk sellers and establishing a separate operations team for the B-end, directly communicating needs with B-end merchants and collaborating with their high-quality factories to ensure the speed of product development and the accuracy of product selection in the supply chain. The data in this Report on emerging markets such as Japan is also noteworthy. Traditional foreign trade lacks awareness and experience of these "small but beautiful" emerging markets, but highly penetrative cross-border e-commerce can often bring subtle insights in the first instance, helping keen overseas enterprises seize business opportunities. Umimile, a Shenzhen-based company specializing in bathroom products, chose Amazon Japan as its first overseas market. Japanese people, who have experienced an economic bubble burst, tend to be more rational and pragmatic, demanding strict standards for any product. They pursue both appearance design and product materials, as well as internal components and quality. But it is precisely this rigorous and rational shopping attitude of Japanese consumers that brings greater opportunities to Umimile. Therefore, Umimile learned from local brands through exhibitions and media, combined with data from Amazon's Business Opportunities Explorer, which helped them develop a baby sleep aid light in the Japanese market that prioritizes sleep quality, achieving sales of 2,000 units per month. On the other hand, they analyze hot-selling products and consumer reviews in the market every half-month and collaborate deeply with the supply chain to create products more suitable for overseas consumer needs through micro-innovation. For example, they noticed from Japanese consumer feedback that Japanese consumers wanted different amounts of soap dispenser for adults and children, which is more economical and provides better protection for children, so they created a soap dispenser that automatically recognizes the amount of foam based on the height of the hand, which sold very well locally.

Umimile's soap dispenser that automatically recognizes foam quantity based on hand height

Since 2023, Amazon Global Selling has regularly released the "Amazon Global Consumption Trends and Product Selection Report" to Chinese sellers and will continue to launch relevant trend reports in the future. Qiu Sheng, Vice President of Amazon China and Head of Market and Partnership Expansion for Amazon Global Selling Asia Pacific, said, "Product innovation has always been the top priority for cross-border e-commerce sellers to build core competitiveness and achieve high-quality and long-term development. To this end, Amazon has launched a series of effective mechanisms and innovative tools over the years, integrating cutting-edge technologies such as AI, big data, and machine learning, to provide sellers with authentic feedback and data-driven tools from multiple dimensions such as consumer evaluations and actual purchasing behaviors, assisting cross-border e-commerce sellers in continuously enhancing their 'product competitiveness.' The release of Amazon Global Selling's 'Global E-commerce Consumption Trends and Product Selection Insights Report' is undoubtedly another excellent practice of this strategy." In terms of product selection, with the help of big data analysis, AI algorithms, and other new technologies, sellers can accurately insight into market demands and trends, thereby selecting products with potential and competitiveness. Through deep mining of massive data, sellers can understand key information such as consumer preferences, purchasing behaviors, and market saturation in different regions, providing a scientific basis for product selection decisions. In terms of product micro-innovation, new technologies can help sellers capture subtle consumer needs and expectations regarding product functionality, design, and user experience. In the operational aspect, the application of new technologies such as review management tools can greatly improve operational efficiency and quality, further refining product design and production, and responding in real-time to consumer suggestions, providing efficient and accurate services to enhance consumer satisfaction and loyalty. Today, more Chinese companies are making going overseas a core strategy, and how to conquer global markets has become a topic requiring more professionalism. For Chinese enterprises at the forefront, being able to keenly insight trends through digital tools when going overseas is an inevitable choice for Chinese merchants to quickly enter global markets and achieve benign brand development.

References:

[1] "Amazon Global Consumption Trends and Product Selection Report"

[2] Amazon Global Selling | A 10-year foreign trade veteran transforms into cross-border e-commerce, selling rattan and iron crafts on Amazon, reaching 10 million GMV in the first year

[3] Amazon Global Selling | Catching the remote work trend, monthly sales of a single product exceed 10,000 units! A billion-level office seller shares Amazon's "breakthrough" business philosophy

[4] Amazon Global Selling | Top 1 soap dispenser on Amazon Japan! How does an Amazon bathroom seller achieve annual sales of 670 million yen with a "super product"?