Over 100 times PE? Will the capital market buy Hive Box's valuation of 25 billion yuan?

![]() 09/19 2024

09/19 2024

![]() 700

700

After ushering in its first profitable spring, can Hive Box maintain its high growth as always?

The prospectus shows that as of May 31, Hive Box achieved revenue of 1.904 billion yuan, a year-on-year increase of 33.7%, with a net profit of 71.602 million yuan, marking its first profitable year since its inception.

On August 30, Hive Box submitted its IPO prospectus to the Hong Kong Stock Exchange, revealing its latest business performance. Data shows that from 2021 to 2023, Hive Box achieved revenues of 2.526 billion yuan, 2.891 billion yuan, and 3.811 billion yuan, respectively. During this period, the company recorded net losses of 2.071 billion yuan, 1.166 billion yuan, and 541 million yuan, respectively, resulting in a cumulative net loss of 3.768 billion yuan over three years.

Although the dawn of profitability has arrived, the newly revised "Measures for the Administration of the Express Delivery Market" (hereinafter referred to as the "Measures") in March seems to add some uncertainty to Hive Box's long-term profitability.

In addition, after multiple rounds of funding, Hive Box's valuation has reached 25 billion yuan. However, if the net profit for the full year is estimated based on the net profit of the first five months, it implies that the 25 billion yuan valuation corresponds to a PE ratio of over 100 times.

Does this match Hive Box's current situation?

1. Can the high growth behind the 25 billion yuan valuation continue?

Since its inception, Hive Box has been standing on the shoulders of giants.

When it was established in 2015, Hive Box received 500 million yuan in support from five logistics giants, including SF Express Investment, ZTO Express, Yunda's Shanghai Yunyun, and Prologis in Suzhou.

Over time, Hive Box has continued to grow and successfully completed multiple rounds of funding: valued at 5.5 billion yuan in 2017 and 3.3 billion USD in 2021. According to Hurun Research's "2024 Global Unicorn List," Hive Box's valuation has reached 25 billion yuan, ranking 270th on the list. Now, Hive Box has submitted its prospectus to the Hong Kong Stock Exchange, preparing to take the next step in the capital market.

Thanks to the shelter provided by SF Express, Hive Box has developed steadily. However, even SF Express cannot guarantee Hive Box's continued high growth indefinitely.

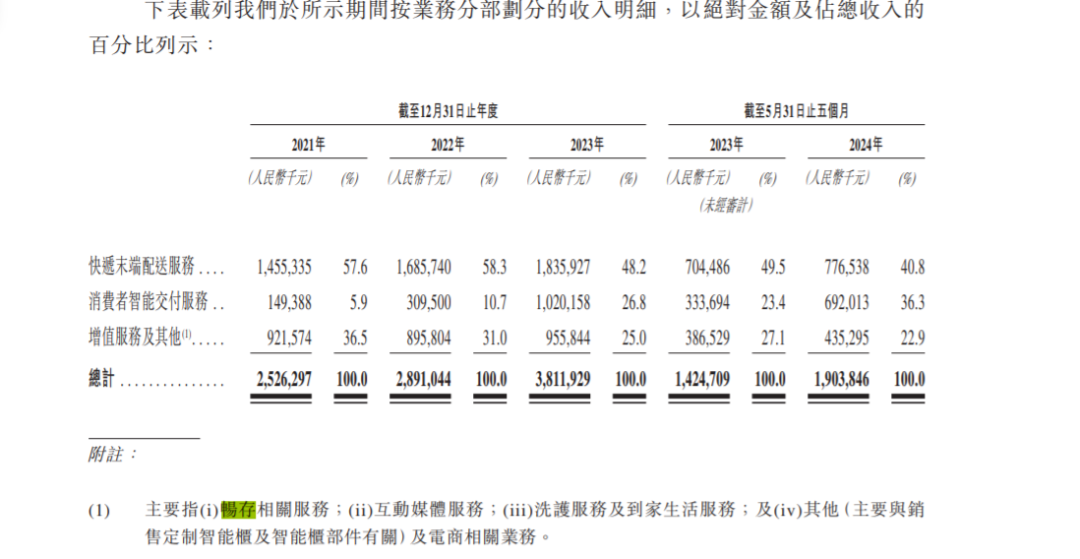

The prospectus shows that Hive Box's revenue business is primarily divided into three parts: express terminal delivery services, consumer smart delivery, and value-added services and others.

Among them, express terminal delivery services are the main source of revenue for Hive Box. From 2021 to 2023, this business segment generated revenues of 1.46 billion yuan, 1.69 billion yuan, and 1.84 billion yuan, respectively, with a compound annual growth rate (CAGR) of 8%. The number of parcels delivered was 6.204 billion, 5.823 billion, and 6.463 billion, respectively, with a CAGR of only 1.4%, significantly lower than the market average of 32.0%.

Furthermore, the Financial Investment News calculated that, based on a minimum fee of 0.5 yuan, Hive Box has collected at least 808 million yuan in storage fees for unclaimed parcels from 2021 to the first five months of 2024. In the first five months of this year, Hive Box achieved operating revenue of 71.602 million yuan, of which at least 104 million yuan came from storage fees for unclaimed parcels. This indicates that the company's other businesses are still incurring losses.

It is worth noting that the actual revenue contribution from storage fees to Hive Box is likely even higher, as 0.5 yuan is merely the starting fee for users.

However, whether the profitable "storage fees" can be sustained remains questionable.

On the HeiMao Complaints platform, many complaints about Hive Box are related to parcel pickup fees. The complaints reveal that many users are charged storage fees because couriers place parcels in Hive Box without the recipient's consent.

This sentiment reflects the attitudes of a significant portion of users and has drawn the attention of regulatory authorities.

Article 28 of the Measures stipulates that express delivery enterprises must not unilaterally use smart parcel lockers or express service stations to deliver parcels without the consent of users, and penalties will be imposed in serious cases.

This means that relying on storage fees to increase operating revenue is no longer viable. This factor may also contribute to the decrease in the proportion of "value-added services and others" in Hive Box's revenue in the first five months of this year.

In fact, the impact extends beyond just storage fees, affecting Hive Box's overall business.

Changes in regulations can lead to market changes. How many users will choose to have their parcels delivered to lockers under the influence of the Measures remains uncertain, as many people consider their doorstep to be the most convenient "locker" for receiving parcels.

Hive Box urgently needs to provide the capital market with a "new story".

2. Can the second growth curve shoulder the responsibility?

Although Hive Box holds a leading position in the smart parcel locker market, competitors such as Cainiao from the Alibaba Group and JD.com are constantly encroaching on this market.

Facing market competition, Hive Box has expanded its "15-minute neighborhood convenience circle" by launching advertising services, laundry and dry cleaning services, and home services to meet consumer needs and further expand profit channels.

Laundry and dry cleaning services, as one of Hive Box's new areas of expansion, have provided users with a fresh experience. Data shows that the number of laundry and dry cleaning orders increased from approximately 6,900 in 2022 to approximately 54,800 in 2023 and reached approximately 96,200 in the five months ended May 31, 2024. As of May 31, 2024, Hive Box's laundry and dry cleaning network included one self-operated facility in Zhongshan, Guangdong, and 135 third-party facilities across 25 provinces in China.

Hive Box's home services, including on-site cleaning, home appliance cleaning, and on-site repairs, also saw an increase in order volume from approximately 1,730 in 2022 to approximately 9,830 in 2023, reaching approximately 7,140 in the five months ended May 31, 2024. Although the growth rate is significant, the small base number does not contribute much to Hive Box's financial reports.

The revenue from these businesses is also reflected in Hive Box's "value-added services and others" segment, which has shown growth but at a modest rate. The revenue proportion decreased from 36.5% in 2021 to 25% in 2023 and further to 22.9% in the first five months of 2024.

Normally, Hive Box has a large number of parcel lockers distributed in various communities and office buildings, which provides a natural advantage for expanding its laundry and dry cleaning services. So why hasn't the second growth curve achieved outstanding results?

One reason is, of course, competition from rival companies. For example, the home service market is already occupied by competitors such as Meituan, Ehome, Ziroom, and 5i5j, which all provide home services.

Compared to specialized home service platforms like Meituan and Ehome, Hive Box has relatively less experience in laundry and dry cleaning services and home services. Expanding into these areas would require new investments, which may not immediately improve its financial reports and could instead put pressure on its profit and loss line. This is clearly not what Hive Box desires at present.

But if Hive Box cannot tell a compelling new story, how can its valuation convince the capital market to invest?