Yuntianlife has lost nearly 2.7 billion yuan in seven and a half years, and the actual controller's net worth has evaporated by more than 8.8 billion yuan in a year and a half

![]() 09/20 2024

09/20 2024

![]() 668

668

Produced | Entrepreneurship Frontline

Art Director | Li Yufei

Audit | Song Wen

A year and a half after its listing, Yuntianlife, an AI big model and chip company, is still struggling to emerge from the quagmire of losses.

From 2023 when it went public to the first half of 2024, Yuntianlife's operating losses have continued to widen. Judging from the company's recent business performance, it will not be easy for Yuntianlife to turn a profit in the future.

Moreover, due to fierce competition in digital city operation and management, Yuntianlife's profitability has suffered a significant decline. Amid various adverse factors such as sustained losses, Yuntianlife's share price has fallen by over 83% from its peak and by over 50% from its IPO price.

Judging from the company's operating performance and cash flow, time is running out for Yuntianlife.

1. Losses widen due to equity incentives, with nearly 2.7 billion yuan lost in seven and a half years

Public information shows that Yuntianlife was founded in August 2014 by Chen Ning and Tian Dihong. Yuntianlife is an AI enterprise that provides digital city operation and management services to government and public security agencies based on algorithmic chips and other products.

In 2019, with the successful launch of the STAR Market, financial performance ceased to be a barrier to tech companies going public. Yuntianlife, which had been losing money for several consecutive years, saw a glimmer of hope for listing. In July 2020, Yuntianlife successfully completed its shareholding system reform, and in December 2020, it submitted its IPO prospectus for the first time, aiming to list on the STAR Market.

It is noteworthy that in the year prior to the IPO submission, 2019, Yuntianlife's net profit attributable to shareholders was still a loss of 500 million yuan. Due to continued losses and other factors, Yuntianlife's IPO journey was not short, and it finally listed on the STAR Market in April 2023.

After going public, Yuntianlife did not turn the corner on losses. In 2023, the company incurred a net loss of 383 million yuan. In the first half of 2024, Yuntianlife lost another 310 million yuan. Notably, Yuntianlife has been losing money for seven and a half consecutive years since 2017, with cumulative losses approaching 2.7 billion yuan.

Worryingly, although Yuntianlife continued to lose money before 2021, the company's revenue was growing rapidly. However, in recent years, Yuntianlife seems to have lost its growth momentum. Data shows that Yuntianlife's operating revenue from 2021 to 2023 was 566 million yuan, 546 million yuan, and 506 million yuan, respectively, showing a downward trend year on year.

It is worth noting that the industry in which Yuntianlife operates is still booming. Taking smart security, the main downstream application market for the company, as an example, data from the China Security and Protection Industry Association shows that the domestic smart security market was worth approximately 63 billion yuan in 2022, up approximately 7.5% year on year. It is estimated that by the end of 2023, the market size of China's smart security industry will reach approximately 80 billion yuan.

(Image from Shutterstock, based on the VRF agreement)

Despite growing downstream demand, Yuntianlife's revenue has failed to increase and has even declined, reflecting intense competition in this field. In the first half of 2024, Yuntianlife achieved operating revenue of 289 million yuan, up 97.40% year on year, reversing the trend of consecutive declines in operating revenue.

Despite a significant increase in the company's revenue, Yuntianlife's losses have not decreased but have instead increased. In the same period, Yuntianlife incurred a loss of 310 million yuan, compared to 211 million yuan in the first half of 2023.

In response, Yuntianlife stated that the primary reason for the increased losses in the first half of 2024 was the increase in share-based payments. It is understood that in the first half of 2024, Yuntianlife's share-based payment expenses alone amounted to 78.6231 million yuan.

According to information disclosed by Yuntianlife, the company's equity incentives cover some of its core employees. Yuntianlife also noted that to retain talent, it does not rule out the possibility of continuing to offer large-scale equity incentives in the future.

While equity incentives are somewhat necessary for tech companies, it remains debatable whether the continued expansion of losses due to equity incentives is worthwhile.

2. Caught in the 'Hundred Models War,' Yuntianlife's gross margin plummets

2023 marked the beginning of the AI explosion, and Yuntianlife is one of the few A-share companies that possess both large models and AI chips, making it somewhat scarce. As a result, investors have high expectations for Yuntianlife, which contributed to its oversubscribed IPO.

At the outset of its development, Yuntianlife faced heated debates over its technical direction, primarily due to disagreements between its two founders. Chen Ning and Tian Dihong, both of whom are Ph.D. graduates from the Georgia Institute of Technology and experienced tech professionals, had differing views on the company's development path.

However, due to conflicts and a relatively small equity stake, Tian Dihong, who had less say in the company's decisions, sold his shares and exited Yuntianlife when the company submitted its IPO prospectus, pocketing only tens of millions of yuan. After Yuntianlife went public, Chen Ning's net worth briefly exceeded 10 billion yuan due to his equity holdings.

After Tian Dihong's departure, Yuntianlife increased its investment in algorithmic chips, leading to the development of three generations of instruction set architectures and four generations of neural network processor architectures.

With these breakthroughs, Yuntianlife commercialized these products in digital city operation and management, with smart security being the first application area.

As of the end of 2023, Yuntianlife's revenue from AI products and overall solutions for digital city operation and management amounted to 392 million yuan, accounting for 77.39% of the company's total revenue. These products primarily collect, analyze, mine, and manage data through cameras in various application scenarios to enhance the level of intelligent urban management.

(Image from Shutterstock, based on the VRF agreement)

However, in this field, Yuntianlife faces intense competition. According to IDC data, the top five players in the domestic computer vision market are SenseTime, Megvii, Hikvision, Innovusion, and CloudWalk, with a combined market share of 42%. In comparison, Yuntianlife's market share has hovered around 1% in recent years.

Due to fierce competition in the industry and the fact that the company's downstream clients are primarily governments, the company's bargaining power is relatively weak. Under various adverse factors, Yuntianlife's overall profitability has declined year by year.

Data shows that the company's gross margin was as high as 50.64% in the first quarter of 2023, but it plummeted to 15.76% in the first half of 2024. In just over a year, the company's gross margin experienced a cliff-like decline.

In recent years, due to the popularity of large models, Yuntianlife has also launched its "Tian Shu" trillion-parameter large model. With both chips and large models, Yuntianlife garnered capital attention during its IPO, and its market value briefly exceeded 45 billion yuan shortly after listing.

However, both algorithmic chips and large models require significant R&D investments. From 2021 to 2023, Yuntianlife's R&D expenditures were 295 million yuan, 347 million yuan, and 295 million yuan, respectively. For a company with annual revenue of only 500 million yuan, these expenditures are considerable and a significant contributor to Yuntianlife's ongoing losses.

In 2023, the algorithmic chips that Yuntianlife vigorously developed generated only tens of millions of yuan in revenue, while the large model became embroiled in the "Hundred Models War," and the substantial R&D expenditures are likely to further drag down the company's performance.

Judging from its operating performance and results, Yuntianlife's current business strategy can hardly be considered successful.

3. Delayed fundraising projects, and the actual controller's net worth evaporates by over 8.8 billion yuan in a year and a half

Due to poor performance, expectations for Yuntianlife in the capital market have diminished significantly.

As of September 19, Yuntianlife's share price closed at 21.55 yuan per share, down over 83% from its peak and over 50% from its IPO price of 43.92 yuan per share.

The sharp decline in Yuntianlife's share price has ostensibly caused the greatest loss to the company's actual controller, Chen Ning. As of now, Chen Ning holds 83.6721 million shares of Yuntianlife, and during this round of share price declines, his net worth has evaporated by over 8.8 billion yuan. However, due to Chen Ning's extremely low holding cost, he is still significantly profitable compared to his initial investment.

Furthermore, many core employees of Yuntianlife have also benefited greatly. As of now, three employee stock ownership platforms, Shenzhen Yuntian Chuangxiang, Zhuhai Yuntian Chuangxiang No. 1, and Shenzhen Yuntian Chuangxiang No. 2, rank among the company's top ten shareholders, holding a combined 13.65% stake in the company with a market value of over 1 billion yuan.

These stock ownership platforms involve a large number of Yuntianlife's core personnel. Thanks to the company's continuous equity incentives and successful IPO, some core personnel of Yuntianlife have also earned substantial profits. During the IPO process, Yuntianlife successfully raised 3.9 billion yuan, with CITIC Securities and other sponsoring institutions taking away 280 million yuan in sponsorship fees alone.

Thanks to this fundraising, Yuntianlife was able to address its immediate financial needs, and its monetary funds increased from 391 million yuan at the end of 2022 to nearly 4 billion yuan by March 31, 2023.

However, due to continued losses and the need for external investments, Yuntianlife's monetary funds and tradable financial assets declined to 2.355 billion yuan as of June 30 this year, down nearly 2 billion yuan from March 31, 2023.

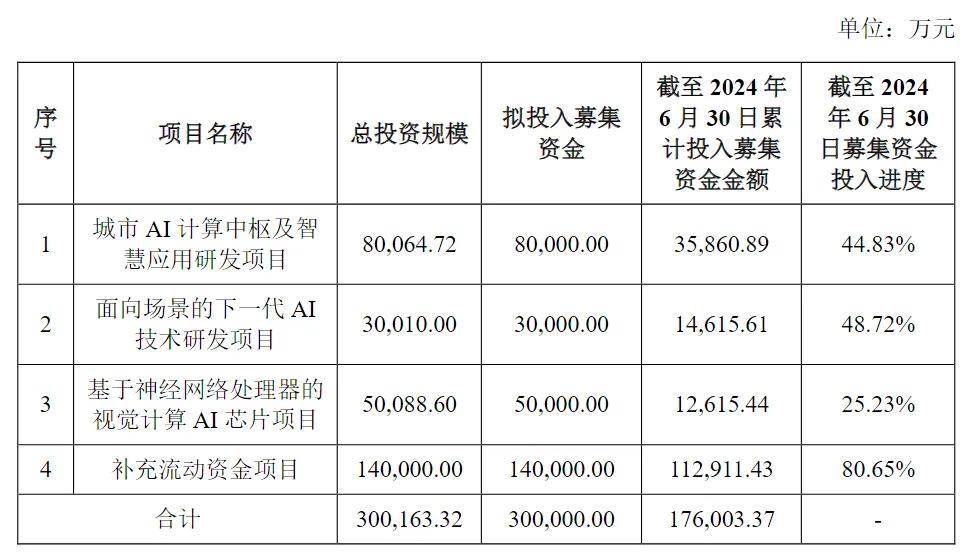

Interestingly, as Yuntianlife's monetary funds continued to dwindle, the company also chose to delay its fundraising projects.

The company's urban AI computing hub and smart application R&D project, next-generation AI technology R&D project for scenarios, and visual computing AI chip project based on neural network processors, which were originally expected to be ready for use by December 2024, have been delayed until June 2026.

(Breakdown of the company's fundraising capital usage)

Regarding supplementary working capital, Yuntianlife had invested 1.129 billion yuan as of June 30. Additionally, Yuntianlife utilized over-subscribed funds twice, amounting to 150 million yuan and 175 million yuan, respectively.

Judging from Yuntianlife's capital usage and the delay of its fundraising projects, the company has a high demand for working capital. Without the 3.9 billion yuan raised through its IPO, it is uncertain whether the company would have sufficient liquidity to support the development of new projects.

From the results of Yuntianlife's IPO, it is clear that the actual controller and core employees have benefited greatly from the company's listing, with CITIC Securities and other sponsoring institutions also receiving substantial sponsorship fees. Yuntianlife itself has also addressed its immediate financial needs by raising over 3 billion yuan in funds.

However, due to factors such as poor performance, high valuation at the time of issuance, and changes in the market environment, the company's share price has plunged significantly, causing heavy losses for investors.

In response, Yuntianlife has launched a share repurchase plan ranging from 25 million yuan to 50 million yuan. As of September 3, Yuntianlife had repurchased 394.47 million yuan worth of shares, but this repurchase failed to halt the decline in the company's share price.

For Yuntianlife, the current situation is undoubtedly challenging – possessing both large models and algorithmic chips, two popular projects that generate expectations in the capital market. However, the company's slow commercialization process and poor performance have cast doubts on its growth potential.

Based on the current competitive landscape and the company's financial situation, Yuntianlife needs to quickly improve its operating performance to ensure its long-term survival.

*Note: The featured image in this article is from Shutterstock, based on the VRF agreement.