How will Dida Chuxing, standing still, cope with Gaode and T3's high-profile entry into the ride-sharing market

![]() 09/20 2024

09/20 2024

![]() 553

553

This article is the 845th original work of Shen Qian Atom

Surrounded by strong competitors,

Does Dida Chuxing regret its initial decision?

Written by Meng Fanle

Edited by Shen Qian Atom Studio

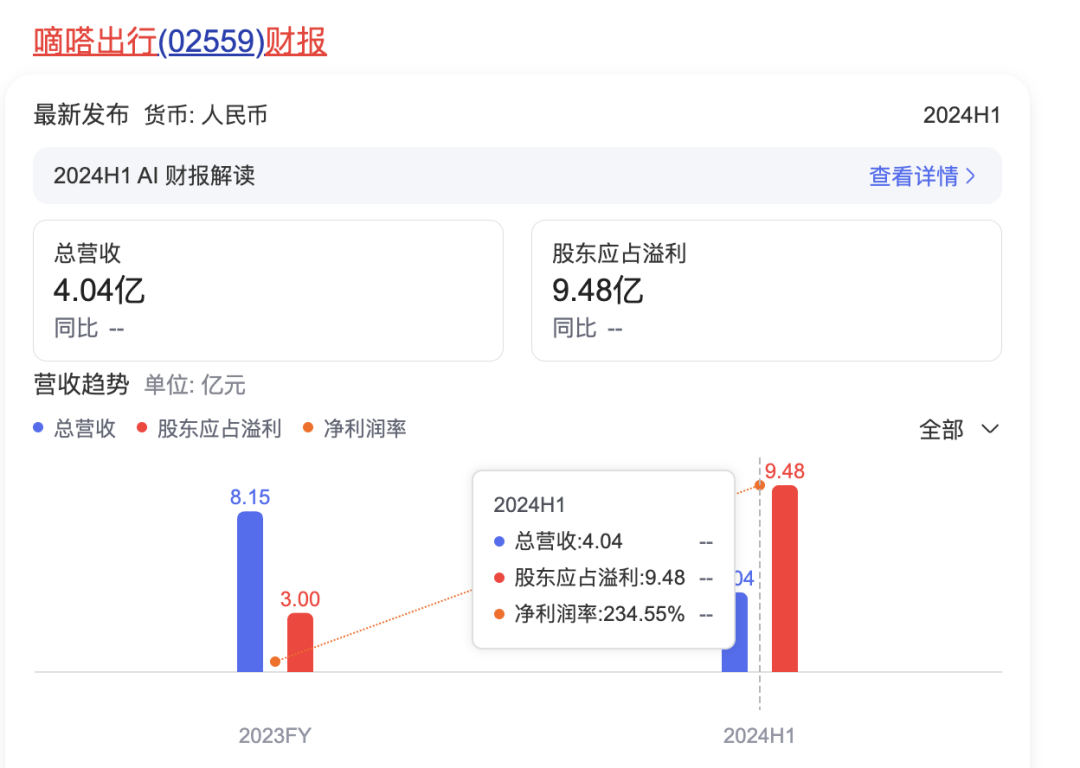

On August 30, 2024, Dida Chuxing released its first financial report after going public.

In the first half of the year, Dida Chuxing's total revenue was 404 million yuan, an increase of 2% year-on-year; adjusted net profit was 130 million yuan, an increase of 51.3% year-on-year; the total number of registered users was 368 million, and the number of certified private car owners on Dida Chuxing reached 17.7 million, an increase of 17% year-on-year. Boosted by these results, Dida Chuxing's share price surged 31.29% on September 2.

Dida Chuxing's performance reflects a steady recovery in the ride-sharing market. Precisely because of this, new variables have emerged in this sector, with T3 Travel and Gaode Taxi successively announcing their entry into the ride-sharing market with great fanfare. With the re-entry of Gaode, the second largest player in the online car-hailing market with 800 million registered users, Dida Chuxing's competitive pressure has risen sharply. Perhaps due to intensified competition, Dida Chuxing's share price began to decline for four consecutive days starting from September 5.

Due to the private car nature of ride-sharing, there are often blind spots in regulation, and platforms tend to shirk responsibility. With the emergence of more players, this may drive improvements in regulatory oversight of this sector. As a leading enterprise, Dida Chuxing must also begin to assume related responsibilities.

Dida Chuxing stands still, but management salaries increase by over 22 times

In 2014, taxi-hailing apps were not yet widespread, and finding a taxi was a problem for many people. Because of this, the Beijing Municipal Transportation Commission issued the "Opinions on Shared Rides for Small Passenger Vehicles in Beijing," encouraging citizens with similar travel routes to share rides through carpooling.

In 2014, Song Zhongjie, standing on Jianguo Road and unable to hail a taxi, noticed that most private cars were occupied only by the driver, with the other seats empty. This inspired Song with the idea that connecting these private cars could significantly increase transportation capacity in the ride-hailing market.

Having worked in the internet industry for many years, Song Zhongjie was also considering his next entrepreneurial direction, with online education and online healthcare among the options. Upon discovering the vast market potential of private cars, Song and his team decided to focus their entrepreneurial efforts on the ride-sharing sector, and Dida Chuxing was officially launched.

Regarding the layout of ride-sharing, Li Yuejun, co-founder and vice president of Dida Chuxing, said that at the time, they judged that if the platform could effectively match supply and demand, it would theoretically have a healthy profit model, benefiting car owners, passengers, the platform, and society as a whole.

In 2014, platforms such as Didi, Kuaidi, and Uber were all focused on online car-hailing, and under their collective efforts, the online car-hailing market developed rapidly. Dida Chuxing benefited from this trend, but its ride-sharing model also set it apart, allowing it to bypass major competitors.

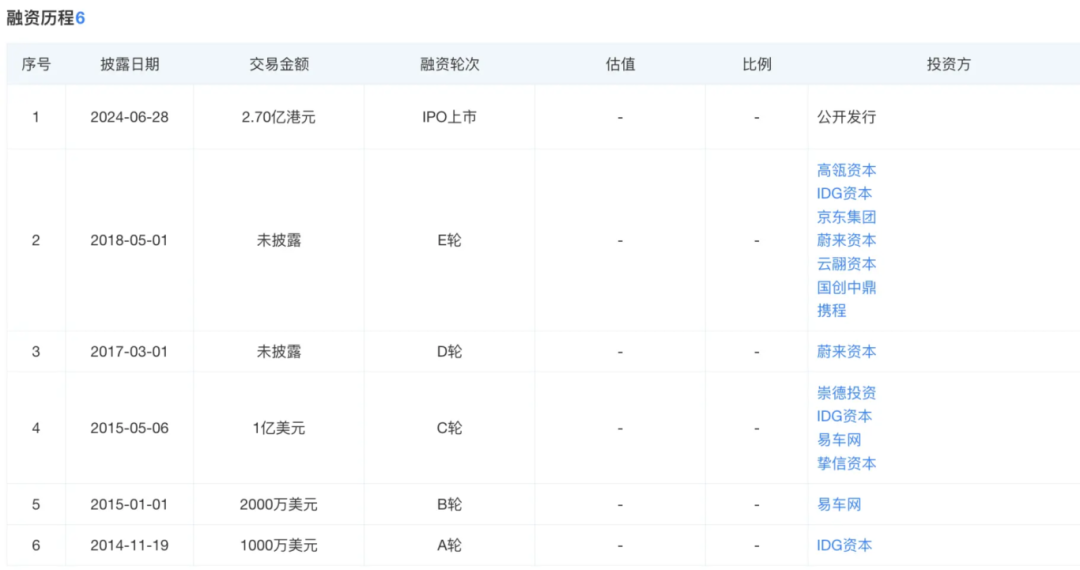

The boom in the online car-hailing market also fueled the ride-sharing market. Soon, Dida Chuxing gained recognition from IDG Capital, which invested $10 million in the company. In just three and a half years, Dida Chuxing completed five rounds of financing, raising approximately 2 billion yuan from investors including IDG Capital, Hillhouse Capital, NIO Capital, Yiche, JD.com, Ctrip, Chongde Investment, Trustbridge Partners, and Guochuang Zhongding. The company successfully listed on the Hong Kong Stock Exchange in 2024, becoming the "first ride-sharing stock."

At that time, Dida Chuxing could be said to have enjoyed the perfect combination of favorable timing, location, and people. By 2017, Dida Chuxing had established a presence in 394 cities nationwide, with 60 million registered users and 10 million private car owners. In 2019, Dida Chuxing experienced explosive growth, with revenue reaching 580 million yuan.

However, 2019 seems to have marked a peak that Dida Chuxing has struggled to surpass since then. From 2020 to 2023, the company appeared to have hit a bottleneck. Over this period, Dida Chuxing's total revenue was 754 million yuan, 780 million yuan, 569 million yuan, and 815 million yuan, respectively, indicating a slowdown in revenue growth. Although the pandemic played a role, it cannot be denied that even in 2023, there was no significant change in revenue growth or scale. In the first half of 2024, Dida Chuxing's total revenue was 404 million yuan, an increase of just 2% year-on-year.

In terms of gross profit, from 2020 to 2023, Dida Chuxing's gross profit was 623 million yuan, 631 million yuan, 427 million yuan, and 605 million yuan, respectively, with corresponding gross profit margins of 35.07%, 1.23%, -32.37%, and 41.59%. Setting aside 2022, Dida Chuxing's gross profit remained relatively stable, and the gross profit margin did not increase significantly despite fluctuations.

It is evident that in recent years, Dida Chuxing has essentially stood still in terms of both market size and commercialization.

However, the salaries of Dida Chuxing's senior management have not remained stagnant. In 2023, the total compensation for Dida Chuxing's directors amounted to 92.3 million yuan, a year-on-year increase of 2,267%. Among them, Song Zhongjie, the founder, received a compensation of 54.09 million yuan, including a salary and other benefits of 655,000 yuan and share-based payment expenses of 53.325 million yuan.

Compared to the stagnant market, it is reassuring that Dida Chuxing has begun to turn a profit. In 2023, Dida Chuxing's net profit reached 300 million yuan; in the first half of 2024, its adjusted net profit was 130 million yuan, an increase of 51.3% year-on-year.

Surrounded by strong competitors, Dida Chuxing aims for the automotive aftermarket

According to the F&S report, the ride-sharing market is expected to reach 103.9 billion yuan by 2028, with a compound annual growth rate of 29.4%. Perhaps for this reason, companies such as Gaode and T3 have announced their entry into the ride-sharing sector. In contrast, Dida Chuxing, whose revenue growth has stagnated, seems to have fewer opportunities to capture market share.

In September 2024, Gaode relaunched its ride-sharing service and opened it in 65 cities, offering up to 60 yuan in rewards to attract new car owners. Additionally, T3 has also recently launched its ride-sharing service. Together with Didi Chuxing and Hello Limousine, the ride-sharing sector has once again become lively.

From 2018 to 2019, Dida Chuxing's revenue surged from 117.6 million yuan to 580.6 million yuan, an increase of 293.8% year-on-year. This was due to safety concerns surrounding ride-sharing, which led companies such as Didi and Gaode to withdraw from the market. In 2018, when competitors were withdrawing, Dida Chuxing invested heavily in sales and marketing, spending 1.094 billion yuan that year to quickly capture the market abandoned by its competitors, reaping unexpected benefits.

Perhaps due to its perceived market dominance, Dida Chuxing's marketing expenses have remained at around 200 million yuan for several consecutive years, without significant investment in brand building and market cultivation, which may have laid the groundwork for future concerns about its development.

In a market with virtually no technical barriers, Dida Chuxing must formulate and implement a series of effective strategies to address the entry of competitors such as Gaode and T3 into the ride-sharing market. These strategies should encompass branding, technology, marketing, competition, compliance, and user needs. Currently, it appears that Dida Chuxing has wasted valuable time.

Perhaps sensing market pressure, Dida Chuxing has been active in recent years. For example, in 2023, it began collaborating with Tencent Maps to build dedicated mapping capabilities for ride-sharing and taxi services, leveraging Tencent Maps' robust data foundation and technical support.

Entering September 2024, Dida Chuxing's activities have also accelerated. Recently, it was reported that Dida Chuxing is advancing in-depth strategic partnerships with major players in the automotive aftermarket to jointly explore new growth opportunities. For example, on September 13, Dida Chuxing signed a memorandum of cooperation with Uxin Group, a used car retailer, and will subscribe to 7.5 million US dollars' worth of Uxin shares. After the cooperation, Uxin will provide used car trading, vehicle maintenance, and repair services to private car owners and potential car buyers on the Dida platform.

Instead of consolidating its core business, Dida Chuxing is betting on an unfamiliar sector, and it remains to be seen whether this will be a good or bad move in the future.

Overlooked drivers and regulation

In 2019, Dida Chuxing launched the "Taxi·New Mobility" strategy, but it made little progress. In 2024, its smart taxi service revenue was just 3.1 million yuan, negligible. The company's relatively simple revenue structure indicates a heavy reliance on drivers. However, Dida Chuxing also seems to have developed an arrogant attitude and is no longer as friendly to drivers as before.

On Heimao Complaints, there are up to 19,531 complaints about Dida Chuxing, with the majority coming from drivers. Some drivers have complained that Dida Chuxing deducted fees from them without reason, while others have reported unauthorized deductions, with one driver stating that a total fare of 62.8 yuan was deducted to 45.6 yuan without their consent, and that customer service staff were unfriendly.

In terms of rewards, Dida Chuxing has also cut back. In the first half of 2024, the total rewards for drivers and passengers amounted to 18.947 million yuan, a decrease of 30.761 million yuan or 62% year-on-year. When there were fewer players in the market and fewer options for drivers, Dida Chuxing could act with impunity. However, with changes in the market, the relationship between Dida Chuxing and its drivers may shift.

Ride-sharing involves private cars, and neither drivers nor vehicles need to obtain the corresponding qualifications issued by the transportation authorities. The civil actions undertaken by drivers and passengers on a voluntary and equal basis are undertaken by all parties to the ride-sharing arrangement in accordance with the law and their agreements, and related obligations and safety liability accidents are borne by the parties themselves. This means that regulating ride-sharing platforms is not as straightforward as regulating online car-hailing platforms, and there are blind spots in regulation.

As the "first ride-sharing stock," regardless of its market share, Dida Chuxing bears primary responsibility for regulation. However, in recent years, the company has faced numerous regulatory and management issues.

In 2020, Dida Chuxing, without obtaining a "Network Appointment Taxi Business License," Unauthorized release of passenger orders , The driver takes the order and completes the journey , The platform generates operating revenue 。On April 26, the Beijing Municipal Transport Law Enforcement Corps imposed a fine of 30,000 yuan on Dida Chuxing and ordered it to rectify immediately. Another example is that Dida Chuxing's operating entity, Beijing Changxing Information Technology Co., Ltd., was listed as a defendant by the People's Court of Hanting District, Weifang City, in 2020 for defaulting on administrative penalties for traffic violations, with an execution target of 10,000 yuan.

Ride-sharing represents a significant opportunity, but as Dida Chuxing enjoys the benefits of this sector, it must shoulder corresponding responsibilities, strengthening investment in strict access control for ride-sharing car owners, pre-trip prevention, in-trip protection, and platform security. The company cannot evade responsibility due to regulatory blind spots.