Can the Price War Be Halted by a State Ban on Selling Cars Below Cost?

![]() 12/16 2025

12/16 2025

![]() 501

501

Introduction

"At least not so blatantly and brazenly."

"The world has endured the price war for far too long."

Over the past few years, the electrification transformation has intensified, reshaping the rules of the game and the competitive landscape in the Chinese auto market.

Against this backdrop, as one "new king" after another ascends the throne, nearly every market segment has been engulfed in similar competitive firepower. The opening remarks reflect the prevailing sentiment among automakers still in the fray.

Why Is There a 'Price War'?

Fundamentally, the pricing system that prevailed during the era of traditional fuel vehicles has been completely upended. As the industry establishes a new survival order, inevitable fierce internal competition and chaos emerge.

Rationally and objectively speaking, such vicious internal competition brings no benefit to the healthy development and virtuous cycle of the entire market. However, some automakers remain obstinate, perhaps out of fear of falling behind, and the remaining players reluctantly follow suit.

Last week, in response to this situation, the state delivered a decisive "heavy punch."

On December 12, Beijing time, the State Administration for Market Regulation issued the "Compliance Guidelines for Pricing Behavior in the Automotive Industry (Draft for Comment)" (hereinafter referred to as the "Guidelines") to regulate pricing behavior in the automotive sector.

Specifically, the "Guidelines" refine pricing behavior norms for automotive manufacturers, clarifying price compliance requirements across all links—from vehicle production to spare parts manufacturing, and from pricing strategies to sales behavior.

At the promotional and pricing level, the "Guidelines" mandate that rebate policies be clearly stated and explicitly agreed upon in contracts or other forms, while respecting the independent pricing rights of dealers.

The "Guidelines" also explicitly state that illegal pricing behaviors will be combated in accordance with the law, detailing various manifestations, primarily including pricing behaviors aimed at excluding competitors or monopolizing the market. In general, automotive manufacturers must ensure that their ex-factory prices are not lower than production costs.

The "Guidelines" prohibit price discrimination against operators under equal trading conditions and prohibit price collusion among producers and between spare parts enterprises. They also regulate spare parts and functional fees, clarifying that "pay-to-unlock" functions must inform consumers of the free trial period and fee standards to protect their right to know.

At the sales level, the "Guidelines" focus on regulating prominent issues such as failure to display prices clearly as required and false promotions. Additionally, the "Guidelines" will guide automotive manufacturing and sales enterprises to establish a systematic internal price compliance management system to prevent pricing violations from the source.

In summary, the most crucial signal conveyed is: "Both at the automaker level and the dealer level, stop the price war and adhere to the legal, compliant, and reasonable corporate bottom line."

At the end of 2025, the release of the "Guidelines" serves as a "wake-up call." Consequently, various brands have begun to actively respond to the state's call.

For example, BYD immediately promised: "We will take the 'Guidelines' as a guide to continuously optimize our price management and compliance system. We commit to strictly implementing the requirements for standardized price competition behavior, safeguarding consumer interests, and resolutely putting an end to any form of price fraud and unfair competition. We will actively play a leading role in the industry, work hand in hand with colleagues across the industry to establish a solid order of compliant operations, promote a collaborative and win-win development ecosystem, and contribute to the high-quality development of the automotive industry."

For instance, XPENG stated: "We highly agree with and actively support the 'Guidelines.' We will comprehensively review and continuously optimize our price management and compliance system to ensure greater transparency and standardization in every link, from product pricing to sales services. We commit to strictly adhering to the principle of clear price labeling, safeguarding consumers' right to know and choose, and resolutely putting an end to any form of price fraud and unfair competition."

Another example is Chery, which posted on Weibo: "We oppose price wars and cutthroat competition, commit to keeping prices transparent, oppose any vicious competition that disrupts the healthy ecosystem of the industry, and return competition to its essence of value creation. We oppose any form of price fraud and pricing tricks, and jointly maintain a good market ecosystem."

So far, according to incomplete statistics, many other players, including Dongfeng, Changan, BAIC, Great Wall, and Leapmotor, have also made positive statements, all centered around: "Support the 'Guidelines.'"

Two Sets of 'Grim' Figures

As an observer, I take this opportunity to present two sets of "grim" figures.

Firstly, according to a report from the China Automobile Dealers Association, in the first half of 2025, the proportion of dealers experiencing losses rose to 52.6%, with 74.4% of dealers experiencing price inversions to varying degrees.

Secondly, in 2023, China's automobile production and sales exceeded 30 million vehicles for the first time, and in 2024, China's annual new energy vehicle production exceeded 10 million vehicles for the first time.

Although the overall achievements are remarkable, the industry profit margin has plummeted from 7.8% in 2017 to 4.3% in 2024. Entering 2025, this situation has not improved; in the first four months, automobile production and sales continued to climb, exceeding 10 million vehicles for the first time, but the industry profit margin further declined to 4.1%.

It is by no means an exaggeration to say that if the "price war" continues in this manner, most players will be eliminated. Such a situation is certainly not what the state wants to see. The primary mission of the "Guidelines" is undoubtedly to restore order as much as possible.

Can the 'Price War' Be Stopped?

So, another question becomes increasingly prominent, as stated in the article's title: Can the "price war" be stopped by banning selling cars at a loss?

My answer to this is: "At least not so blatantly and brazenly."

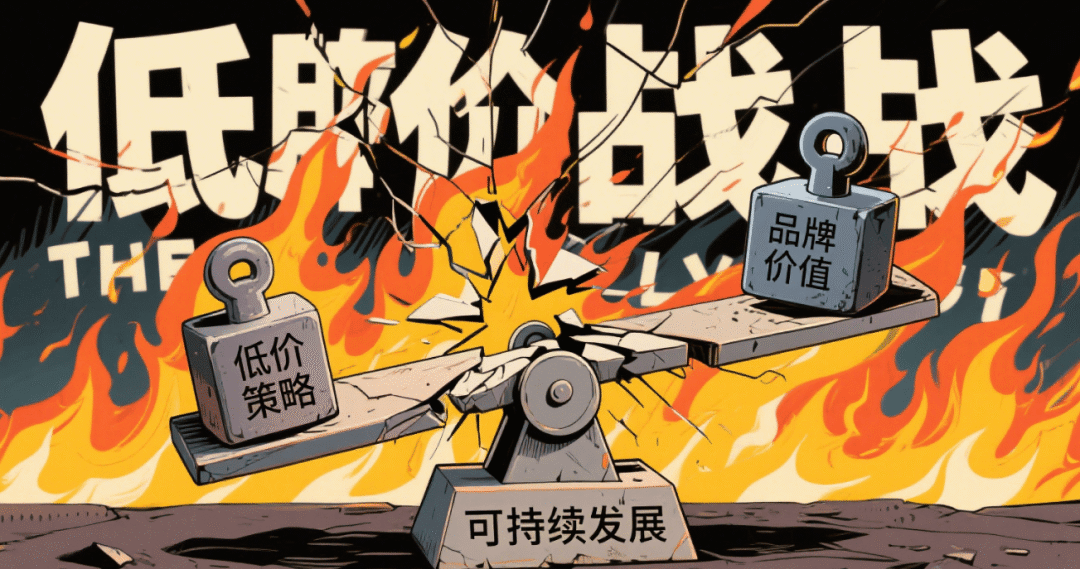

In reality, appropriate price competition can completely promote better development of the entire market. For many leading players, they also possess excellent scale effects and supply chain management capabilities. Under the premise of ensuring quality and experience, reasonable cost reduction and price cuts are also benefits for potential consumers. The essence of smart electric vehicles has always been to allow everyone to enjoy superior products at a lower threshold.

However, the prerequisite for all this is to grasp a "degree."

In recent years, the Chinese auto market has clearly been overexerting itself. Once the balance is broken, it is bound to trigger a series of rejection reactions. Next year, with strict supervision similar to the "Guidelines," it is believed that behaviors that distort or even disrupt the market will most likely not recur frequently.

Nevertheless, the same viewpoint mentioned multiple times still holds: According to the current situation, "the era of rapid growth in the Chinese auto market has ended, and instead, a somewhat daunting era of stock competition has arrived."

A Harsh Winter Awaits

Looking at the new energy vehicle camp, if the absence of a year-end rally effect in the fourth quarter of this year has already made everyone feel a chill, then next year will truly be a harsh winter.

On one hand, the external survival environment continues to deteriorate; on the other hand, the internal demand for survival intensifies. The irreconcilable contradictions are becoming increasingly prominent.

Ultimately, the result will most likely be the concentration of industry resources toward members of the top tier. Under the Matthew effect, the struggle for the market structure will show no mercy.

The "price war" may persist in a different form, become more difficult to follow, or leave people feeling particularly helpless. For example, without selling cars at a loss, competition may shift to comprehensive configurations, functional richness, and the speed of new product iterations.

At that time, the advantages of "big players" will undoubtedly be laid bare on the table. For "small players," how to seize breathing space amidst the cracks will determine whether they can remain in the game.

Again, "the true winnowing has begun."

Editor-in-Chief: Cui Liwen Editor: Wang Yue

THE END