"Xiaoyangge Incident" Reveals the Cruel Side of Douyin's E-commerce Ecosystem

![]() 09/24 2024

09/24 2024

![]() 467

467

Behind the "Three Sheep Incident", Douyin's e-commerce is facing a crisis due to high costs and low prices. It is hoped that through concerted efforts, Douyin can explore a new upward and benevolent path and emerge from the vicious cycle as soon as possible.

Author/Ling Zhuhou

Produced by/Xinzhai Business Review

Mid-Autumn Festival has passed, but the "Meicheng Mooncake Incident" in Xiaoyangge's live stream is still brewing.

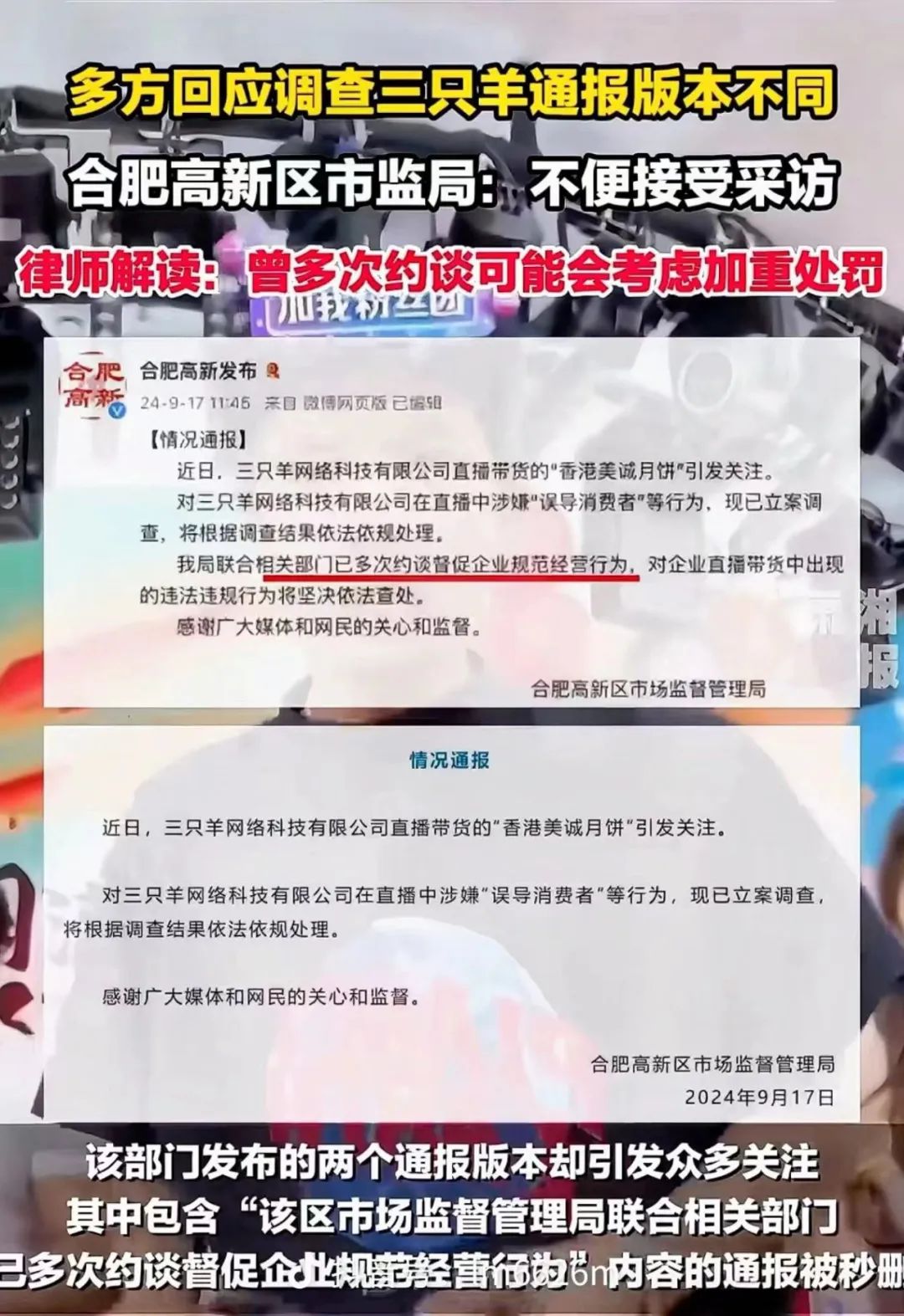

It is reported that the "Hong Kong Meicheng Mooncakes" promoted by Xiaoyangge and the anchors under Three Sheep claim to be "a Hong Kong brand specializing in high-end mooncakes" and have sold in large quantities. However, after multiple verifications, it was found that they have no stores in Hong Kong, and the actual operator is a company in Guangzhou. As public opinion escalated, many details about the origin and quality of Meicheng mooncakes were questioned.

The media discovered that such counterfeit mooncakes were largely supplied to internet celebrities for live streaming sales. An insider in the live streaming industry told the Paper that, "The cost of a mooncake is about 2 yuan, and the cost of a gift box is less than 20 yuan, but the selling price often reaches around 150 yuan, marking a 7-fold increase with just one sale. This is a conservative estimate, and the excessive profits in the mooncake industry exceeding 90% have become the norm in the industry."

A lawyer analyzed that this behavior by "Three Sheep" is suspected of false advertising, deliberately using false, exaggerated, or misleading information to attract consumers to purchase or use products. The seller of "Hong Kong Meicheng Mooncakes" violated Article 55 of the "Law of the People's Republic of China on the Protection of Consumer Rights and Interests" and should provide a "refund plus triple compensation."

This is not the first time Three Sheep has been caught in a whirlwind of public opinion. Previously, Three Sheep frequently fell into controversy due to incidents such as "unlicensed hair dryers," "fake beef rolls," and "head meat," earning them the nickname "Fake Goods Prince" among netizens.

The "3.15" exposé revealed the "head meat incident" involving preserved vegetables with pork in Anhui, leading to the revocation of production licenses for the three companies involved and fines totaling 12.87 million yuan. Xiaoyangge had previously promoted one of these companies. Xiaoyangge's "original cut beef rolls" were also reported to be spliced meat, and the supplier was fined 500,000 yuan, truly earning the reputation of "a record of military exploits, with the name of the commander appearing on every page."

Among top anchors, incidents of selling counterfeit goods similar to Xiaoyangge's are not isolated cases. The previous top anchor who collapsed due to the "olive oil false advertising" incident has already voluntarily withdrawn from the internet.

In February of this year, Douyin reviewer @Dahukebiaozhunfa posted a test report revealing that the CSS olive oil essence product promoted by the 20 million-follower Luo Wangyu had issues with false advertising of ingredients. In response, Douyin did not explicitly handle the matter, and it ended with Luo Wangyu personally refunding 150 million yuan to users and announcing his withdrawal from the internet.

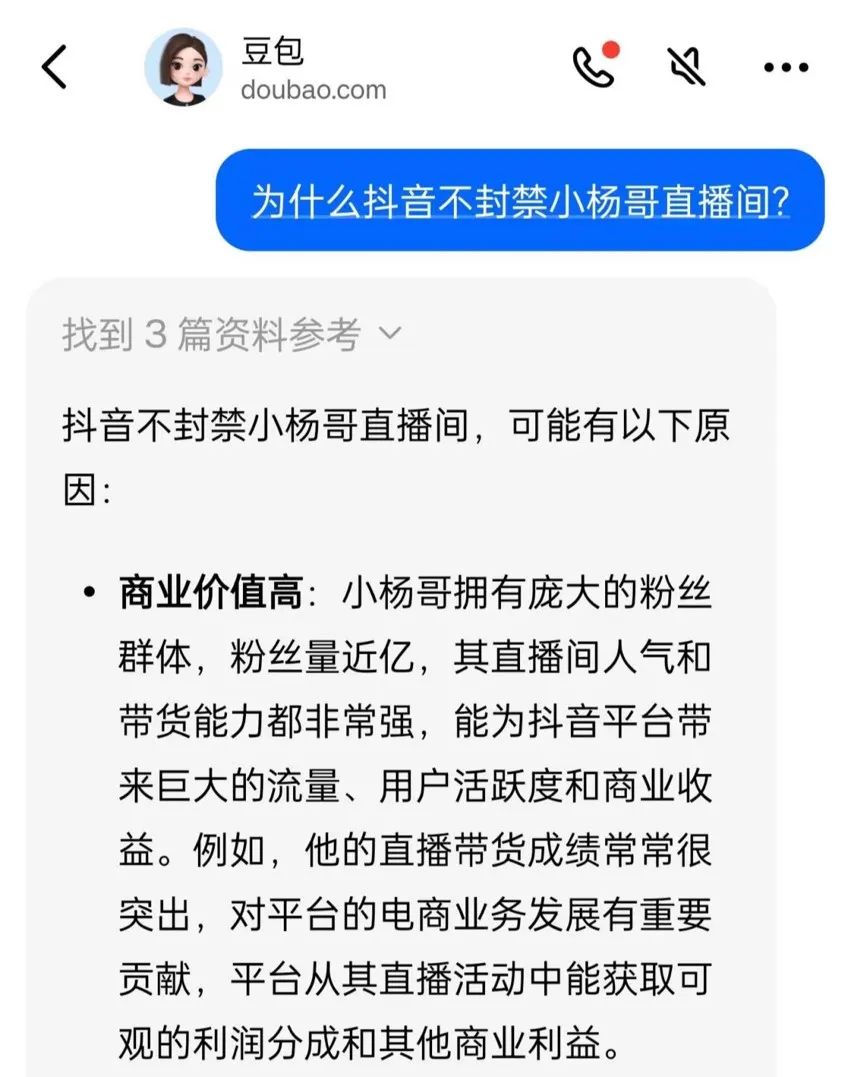

Why do incidents like Xiaoyangge's continue unabated on Douyin, and why are they still active in the live streaming ecosystem and firmly entrenched at the top despite their "multiple priors"? If isolated cases can be attributed to the personal integrity of the anchors, the "portrait of fake goods sales" behind them may indicate a problem with the entire platform ecosystem.

As a representative of interest-based e-commerce, Douyin e-commerce once rose to prominence at an astonishing rate, becoming a formidable competitor in the eyes of established e-commerce players and an emerging force in the e-commerce field that could not be ignored due to its vast user base and content-driven live streaming sales model.

However, as Douyin continues to raise traffic costs, increase competitive pressure in the content pool, and intensify its low-price strategy, merchants are under unprecedented pressure. By transferring this crisis, consumers ultimately become the victims, plunging the entire ecosystem into a vicious cycle.

In short, the frequent alarms sounding about consumer trust indicate that Douyin's internet celebrity sales model is in crisis. At present, Douyin's e-commerce business model urgently needs to change course to improve the ecosystem and emerge from the negative quagmire.

I. Ecological Decline Under the "Low Price" Indicator:

Bad Money Drives Out Good, and Return Rates Remain High

It's not just top anchors who are frequently exposed. At present, Douyin's ecosystem is experiencing a comprehensive and multidimensional decline, with the most notable manifestations being surging return rates and increasing traffic costs, trapping merchants in vicious competition.

For example, "Douyin jewelry merchants have a 90% return rate" once trended on social media, and women's clothing, with a consistently high return rate of up to 80%, is even more of a return disaster zone. Lola Password, once a top women's clothing brand on Douyin but now closed, once publicly stated that when their brand first gained traction in 2021, the return rate was 30%-40%, but now it is 70%-80%, a doubling of the previous rate. Moreover, traffic costs have increased tenfold.

Regarding the reasons for frequent returns, some consumers complain that no one buys something intending to return it. Ultimately, many merchants pass off inferior products as good ones and exaggerate their promotions, resulting in products that don't match the description and are of poor quality, leaving consumers with no choice but to return them.

High return rates, declining product quality, and persistent incidents of selling counterfeit goods have ultimately led to a situation where bad money drives out good, rooted in Douyin's low-price-centric strategy. Some merchants have reported that since the beginning of this year, Douyin's recommended traffic rules have been "low price wins traffic," leaving merchants unwilling to attract traffic with "inexpensive but low-quality" products unable to obtain traffic and forced into vicious competition, ultimately resulting in an ecosystem where "cheap equals poor quality."

"You cut corners on fabric, and I copy designs wildly. It's a competition to see who can drive costs through the floor," one merchant complained.

And as reported, Lola Password also stated that under the consumption trend of "low price is everything," lower-priced counterfeit products are appearing faster and faster, with copies appearing "within a week." Copycat merchants use inferior fabrics to pass off inferior products, and their lower prices for the same styles make their products even harder to sell.

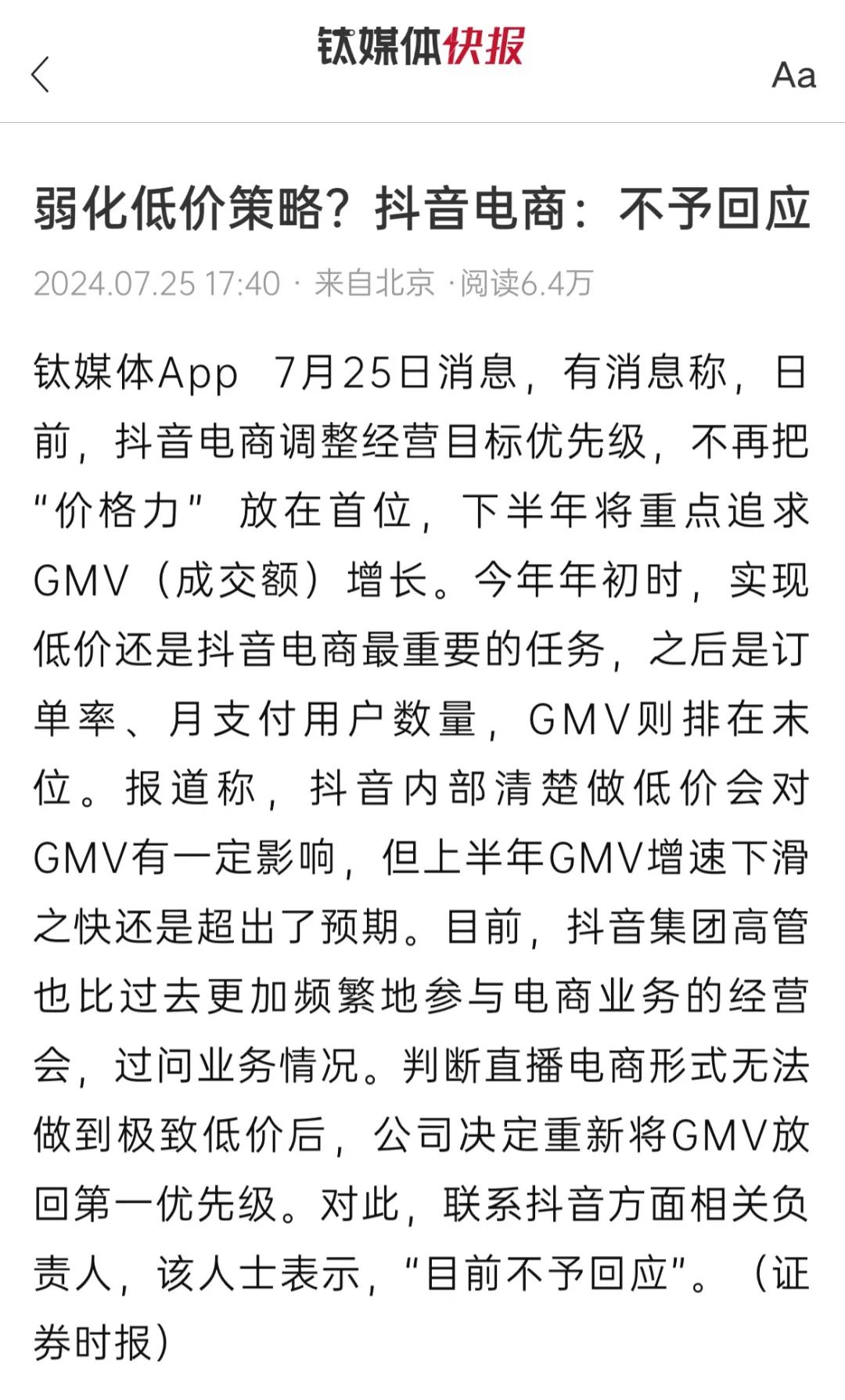

This can be traced back to Douyin e-commerce's adjusted target priorities in February of this year: price competitiveness became the top priority, followed by perfect order rate and monthly paying user count. The perfect order rate measures user experience, while the monthly paying user count reflects consumers' mindset of using Douyin as an e-commerce platform, with sales volume ranking last.

What frustrates merchants the most is that Douyin classifies products within the platform into three categories: "lowest price on the entire network," "lowest price for the same item," and "higher price for the same item," and provides different traffic exposure based on price, offering merchants price adjustment suggestions. By combining carrots and sticks, Douyin promises merchants that reducing prices can earn them more traffic.

At the same time, on the order page pending payment, Douyin displays low-priced versions of the same item, attracting users to switch, leaving merchants who have invested heavily in traffic and painstakingly showcased their brands to benefit others.

However, practice has shown that this was an unsuccessful strategic adjustment, and Douyin itself quickly realized the significant harm this strategy inflicted on the e-commerce ecosystem, weakening the low-price strategy after five months of chaos.

On the evening of July 23, according to a report by LatePost, Douyin e-commerce recently adjusted its business target priorities, no longer placing "price competitiveness" at the forefront, and will prioritize GMV (Gross Merchandise Volume) growth in the second half of the year.

However, just as one wave subsides, another rises. After easing the "low price" restraint, Douyin has strengthened its requirements for merchants' content. Ultimately, these policies stem from Douyin's growth anxiety. Amid its "midlife crisis," Douyin now demands both low prices and high-quality content, attempting to have its cake and eat it too, placing merchants under immense pressure.

II. The Anxiety Behind the Chaos in Douyin E-commerce:

Multiple Mountains Formed Under Demanding Both and And

At present, the Douyin market is highly competitive and overly saturated: Douyin's penetration rate has reached its ceiling, and traffic growth has entered a slowdown period, with increased competition for traffic among general content, commercialization, e-commerce, and local services.

At the 2024 Douyin E-commerce Author Awards Ceremony, Douyin E-commerce President Wei Wenwen introduced that over the past year, Douyin E-commerce's GMV (Gross Merchandise Volume) increased by 46% year-on-year, although the growth rate has slowed from the 70-80% of previous years. Nevertheless, the continuously growing e-commerce business has gradually encroached on the traffic originally intended for content.

Douyin once conducted a test, revealing that once the proportion of e-commerce content recommended to users exceeded 8%, there would be a noticeable negative impact on user retention and usage duration on the main site. Since the beginning of this year, Douyin's active user count and usage duration growth rates have significantly slowed.

This means that influencers and self-broadcasters must increase their investments, fully internet-celebritize their anchors, and thoroughly "compete" in content to grab more traffic from an increasingly crowded pool.

Operator "Shuisong Zhangyang" shared a case. In 2021, the founder of Douyin's top pet brand "Maodali" filmed short videos trying cat food, attracting 100 million views per month. Today, even anchors imitating him eating cat food and litter can only garner a few dozen likes.

Yet Douyin continues to encourage inflation in content and traffic costs. On September 9, Douyin's Wei Wenwen proposed returning to the essence of content, with "content power" and "transaction power" becoming two important directions for authors to develop their businesses on the platform.

Moreover, Douyin E-commerce's newly released CORE strategy places equal emphasis on affordable and comprehensive products, omnichannel content, marketing amplification, and experience enhancement, further exemplifying the "both and and" approach, which may exacerbate ecological internal competition, an unwise move.

The "both and and" approach adds two extra costs for Douyin merchants and influencers: the cost of creating or purchasing high-quality content and the cost of investing in traffic and competing for traffic with peers. This double-pronged approach makes it increasingly difficult for merchants to make money.

Take Blue Moon, for example. In the first half of 2024, Blue Moon reported a massive loss of HK$665 million, a 295.8% increase from the same period in 2023.

In response, Blue Moon stated that the increase in sales in the first half of this year was offset by increased sales and distribution expenses resulting from increased sales activities, particularly those related to promoting new products, expanding into new e-commerce channels, and brand building.

During this year's 618 period, Blue Moon invited Douyin's top anchor couple, the Guangdong Couple, for a live streaming event, generating sales of between 75 million and 120 million yuan. However, it was reported that Blue Moon spent up to 40 million yuan on traffic for this live stream, with paid traffic accounting for up to 69% of the total, far exceeding the industry average. With such a heavy investment in marketing, Blue Moon's losses were inevitable.

By continuously raising traffic costs and content production requirements while encouraging low prices, Douyin's entire e-commerce business model has fallen into crisis, with merchants passing on the crisis, ultimately making consumers the victims.

III. Merchants Passing on the Crisis, Consumers Becoming the Ultimate Victims:

The Ecosystem Urgently Needs Improvement

Internet celebrities promoted by Douyin traffic are continuing Xiaoyangge's style and repeating his mistakes.

After controversy erupted, Xiaoyangge lost 3 million followers, while K-General, who recently gained popularity, gained over 10 million followers in a week. K-General started as a beauty and gaming blogger, with a personal history and content style reminiscent of Xiaoyangge. Most of those seeking his endorsement are unknown small merchants, such as "Dian Guoguo" potato chips and "Lan Yuefang" flower cakes.

The "Xiaoyangge Model" can simultaneously capture traffic and low prices, fulfilling Douyin's demands for both, and has become the ultimate form of internet celebrity sales on the platform. While one Xiaoyangge falls, another K-General rises, albeit with even more amateurish products.

K-General has also built a live streaming clip matrix but does not charge for it. Currently, anyone can edit and publish clips, but they must include products from his showcase in the video. He explained two reasons for this during a live stream: one is "you'll be sued," and the other is "if something goes wrong, I'll be there to take the blame."

However, K-General's crisis came earlier. More than ten days ago, K-General revealed that many people had offered to invest in him, and some threatened him and his family after their investment offers were rejected. The unknown merchants he endorsed, such as "Dian Guoguo" and "Lan Yuefang," also suffered losses.

By continuously encouraging low-price comparisons and content competition, the platform forces merchants to continue cutting corners on product and service quality, driving the e-commerce environment with the "law of the jungle" and lowering the bar. From pushing the boundaries to selling counterfeit goods, consumers ultimately foot the bill.

At present, Douyin's ecosystem urgently needs improvement, and policy directions are also calling for a healthy competitive environment. Since September 1 of this year, the implementation of the "Provisional Regulations on Countering Unfair Competition on the Internet" may help turn the tide.

Furthermore, the frequent Overturning (failures or scandals) of internet celebrity sales have sounded the alarm for live streaming anchors, forcing them to actively save themselves by becoming more professional in supply chain management.

As the market size continues to expand, internet celebrities need to recognize that to remain competitive in this fiercely contested market, they must not only master lively, entertaining, and humorous communication skills but also demonstrate professionalism and seriousness in supply chain management.

Across the internet, many top anchors are increasingly "treasuring their feathers" by partnering with third parties for quality control and building their labs to continuously improve their professionalism and product quality. Externally, some anchors have signed quality control cooperation agreements with testing and certification groups, leveraging third-party expert teams to ensure product quality. Others have built their labs for self-inspections to ensure product compliance and prevent being exposed by external agencies and losing control.

The bitter sea of low-price internal competition is boundless, but turning back is salvation. It is hoped that through concerted efforts, Douyin can explore a new, upward, and benevolent path and emerge from the vicious cycle as soon as possible.