Behind Sichuan Changhong's 50 billion revenue: net profit margin is less than 1%, TV business is declining

![]() 09/24 2024

09/24 2024

![]() 613

613

As performance improves, Sichuan Changhong (600839.SH) intends to distribute over 80% of its profits as dividends.

On the evening of September 19, Sichuan Changhong announced the implementation of its 2024 semi-annual equity distribution, with a cash dividend of 0.05 yuan per share (including tax), amounting to 231 million yuan (including tax). This represents 82.5% of the company's net profit attributable to shareholders in the same period.

In the secondary market, possibly influenced by the dividend announcement, the company's share price increased by over 4% intraday on September 20 before retracing slightly. By the close, the share price settled at 5.05 yuan per share, up 2.85%, with a current total market value of 23.31 billion yuan.

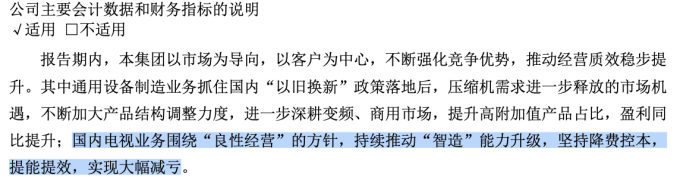

Stockstar notes that while Sichuan Changhong has been actively diversifying its business in recent years, its performance in intermediary products, network communication terminals, logistics services, and other areas has been disappointing, failing to support the company's overall performance. The main driver of revenue remains the smart home appliance business. Meanwhile, the company's ICT integrated services, its second-largest revenue source, have limited returns, with low gross margins that drag down the company's overall sales gross margin.

Notably, despite the company's revenue exceeding 50 billion yuan for the first time in the first half of the year, its net profit was less than 300 million yuan, with a net profit margin of less than 1%. Notably, government subsidies contributed over 40% of the company's net profit during this period.

01. Diversified but Unspecialized Business

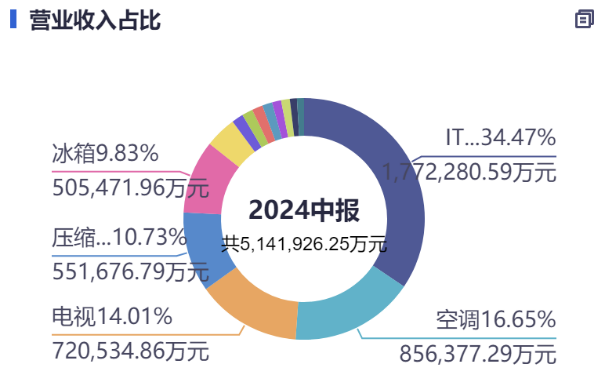

According to the 2024 semi-annual report, Sichuan Changhong (600839.SH) achieved revenue of 51.419 billion yuan in the first half of the year, up 10.24% year-on-year, with net profit attributable to shareholders of 280 million yuan, up 38.71% year-on-year, marking a double increase in both revenue and profit.

Currently, Sichuan Changhong's business spans eight major areas, including smart home appliances, general equipment manufacturing, ICT integrated services, intermediary products, network communication terminals, logistics services, real estate, and logistics services, covering multiple industries.

In terms of revenue composition, smart home appliances, including TVs, refrigerators, air conditioners, and washing machines, are the company's primary revenue source. During the reporting period, the home appliance business generated approximately 22.376 billion yuan in revenue, up approximately 17.69% year-on-year.

Stockstar notes that the growth rate of the smart home appliance business has slightly slowed from 18.27% in the same period last year.

When broken down by product, the growth rates of refrigerator, air conditioner, and washing machine sales have declined compared to the same period last year, while kitchen and bathroom appliances and small appliances have experienced negative growth.

In fact, Sichuan Changhong is widely known for its TV business, but according to the 2024 semi-annual report, TV revenue accounted for only 14.01% of total revenue, lower than the 16.65% share of air conditioner sales.

Furthermore, amidst the sluggish domestic TV market in recent years, the company's domestic TV business has incurred losses. Although the company has not disclosed specific financial data, it mentioned in the 2024 semi-annual report that its domestic TV business has focused on "sound business operations," reduced costs, and achieved significant loss reduction.

In addition, the company's competitiveness in the domestic market has declined. It is reported that Changhong TVs once held a domestic market share of up to 35% during its heyday, making it a dominant player in the industry. However, the latest data shows that Changhong, Konka, and Haier combined hold a market share of only 13.7%, indicating a significant decline in Sichuan Changhong's TV business.

ICT integrated services, represented by the distribution of ICT products and the provision of professional ICT solutions, are Sichuan Changhong's second-largest revenue source. In the first half of the year, this business generated approximately 17.723 billion yuan in revenue, up approximately 16.31% year-on-year, accounting for 34% of total revenue.

However, the returns from this business are limited. Stockstar notes that the gross margin of the company's ICT integrated services is relatively low at only 3.71%, the lowest among the company's eight major businesses, and has declined by 0.16 percentage points year-on-year.

The low gross margin of the ICT integrated services business is related to the company's business model. It is reported that the company's ICT integrated services are primarily handled by its subsidiary Changhong Jiahua, which distributes ICT consumer products (including personal computers, digital products, and IT accessories) and ICT enterprise products (including storage products, mini-computers, network products, etc.). As most of these services are concentrated in distribution and basic service levels, their added value is relatively low, making it difficult to achieve higher gross margins.

Apart from the two aforementioned businesses, the company's remaining six businesses account for a relatively small proportion of revenue and have not yet formed a significant revenue scale.

02. Net Profit Margin Below 1%

Despite Sichuan Changhong achieving double-digit growth in both revenue and profit in the first half of 2024, its net profit margin was only 0.54%, indicating weak profitability.

In response to this, some investors have questioned why the company's net profit margin is so much lower than that of its peers in the home appliance industry, such as Midea, Gree, and Haier, which reported net profit margins of 14%, 10%, and 8%, respectively, in their semi-annual reports.

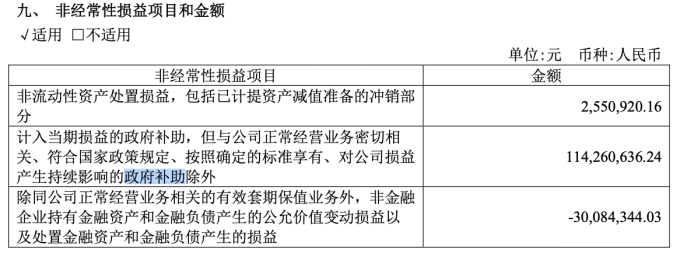

Stockstar notes that government subsidies contributed over 40% of the company's net profit during this period. In the first half of this year, Sichuan Changhong received government subsidies amounting to 114 million yuan, accounting for 41% of its net profit attributable to shareholders.

Over a longer time frame, from the first half of 2022 to the first half of 2023, government subsidies amounted to 206 million yuan and 118 million yuan, respectively, accounting for 135% and 58% of the company's net profit during those periods. Although the amount of government subsidies has decreased year by year, they still account for a significant proportion of the company's net profit.

Sichuan Changhong's weak profitability is related to its low gross margin. In addition to being dragged down by the low gross margin of its ICT integrated services business, the gross margin of its smart home appliance business also declined by 1.35 percentage points year-on-year to 14.09% in the first half of this year. As a result, Sichuan Changhong's overall gross margin was 10.21% in the first half of this year, down 0.83 percentage points year-on-year.

At the same time, asset impairment losses have also impacted the company's net profit to some extent. In the first half of 2024, Sichuan Changhong's asset impairment losses amounted to 198 million yuan, up 61.46% year-on-year, primarily due to inventory write-downs of 196 million yuan.

It is worth noting that after the write-downs, Sichuan Changhong's inventory book value reached 20.219 billion yuan, of which goods in inventory accounted for 7.055 billion yuan. If raw material prices fluctuate significantly or product market prices drop significantly in the future, the company's inventory may face impairment risks, which could have a significant adverse impact on its operating performance.

Moreover, despite achieving strong profit growth in the first half of 2024, Sichuan Changhong's net cash flow from operating activities was -1.049 billion yuan, a significant year-on-year decrease. The company explained that this was primarily due to changes in the settlement structure of sales and purchases. Going forward, the company plans to continuously improve operational efficiency, optimize sales and purchase settlement methods, and enhance operating cash flow. (This article was originally published on Stockstar by Li Ruohan)

- End -