Over 1.2 billion chips produced, China's chip production capacity hits a new high, and Japan takes advantage to make 50 billion yen! American companies are envious

![]() 09/24 2024

09/24 2024

![]() 504

504

China's chip production capacity has been continuously increasing in recent years, setting a new record high this year, indicating that the substitution of domestic chips is accelerating. Riding on China's vigorous promotion of chip manufacturing, Japan has vigorously exported chip equipment and materials to China, thus earning substantial revenue from the Chinese market.

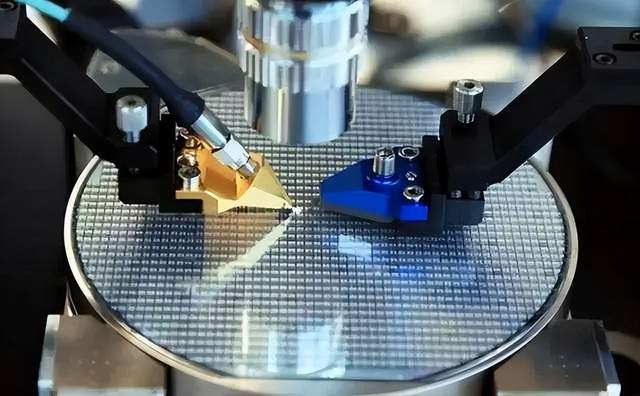

In the first eight months of this year, China produced more than 280 billion chips, exceeding 1.2 billion chips per day, an increase of 27% over the previous year, highlighting China's continued push for domestic chip substitution, which will further enhance the core competitiveness of Chinese manufacturing and ensure the security of chip supply.

The United States believed that blocking chip exports to China could curb the development of China's high-tech sector. However, the growth of China's chip industry has shown that the US plot has failed. Instead, China's chip industry has formed its own industrial chain and leveraged the vast domestic market to achieve breakthroughs.

In terms of chip manufacturing, foreign media speculate that China has already achieved mass production of 7-nanometer technology. It is estimated that the domestic 5G chip is produced by Chinese chip companies using 7-nanometer technology but can achieve the performance of 5-nanometer chips, highlighting China's progress in other new technologies and significantly enhancing the performance of 7-nanometer technology.

China has also broken through in many chip areas, with CMOS, memory, and RF chips all being localized. These chips are now being adopted by domestic mobile phone companies, reducing dependence on overseas chips. In fact, the Chinese manufacturing industry has a greater demand for mature process chips, which can be used in various consumer electronics such as home appliances and automobiles, accelerating the development of China's chip production capacity.

China's substantial increase in chip production capacity has propelled it to become the world's largest chip manufacturing country, with its share of global chip production capacity exceeding 30%. It was probably unexpected by the United States that China would become the world's largest chip producer in just a few years.

As China's chip production capacity grows, it has become the world's largest market for chip equipment and materials. Companies from the Netherlands, Japan, and the United States are increasingly reliant on the Chinese market for their chip equipment and materials. Although Japan followed the United States in expressing its intention to restrict the export of 23 types of chip materials to China, data from the first eight months of this year tells a different story.

Data shows that Japan's exports of chip equipment and materials to China continued to grow rapidly in the first eight months, with a year-on-year increase of nearly 60%. The Japanese chip equipment and materials industry earned up to 50 billion yuan from the Chinese market, with companies such as Tokyo Electron reporting that nearly half of their revenue came from China.

For Japan, the influence of the Chinese market is greater than expected. As Japan's lithography machines and other chip equipment lag behind ASML, and many overseas companies have stopped expanding their capacity for mature processes, China's continued expansion of mature processes makes the Chinese market particularly important for Japan's chip equipment and materials industry.

As Japanese companies reap substantial revenue from the Chinese chip market, American chip equipment and materials companies hope the US will grant them licenses to export more chip equipment and materials to China, allowing them to earn more revenue from the fastest-growing market and prevent Japanese companies from dominating the field, which would be unfair to American companies.

After all, the global chip market is limited. China's reduced chip imports have led to a significant decline in revenue growth for TSMC and GlobalFoundries, which primarily focus on mature processes. These two chip manufacturers have also been surpassed by SMIC in China, resulting in reduced procurement of chip materials and equipment. Naturally, American companies have an even greater need for the Chinese market.