Yonghui, which "couldn't be driven" by JD.com, has been taken over by MINISO

![]() 09/26 2024

09/26 2024

![]() 518

518

Is it a risky move or a surprise victory?

Editor's Note

JD.com, once an internet giant, failed to drive Yonghui Supermarket with its internet strategy. Previously, Suning took over Carrefour, and Wumart acquired Metro, but neither produced significant results. Now, MINISO has chosen to enter Yonghui, which is learning from Pang Donglai's model, marking a risky move by Ye Guofu himself.

On the evening of September 23, a shocking news in the investment community spread on social media: MINISO (HK: 09896) announced on the Hong Kong Stock Exchange that it would acquire a 29.4% stake in Yonghui Supermarket (SH: 601933) for 6.3 billion yuan, making it the largest shareholder in Yonghui Supermarket after the acquisition.

On September 24, MINISO's U.S. stock price closed down 16.65% from the previous day, while its Hong Kong stock price closed down 23.86%. In addition to the downturn in stock prices, some institutions also gave negative evaluations: Jefferies, a well-known investment bank, downgraded MINISO's rating from Buy to Hold, lowered its U.S. stock price target from $31.86 to $14.91, and its Hong Kong stock price target from HK$61.9 to HK$29.1. BofA Securities analysts downgraded MINISO to Sell and lowered its price target from $25.6 to $12.6.

However, MINISO founder Ye Guofu is very optimistic, saying in a social media post, "It's normal that no one understands it. If everyone understood it, I wouldn't have an opportunity."

01

Yonghui, which "couldn't be driven" by JD.com, has been taken over by MINISO

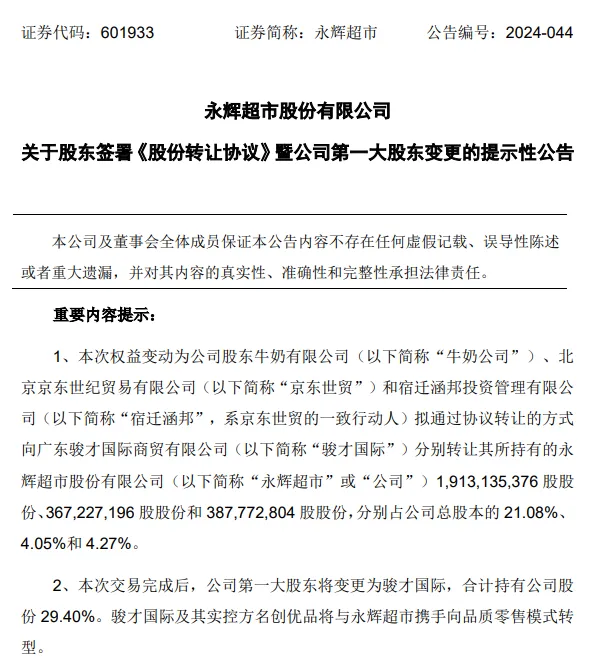

According to the details of the transaction, part of the Yonghui Supermarket shares acquired by MINISO came from JD.com. On the evening of September 23, Yonghui Supermarket announced that its shareholders, Dairy Farm International Holdings Limited (hereinafter referred to as "Dairy Farm"), Beijing JD Century Trading Co., Ltd. (hereinafter referred to as "JD Century Trading"), and Suqian Hanbang Investment Management Co., Ltd. (hereinafter referred to as "Suqian Hanbang") planned to transfer their respective shares in the company to Guangdong Juncai International Trading Co., Ltd. (hereinafter referred to as "Juncai International") through an agreement.

Both JD Century Trading and Suqian Hanbang are subsidiaries of JD.com, while MINISO is the actual controller of Juncai International. In this transaction, they transferred 367 million and 388 million shares of Yonghui Supermarket, respectively, accounting for 4.05% and 4.27% of Yonghui Supermarket's total share capital. After the share transfer, JD.com's overall shareholding fell to 2.94%.

In 2015, JD.com invested approximately 4.3 billion yuan to acquire a 10% stake in Yonghui Supermarket at a price of 9 yuan per share, and the two parties subsequently collaborated in the fresh food sector. However, since this year, in addition to this share transaction, JD.com has made multiple share reductions, and after this transfer, its overall shareholding fell below 3%, leading to speculation that JD.com may be "cutting its losses and exiting."

The reason for this speculation and the sharp decline in MINISO's share price after its announcement of its investment in Yonghui Supermarket is primarily due to issues with Yonghui Supermarket's own operations.

Since Yonghui Supermarket's market value exceeded 100 billion yuan in 2020, it has been on a downward trend. From 2021 to 2023, Yonghui Supermarket's revenue decreased consecutively to 91.062 billion yuan, 90.091 billion yuan, and 78.642 billion yuan, respectively. During the same period, its net profit was also in the red, with losses of -3.944 billion yuan, -2.763 billion yuan, and -1.329 billion yuan, respectively. Not only did revenue decline significantly, but Yonghui Supermarket's performance in these years was disappointing. Our readers may recall that during these three special years, the business of supermarkets was booming, with scenes of empty shelves everywhere. Yonghui Supermarket's consecutive decline in revenue during these years indicates serious operational issues.

Therefore, it is not surprising that JD.com wants to "cut its losses and run," and that the capital market is not optimistic about this transaction.

02

Is MINISO's investment in Yonghui Supermarket a risky or smart move?

Among the various speculations about MINISO's investment in Yonghui Supermarket, there is one direct source: Ye Guofu himself discussed the reasons in the "Telephone Conference Record of MINISO's Proposed Acquisition of Yonghui Supermarket Shares." He expressed optimism about the transformation of Yonghui Supermarket under Pang Donglai's model.

Most Chinese people have never seen Pang Donglai's supermarkets because all 13 of its stores are located in Xuchang and Xinxiang, Henan Province, and even many Henan locals may not have had the opportunity to visit them. However, Pang Donglai is very popular online, with tens of thousands of posts about it even on younger platforms like Xiaohongshu, indicating its wide influence beyond its physical presence.

Yonghui Supermarket, which has long been in operational difficulties, decided at its semi-annual work seminar this year to "learn from Pang Donglai." In May, Pang Donglai and Yonghui Supermarket collaborated to transform the Yonghui Supermarket (Zhengzhou Xinwan Plaza Store). According to Yonghui Supermarket's data, as the first store transformed by Pang Donglai, its first-day sales reached 1.88 million yuan, 13.9 times the average daily sales before the transformation; customer traffic reached 12,926 people, 5.3 times the average daily traffic before the transformation. As of July 15, the store's average daily sales were 1.8 million yuan, with an average daily customer traffic of 10,000 and an average transaction value of approximately 174 yuan. On August 7, the second transformed store, Yonghui Supermarket Zhengzhou Hanhai Haishang Store, reopened with customer traffic comparable to the first store. In the semi-annual report on August 23, although Yonghui Supermarket's revenue declined by 10.11% year-on-year, the two transformed stores have achieved profitability.

Ye Guofu himself is a big fan of the Costco model and led a team to the U.S. to study Costco in 2014. However, he later discovered that China's Pang Donglai model is even better and more suited to China's national conditions. While Sam's Club, Costco, and Pang Donglai all place great importance on products, the difference lies in Pang Donglai's customer experience, greater respect for employees, and lack of membership barriers. He believes that Pang Donglai is the best-paid, most efficient, and best-treated retail enterprise in China.

However, we also see that despite Pang Donglai's popularity and high online presence, it has not yet expanded beyond Henan Province or even into its provincial capital. While the stores transformed by Pang Donglai in Yonghui Supermarket have been successful, and Yonghui's self-transformed stores in Xi'an are said to have undergone significant changes, the overall scale is still relatively small. Whether the Pang Donglai model can be promoted nationwide remains to be seen.

Moreover, as Ye Guofu himself said, China's large supermarkets have reached an "inflection point." In recent half-year reports, net profits of Yonghui Supermarket, Jiajiayue, Zhongbai Group, Jingkelong, Liqun Stocks, and Sanjiang Shopping all declined year-on-year. Zhongbai Group saw the largest decline, with a year-on-year drop of 614.42%. Entering the market at a time when large supermarkets are in a sustained downturn poses significant challenges for MINISO.

JD.com, once an internet giant, failed to drive Yonghui Supermarket with its internet strategy. Similarly, Suning's takeover of Carrefour and Wumart's acquisition of Metro did not produce significant results. Nowadays, MINISO's choice to enter Yonghui, which is learning from Pang Donglai's model, marks at least a risky move by Ye Guofu himself.

However, not all capital markets are pessimistic about this high-stakes gamble. Huatai Securities recently issued a report maintaining its Buy rating on MINISO and setting a target price of HK$51.21. Huatai Securities believes that MINISO will continue to focus on interest-driven consumption and create IP products, leveraging its business resources with Yonghui to enhance the scale advantages of both parties' supply chains and channel operational efficiency. This layout in the offline supermarket sector and business synergy are worth looking forward to.

Conclusion

MINISO's strategic move to acquire Yonghui Supermarket, while initially causing a significant market reaction, reflects the innovative courage of founder Ye Guofu. He sees the potential of the Pang Donglai model for Yonghui Supermarket and attempts to reverse the industry's decline through resource integration and business synergy. Facing the turning point in the retail industry, MINISO's decision is not only a bold attempt but also a profound exploration of business model innovation and market adaptability. Only time will tell the success or failure of this cross-industry layout.

- END -