"Vertical and horizontal integration" prepares for Singles' Day, Alibaba and JD.com confront emerging e-commerce forces

![]() 10/14 2024

10/14 2024

![]() 497

497

The battle for Singles' Day has kicked off with new competition! E-commerce giants are breaking down over a decade of barriers and joining forces to confront emerging forces, intensifying the competition for market share. Vertical and horizontal integration has emerged as the new strategy.

Original @ New Entropy

The battle for Singles' Day in 2024 has come earlier and fiercer than in previous years.

Compared to last year, the Singles' Day promotions on major platforms have escalated their tactics—not only by preheating early and extending the campaign period but also by abandoning the relentless pursuit of low prices and optimizing the much-criticized "refund-only" policy. At the same time, platforms are beginning to "favor" merchants, genuinely caring for their interests and introducing favorable terms that can help merchants expand traffic and reduce costs.

In terms of specific tactics, platforms have emerged from the uniform approach of relentless price wars and are now engaged in all-round competition across multiple dimensions, including traffic, operations, pricing, and services.

In essence, the preparation for Singles' Day has already begun with the "vertical and horizontal integration" moves by Alibaba, Tencent, and JD.com. First, Taobao and Tmall integrated WeChat Pay, followed by mutual openness between Alibaba and JD.com. JD.com will also officially integrate Alipay, and both parties' logistics systems have begun to interconnect.

In a sense, this represents a "vertical and horizontal integration" strategy for traditional shelf e-commerce, which can to some extent resist the strong offensive of emerging forces like Douyin and Pinduoduo. Through strategic adjustments, the past situation of various warlords competing in the e-commerce industry may evolve into an overall confrontation between two camps.

01

Price wars shift to comprehensive competition

Starting in September, platforms like Taobao, Tmall, JD.com, Douyin, Kuaishou, and Pinduoduo began preparations for Singles' Day by first pursuing "vertical and horizontal integration" and then preheating the campaign while extending the promotional period. Everyone is gearing up for the battle ahead.

In order to gain an early advantage, this year's Singles' Day promotions have generally started one to two weeks earlier, with the entire campaign period extending to a full month.

As of now, Douyin was the first e-commerce platform to kick off Singles' Day, announcing its campaign on October 8, 12 days earlier than last year. Other platforms are also vying for an early start. Taobao and Pinduoduo will both announce the first wave of Singles' Day presales on October 14, while Kuaishou will officially enter the preheating stage on October 16, and JD.com will kick off Singles' Day early access on October 17.

At the same time, platforms are also innovating in their tactical strategies. This year, platforms have shifted away from the uniform approach of relentless price wars and are now engaged in comprehensive competition.

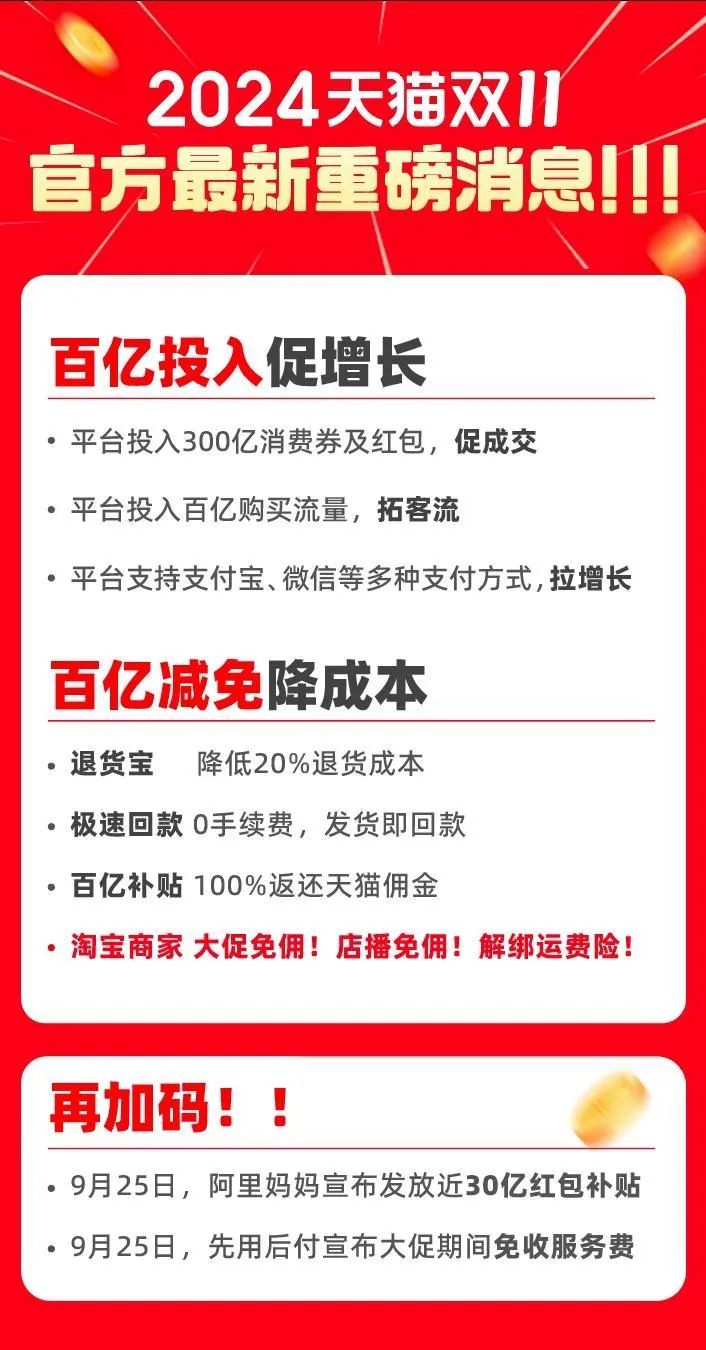

This year, Taobao has abandoned last year's strategy of offering the "lowest price on the entire network" and instead focused on "investing 10 billion in traffic to drive growth and waiving 10 billion in fees to reduce costs." Specifically, in addition to official discounts of 15% off or cross-store discounts of 50 yuan off every 300 yuan spent, Tmall will invest an additional 30 billion yuan in consumption vouchers and red envelopes. On October 14, the live streaming rooms will distribute 1 billion yuan worth of red envelopes, with each consumer able to receive up to 1,500 yuan per day in a single live streaming room. At the same time, Tmall is also investing 10 billion yuan in purchasing traffic to expand customer flow for merchants through partnerships with over 200 internet platforms. Taobao's 10 billion yuan subsidy program has also been enhanced, with Singles' Day offering "super subsidies" that include discounts of up to 80% off for tens of thousands of branded products, directly targeting the lowest prices across the entire network.

JD.com has also shifted away from its previous strategy of competing solely on price and is now focused on comprehensive competition, emphasizing "more traffic, faster operations, better service, and lower costs." In terms of promotional mechanisms, this year's JD.com Singles' Day will offer cross-store discounts and platform-wide subsidies of 20 yuan off every 200 yuan spent. The cross-store discount is 50 yuan off every 300 yuan spent, with promotional expenses fully borne by merchants. For products participating in cross-store discounts and with sales within the past 30 days, JD.com will provide additional traffic exposure for them during the promotional period.

Pinduoduo has continued its 618 strategy of "weighted search promotion for discounted products" and has committed to investing in traffic to support brand merchants, shifting its focus from consumers to merchants, especially brand merchants.

The "weighted search promotion for discounted products" strategy means that all discounted products offered by merchants will receive increased traffic weighting across the entire platform, and the transaction prices of all active orders during the entire Singles' Day period will not be counted towards the historical lowest price. Pinduoduo has introduced the "10 billion yuan consumption voucher" program for the first time and upgraded its "10 billion yuan doubled subsidy" to a "super doubled subsidy," investing heavily in subsidies and resources.

Douyin's core approach is to offer an official 15% discount and direct price reductions, with a commitment to traffic support. On top of this, platform consumption vouchers will continue to be distributed.

According to public information, Douyin's brand strategy focuses on discounts for major brands and marketing IPs; its mall strategy includes brand memberships, product card task races, super value purchases, flash sales, and more; and its live streaming room strategy encompasses super value group live streaming rooms, super value category live streaming rooms, and live streaming task races.

Kuaishou will also provide 20 billion yuan in traffic subsidies, 2 billion yuan in user red envelopes, and 1 billion yuan in product subsidies.

02

Breaking down over a decade of barriers

In fact, the more crucial preparations for Singles' Day began with the "interconnection" initiatives launched by Alibaba, Tencent, and JD.com in September of this year.

Payment is a critical node in e-commerce transactions. In the past, e-commerce players vied for payment licenses in an effort to tightly control payment processes and achieve closed-loop transactions on their platforms.

At the same time, through their own payment systems, e-commerce platforms can fully control core transaction data, reduce their reliance on third-party payment platforms, and lower transaction costs.

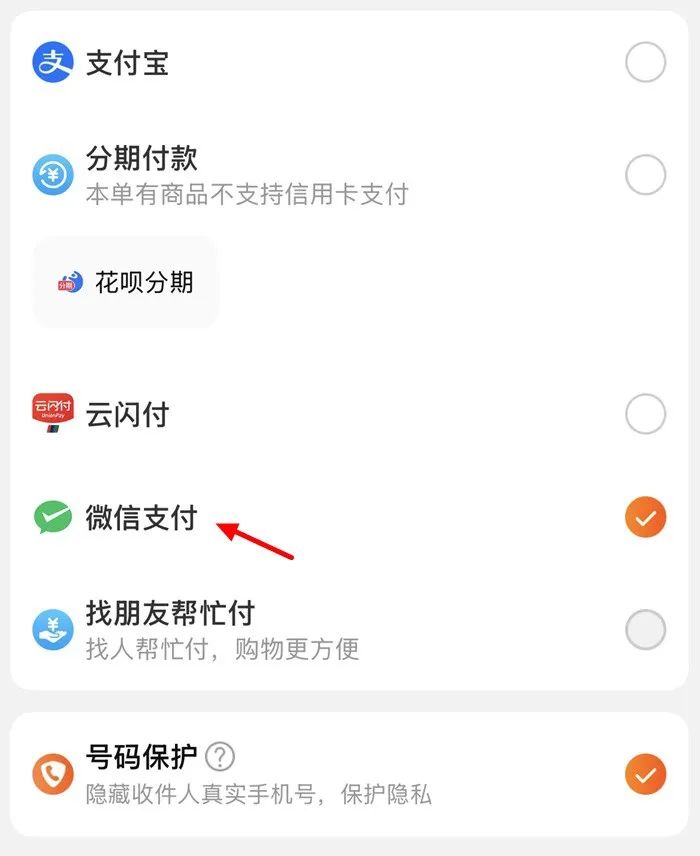

In September, Taobao fully integrated WeChat Pay, and JD.com will officially integrate Alipay ahead of Singles' Day.

Previously, the "blockade" between Alibaba and Tencent had lasted for over a decade, and it has been 13 years since JD.com last terminated its cooperation with Alipay.

In 2011, JD.com severed its payment links with Alipay. At the time, Liu Qiangdong explained the reasons for discontinuing the use of Alipay: firstly, Alipay's fees were too high, costing JD.com an additional 5 to 6 million yuan per year; secondly, 80% of JD.com's transactions were cash on delivery, with only about 10% using online UnionPay payments, so the discontinuation of cooperation with Alipay would not affect users.

However, as the e-commerce industry enters a phase of low growth, ecosystem building becomes crucial. Gradually constructing an interconnected e-commerce ecosystem and commercial synergy can "unlock" more traffic.

Beyond core payments, coordinated cooperation in logistics is also a win-win situation for Alibaba and JD.com.

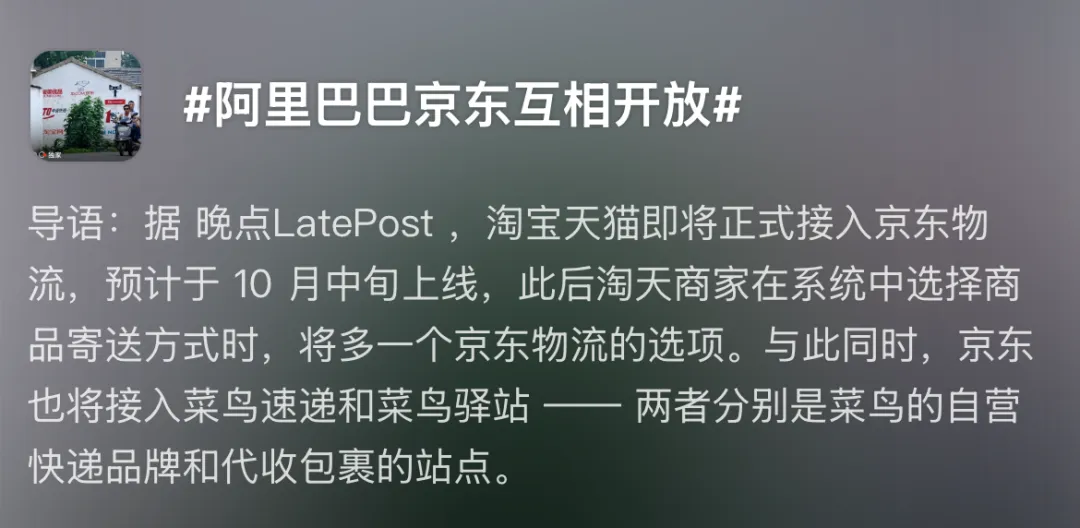

In October of this year, Taobao and Tmall began integrating JD.com Logistics, while JD.com will also integrate Cainiao Express and Cainiao Post Stations—Cainiao's self-operated express brand and parcel collection stations, respectively.

However, with Taobao's integration of WeChat Pay, Taobao will face significant pressure during Singles' Day, and integrating JD.com Logistics will greatly alleviate pressure on logistics and delivery.

For merchants, the integration of JD.com Logistics by Taobao offers fast and high-quality services, as well as integrated warehousing and logistics, which can significantly improve product turnover and delivery efficiency.

Merchants with stores on both Taobao and JD.com often need to manage inventory separately to adapt to the different operating rules and logistics requirements of each platform. However, with the integration of JD.com Logistics by Taobao, unified inventory management becomes possible, reducing redundant stockpiling and management costs and improving inventory utilization efficiency.

For small and medium-sized merchants on JD.com, the future opening of Cainiao Logistics is also expected to further reduce their delivery costs.

For JD.com, Taobao and Tmall generate annual e-commerce transaction volumes of approximately 8 trillion yuan. When the massive user base of Taobao and Tmall is integrated, JD.com Logistics will see a significant increase in user volume and revenue.

From core payments to logistics and delivery, Taobao, Tmall, and JD.com have achieved interconnection across a series of infrastructure, breaking down payment barriers, diversifying and streamlining logistics, and facilitating the mutual flow of traffic between the platforms.

03

Reshaping the competitive landscape of the market

The integration and win-win cooperation between Alibaba, Tencent, and JD.com can be seen as a "vertical and horizontal integration" strategy for traditional shelf e-commerce at a deeper strategic level. The past situation of various warlords competing in the e-commerce industry may evolve into collective confrontation between two camps.

According to a Goldman Sachs report, Taobao and Tmall's market share declined from 66% in 2019 to approximately 45% in 2023, a decrease of one-third over four years.

As new internet formats continue to erode the traffic, advertising, and GMV of traditional internet platforms, traditional e-commerce players need to band together for mutual support.

As the bonus period for traditional e-commerce comes to an end, the need for cooperation and win-win outcomes transcends disputes, barriers, and zero-sum games. By integrating their core strengths and sharing traffic, resources, and users, traditional e-commerce players can achieve a new e-commerce ecosystem and landscape.

At the same time, the "vertical and horizontal integration" strategy also meets regulatory compliance requirements. Under China's anti-monopoly policies, e-commerce giants must also transition from isolation to interconnection.

In 2021, the Ministry of Industry and Information Technology proposed ensuring normal access to legitimate website links. In the same year, Alibaba was fined 18.2 billion yuan for violating the Anti-Monopoly Law. The "Provisional Regulations on the Prevention of Unfair Competition on the Internet," which came into effect on September 1, 2024, also prohibits platform enterprises from abusing their dominant position to disturb the order of fair market competition through technical means or blocking measures.

Following the announcement of the completion of a three-year rectification in August 2024, Alibaba needs to demonstrate compliance outcomes.

This round of interconnection between Alibaba, Tencent, and JD.com can be seen as Alibaba's proactive and relentless effort to tear down walls. On the one hand, it can satisfy regulatory compliance requirements, and on the other hand, it can improve the currently unfavorable competitive landscape.

In the past, Alibaba has been resistant to WeChat. However, in China's vast lower-tier markets, WeChat Pay has become the mainstream payment method. In the era of stock growth, both user and traffic growth have hit a bottleneck, and WeChat's vast user base is highly coveted by Alibaba. How to compete for users accustomed to WeChat Pay has become an important and urgent choice for Alibaba.

Of course, vertical and horizontal integration also plays a vital role in promoting cost reduction and efficiency enhancement.

A logistics analyst believes that the core driving force behind the transition from isolation to openness on the internet should be cost reduction. The analyst notes that whoever can offer lower prices will have a competitive edge. In the past, when consumers returned or exchanged products on Taobao, Cainiao was responsible for receiving them. However, now Taobao's in-house logistics department can achieve lower costs and higher operational efficiency. The current cooperation between JD.com Logistics and Cainiao can also complement each other's strengths and improve logistics efficiency.

Currently, the transition of traditional internet giants from isolation to interconnection is a natural evolution driven by competitive landscapes, policy pressures, and the need for cost reduction and efficiency enhancement. It also lays the groundwork for a new e-commerce landscape in the future.