iPhone SE4 is confirmed! Did Apple fail with iPhone 16 and need to redeem itself with a compact flagship?

![]() 10/15 2024

10/15 2024

![]() 577

577

Due to minimal upgrades and the long-delayed launch of its flagship feature, Apple Intelligence, Apple's new iPhone 16 series has failed to meet sales expectations despite no price increase. After all, at a starting price of 5999 yuan, one can already purchase a large or even extra-large flagship Android device.

Faced with an increasingly competitive market, the high-priced iPhone 16 series has seen declining competitiveness. Apple needs products that can better attract consumers. Contrary to popular belief, while Apple dominates the high-end smartphone market, a significant portion of its sales rely on discounted older models. It was only on October 8 this year that Apple added the iPhone 6 to its discontinued list (the iPhone 6 Plus was discontinued earlier).

Apple needs products with relatively lower prices that support Apple Intelligence, targeting consumers with limited budgets but a desire to experience iOS and Apple's AI technology. Currently, the only model in Apple's lineup that can fulfill this role is the iPhone SE. Fortunately, consumers won't have to wait long as the specifications of the iPhone SE4 have already been largely revealed, with a potential release as early as March next year.

Self-developed modem + A18 chip, the iPhone SE4 is coming!

Recently, 9to5Mac, an overseas media outlet that accurately leaked information about the iPhone 16 series, shared details about the iPhone SE4.

9to5Mac reports that the internal code name for the iPhone SE4 is "V59." Its front design is similar to the iPhone 14, featuring a notch display that eliminates the large forehead and chin. However, the iPhone SE4 only has a single rear camera, making its overall design closer to the iPhone XR, except with narrower bezels due to the OLED flexible panel.

The iPhone SE4 upgrades to a 6.1-inch screen with a resolution of 1170×2532, identical to the iPhone 14. With the adoption of the notch design, Face ID is also included, eliminating the Home button with Touch ID, but without the Dynamic Island feature.

The camera is a significant upgrade for the iPhone SE4. Its front camera is 12MP, while the rear camera may be upgraded to a 48MP lens similar to the iPhone 15/15 Plus. Although the iPhone SE4 still lacks a telephoto or ultra-wide-angle camera, the upgraded main camera can somewhat satisfy users' photography needs, at least matching mid-range Android flagships.

Following tradition, the iPhone SE4 will be equipped with the same A18 chip as the iPhone 16 and come with 8GB of RAM, supporting Apple Intelligence. Every generation of iPhone SE lives up to its reputation as a "performance powerhouse," and the iPhone SE4 is no exception. Its support for Apple's AI features will become a core competitive advantage.

(Image source: Apple)

Notably, the iPhone SE4 abandons Qualcomm's SDX71M modem and instead adopts Apple's first self-developed 5G modem, code-named "Centauri." This modem supports Wi-Fi, Bluetooth, and GPS and seems to consume less power than Qualcomm's modems, but it does not support millimeter-wave technology.

Renowned semiconductor companies like Texas Instruments and Intel have struggled with modems, eventually abandoning the mobile SoC business. Apple has faced similar issues, with the iPhone XS and iPhone 11 series often criticized for poor signal quality due to their modems. 9to5Mac warns that the 5G performance of the iPhone SE4 may be limited in some high-frequency network environments.

Famous Apple leaker and analyst Ming-Chi Kuo stated that Apple will launch two phones equipped with self-developed modems in 2025: the iPhone SE4, the focus of this article, and the ultra-slim iPhone 17. For Apple, testing its self-developed modem with a lower-end product is indeed a safer choice.

Regarding pricing, 9to5Mac estimates that the iPhone SE4 will cost between $459 and $499 (approximately RMB 3,250 to RMB 3,530). Based on the price difference between the iPhone SE3 in China and the US, Lei Tech predicts that the starting price of the iPhone SE4's Chinese version will likely remain at RMB 3,499, with the 256GB version priced around RMB 4,500.

In overseas markets lacking direct competition, the iPhone SE4 can be considered an excellent alternative to the iPhone 16. However, in the fiercely competitive Chinese market, where high-performance and AI-enabled devices abound, including increasing numbers of compact flagships, does the iPhone SE4 still warrant consideration from domestic consumers?

Compact flagships gain popularity; can the iPhone SE stand out?

iPhones have always been synonymous with luxury. Take the iPhone SE3 as an example; its starting price of RMB 3,499 only buys a 64GB model, while the 256GB version costs a whopping RMB 4,699, at which price point, there are plenty of Android flagships to choose from. Considering that the iPhone SE has always adhered to the compact flagship segment, comparing it to Android compact flagships is necessary to determine its true position.

Of course, the standard for compact flagships is evolving. Apple co-founder Steve Jobs once believed that 3.5 inches was the optimal screen size for a phone, and Tim Cook has launched 5.4-inch mini versions for two consecutive years. Times have changed, and nowadays, devices with screens up to 6.5 inches can claim to be compact flagships, while flagship standards generally hover around 6.7 inches.

MediaTek's latest flagship chip has been released, Qualcomm's Snapdragon Summit is around the corner, and new products from major domestic smartphone manufacturers have been gradually unveiled or launched, including two compact flagships that have caught Lei Tech's attention. The first is the Xiaomi 15. Since the Xiaomi 12, the standard version of Xiaomi's digital series has been positioned as a compact flagship.

The Xiaomi 15 will be equipped with the Qualcomm Snapdragon 8 Ultimate Edition (Snapdragon 8 Gen 4), a 6.36-inch 1.5K LTPO screen, ultrasonic fingerprint recognition, a 50MP main camera, a 3.2x optical zoom telephoto camera, a 5400mAh battery, and 90W wired/50W wireless fast charging.

(Image source: Lei Tech)

Xiaomi CEO Lei Jun has explicitly stated that the Xiaomi 15 will no longer start at RMB 3,999. Considering the Xiaomi 15's upgraded specifications and product positioning, Lei Tech predicts a starting price of around RMB 4,399, with a minimum storage combination of 12GB+256GB, likely lower than the 256GB version of the iPhone SE4.

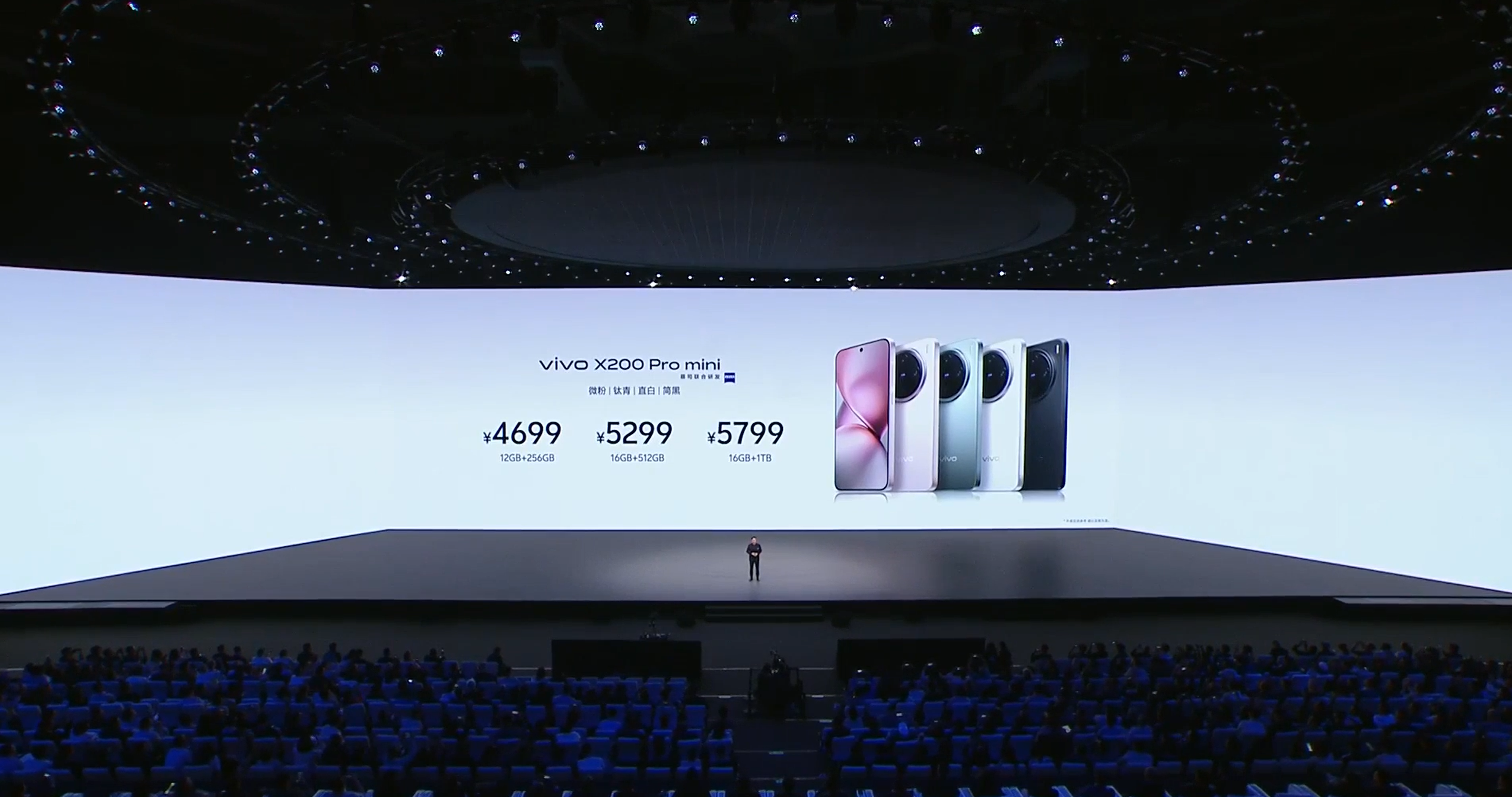

The second model is the vivo X200 Pro mini, unveiled on October 14, equipped with a MediaTek Dimensity 9400, a 6.31-inch screen, a 5700mAh battery, 90W wired/30W wireless fast charging, and an LTY-818 main camera with a periscope telephoto lens, supporting Zeiss full-range portrait mode.

(Image source: vivo)

As its name suggests, all configurations of the vivo X200 Pro mini are based on the Pro standard. Pricing-wise, the vivo X200 Pro mini starts at RMB 4,699 for a 12GB+256GB storage combination, similar to the price of the 256GB version of the iPhone SE4.

(Image source: vivo)

Domestic smartphone manufacturers are collectively venturing into the compact flagship market, competing with the iPhone SE's niche. In comparison, Android compact flagships offer richer configurations. While the iPhone SE4 has only a single rear camera, Android compact flagships boast triple cameras, and higher-end models like the vivo X200 Pro mini even include a periscope telephoto lens. In terms of battery capacity and charging speed, Android flagships far surpass their counterparts.

With its full-screen design, the iPhone SE4 is more competitive than its predecessor. Coupled with features like Apple Intelligence, the A18 chip, and a 48MP main camera, some potential iPhone 16 buyers may opt for the iPhone SE4 instead. However, on balance, Android compact flagships already possess the capability to compete with the iPhone SE4, iPhone 16, and even the iPhone 16 Pro.

Relying on iOS and Apple's long-established brand image, the iPhone SE4 may achieve decent sales in China, at least outperforming the outdated designs of the iPhone SE2 and SE3. It's also suitable for Android users looking to experience iOS and Apple Intelligence. Nevertheless, if Apple fails to promptly upgrade the hardware configurations of the iPhone SE and its standard and Plus models, their future competitiveness may continue to decline.

Intense smartphone market competition: either advance or fall behind

According to research firm Counterpoint Research, domestic smartphone sales increased by 4% year-on-year in the first half of 2024, amid an overall positive trend. However, iPhone sales bucked this trend, declining by 13%.

Typically, iPhone sales peak in the first and fourth quarters following the launch of new models, often leading both domestic and global sales. However, iPhone sales suffered a significant decline in the first quarter of this year. Notably, iPhone sales fell by a staggering 24% year-on-year in the first six weeks of 2024, an unusual performance for a newly launched iPhone model. Ming-Chi Kuo revealed that pre-orders for the iPhone 16 series decreased by 12.7% year-on-year during its first weekend, significantly below expectations.

The core reason for the decline in iPhone sales lies in the narrowing gap between the user experience of Android flagships and iPhones as a result of technological advancements. Qualcomm and MediaTek's flagship chips have surpassed Apple's A-series chips in multi-core performance, and many new iOS features have been questioned for resembling Android features.

On the other hand, while Android manufacturers have been experimenting with foldable phones and piling on specifications, Apple has remained relatively reserved. The iPhone 16 and 16 Plus, for instance, still sport 60Hz screens, widening the hardware gap with Android flagships.

It's undeniable that as an industry leader, Apple's brand image and unique iOS ecosystem have ensured its unshakable position in the global high-end market in the short term. However, the domestic market presents a different picture. With the resolution of supply chain issues, Huawei is regaining its footing in the high-end market, gradually gaining parity with Apple. According to Canalys statistics, Huawei captured a 30% share of the market above $600 (approximately RMB 4,250) in the second quarter of this year. With this trend, Huawei is likely to match Apple's share in the high-end market next year.

Other Android manufacturers are also stepping up their game, with upcoming series like Xiaomi 15, OPPO Find X8, and Honor Magic 7 promising exciting features. The era when Apple could effortlessly profit from brand premium is slowly coming to an end. Even the mighty iPhone needs to upgrade its configurations to maintain product competitiveness.

Nokia, once a dominant force in the mobile industry, failed to make the right choices in the smartphone era, eventually becoming a minor player. While Apple's size and resources give it an advantage, complacency could lead it down the same path as Nokia. Leveraging its current product prowess and brand value, Apple should swiftly enhance its hardware configurations to maintain an edge over Android devices, which may be the best strategy in the face of intense industry competition.

Source: Lei Tech