Beijing has another super unicorn: annual revenue of 17.3 billion yuan, ranking first in China

![]() 10/18 2024

10/18 2024

![]() 572

572

Pencildao author | Haiyoumeng

Recently, Beijing has emerged another super IPO: JD Industrial. Since then, JD.com Group may give birth to a new listed company (the sixth one), sprinting for the Hong Kong Stock Exchange's main board. In layman's terms, it is the industrial version of JD.com. In the industrial supply chain field, this is a solid super hidden champion. According to ZDC data, in terms of transaction volume in 2023, JD Industrial is the largest service provider in China's industrial supply chain technology and service market, with a market share of 4.1%. In addition, it is also a super unicorn. Last March, after completing its Series B financing, JD Industrial was valued at approximately $6.7 billion (approximately RMB 47.03 billion).

- 01 -

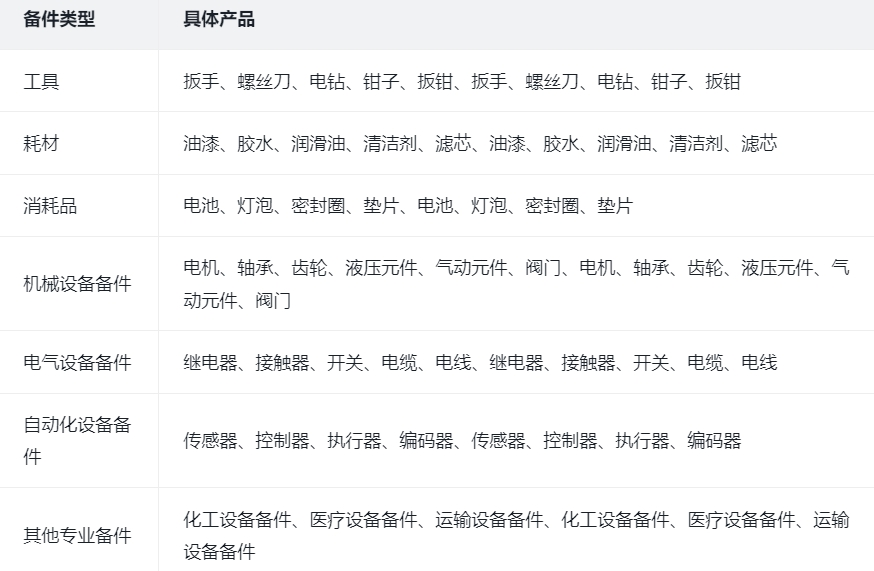

Founded in July 2017 (headquartered in Beijing), JD Industrial initially served as a business unit of JD.com Group, focusing on industrial supply chain technology and services. In layman's terms, it is the industrial version of JD.com. Buyers can purchase products online; sellers can sell products online, and the platform provides them with services such as marketing, inventory management, and logistics and distribution. It is worth noting that most of the products on the platform are self-operated, with a small number coming from third-party suppliers. These products mainly include a wide range of industrial products such as spare parts, chemicals, manufacturing parts, general consumables, and office supplies. Among them, the highest proportion is spare parts (as shown in the figure).

JD Industrial's profit model is also very similar to that of JD.com, mainly derived from product sales, accounting for more than 90% (93% in 2023), which is the company's primary source of revenue. Sales revenue includes two categories: one is self-operated, where the company purchases and sells products itself; the other is non-self-operated (third-party operated), where suppliers set up stalls on the platform to sell products. Self-operated business mainly earns money through product price differences, i.e., profits are obtained through the difference between procurement costs and sales prices. Among sales revenue, self-operated revenue accounts for the vast majority; while non-self-operated revenue mainly relies on commissions and other methods to generate income, accounting for a small proportion. According to public data, JD Industrial holds a 0.7% market share in China's MRO (Maintenance, Repair, and Operations) procurement service market, roughly equal to the combined market shares of the second to fifth largest players.

- 02 -

JD Industrial's primary customers include large enterprises in manufacturing, energy, transportation, and other industries – including approximately 50% of China's Fortune 500 companies and over 40% of global Fortune 500 companies operating in China. Its main competitors include but are not limited to the following four: 1. Xiyu: China's largest B2B e-commerce platform for industrial products, with a vast SKU count and a wide range of customer groups. 2. Yunhanxincheng: A B2B e-commerce platform specializing in electronic components, providing one-stop procurement services. 3. Jialichuang Group: Provides comprehensive services for industrial product procurement, logistics, warehousing, and more, with rich industry experience. 4. Zhenkunhang: Provides industrial product procurement, supply chain management, logistics and distribution services, and boasts a robust logistics network. Compared to its competitors, JD Industrial differentiates itself in the following ways: 1. End-to-end digital solutions. JD Industrial is not just an e-commerce platform for selling industrial products; it focuses on end-to-end digital solutions, achieving digital transformation across all aspects of the industrial supply chain, from products, procurement, fulfillment, to operations. 2. Backing from JD.com Group. As part of JD.com Group, JD Industrial can share the group's logistics, technology, data, and other resources, making it irreplaceable. For example, Xiyu primarily operates as an e-commerce platform, focusing on product sales; Yunhanxincheng specializes in electronic component procurement services; Jialichuang Group focuses on integrating services such as procurement, logistics, and warehousing; while Zhenkunhang primarily revolves around industrial product procurement and logistics distribution services, with a less comprehensive business model compared to JD Industrial.

- 03 -

Since 2020, JD Industrial has rapidly capitalized. In May of that year, it completed a $230 million Series A financing round led by GGV Capital, with follow-on investments from Sequoia China and CPE Source Peak, pushing its valuation above $2 billion. The following January, it completed another $105 million Series A1 financing round led by Domking and GGV. In March 2023, JD Industrial raised $300 million in Series B financing, led by investors such as Abu Dhabi sovereign wealth fund Mubadala and 42XFund, pushing its valuation to a new high of $6.7 billion (approximately RMB 47.03 billion). From 2021 to 2023, JD Industrial's revenue was RMB 10.345 billion, RMB 14.135 billion, and RMB 17.336 billion, respectively. Although it incurred significant losses in the first two years (RMB 1.234 billion and RMB 1.334 billion), it turned a profit in 2023, realizing a net profit of RMB 4.8 million. From a GMV perspective, according to ZDC data, JD Industrial's transaction volume increased from RMB 17.4 billion to RMB 26.1 billion between 2021 and 2023, with a compound annual growth rate of 22.5%. According to the forecasts of the Forward Industry Research Institute, from 2020 to 2025, China's annual MRO procurement amount will grow at a compound annual growth rate of 4.5%, reaching RMB 2.75 trillion by 2025. This article does not constitute investment advice.