"China Mobile: Trapped in Zero Growth? Not Really!"

![]() 10/23 2024

10/23 2024

![]() 456

456

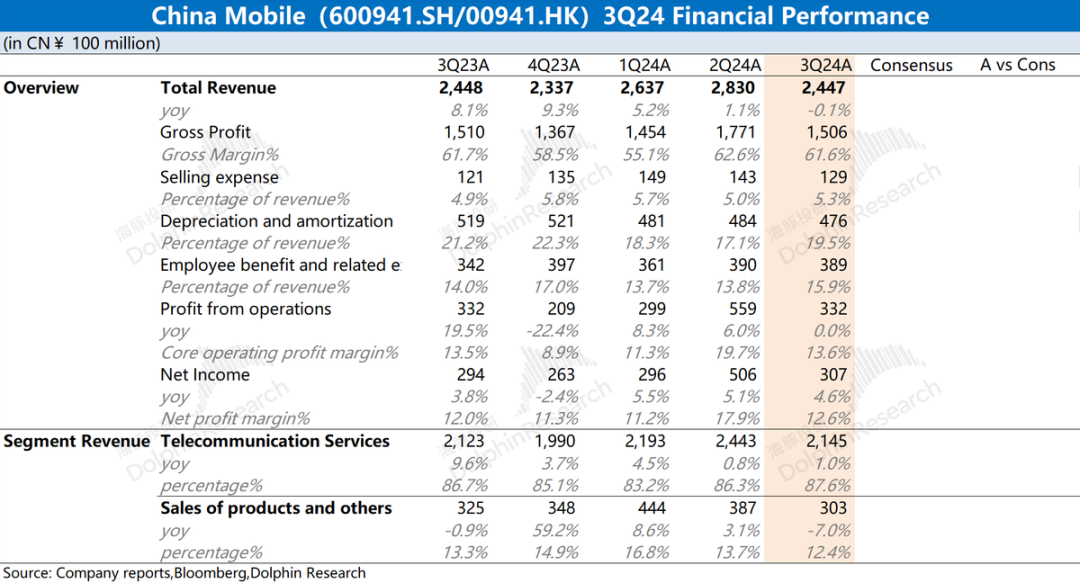

China Mobile (600941.SH/00941.HK) released its third-quarter financial report for 2024 (ending September 2024) after the Hong Kong stock market closed on the evening of October 21, 2024, Beijing time. The key points are as follows:

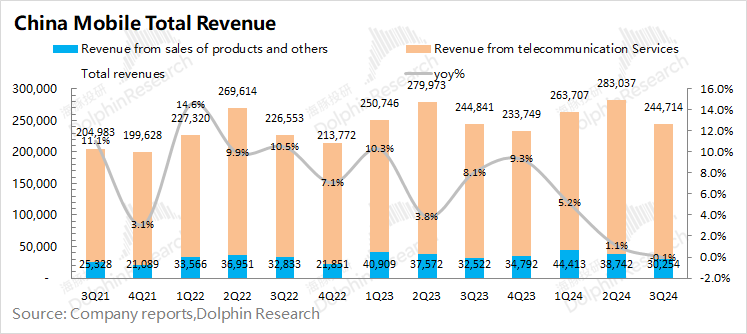

1. Revenue: Slight Decline. China Mobile's total revenue for the third quarter of 2024 was 244.714 billion yuan, a 0.1% decline compared to the previous quarter's 1.1% growth year-on-year. This decline was mainly due to a notable decrease in product sales revenue (such as mobile phone sales) for the first time in several quarters (-7% year-on-year).

2. Key Basic Revenue Stream (57% of total revenue): Telecommunication mobile services (including mobile data, voice calls, etc.) generated 139.8 billion yuan, a 3.3% year-on-year decline, similar to the 3.5% decline in the second quarter.

Behind the decline in mobile services lies a clear strategy of "trading price for volume." With over 1 billion mobile subscribers, China Mobile added nearly 4 million subscribers in a single quarter, but ARPU (average revenue per user) fell 4.7% to 46.5 yuan.

The mobile business is not deteriorating marginally, and the non-wireless services derived from it (mainly broadband, accounting for 30% of revenue) still show some growth potential for China Mobile. Revenue from these services increased 10% year-on-year in this quarter, demonstrating stable performance.

3. Profit: Zero revenue growth this quarter resulted in zero growth in operating profit of 33.2 billion yuan. The largest expense component, operating and network support costs, remained relatively rigid and did not fluctuate with revenue changes. Therefore, without revenue growth, there was no profit margin expansion.

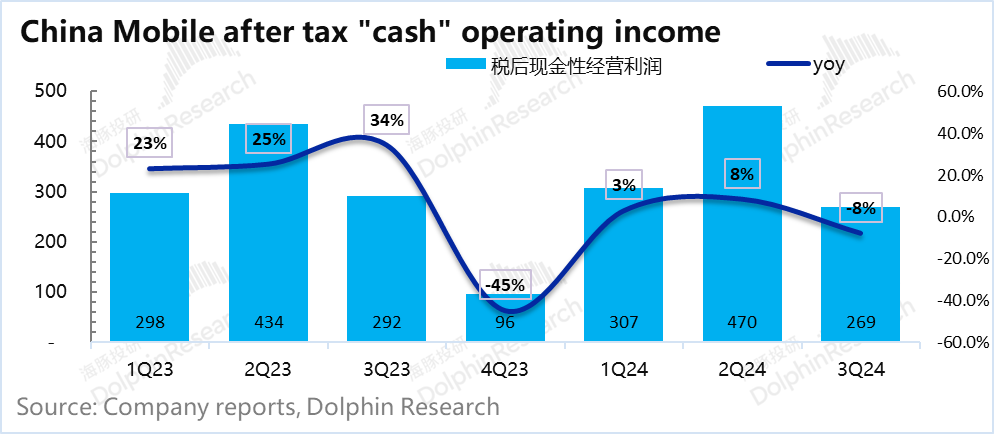

4. Investor Focus: Assuming capital expenditures from the cash flow statement can be roughly considered as the company's capital spending, and dividend repurchases as returns to shareholders, Dolphin Insights calculated an 8% year-on-year decline in post-tax cash profits. Apart from the rigid expenses mentioned earlier, capital spending also increased slightly year-on-year.

Dolphin Insights' Perspective:

China Mobile, usually steady as a rock, appears to be showing signs of weakness this quarter. However, Dolphin Insights views this as a normal quarterly fluctuation rather than a cause for concern.

Firstly, the weak revenue growth was primarily due to less significant product sales, while the core mobile and broadband businesses remained stable.

Dolphin Insights did notice that China Mobile's wireless data usage increased by less than 3% year-on-year from 422GB in Q2 to 428GB in Q3, indicating the end of the traffic growth dividend from China's video internet.

With voice revenue declining and data usage reaching saturation, if data prices continue to drop, China Mobile's overall mobile business revenue may also plateau. The only remaining path for wireless services may be price wars to compete for users from Unicom and Telecom, especially as the leading player can capitalize on economies of scale to gain market share more easily.

Given the business logic of mobile broadband, Dolphin Insights is not concerned about short-term price cuts by China Mobile aimed at acquiring users:

a) In the long run, with C-end internet penetration and dividends nearly exhausted, and as the industry shifts to industrial internet, Dolphin Insights believes the risk of further data price cuts has significantly decreased. Essentially, when the downstream C-end mobile internet market is mature, there is no need for further price reductions to benefit downstream players.

b) The ongoing price cuts can be seen as China Mobile leveraging its financial strength to engage in price wars and gradually increase its user share, which will ultimately benefit the company in the long run as user concentration increases.

With overall stable demand, Dolphin Insights is more concerned about the company's investment and production control and potential shareholder returns:

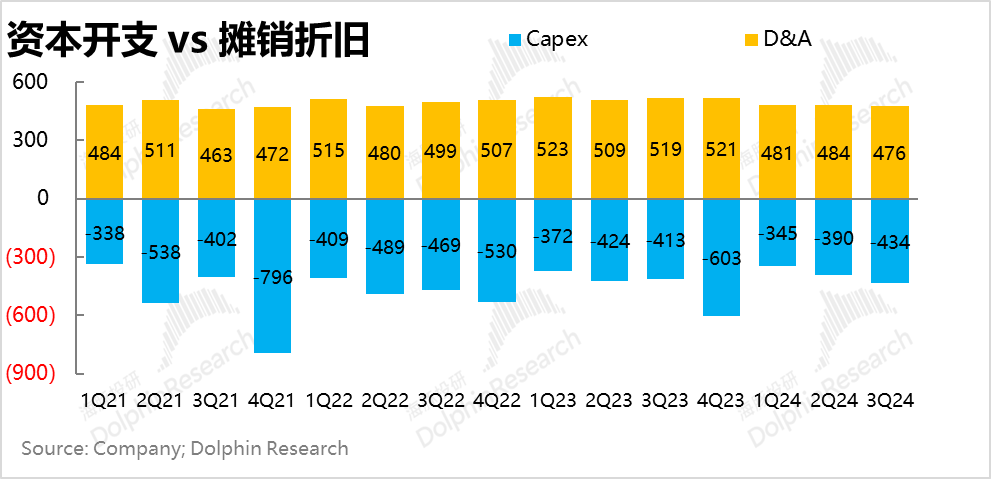

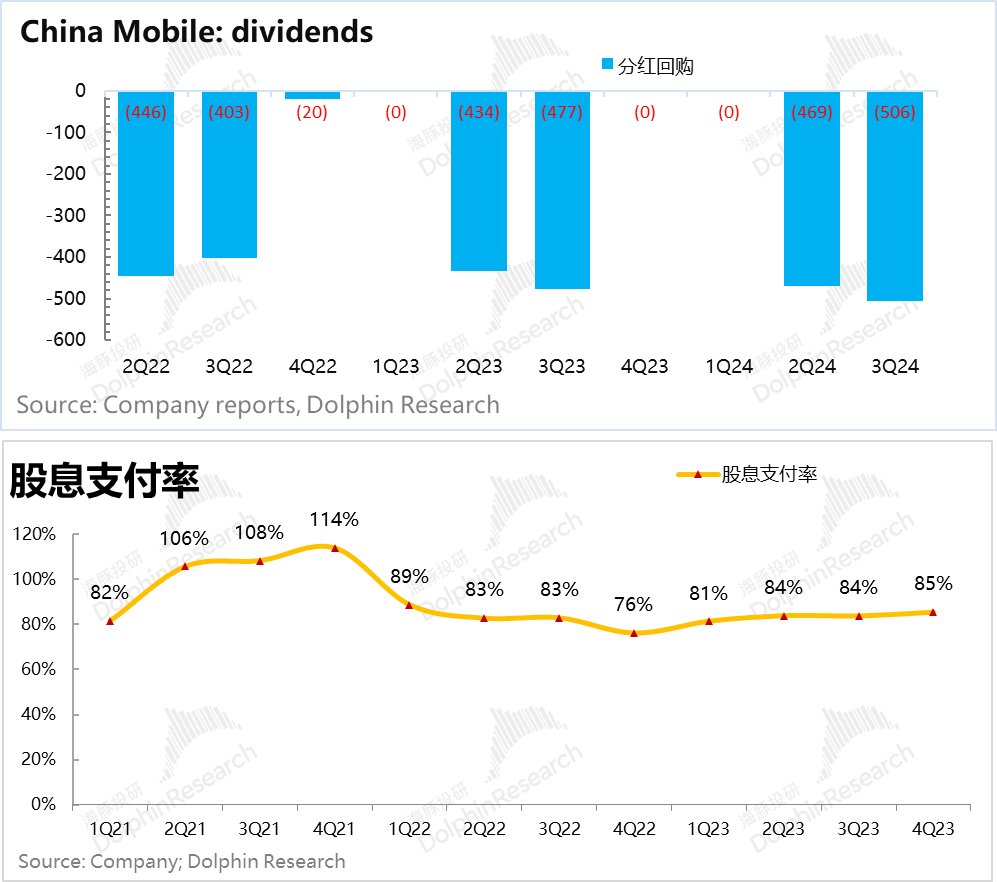

a) With 6G investments still far off, Dolphin Insights uses EBITDA (earnings before interest, taxes, depreciation, and amortization), adjusted for capitalized expenses and fixed asset spending from the cash flow statement, to estimate quarterly post-tax cash operating profits. The picture that emerges is clear: having emerged from the capital expenditure cycle of 5G, China Mobile is a highly predictable cash cow business. Its average quarterly profit for the first three quarters of this year was 35 billion yuan, with a dividend yield of approximately 85%.

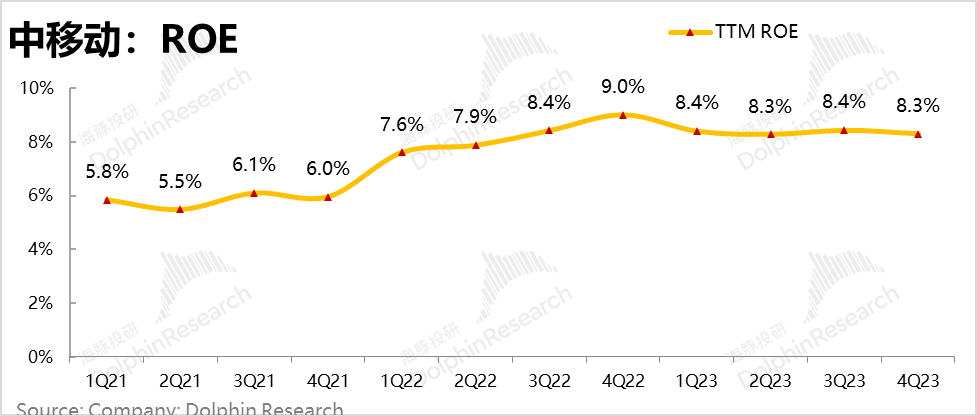

b) As a market with stable demand but limited growth potential, China Mobile does not engage in capital-intensive production related to its core business. Instead, it holds significant cash and financial assets totaling 440 billion yuan, accounting for 30% of its Hong Kong stock market value. Due to its ample cash reserves, the company has virtually no interest-bearing liabilities.

China Mobile's current 85% dividend payout ratio is roughly in line with its Hong Kong stock market value, translating to a shareholder return of around 6.5%. For RMB-denominated funds from southbound institutions that do not pay taxes on dividends, this remains a relatively attractive return.

Therefore, Dolphin Insights believes that in the current deflationary environment, China Mobile remains one of the optimal choices under countercyclical dividend logic.

Detailed Analysis

I. Are Dividends Generous?

Given China Mobile's typically stable revenue stream and investors' focus on its high cash balances and dividend prospects post-5G investment, Dolphin Insights examines two key metrics: cash profits and dividends.

1) Cash Profits:

For capital-intensive companies like BOE, book profits can be deceiving as they may already be tied up in equipment purchases and production lines. For China Mobile, Dolphin Insights focuses on true cash operating profits after adjusting for accounting items. This is calculated by adding back depreciation and amortization expenses to operating profits and subtracting capital expenditures (roughly equivalent to fixed asset spending). The resulting cash operating profit is then adjusted for corporate tax to arrive at post-tax cash operating profits (note: interest income's impact on profits is ignored here, as the company's high cash balances generate significant interest income, but we focus on the cash cow potential of its core business).

One clear takeaway is that due to gradually decreasing capital expenditures and relatively high depreciation and amortization, China Mobile's cash operating profits are actually higher than its reported operating profits, indicating stronger earnings power.

Dolphin Insights calculates China Mobile's post-tax cash operating profits for Q3 at 27 billion yuan, a year-on-year decline of 8%, primarily due to the aforementioned factors related to revenue and expense rigidities.

2) Dividend Generosity:

Despite the decline in cash profits, China Mobile's dividend and repurchases totaled 50.6 billion yuan in the previous quarter. Its dividend payout ratio relative to post-tax cash operating profits remained stable at 85% over the past year. Given the company's significant cash reserves, it could theoretically increase its dividend payout ratio above 100% during periods of aggressive user acquisition.

If macroeconomic conditions remain challenging, China Mobile, with its modest price corrections and stable dividend yields (4.5% in A-shares and 6.7% in H-shares, compared to around 2% for 10-year Chinese government bonds), remains an attractive Chinese asset with relatively predictable returns amidst uncertainty.

II. Revenue: Slight Decline

China Mobile's total revenue for Q3 2024 was 244.714 billion yuan, a 0.1% year-on-year decline. The slight revenue decline was due to lower product sales and other income.

By segment, revenue from telecommunications services was 214.46 billion yuan, up 1% year-on-year, while revenue from product sales and other sources was 30.254 billion yuan, down 7% year-on-year.

Based on current mobile subscriber numbers and ARPU, Dolphin Insights estimates that China Mobile's mobile business revenue in Q3 was approximately 139.8 billion yuan, down around 3% year-on-year, similar to the second quarter. The mobile subscriber base reached 1.004 billion, with a quarterly increase of 3.7 million. The calculated monthly ARPU was 46.5 yuan, down 4.7% year-on-year.

On the broadband front, both subscriber numbers and revenue showed healthy growth. The broadband subscriber base reached 314 million, with a quarterly increase of 4.8 million. The calculated revenue from non-mobile telecommunication services (including broadband) was approximately 74.6 billion yuan, up 10% year-on-year.

Overall, China Mobile's revenue decline in Q3 was primarily driven by lower product sales, such as mobile phones and set-top boxes. In its core telecommunication business, mobile revenue continued to decline at around 3%, while broadband and other telecommunication revenue maintained growth.

III. Profit: Flat Operating Profit Year-on-Year

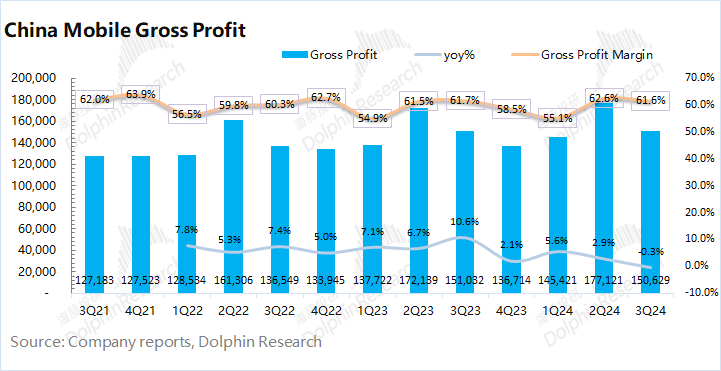

3.1 Gross Margin

China Mobile's gross margin for Q3 2024 was 61.6%, down 0.1 percentage point year-on-year but remaining stable. Dolphin Insights calculates gross margin by considering "network operation and support costs" and "product sales costs" as operating costs. Both of these costs remained relatively unchanged year-on-year, contributing to stable gross margin performance.

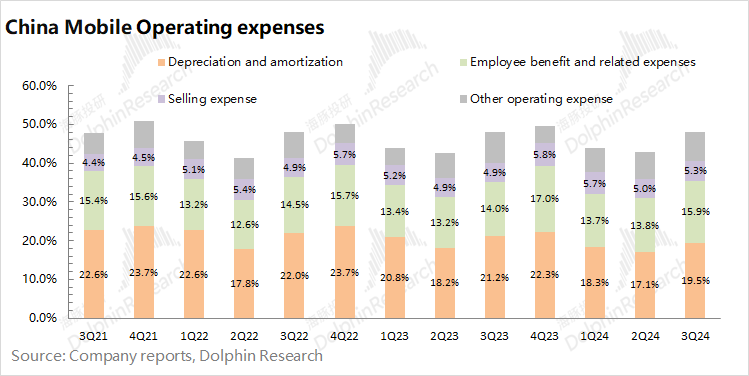

3.2 Operating Expenses

China Mobile's operating expenses for Q3 2024 were 117.5 billion yuan, down 0.1% year-on-year, broadly in line with revenue trends. Dolphin Insights categorizes operating expenses into four main components: sales expenses, employee compensation, depreciation and amortization, and other operating expenses.

1) Sales Expenses: 12.8 billion yuan, up 6.3% year-on-year, accounting for 5.3% of revenue. The increase in sales expenses reflects the company's efforts to expand its user base.

2) Employee Compensation: 38.95 billion yuan, up 14% year-on-year, accounting for 15.9% of revenue. Employee-related expenses increased year-on-year, demonstrating some rigidity.

3) Depreciation and Amortization: 47.53 billion yuan, down 8.2% year-on-year, accounting for 19.5% of revenue. As the peak investment period for 5G and other initiatives passes, depreciation and amortization expenses are gradually declining.

3.3 Net Profit

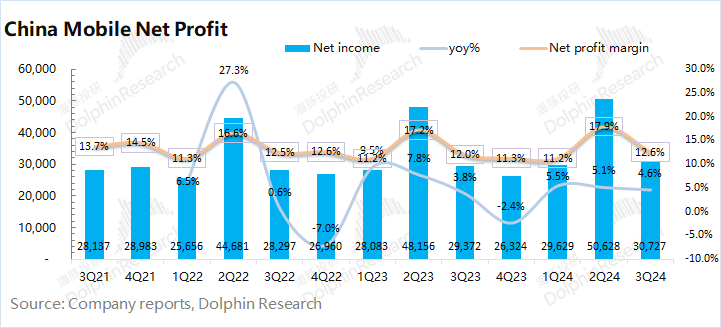

China Mobile's net profit for Q3 2024 was 30.73 billion yuan, up 4.6% year-on-year. The increase in net profit was primarily driven by non-operating factors, with interest income growing 1.2 billion yuan year-on-year, a significant contributor to the profit growth. From an operating perspective, revenue, gross margin, and expenses remained relatively stable. China Mobile's operating profit for the quarter was 33.2 billion yuan, flat year-on-year.

- END -

// Reprint Authorization

This article is original content from Dolphin Insights. For reprinting, please obtain authorization.