"Second-hand saves the world, second-hand luxury saves Zhuanzhuan?"

![]() 10/24 2024

10/24 2024

![]() 579

579

Competition fierce both online and offline

Written by Li Jinlin

Edited by Li Ji

Typeset by Annalee

The first round of the "longest Double 11 in history" has already begun, with major e-commerce platforms redefining low prices through tens of billions of subsidies and doubled subsidies to lure increasingly rational consumers.

As Double 11 enters its 15th year, this shopping spree is no longer exclusive to top e-commerce platforms, but rather serves as a barometer reflecting consumer vitality and trends, with participants spanning various industries. Among them, second-hand e-commerce platforms have quietly ramped up their efforts in recent times, infiltrating every corner of short videos.

It's hard to miss the presence of Zhuanzhuan and AI Huishou (a popular second-hand electronics recycling platform in China) in short videos. Some even joke that these platforms sustain a myriad of lifestyle, tech, film, and food bloggers on the platforms. They appear unexpectedly, consistently delivering the same message to users through a barrage of advertisements.

However, while traffic can be bought, sales are not guaranteed. In the second half of the all-industry melee, new narratives equate to new growth.

Recently, Zhuanzhuan announced the full acquisition of Hongbulin, filling gaps in its second-hand luxury offerings and traffic, gradually transforming from a 3C recycling platform to a full-category second-hand trading platform. This marks a new chapter for Zhuanzhuan after several acquisitions.

Yet, the question looms: Can Zhuanzhuan truly compete with Xianyu and AI Huishou in the second-hand luxury market amidst the booming circular economy? And how much can the issues of quality and service, which have plagued Zhuanzhuan and Hongbulin, be resolved through this "union"?

Advertisements and Business: Buying Non-Stop

"Vertical e-commerce platforms eventually face a survival curve: expanding scale leads to higher customer acquisition costs, while failing to expand leads to growth ceilings," said Hu Weikun, COO of Zhuanzhuan, explaining the rationale behind the Hongbulin acquisition.

Put simply, Zhuanzhuan, with its core business in second-hand 3C product trading, and Hongbulin, specializing in second-hand luxury trading, aim to achieve painless scale growth through this partnership. Hongbulin will maintain independent operations, while Zhuanzhuan and Hongbulin will fully integrate their backend systems and fulfillment capabilities. Hongbulin will also tap into Zhuanzhuan's on-site services and store network.

For Zhuanzhuan, this may be a shortcut to breaking through growth ceilings. Compared to Xianyu, backed by Alibaba, and AI Huishou, backed by JD.com, both of which embraced a full-category strategy early on, Zhuanzhuan's traffic dilemma stands out.

Prior to acquiring Hongbulin, Zhuanzhuan pursued a "buy, buy, buy" strategy, investing in advertisements to boost visibility and expanding its business portfolio.

Zhuanzhuan offline stores

On short video platforms, Zhuanzhuan appears unexpectedly in food, tech, lifestyle, and film videos, with bloggers repeatedly promoting their purchases of new devices on Zhuanzhuan and selling old ones for good prices. Zhuanzhuan has become a meme, with people joking about putting unwanted items on Zhuanzhuan for recycling. Its heavy advertising presence on short video platforms has led fans to judge a blogger's monetization success by whether they've received Zhuanzhuan advertisements.

Undeniably, Zhuanzhuan's massive advertising campaigns have driven user growth. As of April 2024, Xianyu had 162 million monthly active users, ranking first in the idle trading industry with a year-on-year growth of 19.1%, while Zhuanzhuan ranked second with 22.48 million monthly active users, up 3.7% year-on-year.

In Q2 2021, Xianyu and Zhuanzhuan had 130 million and 14.486 million monthly active users, respectively. Over three years, Zhuanzhuan has grown both in comparison to itself and Xianyu.

However, does all this traffic translate into positive feedback? Not necessarily. "I saw a Zhuanzhuan ad on Douyin and decided to give it a try, only to encounter a major disappointment. The platform promised an undamaged, 99% new phone, but I found significant wear on the frame upon receipt. Even more suspicious were the non-functional mute button, glue spilling from the screen, and signs of disassembly on the back cover," said Kang Yuyang, who purchased a second-hand Vivo phone from Zhuanzhuan in September 2023.

Zhuanzhuan has 93,593 complaints on Heimao Complaint Platform

According to Vivo's official inspection report, the phone had been disassembled and repaired by a non-official service center, with a non-original battery cover and a broken internal seal. Kang approached Zhuanzhuan's official after-sales service but was told that the platform's reports and inspection opinions would prevail over those of manufacturers and officials. Ultimately, Kang reluctantly continued using the unsatisfactory phone.

At the heart of this controversy lies Zhuanzhuan's heavily promoted "official inspection" service.

Introduced to address the non-standardization of second-hand goods, Zhuanzhuan's "official inspection" involves individual inspection of each non-standard item by professional quality inspectors, accompanied by detailed inspection reports. Initially intended to increase transparency, the service has since taken a different turn.

Late last year, blogger "Hou Dawan" released a video alleging that Zhuanzhuan issued "double-sided inspection contracts." The blogger purchased a 95% new 128GB iPhone 12 Pro from Zhuanzhuan for 3,112 yuan and later sold it back for only 1,990 yuan. Further investigations revealed discrepancies in Zhuanzhuan's inspection reports for both purchases and sales.

The incident sparked question s about Zhuanzhuan's "official inspection": "If the platform conducts inspections and issues reports to ultimately hold the final say, who safeguards consumers' rights?"

More Than One Competitor Online and Offline

Both Zhuanzhuan's massive advertising campaigns and controversial "official inspection" service are attempts to break through barriers and expand its product categories. While it aims to maintain its second place and compete for first, Zhuanzhuan faces more than just Xianyu. Profitability remains a crucial test in this protracted battle.

Prior to acquiring Hongbulin, Zhuanzhuan assessed that the overall volume of luxury goods was comparable to consumer electronics, with a higher stock of second-hand luxury items. It hoped to achieve 1+1>2 growth through this acquisition.

Moreover, the "Luxury" category on Zhuanzhuan's app interface ranks third after Mobile & Electronics and Computers & Office Supplies, with subcategories like Watches, Books, Sneakers, Games & Entertainment, and Accessories prominently featured on the homepage.

In the "Free Market" section, Zhuanzhuan prioritizes celebrity merchandise and pop culture products, including JK uniforms, Lolita dresses, Hanfu, cosplay costumes, and celebrity-related items like trading cards, photobooks, and calendars. While Zhuanzhuan strives to differentiate itself, Xianyu has already secured a foothold in the anime and pan-entertainment categories, with the anime industry's transaction volume growing by 104% year-on-year in 2024, the fastest-growing interest group on Xianyu among young users.

Zhuanzhuan's unique commercial path involves deploying offline stores, with franchising as a key strategy.

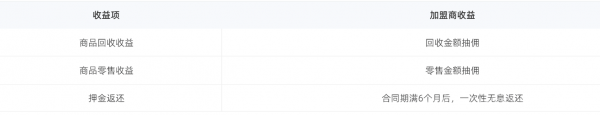

Franchisee benefits at Zhuanzhuan offline stores

According to Zhuanzhuan's official website, its offline stores cover 33 provincial capitals with over 600 locations. Franchisees can choose between standard and micro-stores, requiring an initial investment of 100,000 yuan, a deposit of 300,000 yuan, and the opening of two stores within three months. Franchisees must also be top-tier 3C/mobile retailers with mall recruitment and advertising resources.

The estimated one-time investment ranges from 300,000 to 400,000 yuan, with franchisees bearing all rental, decoration, and salary costs. Soft furnishings, props, retail merchandise, and recycling funds are secured through deposits paid to Zhuanzhuan.

Notably, franchisees earn commissions on recycling and retail sales, raising questions about whether the investment justifies the returns.

Comparison of offline store counts between Zhuanzhuan and AI Huishou

Setting aside franchisee profits, Zhuanzhuan lags behind AI Huishou in offline expansion. AI Huishou operates over 1,500 stores nationwide, having established an automated circulation system for non-standard second-hand products four years ago, ventured into luxury recycling three years ago, and expanded into multi-category recycling two years ago.

Zhuanzhuan faces an uphill battle both online and offline, requiring new narratives across categories, services, positioning, and models.

Industry Growth: Where Does Zhuanzhuan Go From Here?

In its nine-year journey, Zhuanzhuan has transformed from a C2C to a C2B2C model, branching out into second-hand luxury and leasing. However, compared to Xianyu and AI Huishou, which enjoy clear growth paths and traffic advantages from Alibaba and JD.com, Zhuanzhuan's shortcomings are more pronounced, lacking a dominant competitive advantage in niche areas.

Yet, the second-hand trading market remains promising.

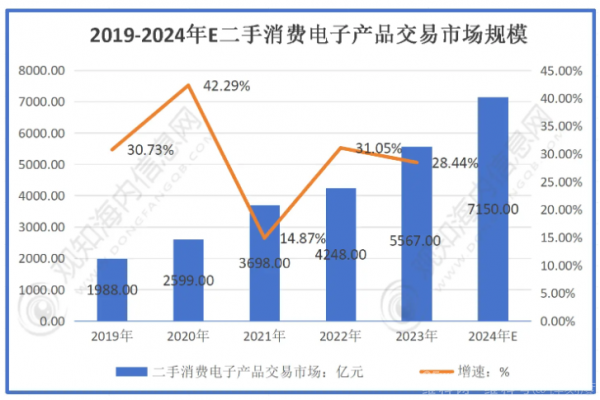

According to the "2024-2029 China Second-hand Consumer Electronics Industry Market Prospect Forecast and Future Development Trend Report" published by the China Chamber of Commerce for Import and Export of Machinery and Electronic Products, China's second-hand mobile phone trading volume grew from 164.8 billion yuan in 2019 to 415.6 billion yuan in 2023. Analysts predict a trading volume of 525.4 billion yuan in 2024.

Source: Frost & Sullivan, Guanzhihainei Consulting

Another set of data reveals a broader second-hand trading market, with daily idle goods transactions exceeding 1 billion yuan and 4 million idle items listed daily, pushing the overall market size beyond trillion yuan.

The circular economy's upward trend has fueled growth across the industry. In June 2024, Xianyu's monthly active users reached 183 million, up over 33% year-on-year. In Q2 2024, AI Huishou reported total revenue of 3.78 billion yuan, up 27.4% year-on-year, while Zhuanzhuan's sales orders grew 35% and recycling orders 42% year-on-year.

As internet giants struggle with business contractions and layoffs, second-hand trading platforms have capitalized on the trend, entering a fast growth phase. Discussing the acquisition, Zhuanzhuan executives noted that both Zhuanzhuan and Hongbulin have achieved profitability, with Hongbulin poised to diversify Zhuanzhuan's growth engines.

Driven by shared interests, the acquisition of more vertical and niche platforms by market leaders is inevitable. However, the successful integration of Zhuanzhuan and Hongbulin's backend systems and the contribution of offline stores to the online platform will determine the success of this partnership and the access to new traffic sources.

In summary, while profitability is not Zhuanzhuan's most pressing concern, preparing for the future by breaking through platform limitations and tapping into new traffic channels is crucial as the second-hand e-commerce industry rides the wave of increasingly rational consumer behavior.