Short drama market size may exceed 50 billion yuan, Youku, iQIYI, Tencent Video, Mango TV want to become like Douyin and Kuaishou?

![]() 10/25 2024

10/25 2024

![]() 967

967

If you can't beat them, join them

Written by / Li Xuanqi

Edited by / Li Jinlin

Typeset by / Annalee

Recently, Youku announced its new short drama revenue-sharing rules for 2024, which not only raised the upper limit of per-episode revenue sharing for short dramas but also introduced a new indicator, the new user acquisition coefficient, to further refine the platform's exploration of short drama commercialization.

Not long ago, iQIYI, which had long been cautious about short dramas, changed its stance and officially launched VIP-exclusive "Short Theater" and "Micro Theater." It also re-formulated the revenue-sharing rules for short dramas based on the long-video business model, attempting to distribute over 70% of revenue to producers.

The short drama sector is gaining momentum. On the one hand, during the recently concluded National Day holiday, the SARFT's Network Audio-Visual Department released a list of recommended short dramas for the holiday season, covering 29 titles such as "I Opened a Supermarket on the Long March" and "This World is as You Wish." On the other hand, according to iMedia Research, the size of China's micro-short drama market was approximately 37.4 billion yuan in 2023, an increase of approximately 268% year-on-year, and is expected to exceed 50 billion yuan this year, reaching 100 billion yuan by 2027.

However, short video platforms have long been ahead in the short drama race. Can Youku, iQIYI, Tencent Video, and Mango TV, with their significant investments in short dramas, become the catalyst for change in the industry?

Revenue-sharing price increase of 167%, Youku invests heavily

When "I Opened a Supermarket on the Long March" quickly gained popularity after its debut on Douyin, achieving over 10 million views per episode within 7 hours, over 20 million views across the network within 24 hours, and over 200 million hashtag mentions across the platform, long-video platforms could no longer sit idly by.

Recently, Youku announced its new short drama revenue-sharing rules for 2024.

According to these new rules, the cooperation model is divided into pre-broadcast grading and post-broadcast grading. Pre-broadcast grading increased from S-grade at 6 yuan per episode and A-grade at 4 yuan per episode in 2023 to S-grade at 16 yuan per episode and A-grade at 8 yuan per episode in 2024, representing increases of 167% and 100%, respectively. For post-broadcast grading, in addition to maintaining the original prices of 2, 4, and 6 yuan per episode, Youku also added prices of 8 and 16 yuan per episode. However, all the aforementioned prices are exclusive to the platform.

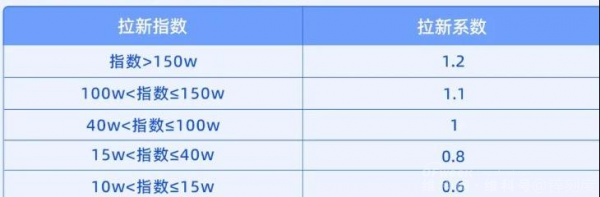

It is worth mentioning that a new dimension, the "new user acquisition coefficient," was added to the formula for calculating member revenue sharing this year. The official explanation for this concept is that the final settlement coefficient is determined based on the cumulative value of the new user acquisition index over 60 days from the project's launch date. The associated "new user acquisition index" specifically refers to the comprehensive performance index based on off-platform marketing, channel traffic, member conversion, and other factors during the project's broadcast period.

"New User Acquisition Index" introduced in the 2024 revenue-sharing rules

Not long ago, at the 2024 iQIYI iJOY Autumn Joyful Sharing Event held in Shanghai, iQIYI's founder and CEO Gong Yu first discussed the trend of short dramas and announced the official launch of "Short Theater" and "Micro Theater." The former features episodes of 5-20 minutes each, with a new episode released weekly, while the latter focuses on vertical content of 1-5 minutes, exclusively available to iQIYI members without additional fees.

According to the announcement, "Micro Theater" will release two new episodes weekly, focusing on content types for both male and female audiences and the silver-haired demographic, primarily featuring vertical content of 1-5 minutes. "Short Theater," on the other hand, plans to release a new episode weekly, covering various genres such as ancient romance, modern romance, suspense, etc., with episode lengths of 5-20 minutes and primarily featuring horizontal content.

iQIYI's short dramas

Earlier, at the end of last year, Mango TV and Douyin held a cooperation launch event and signing ceremony under the theme of "Horizontal and Vertical Trends." Both parties announced the "High-Quality Short Drama Support Plan," aiming to jointly develop short dramas and subsequently promote in-depth cooperation in areas such as short video secondary creation and brand marketing.

Prior to this, Tencent Video had also collaborated with Douyin, focusing on long- and short-video linkage promotion and short video derivative creation.

Looking back at the rapid development of the short drama sector in recent years, the attitudes of long-video platforms have undergone several changes. Although some long-video platforms began laying out independent short drama sections as early as 2020, overall development was relatively conservative. While Youku, Tencent Video, and Mango TV extended their short drama offerings with channels/brands such as Youku's short drama channel, Tencent Video's "Mini Theater," and Mango TV's "Damang Short Dramas," iQIYI remained cautious. However, after the explosive growth and tightened regulation in 2023, the short drama industry has entered a new stage of rapid advancement towards "quality" in 2024. This has become a window of opportunity for long-video platforms to catch up and enter the race.

Mixed motives: icing on the cake or timely assistance?

One of the key reasons why Youku, iQIYI, Tencent Video, and Mango TV are currently betting heavily on short dramas is the timing of the sector's development.

As written by "Rhinoceros Entertainment," last year's phenomenal explosion of low-budget short dramas attracted regulatory scrutiny, leaving no room for past low-quality, explicit short dramas. Conversely, a trend of "quality short dramas" is emerging, attracting many top traditional long-form film and television production forces. Long-video platforms have become suitable "organizers" for this trend. Furthermore, the short drama market is receiving endorsements from "official authorities" such as government agencies, state-owned enterprises, publishing groups, and broadcasting media, giving long-video platforms the confidence to make significant investments.

However, the four major long-video platforms each have their own motivations, with some aiming to add icing to the cake, while others seem to be in dire need of timely assistance.

Among them, Tencent Video and Youku have frequently produced hit dramas this year: Tencent Video kicked off the year with a bang with "Flowers of War," followed by hits such as "Encounter with Phoenix" and "Celebration of Life 2," while "The Story of Rose" and the period romance "Love Like the Galaxy 2" successfully carried the summer season. Youku, on the other hand, also enjoyed a triple hit in the first half of the year with "The Order of Flowers," "Treasure of Time," and "Ink Rain and Clouds," followed by three more hits from its "White Night Theater" series, "Dim Light," "New Life," and "The River's Edge."

According to public financial reports, Tencent's paid long-video membership numbers increased by 13% year-on-year to 117 million in the first half of this year, while Mango TV's membership revenue reached 2.486 billion yuan, an increase of 26.8% year-on-year.

Therefore, for Youku, iQIYI, and Tencent Video, investing in short dramas is more about adding icing to the cake. After all, data from iMedia Research's "China Micro-Short Drama Market Research Report 2023-2024" shows that China's online micro-short drama market size was nearly 37.4 billion yuan in 2023, an increase of nearly 268% year-on-year, and is expected to exceed 50 billion yuan in 2024 and 100 billion yuan by 2027.

Such an attractive "pie" is not something that any long-video platform is willing to give up. However, the situation is slightly different for iQIYI.

Once known as a hit-making machine, iQIYI has struggled this year, even with its flagship "Mist Theater" series underperforming. Titles such as "Misplaced," "The Invisible Shadow Boy," and "Untold Story" failed to replicate the success of past hits from the Mist Theater.

From a data perspective, iQIYI's second-quarter financial report for this year showed a 5% year-on-year decline in total revenue to 7.4 billion yuan. Net profit attributable to iQIYI was 68.7 million yuan, a year-on-year decrease of 81% from the 365.2 million yuan recorded in the same period in 2023. Excluding non-GAAP metrics, net profit attributable to iQIYI was 246.9 million yuan, down from 594.7 million yuan in the same period last year. On the day of the report's release, iQIYI's share price fell 2.6% to $3 in pre-market trading.

iQIYI's second-quarter financial report

Against this backdrop, Gong Yu stated at the Joyful Sharing Event, "Micro-short dramas are currently a good investment option for us." However, it is worth noting that until earlier this year, iQIYI was not optimistic about micro-short dramas. At that time, Gong Yu expressed caution, stating that the business differed significantly from iQIYI's core film and television business in terms of aesthetics, talent types, and business ecosystem.

It is not hard to imagine that iQIYI's shift in attitude towards short dramas is related to the underperformance of its long-form dramas. The disadvantages of long-form dramas include high costs, long production cycles, and uncertainty, while short dramas offer another path for platforms to retain users and regain popularity.

Due to its late entry into the micro-short drama space, iQIYI's presence has been relatively muted in terms of the number of episodes, revenue-sharing box office, and viewing popularity, compared to the other three major video platforms.

According to the "2023 Short Drama Report" by Yunhe Data, Tencent Video released 218 new short dramas in 2023, with a cumulative effective play count of 4.6 billion; Youku released 159, with a cumulative effective play count of 1 billion; Mango TV released 42, with a cumulative effective play count of 400 million; and iQIYI released 16, with a cumulative effective play count of 500 million.

If you can't beat them, join them

From the initial tensions between long and short videos to a complementary relationship that leverages each other's strengths, Youku, iQIYI, Tencent Video, and Mango TV have gone through a journey of questioning, understanding, and now embracing platforms like Douyin and Kuaishou, with aspirations to surpass them.

However, it may take more time for long-video platforms to catch up with Douyin and Kuaishou.

According to data from short-video platforms like Douyin and Kuaishou, as of July this year, Kuaishou had 300 million daily active users for short dramas, with approximately 140 million users watching over 10 episodes per day, an increase of 55.3% year-on-year. Douyin's paid short drama users increased tenfold year-on-year, with paid amounts growing fivefold.

Kuaishou's financial report shows that by the end of 2023, its Xingmang Short Theater had launched nearly 1,000 short dramas, with over 300 achieving over 100 million views. In the fourth quarter of 2023, the daily average number of paid users for Kuaishou's short dramas increased more than threefold year-on-year. During the 618 shopping festival in 2024, Kuaishou Xingmang Short Theater concentrated the launch of 22 premium short dramas exclusively sponsored by Tmall, with a combined exposure of 400 million views by the end of the event.

Some short dramas exclusively sponsored by Tmall during the 618 period

However, long-video platforms also have their advantages when it comes to producing short dramas, one of which is their business model.

The profit models for short dramas on platforms like Douyin, Kuaishou, WeChat Mini Programs, and most short drama apps are primarily IAP paid short dramas and IAA free short dramas. In simple terms, this business model relies heavily on advertising investments.

According to the "2024 First Half Micro-Short Drama Advertising Investment White Paper" recently released by DataEye, the advertising investment scale for short dramas was approximately 11.6 billion yuan in the first half of this year, with an estimated annual total of 25-30 billion yuan.

However, as the market expands, the cost of advertising investments rises, continuously compressing the profit margins of short drama producers, making it difficult for the industry to achieve a virtuous cycle.

Long-video platforms, on the other hand, have chosen a different path.

In early 2023, Tencent Video first proposed a 100% revenue-sharing strategy with producers (for advertising revenue). In addition to member revenue sharing and advertising revenue sharing, Tencent Video also provides producers with incentive income ranging from 9.5 million to 74.5 million yuan based on the number of valid paying members acquired through the series.

According to the "2023 Tencent Video Micro-Short Drama Annual Report," Tencent Video's total micro-short drama revenue sharing exceeded 400 million yuan in 2023, with three series exceeding 20 million yuan and six series exceeding 10 million yuan in revenue sharing. Since the beginning of 2024, Tencent Video's cumulative micro-short drama revenue sharing has exceeded 260 million yuan, with nine projects exceeding 10 million yuan in revenue sharing, and "Knowing When to Quit" and "Writing with a Pen" both exceeding 20 million yuan in revenue sharing.

The same is true for Youku's short dramas. Relevant data shows that 93% of top short dramas on the platform achieved profitability in 2023, and under the "Fuyao Plan," the revenue sharing income of supported short dramas increased by 200% year-on-year.

Clearly, when long-video platforms choose to "join if they can't beat them," they are not blindly following in the footsteps of Douyin and Kuaishou. Moreover, their diversified business models may be more conducive to the "quality" of short dramas. However, as the race heats up, neither Youku, iQIYI, Tencent Video, Mango TV, Douyin, nor Kuaishou can afford to rest easy.