Amazon: Profits Explode Again, but Massive Capex Creates a "Dark Cloud"

![]() 11/04 2024

11/04 2024

![]() 566

566

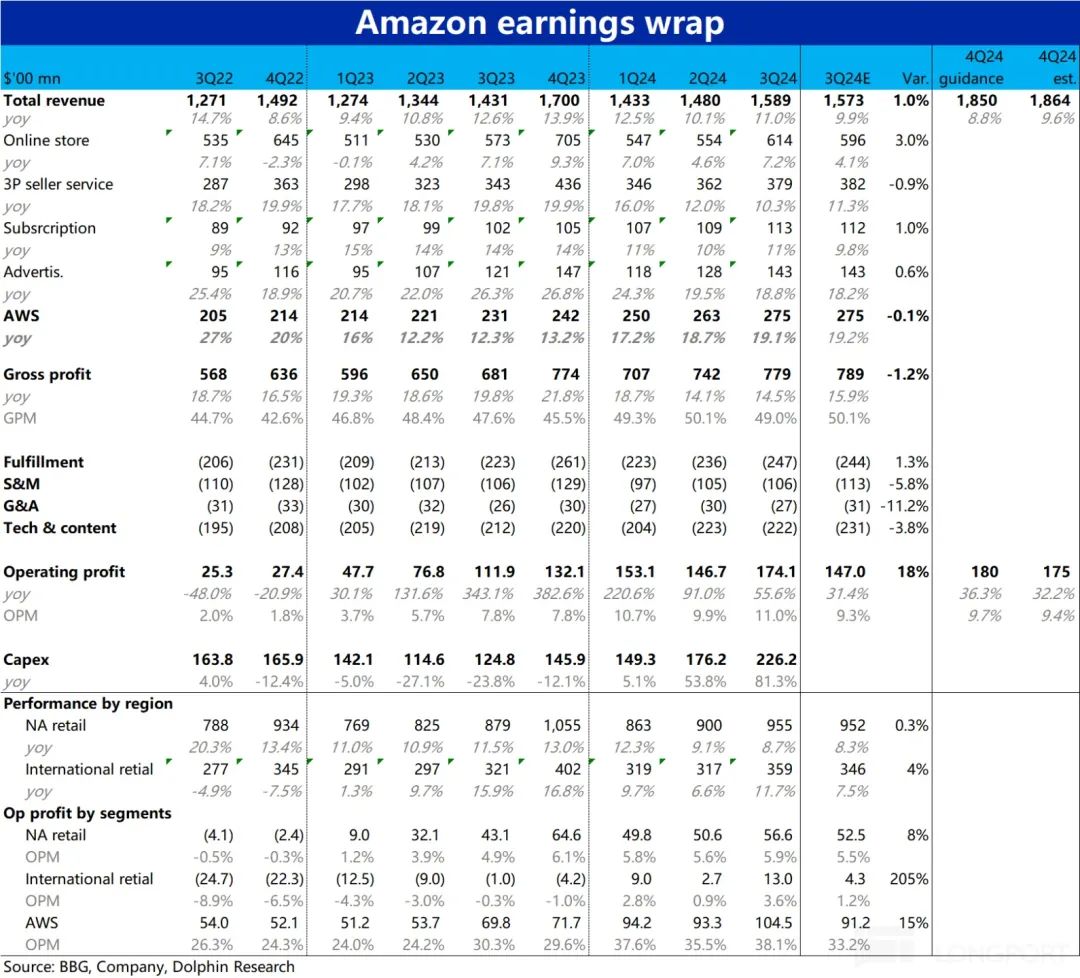

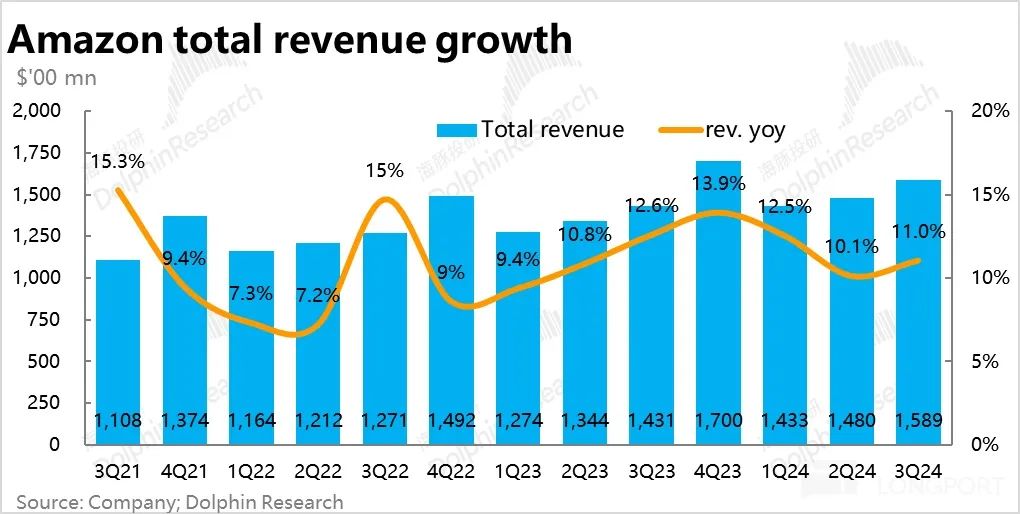

After the US stock market closed on October 30, Amazon released its third-quarter financial report for 2024. Overall, revenue was slightly higher than expected but not impressive, with operating profit again significantly exceeding expectations by over $2 billion, marking Amazon's return to a profit margin expansion cycle. Here are the specifics:

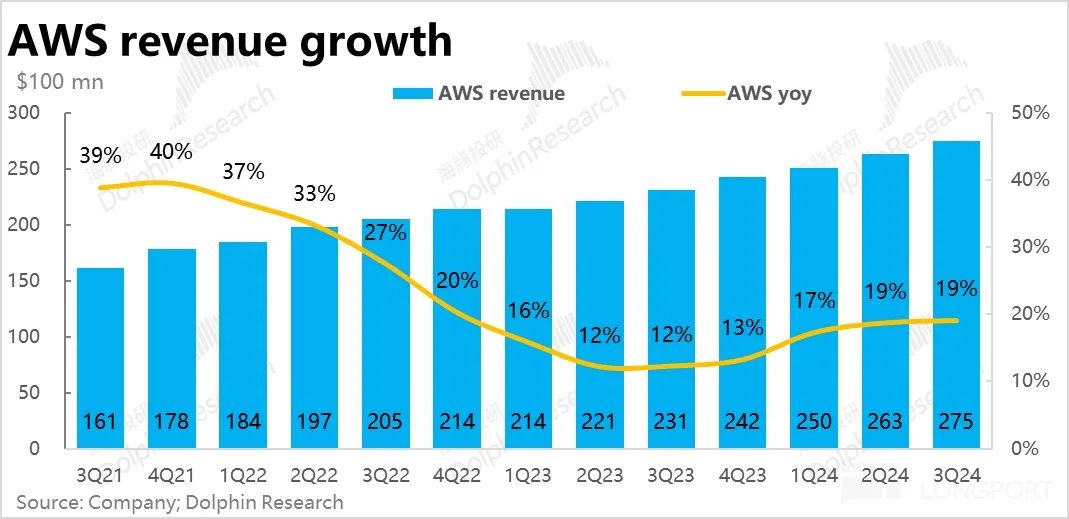

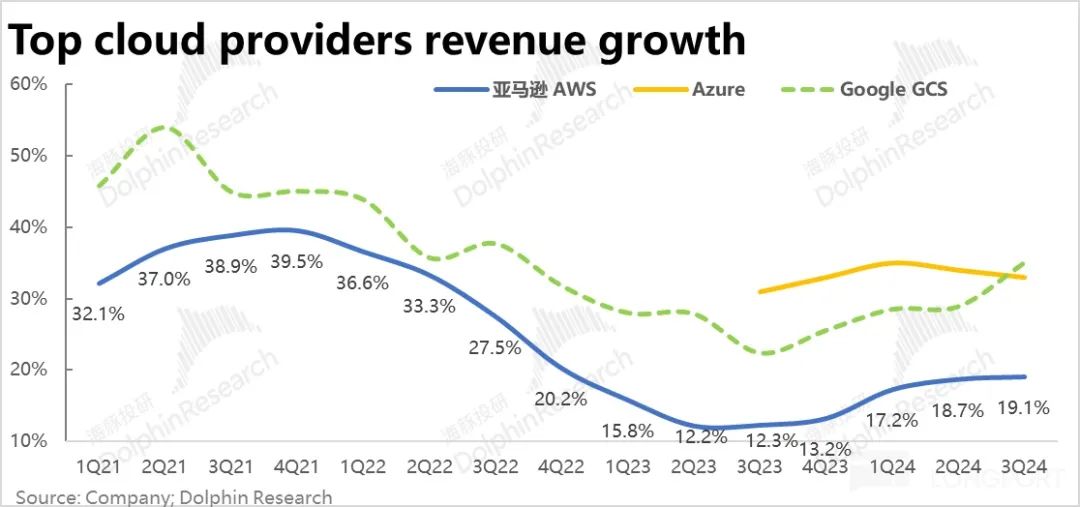

1. As one of the market's main focuses, AWS revenue grew at a year-over-year rate of 19.1% this quarter, up just 0.4 percentage points (pct) from the previous quarter and slightly lower than the consensus forecast by 0.1 pct. Top sellers and buyers expected at least a 20% or higher growth rate to validate AWS's reacceleration and narrowing of the gap with peers, but this did not materialize.

With nearly stagnant growth and no signs of acceleration, combined with Azure's slowing growth, it can be inferred that the overall demand for cloud computing has not truly exploded under the AI wave. This casts a shadow over the entire AI investment logic. GCP's outperformance, despite its smaller size, appears to be more about marginal improvements in the competitive landscape, capturing incremental market share.

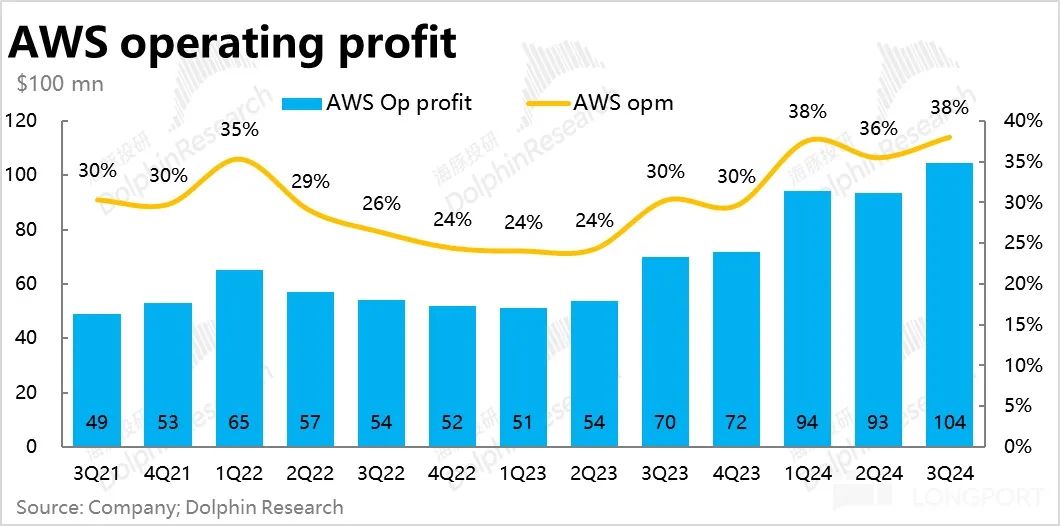

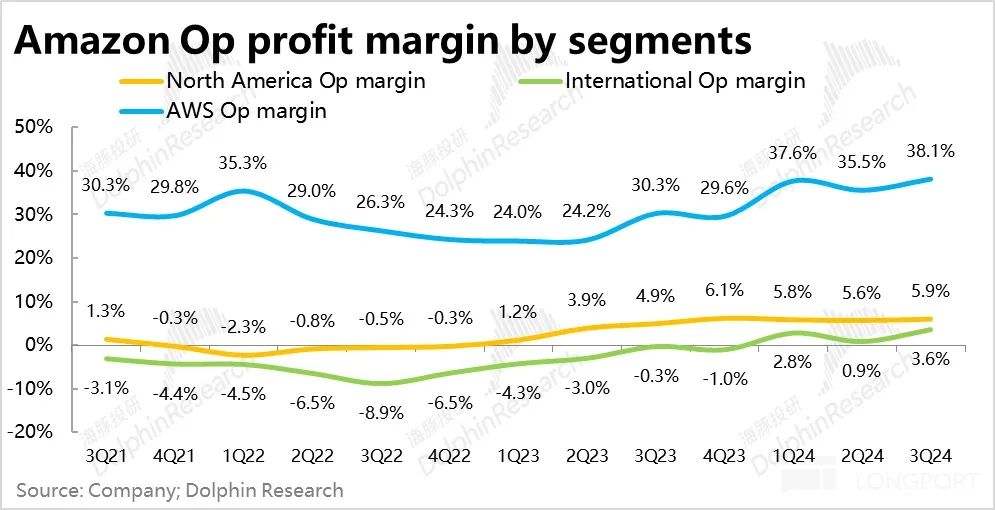

Although growth did not accelerate, AWS's operating profit margin increased significantly, rising nearly 2 pct to 38% quarter-over-quarter, with actual operating profit reaching nearly $10.5 billion, significantly above the expected $9.1 billion. As the benefits of extended depreciation periods gradually wane and AWS enters a period of increased Capex, the market originally expected AWS's operating profit margin to gradually decline (consensus forecast of 33%). It is crucial to focus on how management explains the drivers of the profit margin increase.

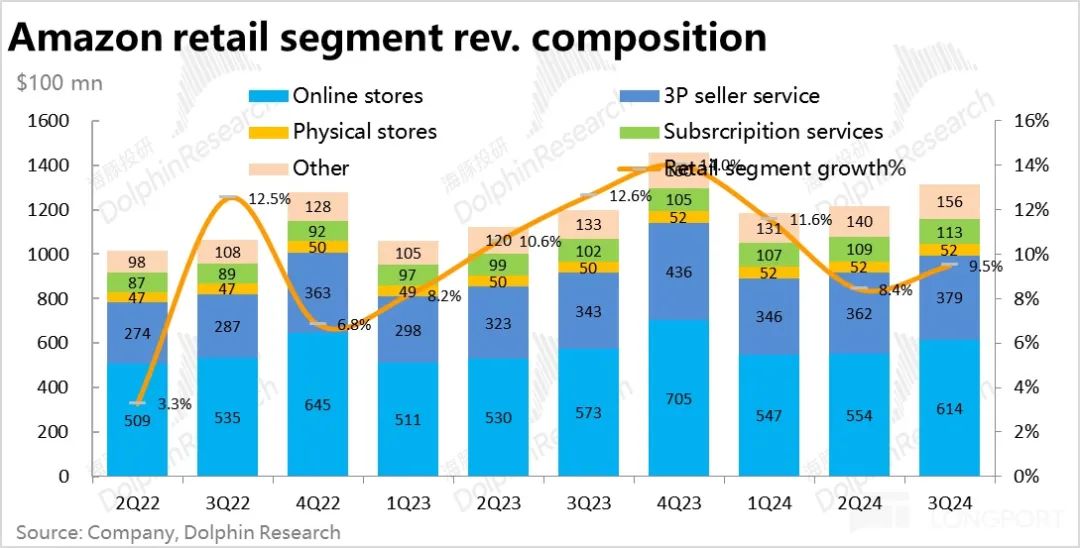

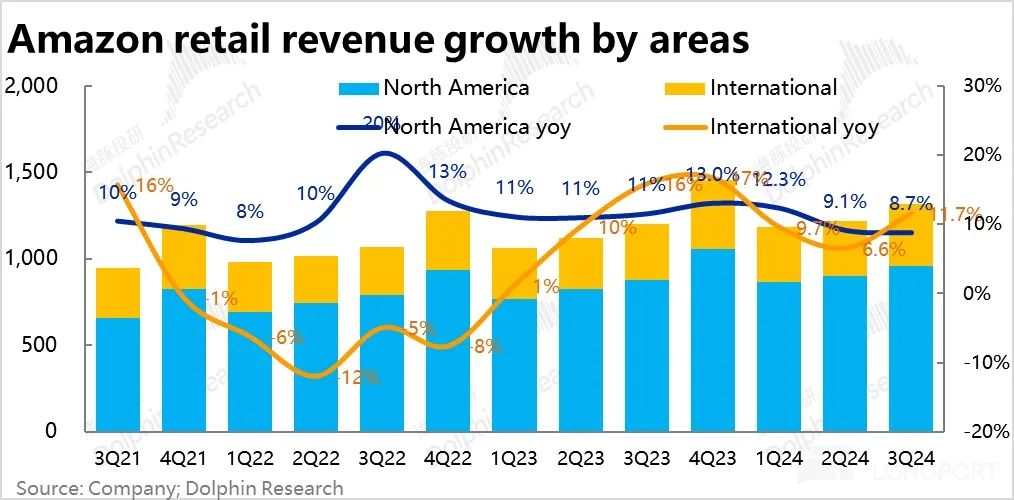

2. The retail segment's revenue growth rate for this quarter was 9.5%, up slightly by 1.1 pct from the previous quarter and slightly stronger than market expectations by 1.2 pct. Regionally, the growth rate of North American retail did indeed slow slightly, from 9.1% to 8.7%, as indicated by high-frequency data. The nominal growth rate of international retail operations surged significantly from 6.6% to 11.7%, a major highlight. However, nearly 3 pct of this growth rate change was due to currency exchange rate contributions.

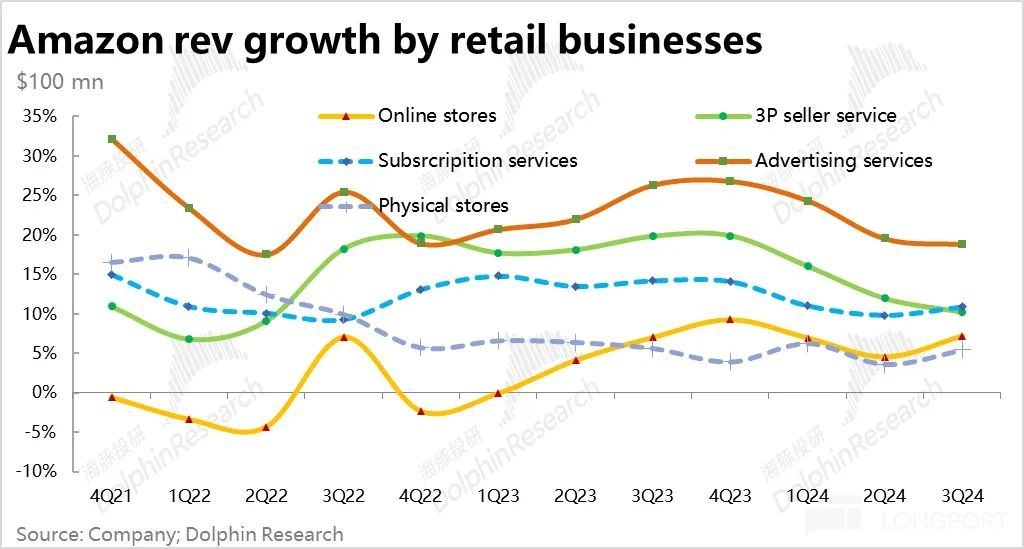

Specifically, the growth of 3P merchant services and advertising revenue slowed slightly, while the growth of first-party retail accelerated significantly. Combined with the official announcement that the proportion of 3P merchant order volume fell from 61% in the previous quarter to 60%, the marginal change in growth rates is likely due to changes in the sales mix between 1P and 3P. Additionally, the growth rate of subscription service revenue increased by 1.1 pct, likely due in part to contributions from Prime video ads.

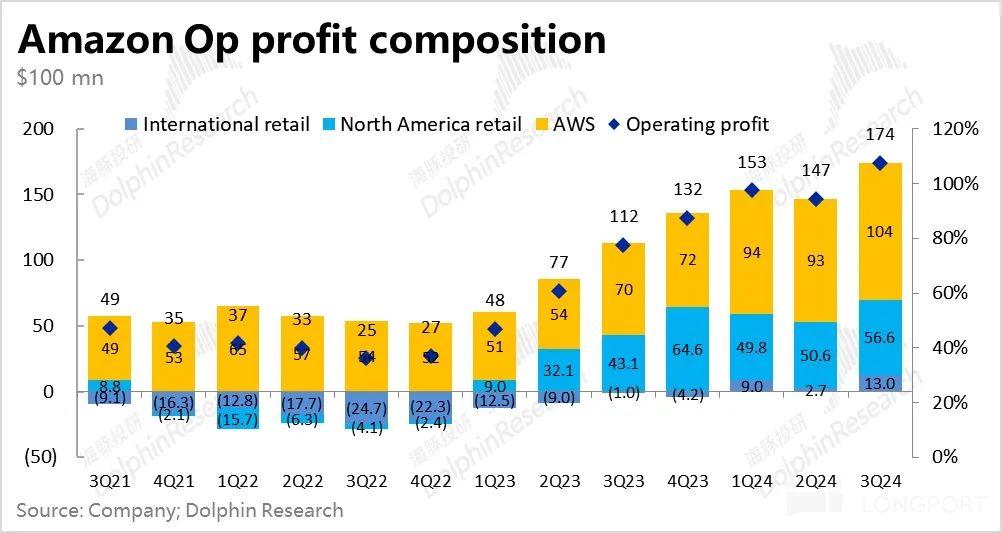

3. In terms of profits in the retail segment, the overseas regions, where revenue growth surged, also significantly exceeded expectations with profits of $1.3 billion this quarter, exceeding one-fifth of North American segment profits. The profit margin reached 3.6%, approaching the 5.9% of the North American segment. In contrast, profits from the North American retail business were not particularly noteworthy, with the profit margin rising slightly by 0.3 pct and actual operating profit of $5.66 billion, just slightly above the expected $5.3 billion. However, considering that nearly 5 pct of the growth rate in international retail operations was due to favorable currency exchange rate movements, Dolphin Research speculates that a significant portion of the international region's outperformance may also be attributed to currency exchange rates.

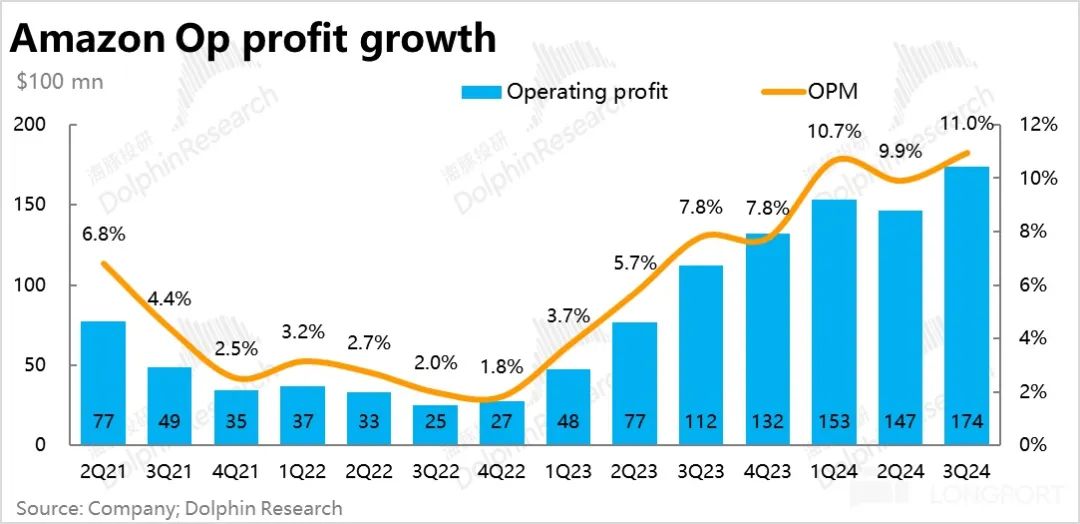

Due to contributions from AWS and the international retail segment, Amazon's overall operating profit reached $17.4 billion, far exceeding the seller's expectations of $14.7 billion and the previous guidance upper limit of $15 billion. The overall operating profit margin was 11%, up 1.1 pct quarter-over-quarter, re-establishing the trend of profit margin expansion.

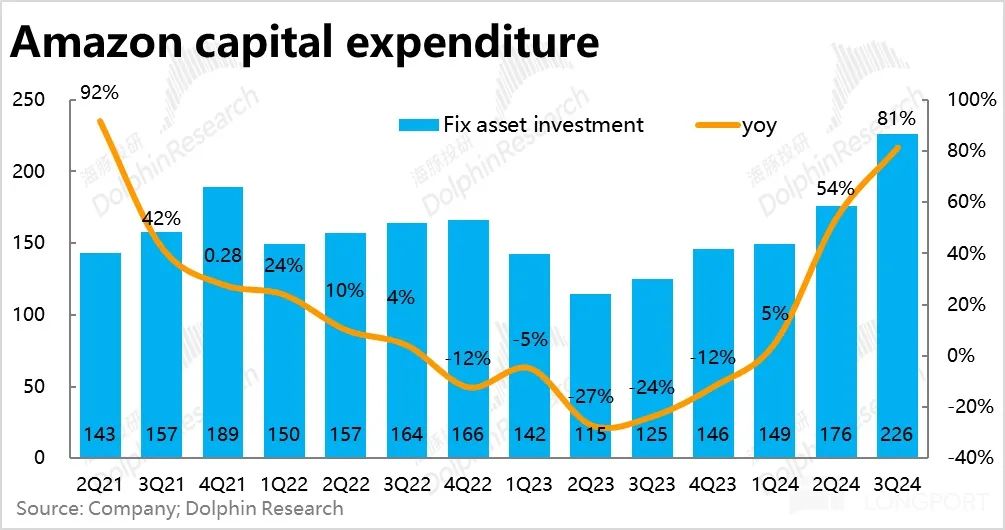

4. However, it should be noted that despite the company's return to a profit margin expansion cycle this quarter, Capex surged significantly to $22.6 billion, an 81% year-over-year increase, nearly doubling from the previous year. The absolute value of investment has also exceeded the previous peak.

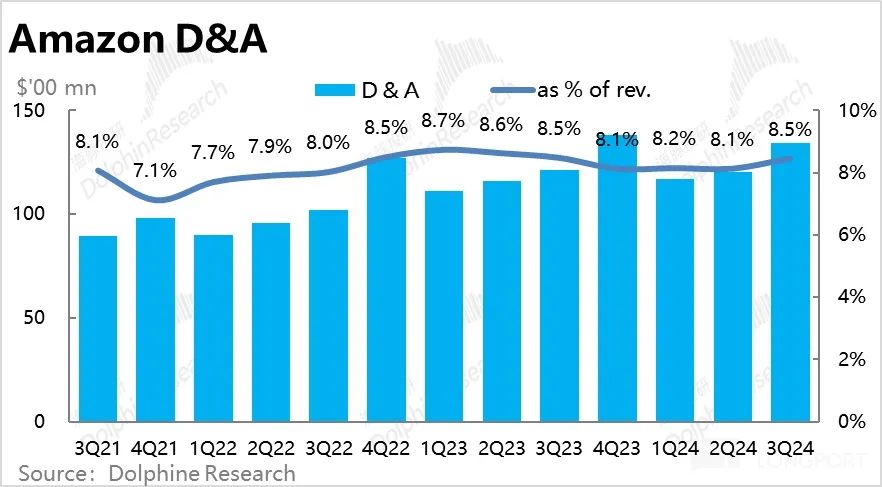

This quarter's amortization and depreciation was $13.4 billion, up only slightly from $12 billion in the previous quarter, indicating that the current high investment has not yet adversely affected profits in the financial statements due to depreciation. However, if this level of investment continues, subsequent profit suppression is likely inevitable, and caution is warranted.

6. For the next quarter's guidance, the company expects revenue to range between $181.5 billion and $188.5 billion, with the median value slightly below market expectations of $186.4 billion. However, based on the historical trend of actual deliveries tending towards the upper end of guidance, this is not considered underperformance.

In terms of profits, the company's guidance for operating profit is $16 billion to $20 billion, while market expectations are $17.5 billion. Following the company's practice of actual profit deliveries exceeding the upper limit of guidance, this guidance suggests that the market will once again significantly increase its profit forecasts for the subsequent period.

Dolphin Research Perspective:

According to Dolphin Research, the market's focus on Amazon's performance before the results was mainly on two points: ① Whether the AWS cloud business could accelerate beyond expectations, validating incremental demand driven by AI and demonstrating signs of improvement in AWS's competitive landscape; ② Whether the company as a whole (especially the retail segment) could continue the previously interrupted trend of profit margin improvement.

It can be seen that: 1) AWS's vision of accelerating beyond expectations did not materialize, with year-over-year growth of 19.1% this quarter, up just 0.4 pct from the previous quarter, showing no significant signs of acceleration. Combined with Azure's performance, it fails to validate that AI has led to a true explosion in demand for computing power at the industry level or that AWS has narrowed the growth gap relative to its peers.

2) However, in terms of operating profit margin improvement, Amazon performed quite well this time. Actual operating profit significantly exceeded market expectations and the previous guidance upper limit by over $2 billion, announcing the return of the profit margin expansion trend, which can prompt the market to once again increase its profit forecasts for the subsequent period.

In particular, the profit margin in overseas regions has increased significantly, rapidly approaching the profit level in North American regions. Although it is unclear how much of this is due to non-operating factors such as currency exchange rate changes, if it is sustainable, it implies that the market is re-evaluating overseas operations that were previously overlooked.

However, Dolphin Research still needs to remind that the current Capex investment of over $22 billion, which has already exceeded the 2021 peak, has not yet put pressure on profitability in the financial statements. But if this level of investment continues, the "sword of Damocles" is already hanging, and it is only a matter of time before it falls and suppresses profits.

Detailed comments are as follows

I. AWS Failed to Accelerate as Expected but Delivered Unexpected Profit Margin Improvement

One of the market's main focuses was on when/if AWS, which has significantly underperformed in this round of the AI wave, could narrow the growth gap with GCP.

This quarter, AWS's revenue grew at a year-over-year rate of 19.1%, up just 0.4 pct from the previous quarter and slightly lower than the consensus forecast by 0.1 pct. According to Dolphin Research, top sellers and buyers expected at least a 20% or higher growth rate to validate AWS's reacceleration and narrowing of the gap with peers. However, this quarter's financial report did not meet these expectations.

In reality, AWS's growth rate was nearly stagnant, showing no signs of acceleration. Combined with the earlier-announced performances of Azure and GCP, it can be inferred that overall cloud computing demand has not truly exploded under the AI wave. Azure's growth has slowed, AWS has stagnated, and only GCP, the smallest in size, seems to have marginally improved its competitive landscape in this wave, capturing incremental market share.

However, in terms of profits, AWS's operating profit margin increased significantly, rising nearly 2 pct quarter-over-quarter to 38%, matching the profit margin in the first quarter when the benefits of extended depreciation periods were just being released. Actual operating profit was nearly $10.5 billion, significantly exceeding the expected $9.1 billion.

According to our understanding, the market originally expected AWS's operating profit margin to gradually return to its original level (consensus forecast of 33%) as the benefits of extended depreciation periods waned and AWS entered a period of increased Capex. However, it was unexpected that profits would improve significantly without a substantial increase in revenue. It is crucial to focus on how management explains the drivers of the profit margin increase.

II. Overseas Business Thrives, and Retail Business Growth is Decent

The retail segment's revenue growth rate for this quarter was 9.5%, up slightly by 1.1 pct from the previous quarter and slightly stronger than market expectations by 1.2 pct. Combined with industry data showing that the overall growth rate of online retail in the US declined slightly from the previous quarter, the actual performance was indeed slightly better than expected.

Regionally, the growth rate of North American retail did indeed slow slightly from 9.1% to 8.7%, in line with market expectations. However, the nominal growth rate of international retail operations surged significantly from 6.6% to 11.7% this quarter. Although nearly 3 pct of this growth rate was due to currency exchange rate contributions, there was still a 2 pct increase at constant exchange rates. This shows that international regions were the main highlight of retail operations this quarter.

Looking at specific business segments: ① The growth rate of first-party retail operations accelerated by 2.7 pct compared to the previous quarter, while 3P merchant service revenue decelerated by 1.7 pct. Combined with the official announcement that the proportion of 3P merchant order volume fell from 61% in the previous quarter to 60%, the main reason is likely the change in the sales mix between 1P and 3P.

② The growth rate of subscription service revenue also accelerated by 1.1 pct. Combined with the company's promotion of Prime video ads, we believe that some users may have chosen to pay higher membership fees to avoid ads, contributing incremental revenue.

③ Advertising revenue, which is the market's main focus, declined slightly by 0.7% this quarter, failing to deliver surprises. This may be partially due to the decline in the sales mix of 3P products this quarter.

Combining cloud and retail operations, Amazon achieved total revenue of approximately $158.9 billion this quarter, up 11% year-over-year with slight acceleration. This was slightly higher than market expectations of $157.3 billion, mainly due to the contribution of international retail growth exceeding expectations.

III. Profits Significantly Exceed Expectations, Returning to Profit Margin Expansion Cycle?

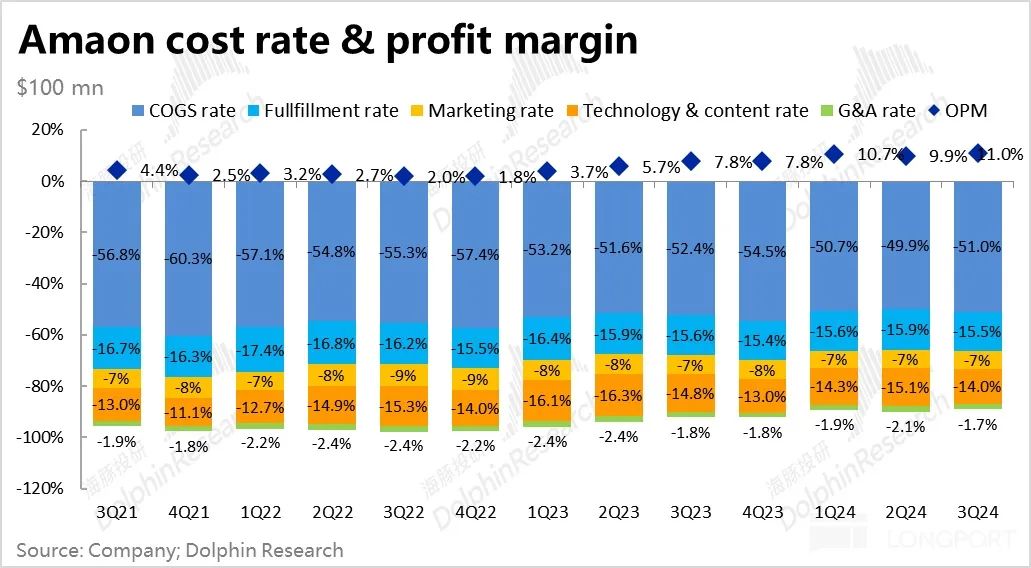

On the revenue side, while AWS cloud computing did not perform impressively and advertising revenue growth slowed slightly, overall revenue slightly exceeded expectations but did not stand out particularly. However, Amazon's profits significantly exceeded expectations again this quarter, returning to the track of profit expansion, which was the biggest highlight of this quarter's results.

Specifically, Amazon's overall operating profit reached $17.4 billion, far exceeding seller expectations of $14.7 billion and the previous guidance upper limit of $15 billion. The overall operating profit margin was 11%, up 1.1 pct quarter-over-quarter, re-establishing the trend of profit margin expansion.

By segment, as mentioned earlier, AWS's actual operating profit exceeded expectations by nearly $1.3 billion, and its profit margin not only did not decline but increased significantly, contributing to the overall outperformance.

Additionally, the retail business in overseas regions, where revenue growth surged, also significantly exceeded expectations with profits of $1.3 billion this quarter, exceeding one-fifth of North American segment profits. The profit margin reached 3.6%, quickly approaching the 5.9% of the North American segment. In contrast, profits from the North American retail business were not particularly noteworthy, with actual operating profit of $5.66 billion, just slightly above the expected $5.3 billion.

However, considering that nearly 3 pct of the growth rate in international retail operations this quarter was due to favorable currency exchange rate movements, Dolphin Research speculates that a significant portion of the outperformance in international region profits may also be attributed to currency exchange rates.

Four, Caution is needed in record-high Capex investment

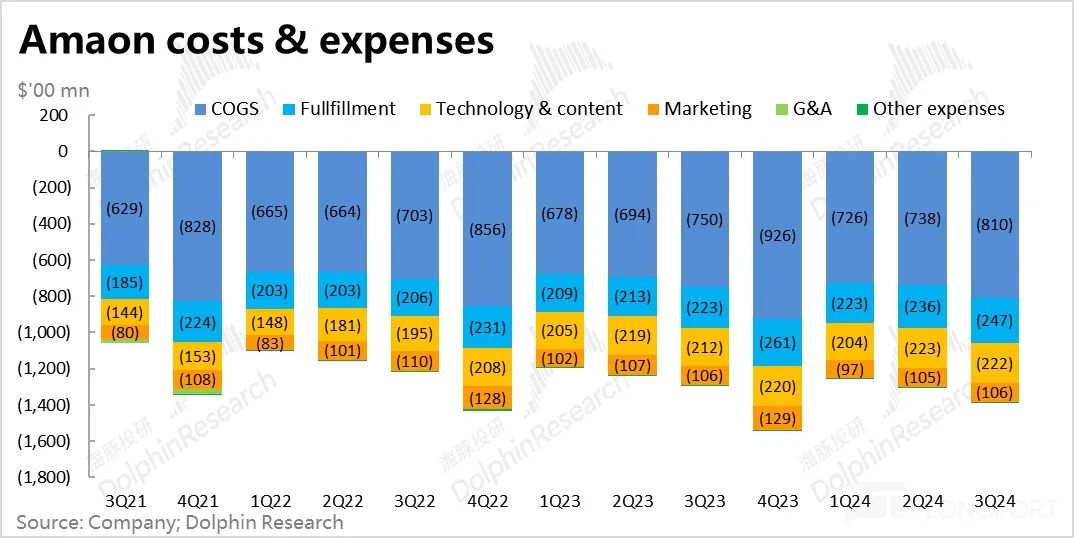

From the perspective of costs and expenses: 1) The gross margin for this quarter was 49.1%, slightly lower than the expected 50.1%. Dolphin Investment Research believes that this may be partly due to the relative decline in the growth of relatively high-margin businesses such as 3P merchant services and advertising revenue in this quarter.

2) From the perspective of expenses, this quarter also marks the end of the expense reduction phase, with all expenses returning to year-on-year growth. However, except for the relatively rigid fulfillment expenses, which increased by 11%, the year-on-year growth rates of other operating expenses remained at around 1%~6%. Therefore, with higher revenue growth, the expense ratio is still declining passively.

However, we also want to remind that although the company has returned to profit expansion this quarter, its Capex soared to 22.6 billion yuan, an 81% year-on-year increase, surpassing the peak value during the peak investment period in 2021.

Although the company's amortization and depreciation for this quarter was 13.4 billion yuan, which is only a slight increase from the previous quarter's 12 billion yuan, indicating that the current increase in investment has not yet reflected the drag on profits in the financial statements. However, if this historically high level of investment continues, the subsequent suppression on profits will be inevitable, and caution is needed.

- END -

// Repost Authorization

This article is an original piece by Dolphin Investment Research. Please obtain repost authorization if needed.