Douyin E-commerce's anxiety is written on East Buy's face

![]() 11/04 2024

11/04 2024

![]() 450

450

After Dong Yuhui's departure, East Buy's traffic plummeted, and the popularity of its self-operated products cooled significantly, leading to a crisis in both products and traffic.

@TechNewKnow Original

As a fan who once strongly supported East Buy online, Chen Liang decided not to renew his membership. "At its peak, I was not only a member but also a shareholder. But now, it just doesn't feel the same anymore."

Chen Liang's disappointment stems not only from the emotional value lost but also from issues like the solo flight of star anchors, internal management chaos, a sharp decline in the secondary market, endless public disputes, and dissatisfaction with products. "Frankly, from a professional perspective, they can't do better than specialized verticals. While they occasionally trace the source, others do it daily. As for prices, they are not only higher but also lack distinctiveness."

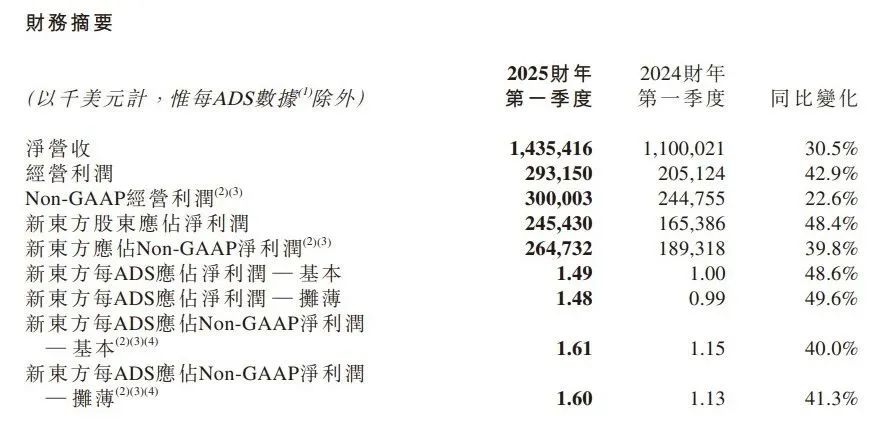

Fans' attitudes towards East Buy can also be glimpsed from financial reports. New Oriental's first-quarter report released on the evening of October 23 showed that operating profit for the first quarter of fiscal year 2025 increased by 42.9% year-on-year to $293 million. However, excluding operating losses from East Buy's self-operated products and live streaming e-commerce business, New Oriental's operating profit for the quarter increased by 58.4% year-on-year to $303 million.

In Dong Yuhui's first quarter after leaving, East Buy faced losses, exacerbating its already declining trajectory. Looking back at 2024, East Buy seemed to be in a state of chaos, with Yu Minhong describing it as "a mess." After Dong Yuhui's departure, traffic declined significantly, and self-operated products, once held in high hopes, also lost momentum. Issues arose in both product and traffic strategies.

On a broader level, the industry trend also seems to be weakening. According to reports, Douyin E-commerce's sales growth rate has dropped from over 60% at the beginning of the year to less than 20% in September. The collective decline in industry sales suggests that many previously concealed problems under rapid growth will gradually surface. Many live streaming rooms similar to East Buy, such as Gaotu Jiapin, have chosen to halt broadcasts for rectification.

Objectively speaking, from a national policy perspective, the education and training industry has begun to rebound. New Oriental, TAL, and Gaotu have all achieved remarkable growth, and their stock prices have rebounded from lows. This implies that the founder-led, all-hands-on-deck live streaming approach of previous years will gradually fade away. A more likely outcome may be focusing on empowering the main business while maintaining stable growth in the future.

With East Buy's losses, the trend of education and training teachers engaging in live streaming may be turning. Yu Minhong and others are also at a crossroads.

01.

Dong Yuhui Leaves, the Glory Fades

"As a former product development manager, I think the only thing worth buying is fruit. Other products can easily be replaced by OEM factories, which can be at least 10% cheaper," said Li Hang, who has 10 years of e-commerce experience and holds a pessimistic view of East Buy. Li Hang believes that East Buy's products lack true competitiveness, and Dong Yuhui's departure has magnified this issue.

"Dong Yuhui's live streaming room stably attracts 40,000 viewers, while East Buy's attracts 5,000. There is also a significant sales gap. Other matrix live streaming rooms are also mixed in quality. The East Buy Fashion live streaming room only has a few hundred viewers. Fans come not only to buy products but also to see stars. Major anchors endorse products, but East Buy currently lacks such anchors," said Zhang Hao, a secondary market investor, who gave a similar assessment of East Buy's current issues.

Getting rid of its dependence on Dong Yuhui is undoubtedly a difficult task for East Buy, facing challenges like declining traffic, falling sales, and frequent accidents involving top anchors. However, the bigger challenge may be repositioning and rebranding East Buy in the minds of consumers.

Judging from Yu Minhong's statements, East Buy is aiming to become a product company, adopting a retail model similar to Costco. The core of this model lies in refining products and managing the supply chain.

However, relying solely on the East Buy APP as a product shelf has not provided significant support. Although individual popular products can be sold without additional traffic, their limited quantities cannot support the company. Moreover, conveying the concept of a product company into easily understandable content for the screen is not easy for East Buy without Dong Yuhui.

In terms of content, East Buy's anchors still adhere to the old formula, including bilingual teaching, product sourcing journeys, talent shows, etc. To some extent, Dong Yuhui was the king of this content, with other East Buy anchors merely serving as foils. This explains why Dong Yuhui has thrived since going solo, while East Buy, living in his shadow, has struggled to find its footing.

For products, which were originally East Buy's biggest strength, not only was the former CEO Sun Dongxu responsible for this sector, but it was also the direction insisted upon by founder Yu Minhong. However, in practice, it seems that a good rhythm has not been found. Compared to Dong Yuhui's peer live streams, East Buy's self-operated products are its differentiated offerings. Yet, in terms of sales, similar replacement products sold by Dong Yuhui's peer live streams have still achieved impressive sales figures, such as toast and sausages. It seems that mothers-in-law do not care about the "East Buy" label, directly driving sales to compete with East Buy's volume. Overall, East Buy seems unable to match Dong Yuhui's live streaming prowess.

In summary, the path for East Buy as a product company is not an easy one. The resulting chain reactions have been intensifying. Recently, East Buy's live streaming content has changed again, incorporating special live streams for brands like Gu Jiajiaju and Yunnan Baiyao. This has begun to converge with the business models of top Douyin live streamers like Jia Nailiang and the Guangdong couple, focusing on discounts and personal traffic to promote sales. To some extent, this has deviated from East Buy's previous path, not only subverting its IP and positioning but also returning to a more traditional live streaming model.

Moreover, East Buy is still expanding its matrix accounts, with nearly 20 accounts starting with "East Buy." The category range is also extremely broad, somewhat reminiscent of Jia Yiping's business model.

In summary, after Dong Yuhui's departure, East Buy seems to have not yet fully found its own path, vacillating between multiple routes such as super anchors, product companies, and even internet celebrities. From the current East Buy, one can see the shadows of multiple top live streamers like Jia Yiping, Dong Yuhui's peer, and the Guangdong couple. Determining which direction to focus on may require a unified consensus rather than the current trial-and-error approach.

From a macroeconomic perspective and considering industry competition, it seems that time is running out for East Buy.

02.

Douyin E-commerce, the Trend is Weakening

From the stock price chart of East Buy, a key time node can be clearly seen: June 2022. During that month, East Buy's stock price quadrupled, marking an upward trend. Dong Yuhui has mentioned in his live streams at different times, "It was that June when you all came, neither too early nor too late, changing my life."

Dong Yuhui is right. Against the broader backdrop, the gears of fate were also turning rapidly during that period. At the Second Douyin E-commerce Ecology Conference in May 2022, Douyin announced the upgrade of interest-based e-commerce to all-for-one interest-based e-commerce. The content field began to merge with the shelf field, ushering in a second growth curve for Douyin E-commerce. That year, Douyin E-commerce's GMV reached $208 billion (approximately RMB 1.41 trillion), a 76% increase from 2021, still on a high-growth trajectory.

However, such a high-growth environment is now disappearing.

According to reports from LatePost, in the first three quarters, ByteDance's quarterly advertising growth rate in China fell from around 40% to less than 17%. It failed to meet its targets in the past two quarters. Furthermore, more than half of ByteDance's advertising revenue comes from merchants operating stores within the platform. Merchants are willing to invest more in advertising only if their business grows, but Douyin E-commerce's sales growth rate has dropped from over 60% at the beginning of the year to less than 20% in September. In 2023, Douyin E-commerce's monthly growth rate was mostly above 50%.

What is even more chilling is that Douyin officials do not seem to have many solutions for the current slowdown in sales. After experimenting with a low-price strategy this year to further expand incremental space, Douyin suspended it due to a significant decline in sales growth. Subsequently, Douyin E-commerce also seemed to enter a "vacuum period." According to reports, employees also need to readjust to the current pace of Douyin: "The top-down guidance used to be very clear—find whatever is cheap. Now, although we are told to prioritize sales, we have to figure out how to achieve our goals on our own."

Data shows that compared to the same period in 2023, the GMV of top live streamers on various e-commerce platforms has declined to varying degrees in 2024, combining the number of live streaming sessions. In the most straightforward terms, anchors do not seem to be as effective at driving sales as they once were.

When the skin is gone, where does the hair adhere? For East Buy, this slowdown seems to have a greater impact.

From a strategic perspective, Douyin has emphasized a low-price strategy this year. Although it was suspended, the user mindset has already been cultivated. In the second half of the year, Douyin's strategic department proposed a new tiered pricing strategy, where standardized products continue to be priced competitively, while non-standardized products weaken price competition. Although this strategy was not recognized by senior management, it is evident that low prices remain a difficult weapon for Douyin to abandon. For East Buy, whose product value has previously relied on celebrity IPs and high-quality, high-premium products, this Obviously not in line Douyin Current environment .

During periods of rapid growth, companies still have room to maneuver based on their ability to control traffic and heat, making changes to product and strategy. However, currently, the conditions for transformation no longer exist. Of course, East Buy still has over 20 million fans, and its operations will continue in the short term.

But from a pessimistic perspective, "Judging from East Buy's current operations, layoffs may soon be visible." More intriguingly, the company recently announced that on October 8, Chief Financial Officer Yin Qiang reduced his holdings in East Buy (01797) by 2.1 million shares at a price of HK$22.026 per share, totaling HK$46.2546 million. This also seems to indicate an unclear attitude towards the company's future.

The trend of Douyin E-commerce is weakening, and for East Buy, which once rode this trend, another pressure is constantly looming.

03.

Yu Minhong, Back at the Crossroads

On November 7, 2021, New Oriental's founder Yu Minhong launched his first live streaming session. Besides selling books, he announced an important decision: New Oriental would transform into live streaming e-commerce and enter the agricultural assistance live streaming sector. Earlier, on November 4, Yu Minhong shared an article on his WeChat Moments, stating, "The era of education and training is over. New Oriental has donated nearly 80,000 sets of brand-new desks and chairs to rural schools." At that time, New Oriental's stock price plummeted from $197 to $8.

On the other hand, Yu Minhong, who had made his choice, acted quickly. On December 28, he launched New Oriental's first agricultural assistance live stream and began promoting its live streaming platform, "East Buy." That night, he achieved sales of nearly $5 million.

In the following two months, East Buy's live streaming room became the main battleground for New Oriental's e-commerce efforts. Data shows that in just over two months, East Buy conducted 26 live streaming sessions but only achieved cumulative sales of $4.5476 million, less than Yu Minhong's debut performance.

The rectification of the education and training industry, a hellish start, and the script of a super-rich person starting from scratch all seemed to make Yu Minhong a new inspirational model. Dong Yuhui tearfully said in the live stream, "I hope to bring back the former New Oriental teachers who have left."

But history seems to have played a joke on "Old Yu." Entering 2024, the education and training industry did not decline as Yu Minhong had predicted but quickly rebounded. New Oriental's education and training-related businesses have maintained growth of over 25% for multiple consecutive quarters. A similar story unfolded at TAL and Tomorrow Advancing Life.

Taking the latest quarterly financial report as an example, New Oriental's net revenue for the first quarter of fiscal year 2025 reached $1.4354 billion, a year-on-year increase of 30.5%; operating profit reached $293.2 million, a year-on-year increase of 42.9%. TAL's revenue for the second quarter of fiscal year 2025 was $619.4 million, a year-on-year increase of 50.4%. Net profit was $57.4 million, a year-on-year increase of 51.5%.

Yu Minhong said in a subsequent conference call, "With our abundant educational resources, we will continue to strive to achieve our long-term vision, strike a balance between growth, stability, and sustainability, and improve profitability by enhancing service quality and operational efficiency.""The recovery of the industry and the rebound in performance have led to a return of talents. At the end of July this year, Rourou, an anchor under 'Gaotu Jiapin', responded that the anchors were simply returning to their old profession, "They have become teachers again, all at Gaotu. Friends, don't worry, they are shining in the positions they want to be in. Those who left 'Gaotu Jiapin' can also find jobs and lives they like.""For Dongfang Zhenxuan and Yu Minhong, the balance of business seems to be rapidly shifting. On one side is the loss-making Dongfang Zhenxuan, and on the other is the rapidly growing education and training business. Affected by Dong Yuhui's departure, Dongfang Zhenxuan will incur a loss of 70 million yuan in the first quarter of fiscal year 2025.""On the live streaming side, industry competition has intensified, profits have begun to thin, and sales growth has slowed. On the other hand, in the education and training sector, after a round of market clearance, the leading effect is evident. Is the glory that once belonged to Dongfang Zhenxuan facing another reversal internally? Is Yu Minhong beginning to downplay live streaming? It seems that New Oriental is once again at a crossroads in the era.

- The end -