Merchants need to make money! Shelf e-commerce returns to the spotlight

![]() 11/06 2024

11/06 2024

![]() 484

484

Since 2021, there has been a prevalent argument in the market and industry: the rise of short videos and the resulting influencer-driven sales model will become the new mainstream direction of e-commerce, putting traditional shelf e-commerce giants at risk.

This argument gained widespread acceptance and had a profound impact, leading influencers, listed companies, and merchants to flock in, aiming to seize the opportunity early.

Unexpectedly, after 2023, mainstream short video platforms began transitioning to shelf e-commerce, and their GMV growth rates have slowed significantly (according to UBS research, Douyin's GMV growth slowed from +66% in Q1 to +41% in Q2 and 20% in Q3).

In a special report on Double 11 released by Jefferies, a Wall Street investment bank, it was even mentioned that "influencer live-streaming e-commerce has lost its previous momentum as merchants are now more concerned with profitability and product return rates, which are better for shelf e-commerce than live-streaming e-commerce" and that "merchants are returning to Taobao and Tmall from other platforms."

Why has the industry narrative reversed in just over two years, and what is the actual development trend of the industry? These are the focuses of this article.

Core viewpoints of this article:

First, within the macro narrative framework, influencer-driven live-streaming sales emerged during the previous cycle of active inventory reduction, during which platforms profited immensely. Now, at the beginning of a new industrial cycle, merchants' discourse power in the industry chain is increasing, signaling the end of the golden age of influencer live-streaming.

Second, shelf e-commerce, with its "product-seeking-customer" model, is regaining importance in the industry.

Third, the interests of merchants and users need to be rebalanced, which is the main driving force behind the recent series of reforms by established shelf e-commerce enterprises represented by Taobao. In the new cycle, merchants' centripetal force determines platform competitiveness, which is the primary reason why Jefferies favors established shelf e-commerce platforms.

Cycle Shift: Merchants Shift Focus from Inventory Reduction to Profitability

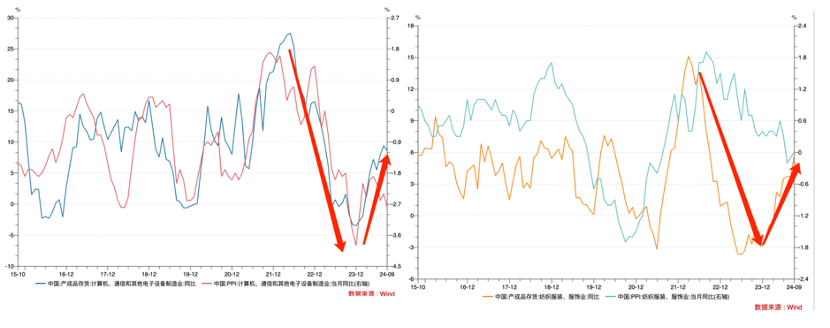

In the past few years, China has experienced a brutal cycle of active inventory reduction, characterized by a synchronized decline in corporate inventory levels and the PPI (Producer Price Index). This was typically understood as companies needing to "reduce prices and profits to clear inventory." However, this process largely concluded in 2023, and the macroeconomic environment now shows a trend of "rising prices and volumes," with companies actively increasing inventory levels and price centers continuing to rise.

For illustration, we use the important retail categories of "electronics" and "apparel" as examples, which both validate the above viewpoints in the figure above.

This reminds us that influencer-driven live-streaming sales on short video platforms emerged in the latter half of 2020, at the beginning of the inventory reduction cycle, and their transition to shelf e-commerce coincided with the end of this cycle in 2023. When we observe corporate behavior in the context of the macroeconomic environment, it becomes clear that the former's success was not coincidental.

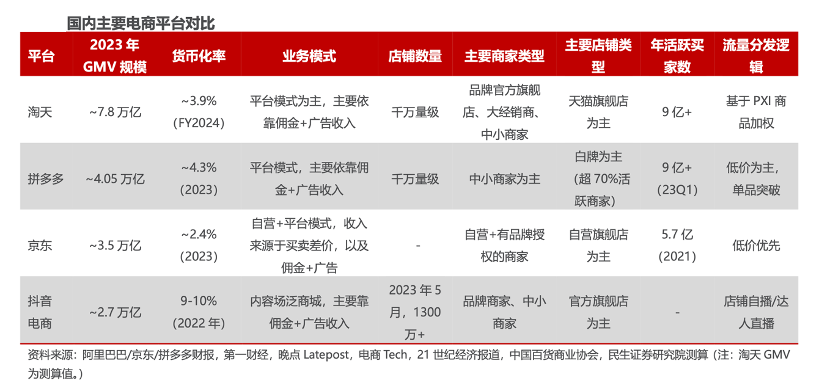

During this cycle of active inventory reduction, merchants' operational focus shifted from "profitability" to "inventory reduction." Influencer-driven sales, with their high traffic, naturally attracted merchants, who were even willing to pay higher operational costs. The monetization rate of Douyin (understood as the cost paid by merchants to the platform) in the figure above exceeds that of Taobao by more than double.

In addition to normal commission and advertising costs, there are also influencers and service providers between merchants and consumers in live e-commerce. Some leading merchants can choose to broadcast themselves, incurring costs such as live-streaming teams, venue rentals, traffic purchases, and equipment. Small and medium-sized merchants without self-broadcasting capabilities often choose influencer-driven sales and pay influencer commissions and slot fees.

At this time, the platform gained higher traffic premium capabilities (extremely high monetization rates), and influencers obtained traffic spreads in the form of "middlemen" (reflected in slot fees and commissions). These costs were borne by merchants, with thin profits or even losses being the norm.

In the new era, changes in the macroeconomic environment necessitate changes in the relationship between merchants and platforms: the former begins to pursue more deterministic growth (profit priority), while the latter's function must shift from "volume" to "profitability." The high costs mentioned earlier become significant constraints.

More importantly, after experiencing the inventory reduction cycle of "survival of the fittest," the "product-seeking-customer" model relied upon by influencer live-streaming will also peak with changes in supply and demand, shifting towards "customer-seeking-product" shelf e-commerce.

However, the contradiction lies in that after total traffic peaks, shelf e-commerce and live-streaming e-commerce engage in a zero-sum game. When platforms shift their focus to the former, it may affect their original base. According to Zheshang Securities, the willingness of Douyin e-commerce live-streaming platform audiences to interact gradually decreased in the first half of 2023, with audience retention time, live-streaming likes, barrage messages, and new followers all decreasing by 29.6%, 18.5%, and 25.0%, respectively.

Live e-commerce was weak during the 618 shopping festival in 2024. According to Feigua Data, the first-broadcast sales of leading anchors such as the Guangdong couple, Qi'er, and Pan Yurun on Douyin decreased by 86%, 88%, and 77% year-on-year, respectively. These changes coincided with the platform's transition to shelf e-commerce, aligning with our earlier analysis.

In this section of the analysis, we found the main reason for the previous prevalence of influencer-driven sales from the "general trend": the macroeconomic environment coincided with the microclimate of corporate development. Many market analysts often overlook the former while focusing only on the latter, leading to misjudgments about industry and corporate expectations.

As the overall environment changes, merchants' demands for platforms will also evolve: from "volume" to "profit preservation." Based on this, the industry landscape is quietly changing.

Industry Reform Focus: Rebalancing the Interests of Users and Merchants

In the new cycle, merchants' weight in the industry chain increases, and competition among platforms shifts to the competition for merchants. From the merchants' perspective and position, we can analyze this part.

For a long time, merchants have had numerous grievances about the industry, mainly summarized as follows:

1) Platform rules excessively cater to users, giving rise to various "wool-pulling" behaviors, including but not limited to freight insurance and full refund policies. A few people exploit loopholes in the system, and most of these costs are passed on to merchants.

2) Merchants' operating profits are compressed, especially as emerging platforms use traffic to coerce merchants. We have elaborated on this in the previous text and will not repeat it here.

For the influencer-driven sales model on short video platforms, their transformation faces a dilemma: on the one hand, the industry's traffic dividend is no longer available, and total traffic has peaked, making it difficult to attract merchants through massive traffic; on the other hand, merchants demand increased profitability opportunities, and their discourse power in the industry chain is amplified, making it very difficult to balance the two.

,The transition especially tests a company's operational skills. Especially in the past two years, short video platforms have earned significant profits with high monetization rates, and internal and external expectations are already very high. Now, if the monetization rate is significantly reduced, it may also have adverse effects. For example, when shelf e-commerce cannot yet support the market on its own, the growth of influencer-driven live-streaming has slowed, and the relationship between the two may not be "complementary" as previously stated.

,In contrast, the industry's spotlight is now shining on shelf e-commerce represented by Taobao. Due to space limitations, we will observe Taobao, which is particularly valued by Jefferies, a Wall Street investment bank, in order to gain a clearer understanding of industry development.

,As a pioneer in China's e-commerce, Taobao's success is often talked about in the industry. Undeniably, merchants' attraction to the platform is the most important reason for its success. For example, the first Tmall Double 11 in 2009 marked the beginning of that inventory reduction cycle (then still called Taobao Mall).",,In the past few years, due to the marginal growth effect (large base), the platform's attractiveness to merchants weakened during the inventory reduction cycle. However, what we need to consider now is whether Taobao can capture this round of benefits and recapture merchants' hearts in the new industrial cycle.,In the previous analysis, we have clarified that the user growth model of "generously granting merchants' wishes" is unsustainable. In the new cycle, the platform must rebalance the interests of users and merchants. Taobao's recent reforms also take this as a starting point:

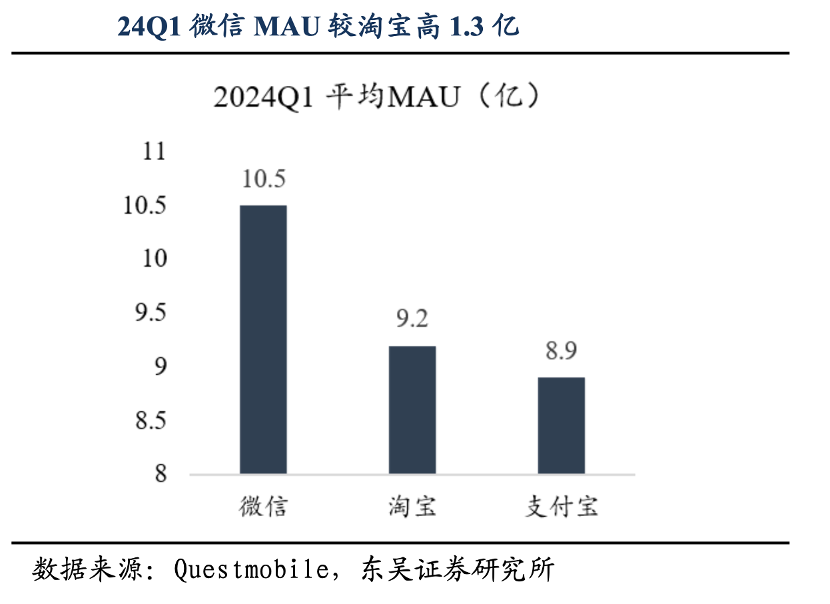

First, full access to WeChat Pay will bring new possibilities for the potential growth of Taobao users. Jefferies' report cites QuestMobile data, emphasizing that the synergy with WeChat will unleash a potential user base of 245 million, and increasing total traffic supply will effectively reduce merchants' traffic costs;

Second, the introduction of a new store rating system focuses more on service evaluation dimensions and shortens the evaluation cycle, encouraging merchants to enhance service quality and inventory, taking the lead in the industry to abandon the practice of determining traffic based on price and instead encouraging merchants to improve services to obtain incremental benefits;

Third, loosen the "full refund" policy to balance merchants' and users' rights and interests, increasing transaction success rates. According to Taobao, in the first week after the "full refund" loosening strategy was officially launched for all merchants on August 9, the platform's intervention in "received goods, only refund" scenarios decreased by 20%;

Fourth, enhance the 88VIP membership price, service, and logistics experience to retain high-value core user assets and consolidate the platform's attractiveness to brand merchants. It achieved double-digit quarter-on-quarter growth in the June quarter, with the total number of users now exceeding 42 million.

,In one sentence, Taobao is following the path of "enhancing user experience - increasing platform traffic - attracting and strengthening merchants' willingness to invest - further consolidating user perception - bilateral prosperity driving up GMV scale" to achieve sustainable operations under the rebalancing of platform and merchant interests, coinciding with the industry development characteristics of the new era.,At the time of writing, the annual Double 11 shopping festival is in full swing. Compared to previous years, various platforms are pulling out all the stops to achieve growth targets, with Taobao offering a consumption red packet subsidy of 30 billion yuan. At the beginning of the new industrial cycle, subsidies are increased to enhance the attractiveness to users and merchants.,When we are obsessed with the narrative logic of the past, industry changes have already quietly begun. Merchants, MCN agencies, and platforms all need to rethink their positioning and approach. By the time the reshuffle fully begins, it may be too late.