Ant Financial, which company has the strongest profitability?

![]() 11/13 2024

11/13 2024

![]() 593

593

Ant Financial, also known as Ant Group, is a leading financial technology company in China. The company owns multiple financial service platforms, including Alipay, Ant Fortune, Ant Credit Pay, etc.

Profitability is usually represented by the amount and level of corporate earnings over a certain period. The analysis of profitability is an in-depth analysis of a company's profit margins.

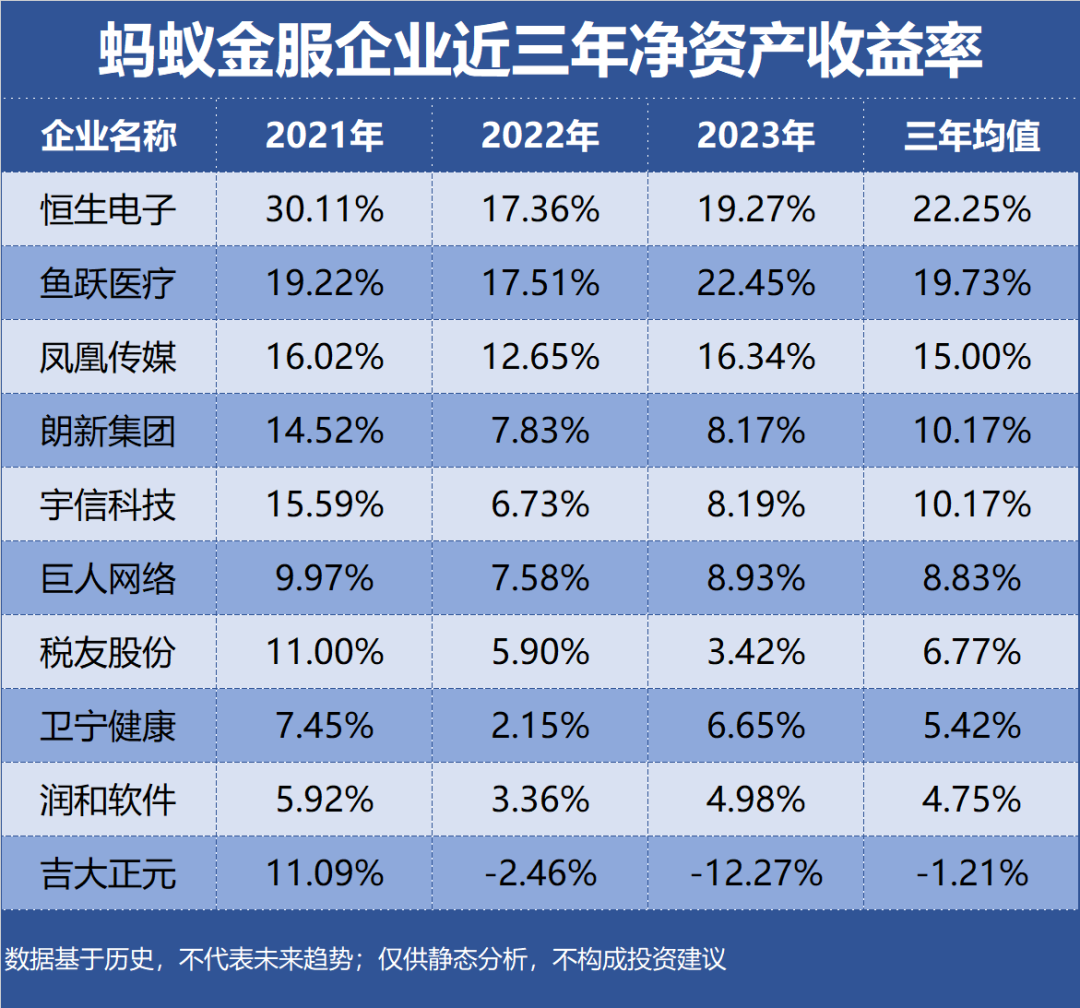

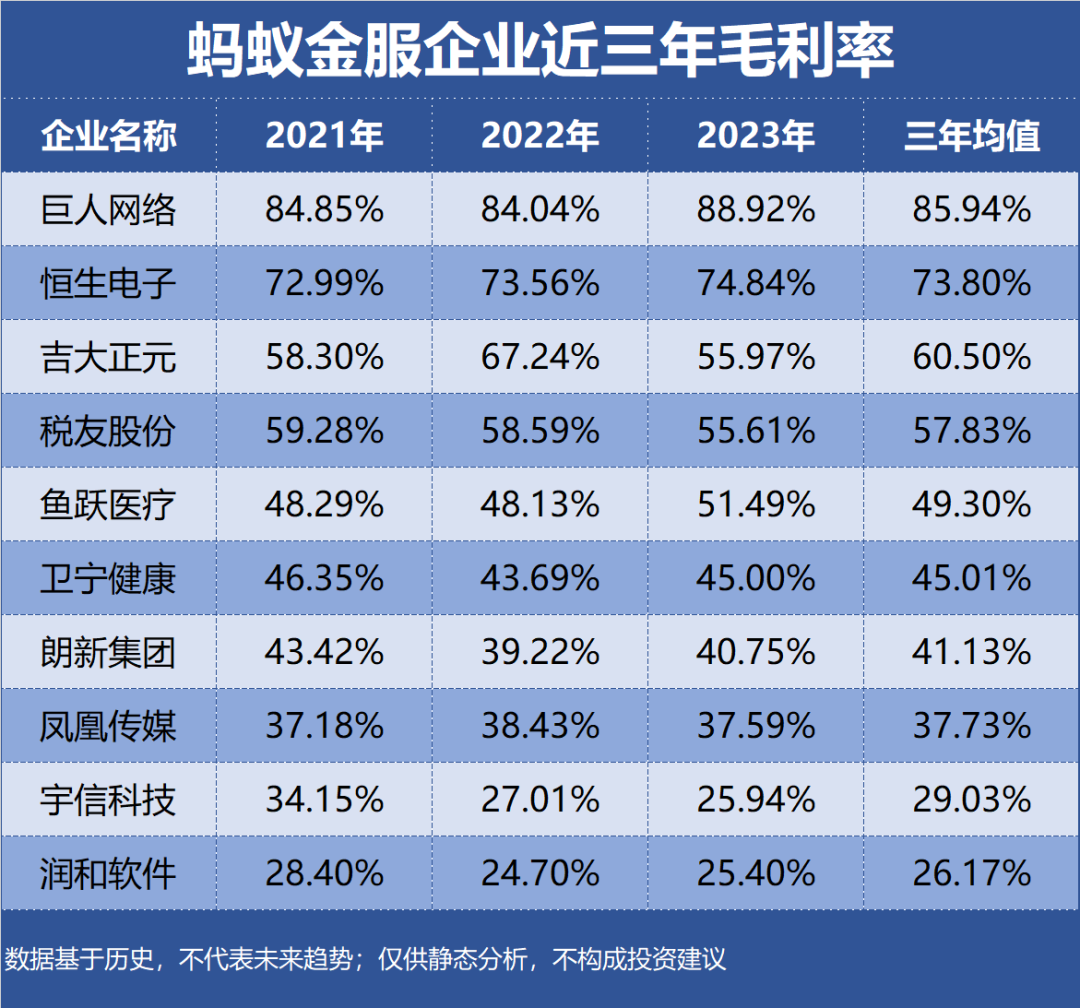

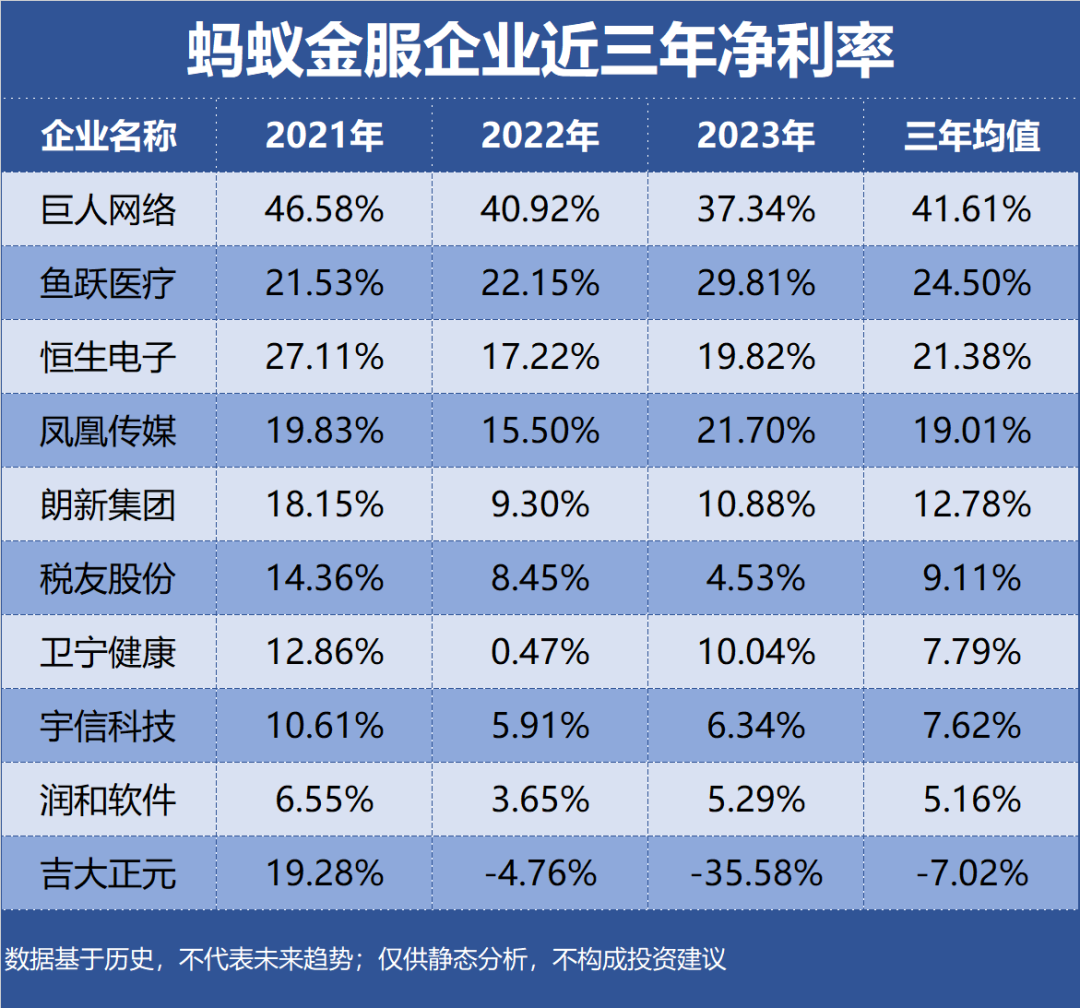

This article is part of the series on corporate value, specifically focusing on [Profitability]. A total of 54 Ant Financial enterprises were selected as research samples, with indicators such as Return on Equity (ROE), Gross Profit Margin, and Net Profit Margin used as evaluation criteria.

The data is based on historical records and does not represent future trends; it is intended for static analysis only and does not constitute investment advice.

Top 10 Most Profitable Ant Financial Enterprises:

10. Jida Zhengyuan

Industry Segment: Vertical Application Software

Profitability: ROE -1.21%, Gross Profit Margin 60.50%, Net Profit Margin -7.02%

Performance Forecast: Highest ROE in the last three years was 11.09%, latest forecast average is 3.11%

Main Product: Network security products are the main source of revenue, accounting for 52.02% of revenue, with a gross profit margin of 65.31%

Company Highlights: Jida Zhengyuan engages in the sale of network security products, development of network security technology, and construction of a network security ecosystem. Shanghai Yunxin Venture Capital Co., Ltd. holds a 11.25% equity stake in the company.

9. Langxin Group

Industry Segment: IT Services

Profitability: ROE 10.17%, Gross Profit Margin 41.13%, Net Profit Margin 12.78%

Performance Forecast: ROE has fluctuated between 7%-15% in the last three years, with the latest forecast average at 7.15%

Main Product: Energy Internet business is the main source of revenue, accounting for 50.48% of revenue, with a gross profit margin of 51.12%

Company Highlights: Shanghai Yunxin and Shanghai Yunju, both subsidiaries of Ant Group, are the third and fourth largest shareholders of Langxin Group, respectively, with a combined shareholding of over 17%.

8. Runhe Software

Industry Segment: IT Services

Profitability: ROE 4.75%, Gross Profit Margin 26.17%, Net Profit Margin 5.16%

Performance Forecast: ROE has fluctuated between 3%-6% in the last three years, with the latest forecast average at 6.97%

Main Product: Financial technology business is the main source of revenue, accounting for 53.08% of revenue, with a gross profit margin of 25.63%

Company Highlights: Shanghai Yunxin Venture Capital Co., Ltd., a wholly-owned subsidiary of Ant Group, is the second-largest shareholder of Runhe Software, holding a 5.05% stake.

7. Weining Health

Industry Segment: Vertical Application Software

Profitability: ROE 5.42%, Gross Profit Margin 45.01%, Net Profit Margin 7.79%

Performance Forecast: ROE has fluctuated between 2%-8% in the last three years, with the latest forecast average at 7.57%

Main Product: Software sales are the main source of revenue, accounting for 46.25% of revenue, with a gross profit margin of 49.28%

Company Highlights: Weining Health's main business is application software in the medical and health field. Shanghai Yunxin Venture Capital Co., Ltd. holds a 4.98% stake in the company.

6. Yuxin Technology

Industry Segment: IT Services

Profitability: ROE 10.17%, Gross Profit Margin 29.03%, Net Profit Margin 7.62%

Performance Forecast: ROE has fluctuated between 6%-16% in the last three years, with the latest forecast average at 7.87%

Main Product: Software development and services are the main source of revenue, accounting for 81.52% of revenue, with a gross profit margin of 35.38%

Company Highlights: Alibaba Cloud and Ant Financial are strategic partners of Yuxin Technology, aiming to jointly promote cloud computing and digital financial microservices.

5. Phoenix Media

Industry Segment: Education and Publishing

Profitability: ROE 15.00%, Gross Profit Margin 37.73%, Net Profit Margin 19.01%

Performance Forecast: ROE has fluctuated between 12%-17% in the last three years, with the latest forecast average at 9.09%

Main Product: Distribution business is the main source of revenue, accounting for 79.40% of revenue, with a gross profit margin of 30.92%

Company Highlights: Phoenix Media's main business is the editing, publishing, and distribution of books, newspapers, electronic publications, and audio-visual products. The company indirectly holds shares in Ant Financial through its investment in Beijing Zhongjin Jiazi Wuhao.

4. Shuiyou Co., Ltd.

Industry Segment: IT Services

Profitability: ROE 6.77%, Gross Profit Margin 57.83%, Net Profit Margin 9.11%

Performance Forecast: ROE has continuously declined to 3.42% in the last three years, with the latest forecast average at 7.45%

Main Product: Digital finance and tax service cloud business is the main source of revenue, accounting for 68.12% of revenue, with a gross profit margin of 73.25%

Company Highlights: Shuiyou Co., Ltd.'s main business includes To G digital government services and To B SaaS subscriptions and consulting services. Shanghai Yunxin Venture Capital Co., Ltd. holds a 4.99% stake in the company.

3. Giant Network Group

Industry Segment: Gaming

Profitability: ROE 8.83%, Gross Profit Margin 85.94%, Net Profit Margin 41.61%

Performance Forecast: ROE has fluctuated between 7%-10% in the last three years, with the latest forecast average at 11.45%

Main Product: Mobile online game revenue is the main source of revenue, accounting for 74.89% of revenue, with a gross profit margin of 90.39%

Company Highlights: Giant Network Group's main business is the development and operation of internet games. The company's participating subsidiary, Shanghai Jukun Network, directly holds 14.1723 million shares of Ant Financial.

2. Yuyue Medical

Industry Segment: Medical Equipment

Profitability: ROE 19.73%, Gross Profit Margin 49.30%, Net Profit Margin 24.50%

Performance Forecast: ROE has fluctuated between 17%-23% in the last three years, with the latest forecast average at 15.45%

Main Product: Respiratory treatment solutions are the main source of revenue, accounting for 38.11% of revenue, with a gross profit margin of 52.11%

Company Highlights: Ant Group established Chongqing Ant Consumer Finance Co., Ltd. in Chongqing. Ant Consumer Finance is 50% owned by Ant Group and 4.99% owned by Yuyue Medical.

1. Hengsheng Electronics

Industry Segment: Vertical Application Software

Profitability: ROE 22.25%, Gross Profit Margin 73.80%, Net Profit Margin 21.38%

Performance Forecast: ROE has fluctuated between 17%-31% in the last three years, with the latest forecast average at 16.15%

Main Product: Software industry revenue is the main source of revenue, accounting for 99.83% of revenue, with a gross profit margin of 71.32%

Company Highlights: Hengsheng Electronics focuses on the financial industry. Ant Group indirectly holds a 20.62% stake in Hengsheng Electronics, making it the company's controlling shareholder.

Top 10 Most Profitable Ant Financial Enterprises: ROE, Gross Profit Margin, and Net Profit Margin over the last three years: