Noblecan files for IPO in Hong Kong with a net profit margin of 27% in the first half of the year, can it achieve overtaking in curves with AI+?

![]() 11/14 2024

11/14 2024

![]() 593

593

Noblecan files for IPO in Hong Kong with a net profit margin of 27% in the first half of the year, can it achieve overtaking in curves with AI+?

This article is originally written by MGresearch

Editor: Detective X

Noblecan AI Technology (Chengdu) Co., Ltd. (hereinafter referred to as "Noblecan") officially submitted a prospectus to the Hong Kong Stock Exchange on November 12, 2024, intending to list on the main board, with CICC serving as the sponsor.

Three major production lines lay the foundation

Overall, Noblecan focuses on advanced technologies such as artificial intelligence and digital twins, including three major industrial applications: AI+transportation, AI+energy, and AI+urban governance.

Specifically:

1. AI+transportation, including AI+rail transportation, AI+urban transportation, and AI+airports - As of November 8, 2024, Noblecan has provided contact wire suspension defect recognition solutions to over 80% of China's railway bureaus. Since the launch of these solutions in 2019, they have been applied to approximately 370,000 kilometers of railway, detecting over 200,000 defects. In addition to AI+rail transportation, as of November 8, 2024, Noblecan's AI+urban transportation and AI+airport solutions are also in commercial trial operation stages.

2. AI+energy, including AI+power and AI+chemicals - As of June 30, 2024, Noblecan's AI+energy has been involved in deploying over 100 distributed energy storage centers for power grid companies, providing intelligent monitoring and data analysis for the operating status of thousands of servers, software and hardware systems, and network devices deployed in these energy storage centers. As of June 30, 2024, Noblecan's AI+ solutions have also assisted customers in conducting intelligent image recognition and data analysis of over 20,000 kilometers of transmission and distribution lines. As of November 8, 2024, in addition to AI+power, Noblecan has also initiated the commercialization process for its AI+chemicals business.

3. AI+urban governance, mainly including application scenarios such as parks, smart campuses, emergency response, and community management - In urban governance, Noblecan is committed to providing intelligent, digital, and visualized AI+ solutions for a wide range of application scenarios. These AI+ solutions aim to achieve intelligent and automated inspection and management of the urban environment.

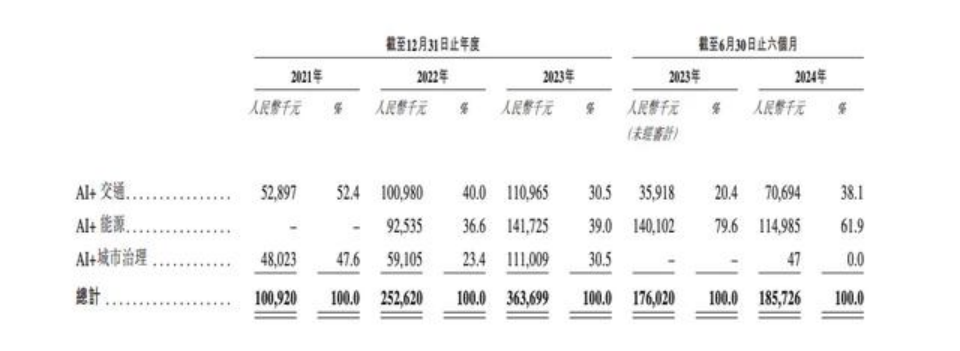

During the track record period, all revenues from Noblecan's AI+transportation came from the AI+rail transportation business, while all revenues from AI+energy came from the AI+power business.

Structurally, the company's AI+energy business has grown significantly faster in the past three years, accounting for over 60% of revenue as of June 2024.

Specifically, in the field of AI+rail transportation, as of November 8, 2024, Noblecan has provided contact wire suspension defect recognition solutions to over 80% of China's railway bureaus, with a cumulative railway application mileage of approximately 370,000 kilometers and over 200,000 defects detected.

In the field of AI+energy, as of June 30, 2024, Noblecan's AI+energy has been involved in deploying over 100 distributed energy storage centers for power grid companies and has assisted customers in conducting intelligent image recognition and data analysis of over 20,000 kilometers of transmission and distribution lines.

Financially, from 2021 to 2023 and the first six months of 2024, Noblecan's revenues were approximately 101 million yuan, 253 million yuan, 364 million yuan, and 186 million yuan, respectively. Net profits for the same periods were 25.743 million yuan, 63.161 million yuan, 88.566 million yuan, and 50.736 million yuan, respectively.

In the AI industry, Noblecan's gross profit margin has remained relatively stable at 54.5%, 55.6%, and 58.1% over the past three years. The gross profit margin for the AI+transportation business is as high as approximately 90%. As the main driver of revenue growth, the AI+energy business has a gross profit margin of only about 40%.

Based on the gross profit margins of representative domestic AI industry companies such as SenseTime, the average gross profit margin of China's AI industry was 37.20% in 2022.

A simple comparison reveals the difference.

Technology reinforcement to consolidate the market

The prospectus shows that Noblecan focuses on the industrialization of artificial intelligence and digital twin technologies in fields such as AI+transportation, AI+energy, and AI+urban governance. It mainly provides hardware and software integrated solutions based on AI industry models.

From 2021 to 2023, Noblecan achieved revenues of 101 million yuan, 253 million yuan, and 364 million yuan, respectively, with profits of 26 million yuan, 63 million yuan, and 89 million yuan during the period.

This is not the first time Noblecan has targeted the capital market. In February 2023, the company initiated IPO tutoring with the intention of listing on the Science and Technology Innovation Board. However, in the second half of 2024, the company withdrew its tutoring registration.

Founded in 2015, Noblecan focuses on applying advanced artificial intelligence and digital twin technologies to highly complex open scenarios, deeply integrating and implementing them in practical applications. Its self-developed intelligent analysis system for the suspension state of contact wires has been included in the National Major Scientific and Technological Innovation Achievements Library and is widely used commercially.

Furthermore, Noblecan Technology has independently developed the NBK-INTARI artificial intelligence platform, which integrates query and processing functions to support intelligent monitoring, detection, and operation and maintenance.

With deep accumulation in advanced technologies such as digital twins and deep learning, Noblecan helps customers achieve intelligent upgrades in monitoring, detection, and operation and maintenance.

Noblecan has market access qualifications for all 18 railway group companies under China Railway, and it is a railway material supplier with the highest level of 3A.

Starting with rail transportation maintenance, Noblecan applies artificial intelligence technology in fields such as smart cities and smart grids.

In the field of smart cities, Noblecan has formed in-depth cooperation with leading smart city general contractors in Sichuan and Zhejiang, among others, and has successful solutions and project cases in fields such as intelligent environmental monitoring, smart campuses, smart water affairs, and forest fire prevention, becoming a pioneer and leader in this niche market.

In the field of smart grids, leveraging its mature experience in intelligent monitoring and detection in rail transportation, Noblecan has launched an all-weather intelligent inspection solution for power transmission and transformation lines, which has been used in the Tibet Power Grid with relatively harsh data collection conditions. This solution automatically identifies abnormalities in fittings, towers, signs, and the surrounding environment from image and infrared data collected by unmanned aerial vehicles, overcoming the challenge of intelligent monitoring of power transmission and transformation lines in harsh weather and natural environments.

Paving the way for a positive market outlook

Regarding the withdrawal, Noblecan revealed in its prospectus submitted to the Hong Kong Stock Exchange that to further expand its global business and considering that the Hong Kong Stock Exchange can provide the company with an international platform to access foreign capital and attract various foreign investors, the company voluntarily decided to no longer proceed with its previous A-share listing plan and instead seek listing in Hong Kong.

In terms of revenue in 2023, Noblecan was the second-largest provider of AI+power supply system inspection and monitoring solutions in China and the seventh-largest provider of AI+rail transportation inspection and monitoring solutions.

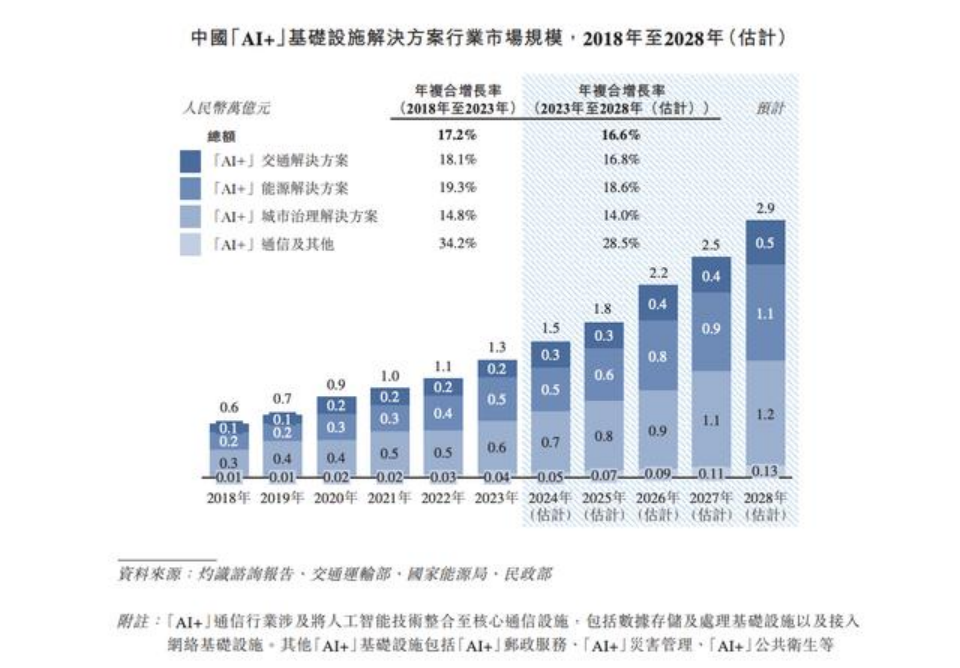

Additionally, data from CIC indicates that China's AI+infrastructure solutions industry is growing steadily, with the market size expanding from 0.6 trillion yuan in 2018 to approximately 1.3 trillion yuan in 2023, representing a compound annual growth rate of 17.2%.

This upward trend is expected to continue, with the market size reaching 2.9 trillion yuan by 2028, representing a compound annual growth rate of 16.6%.

Looking ahead, the journey of AI+ has just begun, and Noblecan's AI digital systems will be applied in more fields. As the wave of artificial intelligence surges, Noblecan may become the most outstanding "wave rider" in the future.

- END -

Disclaimer: Based on the public company attributes of listed companies, MGresearch strives to ensure the objectivity and fairness of the content and viewpoints presented in this article but does not guarantee its accuracy, completeness, or timeliness. The information or opinions expressed in this article do not constitute any investment advice. MGresearch assumes no responsibility for any actions taken based on this article.

This article is originally written by the public account MGresearch (ID: MGresearch). For reprints, please contact the investigator.