Amazon learns from Temu, aiming to win with low prices against Huang Zheng

![]() 11/14 2024

11/14 2024

![]() 568

568

One: Amazon's Version of Temu Has Arrived

If you can't beat them, join them! The trend of low prices has finally reached the e-commerce giant Amazon.

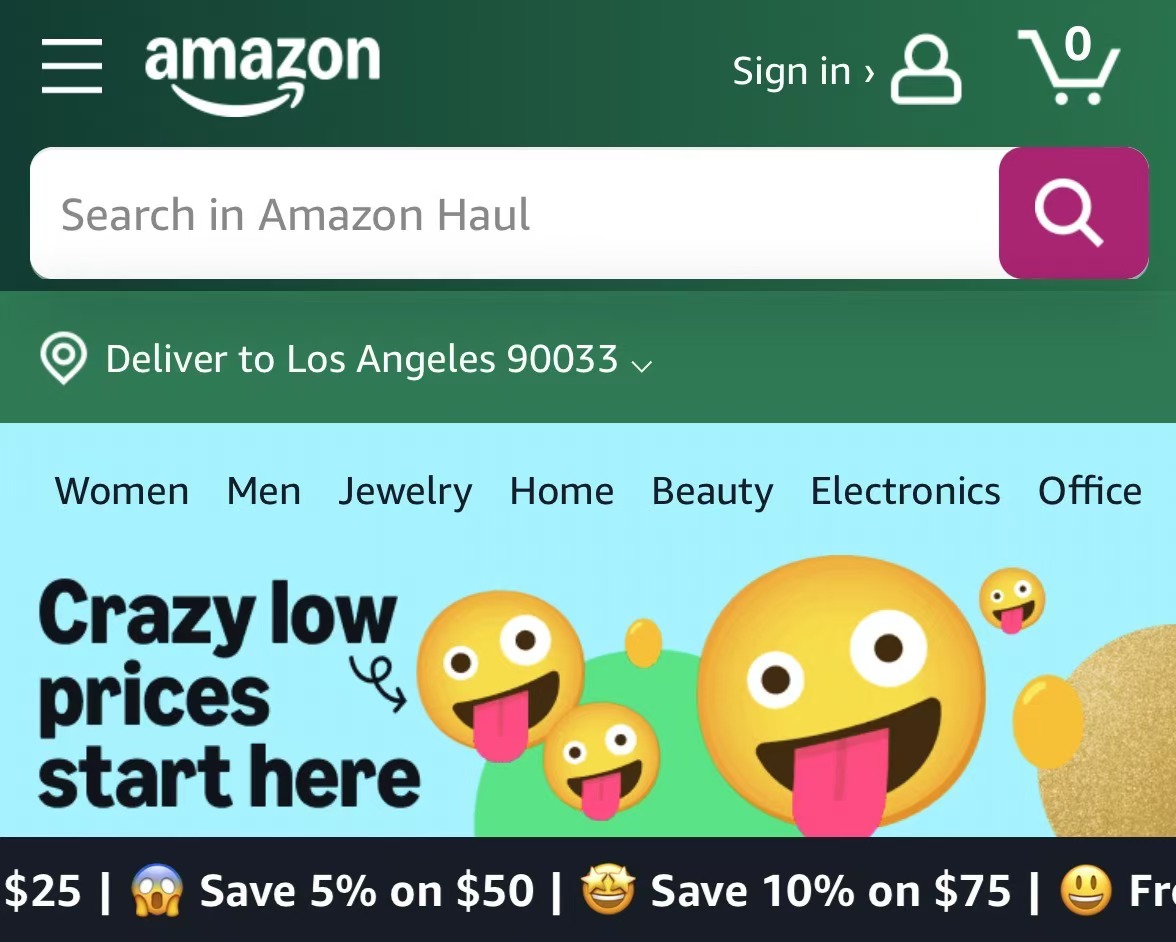

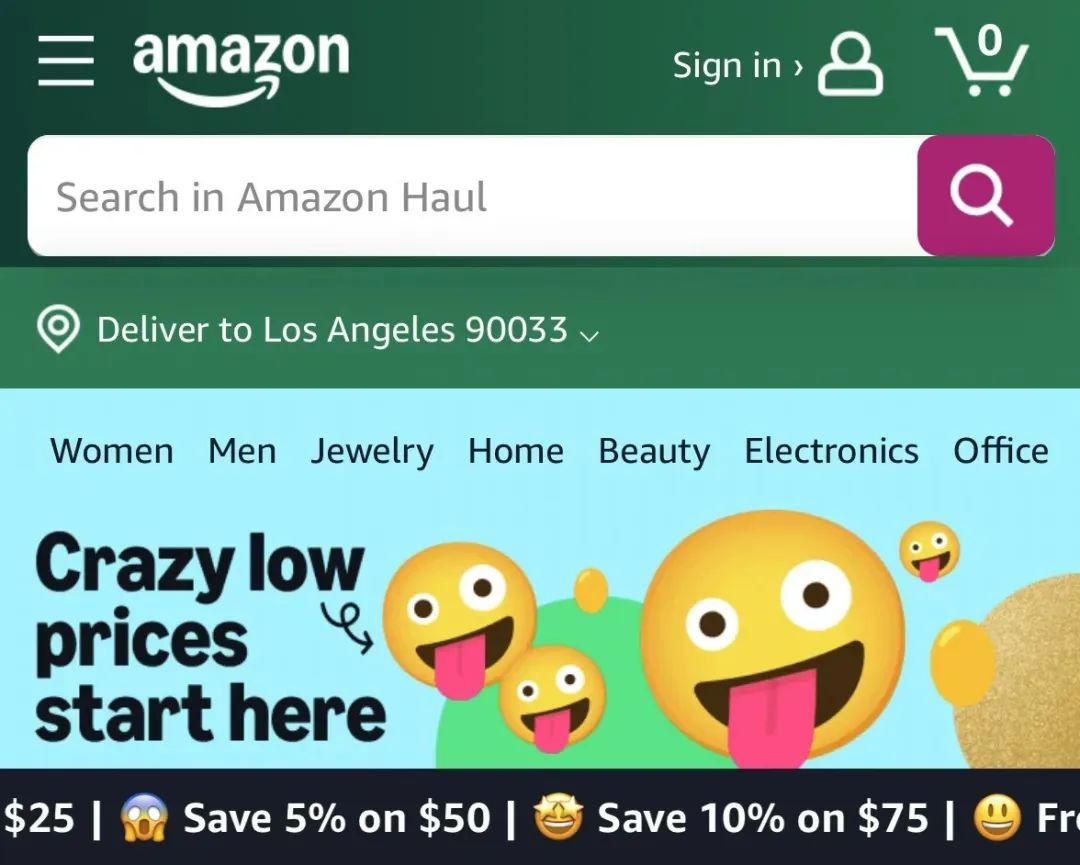

On November 12, Amazon's low-price mall, Amazon Haul, officially launched on mobile devices. According to online rumors, it is currently in the closed beta phase for the first batch of sellers, with large-scale merchant recruitment planned for next year.

The low-price mall page emphasizes "Crazy low prices Start here" and offers various promotional schemes to consumers, including free shipping on orders over $25, 5% savings on orders over $50, and 10% savings on orders over $75. If the mall link is shared with others, it will display "Find new faves for way less."

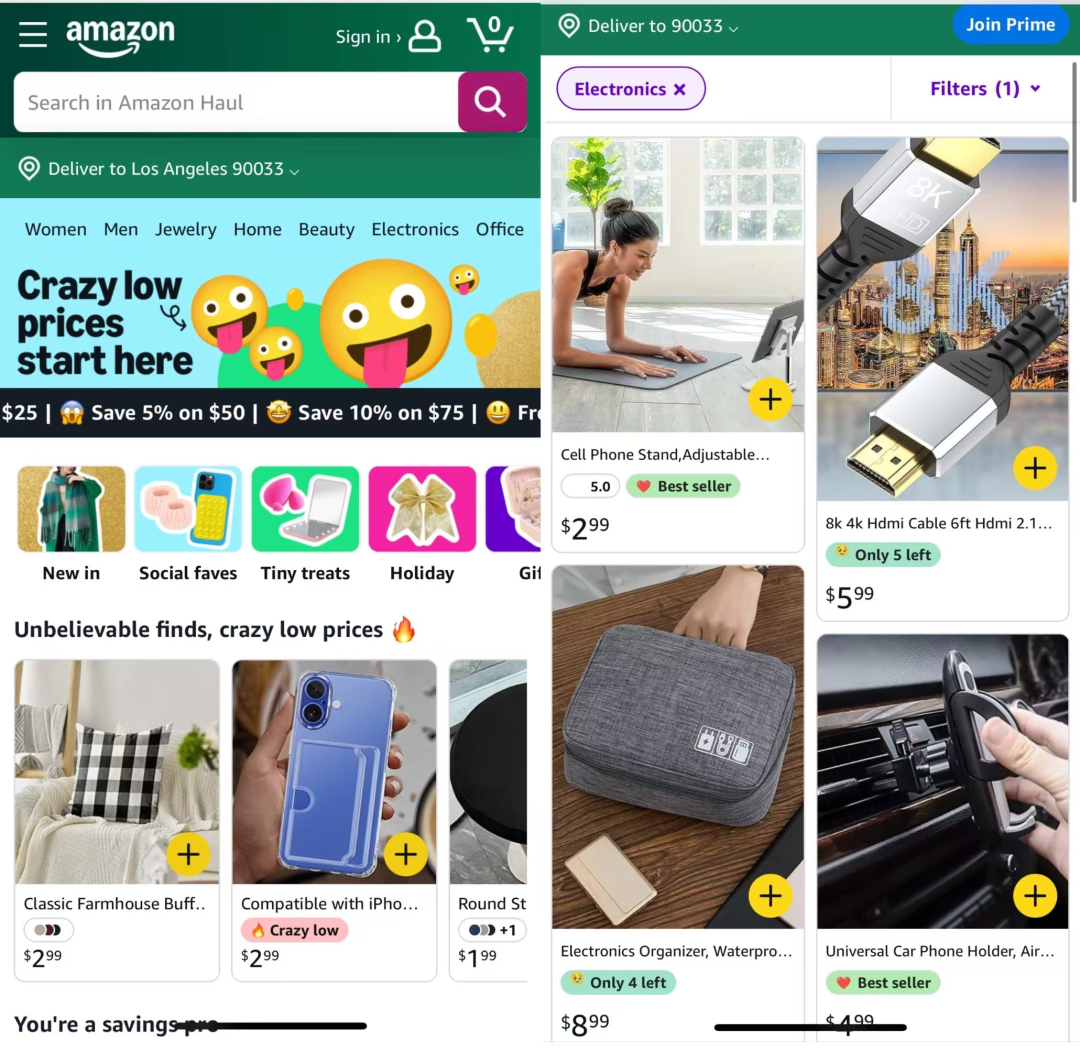

At first glance at the Amazon Haul interface, one might mistake it for Temu. Spoons for $0.99, phone cases for $1.79, three-piece phone screen protectors for $1.99, and dresses for $5.99... The first batch of products currently available covers 15 major categories such as women's wear, men's wear, jewelry, home furnishings, beauty products, electronics, office supplies, accessories, and kitchenware. Most products are priced below $10 or even $7.

This aligns with previous reports that Amazon had sent a "price cap order" to merchants for its low-price store, limiting the price of nearly 700 types of products to no more than $20, with many products capped at $7.

This move almost fully targets Temu, focusing on white-label products priced below $20 and weighing less than 1 pound, aiming to attract consumers who want to save money and are willing to wait longer.

For consumers, delivery times may be longer as products will be shipped directly from warehouses in China, but Amazon currently promises that 75% of orders can be delivered within 7 days.

For merchants, it's simpler to sell on Amazon's low-price mall. They only need to ship their products to Amazon's warehouses in China and don't have to worry about anything else. Amazon handles both on-site and off-site promotion and subsequent logistics.

Two: Amazon Is Desperate

Amazon's focus on low prices has been evident for some time.

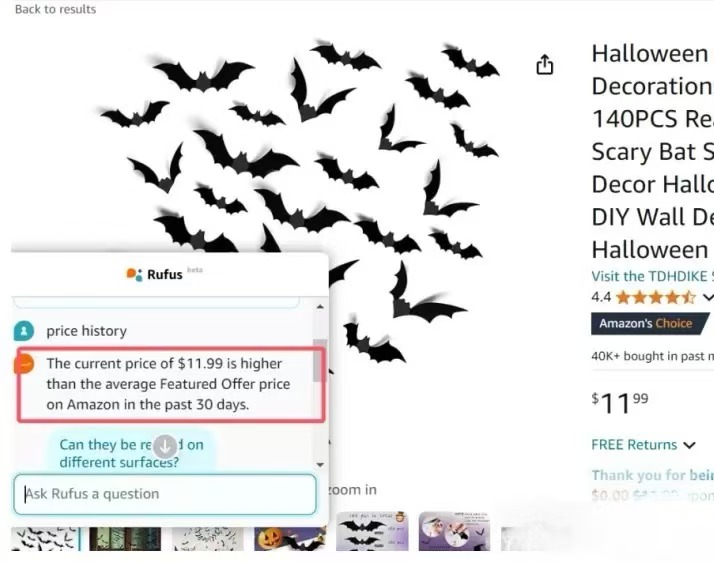

This year, a prompt appeared on Amazon product detail pages, "Tell Us About a Lower Price," encouraging consumers to report if they found a lower price elsewhere.

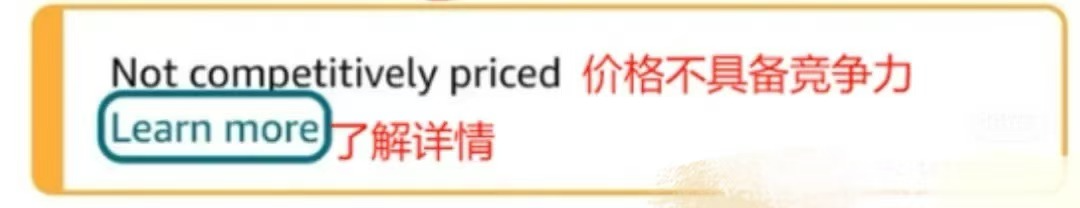

Additionally, Amazon introduced a new label, "Not competitively priced," essentially telling consumers directly that the price is too high!

After hesitantly engaging in low-price competition in its main market, the launch of the low-price mall now seems like a final trump card. It's similar to when JD.com launched its discounted shopping platform Jingxi in response to Pinduoduo's aggressive low-price strategy in China.

Financial reports show that Amazon's net sales from online stores were $61.411 billion in the third quarter of 2024, a year-on-year increase of 7%. According to a Stocklytics survey, the value of the e-commerce market is expected to reach $4.11 trillion in 2024, representing a year-on-year increase of 15%. In comparison, Amazon's e-commerce business growth in 2024 is significantly lower than the overall market.

This means that Amazon's growth potential is being usurped by other e-commerce platforms. Perhaps the most formidable competitor is Temu. The Wall Street Journal quoted sources this year saying that Amazon began to view Shein and Temu as bigger threats than retailers like Walmart.

Currently, Temu has surpassed eBay to become the second most visited e-commerce website globally, and it is expected to surpass Amazon in user base within the year. Based on data analysis by Sensor Tower in the US, as of August 2024, Temu's global user base has reached 91% of Amazon's, and it is expected to surpass the 30-year-old Amazon within the year.

Not only is Amazon facing challenges in user base, but some Amazon sellers are also starting to set up on Temu.

In March this year, Temu launched a semi-managed business, with a focus on attracting established Amazon sellers. With low fees, high growth, and guaranteed revenue, Temu has indeed attracted many Amazon sellers.

Some Amazon sellers who have started cooperating with Temu say that one of the biggest reasons for trying this platform is that Temu does not charge shipping or advertising fees, allowing for lower prices. However, Temu requires that pricing for identical products must be at least 15% to 35% lower than on Amazon. For example, an Anker power bank recently sold for $40 on Amazon but for $25 on Temu.

Despite lower prices, some sellers earn more on Temu.

The Wall Street Journal reported that according to documents provided by sellers, one merchant made more profit from selling printer ink on Temu, despite a lower price than on Amazon. Sellers speculate that Temu guarantees how much they will earn per product sold and may take losses on many items.

Three: Can Amazon Win Against Temu?

Although Amazon's low-price mall is similar to Temu's fully managed model, the biggest difference is that sellers on Amazon's low-price mall have pricing power, while Temu does not, which has been widely criticized. Frequent price cuts by the platform also cause distress among merchants.

Some merchants we contacted have reported that many successful merchants encounter this situation: once sales volume increases to a certain level, the platform frequently reduces prices. If merchants do not comply, the platform may re-recruit sellers, replacing them with others who can offer lower prices.

In contrast, Amazon's low-price mall gives sellers pricing autonomy, which is undoubtedly more friendly and attractive to merchants and may attract more low-cost industrial belt merchants to join.

Dharmesh Mehta, Vice President of Amazon Global Selling Partner Services, said in a statement, "Finding quality products at very low prices is essential for customers. We will continue to explore ways to collaborate with selling partners to help them offer ultra-low-priced products. This experience is just beginning, and we will continue to listen to customer feedback in the coming weeks and months to gradually improve and expand this service."

However, whether Amazon's low-price mall can ultimately win against Temu depends on whether consumers will buy into it.

According to The Wall Street Journal, since its launch in September 2022, Temu's monthly active users in the US have grown to 51.4 million, while Amazon's user base in the US has declined from 69.6 million to 67 million over the same period.

Now that Amazon has entered the same battlefield as Temu with its low-price mall, can it win back lost consumers? Looking back domestically, JD.com used Jingxi, and Taobao used Juhuasuan to compete with Pinduoduo, but ultimately, it's hard to say they successfully thwarted Pinduoduo's momentum. Can Amazon withstand Temu's strong overseas offensive?