The return of shelf e-commerce value may be the biggest highlight of this year's Double 11

![]() 11/14 2024

11/14 2024

![]() 530

530

"Shelf e-commerce is running out of steam."

In recent years, various emerging e-commerce models have stolen the limelight, and there have even been awkward silences during "Double 11". Consumers and merchants occasionally complain, and all sectors seem to have reached a consensus on this conclusion. However, when the results of this year's Double 11 were announced, they were unexpectedly positive.

Representing the old players, Taobao and Tmall have seen a full return of consumer spending power. Data shows that 589 brands generated over 100 million yuan in sales during the entire Double 11 period, setting a new record. In popular categories such as outdoors, collectibles, and pets, consumers enthusiastically placed orders. For example, young people aspire to having both cats and dogs, and nine brands in the pet category surpassed 100 million yuan in sales, with eight of them achieving the "small goal" of 100 million yuan for the first time.

Then there are new players in shelf e-commerce, such as Douyin and Kuaishou, which are also emphasizing the strong growth of related business formats. For instance, Douyin's Double 11 report shows that the GMV of broad shelf scenarios, including search and product cards, accounted for 42% of the total during Double 11, up from 20% two years ago.

Shelf e-commerce has risen up and thus completed its return to center stage.

Unexpected but reasonable.

In addition to explicit factors such as government subsidies and the longest promotional period, the stable performance of shelf e-commerce during this year's Double 11 is inseparable from the drastic self-renewal of various platforms over the past two years. It is also due to the overall recovery of the consumer environment and the industry's renewed examination of the value of the shelf e-commerce model after the hustle and bustle subsided.

"Slowing down" while becoming more stable

When discussing the rapid growth of live streaming e-commerce or other e-commerce models, it is inevitable to compare them with shelf e-commerce and then conclude that shelf e-commerce is slowing down.

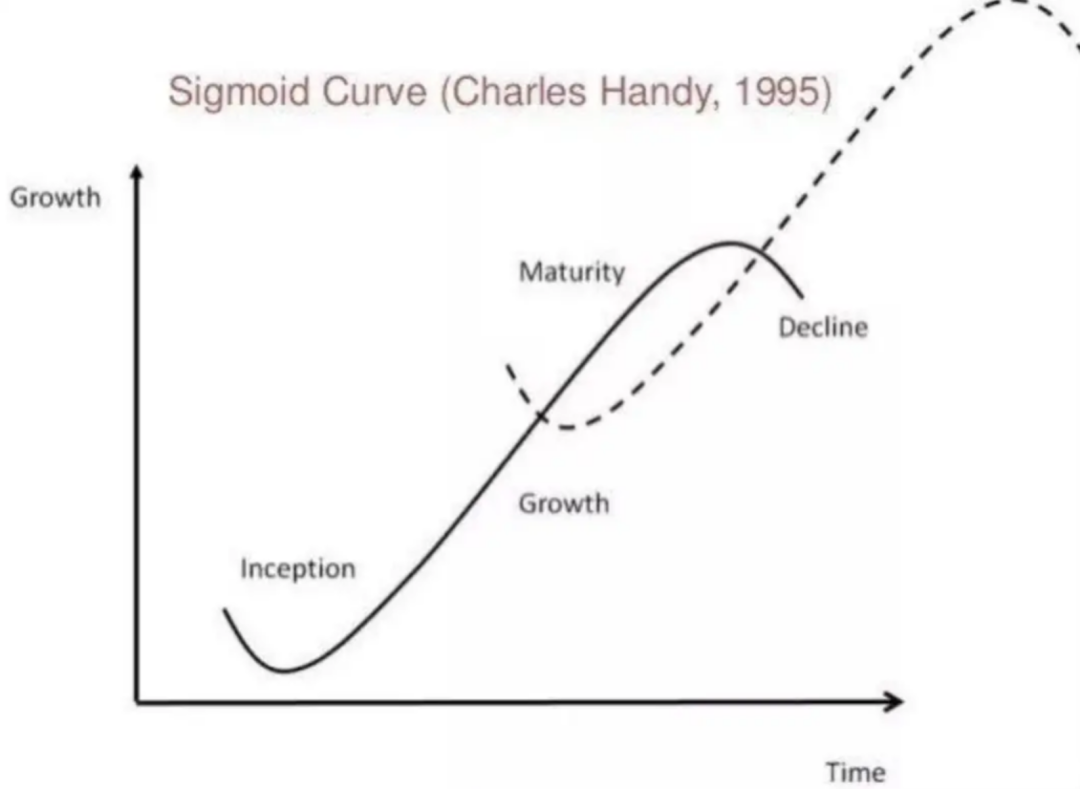

From a data perspective, this reasoning is sound. However, it should be noted that shelf e-commerce and other models are at different stages of development. In the objective development cycle of the industry, the most notable features of the introduction and growth stages are high growth rates, while the performance in the maturity stage, although slower, is more stable.

For example, there was a surge in shelf e-commerce in the early years. In 2009, Taobao launched the first Double 11 with sales of 52 million yuan, involving 27 brands. By 2012, just three years later, Double 11 sales soared from 52 million yuan to 13.2 billion yuan, with over 10,000 brands participating.

Now, after slowing down, it has become a steady increase. During the 2024 Tmall Double 11, the number of merchants with sales exceeding 100 million yuan increased by 46.5% year-on-year compared to the same period last year. The number of merchants joining the 100 million yuan club and the number of consumers participating in Double 11 both reached record highs.

The history of Double 11 is actually a side view of the evolution of shelf e-commerce. As stated in Tmall's letter to the media this year, "Together, we have witnessed the great power of commerce and technology continuously creating countless wonders, and then watched as these wonders gradually became commonplace year after year."

It must be emphasized that the development curve of other e-commerce models is similar, and their "blooming period" seems even shorter. According to iResearch Consulting's estimates, the compound annual growth rate of China's live streaming e-commerce market size is expected to be 18.0% from 2024 to 2026, which is also a sign of slowing down.

Moreover, instead of focusing on superficial sales figures, it is better to shift our attention to internal growth. It is evident to all that shelf e-commerce's determination and actions for self-upgrading have been particularly apparent in recent years.

Billion-yuan subsidies have become an industry standard, allowing consumers to purchase more affordable products. At the same time, merchants are also reducing costs and increasing efficiency, with platform rules being continuously optimized. Even the long-standing industry barriers have been broken down, as Taobao has officially integrated WeChat Pay and JD Logistics, and Alipay has entered JD.com, finally realizing interconnection and interoperability of e-commerce infrastructure.

This year's Double 11 was even a concentrated effort, with Taobao providing 10 billion yuan in support and exemptions for merchants, while consumers received subsidies such as 300-yuan off on purchases of 500 yuan and large consumption vouchers.

These changes have paved the way for the return of consumer spending power in shelf e-commerce. According to the "2024 Double 11 Review and Observation" report released by Analysys, the national express delivery volume during Double 11 exceeded 15.7 billion pieces, a year-on-year increase of 29%. The transaction volume of major e-commerce platforms during the Double 11 period increased by 11.4%.

Therefore, we can draw a new consensus: Although shelf e-commerce has slowed down compared to earlier years, it is also improving quality and speed, resulting in greater stability.

Consumers are becoming more rational, posing a greater test to platforms' long-term capabilities

Stable growth relies on the stable core of shelf e-commerce. It is often said that this is a person's greatest competitiveness, and the same is true in the e-commerce market.

From an operational logic perspective, the person-to-product matching model of shelf e-commerce remains the optimal solution for efficiency in the context of e-commerce.

For example, when users open Taobao, they come with clear shopping needs. Search and recommendation are the shortest links between products and consumer demands. In contrast, content e-commerce and live streaming e-commerce, which recommend products while browsing posts or short videos, stimulate potential demands through longer paths.

Benefiting from the surge of short video traffic in previous years and the strong emotional appeal of live streaming rooms, consumers unknowingly placed orders. As consumers return to rationality and demystify internet celebrities, they increasingly value actual needs, giving shelf e-commerce an advantage once again.

At the same time, to maintain the basic experience, content platforms must balance content and e-commerce, which inevitably limits the distribution of e-commerce traffic and leads to instability. In contrast, another layer of stability in shelf e-commerce is its proficiency in building brand equity, including cultivating store fans and increasing repurchase rates, which helps merchants enhance their ability to withstand fluctuations and operate more stably.

During this year's Double 11, the membership of Taobao's 88VIP program continued to expand, with consumer willingness to spend continuously increasing. As of 24:00 on November 11, the number of 88VIP members placing orders increased by over 50% year-on-year. Over the past year, Taobao's 88VIP program has maintained double-digit growth, with membership exceeding 42 million by June, making it the largest paid membership program in the domestic e-commerce industry. The number of annual cooperation brands for 88VIP increased by over 300%, becoming a new driver for brand business growth during this year's Tmall Double 11.

Moreover, this stability covers all fields and price ranges. During this year's Tmall Double 11, international and domestic brands in categories such as beauty, apparel, electronics, and appliances collectively returned to the top of the rankings, including familiar names like Apple, Haier, Midea, Xiaomi, and Nike. Over 45 brands surpassed 1 billion yuan in sales.

Additionally, although shelf e-commerce and other models have different paths and gameplay, their requirements for basic supply chain capabilities are universal.

Especially for shelf e-commerce platforms, users come with the intention of efficient shopping. If they cannot find satisfactory products after searching, their shopping experience is greatly compromised. This requires platforms to have a sufficient number of SKUs and a robust supply chain. Therefore, platforms that have been operating to date are those with years of experience. For example, Taobao has established the largest pool of high-quality branded products, covering 80% of the world's top brands and mainstream consumer goods across all categories.

In contrast, newer platforms are also emphasizing improving their supply chain shortcomings. However, if the speed of backend improvements cannot keep up with frontend sales, setbacks are inevitable.

For consumers, solid fundamentals can provide more affordable prices and higher-quality products. When merchants and platforms work together to enhance services, the iron triangle of price, quality, and service is strengthened. Amid the recovery of consumer spending, platforms and merchants can naturally succeed in capturing growth dividends.

Moreover, as consumers become more cautious in their shopping decisions and more discerning about platforms and products, product quality and price have become the focus of competition between merchants and platforms.

The brand sales data mentioned earlier also confirms that relying on a solid supply chain foundation and adhering to the logic of shelf e-commerce, high-quality merchants have not only withstood the test of industry cycles over the past few years but have also shown a stable and positive growth trend during this year's Double 11.

Therefore, a stable core is a characteristic of shelf e-commerce and a long-term capability that enhances the satisfaction of both merchants and consumers, supporting the platform's continued development.

Sustainable growth is the common pursuit of the industry

Shelf e-commerce is returning to center stage.

In previous years, the public discourse around shelf e-commerce was overshadowed by live streaming e-commerce and other models. However, the fact is that shelf e-commerce has always been the foundation of China's e-commerce industry. A previous Morgan Stanley research report showed that e-commerce models dominated by shelf e-commerce still occupy nearly 90% of the market space.

The industry's actions in recent years have spoken louder than words, and there has been a change in the perception of the value of shelf e-commerce across all sectors.

On the one hand, the industry has collectively increased its investment in shelf e-commerce.

WeChat has added a "Small Shop" channel to its search results page, revealing Tencent's intention to layout shelf e-commerce scenarios. Platforms like Douyin and Kuaishou also place great importance on shelf e-commerce. For example, in 2022, the president of Douyin E-commerce stated that shelf scenarios accounted for approximately 20% of Douyin E-commerce's overall GMV and were expected to reach 50% in the future.

Screenshot of Weidian Small Shop

It is clear that shelf e-commerce and live streaming e-commerce are not mutually exclusive but rather complementary.

Douyin, Kuaishou, and WeChat have recognized the limitations of a one-legged approach and are striving to complement shelf e-commerce. They are attempting to leverage the long-term growth of shelf e-commerce to expand the platform's e-commerce imagination.

On the traditional e-commerce side, there has also been continuous effort to deepen the synergy between shelf e-commerce and live streaming e-commerce. For example, leveraging its accumulated advantages in brand inventory, product management systems, and store supervision systems, Taobao is exploring a new phase of live streaming that shifts from an entertainment-oriented model to a quality-oriented one, addressing previous issues in live streaming e-commerce.

On the other hand, merchants and consumers are returning.

The return of consumer spending power during Double 11 stems from the support of merchants and consumers. Merchants see growth opportunities on the platform, while consumers are attracted by better prices, quality, and services. This demand translates into orders, setting new records for merchant sales and consumer participation. Moreover, during the overall recovery and rational decision-making phase, it is believed that most consumers no longer view Double 11 as a special event but rather a habitual time to seek quality and discounts.

Therefore, despite the festive atmosphere diminishing, sales are increasing, reflecting a robust and sustainable growth trend driven by real demand. The specific example mentioned earlier, where consumers bought out products in categories such as outdoors, collectibles, and pets during Double 11 due to their preferences and needs, demonstrates this trend.

,"Relying on a more efficient transaction model and self-driven growth in ecological experience over the past few years, shelf e-commerce is enjoying a second renaissance favored by merchants, consumers, and platforms. Looking back at its growth over the years, it resembles the philosophy of flowing water: it does not rush to the front but ensures a steady and continuous flow.