Tencent steps in, will Huya Live be going to the moon?

![]() 11/18 2024

11/18 2024

![]() 474

474

Recently, Huya Inc. (NYSE: HUYA) released its financial report for the third quarter of 2024.

How did it perform? From a financial data perspective, this report card is somewhat disappointing.

During the reporting period, Huya achieved revenue of 1.538 billion yuan, a year-on-year decrease of 7.61%, marking the 12th consecutive quarter of decline.

As for the corresponding net profit attributable to shareholders, although it was only 23.61 million yuan, it represented a year-on-year increase of 123.97% compared to the 10.54 million yuan in the same period last year.

Does it seem decent? But in reality, Huya's three major expenses (R&D, marketing, and general and administrative expenses) all declined year-on-year during the same period, with declines of 12.13%, 30.4%, and 24.68%, respectively.

Behind the declines in these three expenses, there was a reduction in "personnel-related expenses." This indicates that Huya either laid off employees or reduced salaries...

Even so, Huya's operating profit for the same period was still -32.33 million yuan.

So where did the net profit attributable to shareholders come from? It came from interest income from bank deposits and investments.

During the same period, Huya's "interest income" reached 96.58 million yuan, thereby "hedging" against operating losses...

Of course, Huya's third-quarter report is not without highlights. Against the backdrop of sluggish live streaming revenue, Huya's game-related services, advertising, and other business revenues reached 410 million yuan during the reporting period, a year-on-year increase of 209.34%.

Undoubtedly, this is a very impressive growth performance and shows momentum for a second growth curve.

So, how long can this growth momentum continue? And can it support more value imagination for Huya? This has become the focus of debate among numerous capital investors in recent times...

01

Non-live streaming businesses are becoming Huya's new value chips

In August last year, Huya announced a three-year plan with the primary goal of promoting the development and transformation of a second growth curve by providing more game-related services.

After reorganizing its revenue structure, in the first quarter of this year, Huya's game-related services, advertising, and other revenues were 243.6 million yuan. In the second quarter, they were approximately 308.5 million yuan, and in the third quarter, they were approximately 410 million yuan. Total revenues for the first three quarters were 962.3 million yuan, a year-on-year increase of 169.4%.

At first glance, does it seem like this high growth is entirely due to the transformation?

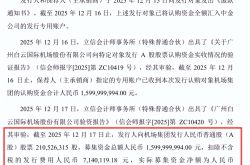

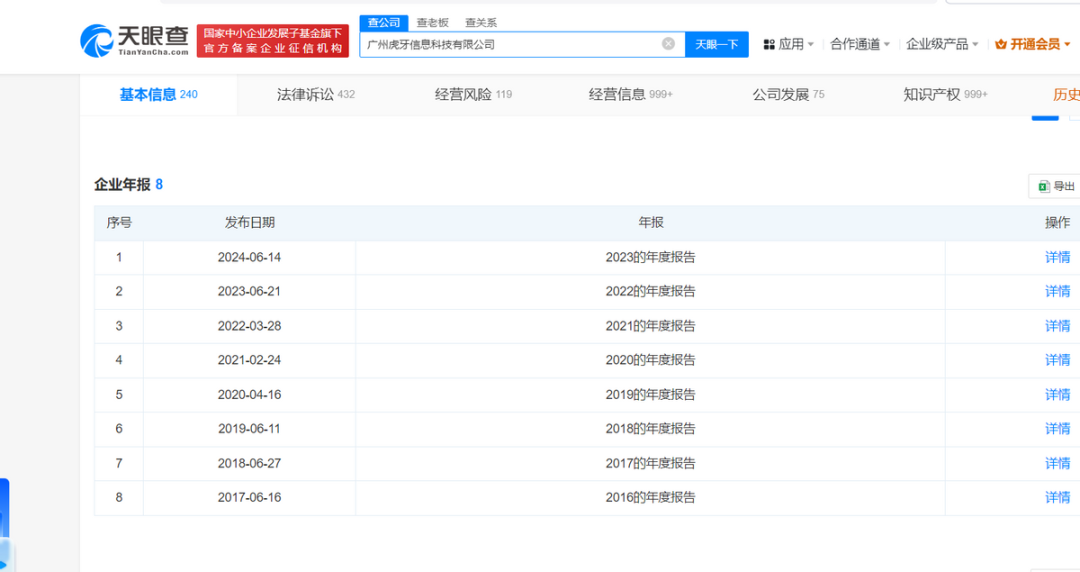

Part of the disillusionment is that Huya already had an advertising business revenue base before. For example, Tianyancha APP shows that Huya's "advertising and other" revenues were 1.068 billion yuan in 2022 and declined to 544 million yuan in 2023.

Behind this are the knock-on effects of the decline in the entertainment live streaming business and the impact of macroeconomic trends, namely, a reduction in internet advertising budgets. This is not hard to understand, especially since cost reduction and efficiency enhancement were the main themes of 2023, and even Huya itself reduced a significant amount of marketing expenses.

However, under various policy stimuli, the macroeconomy has shown signs of recovery this year. Coupled with Huya's focused efforts, even without transformation, Huya's "advertising and other" revenues could perform well.

As such, the transformation effect of Huya's second growth curve may need to be discounted.

If that's the case, let's objectively analyze how high the market ceiling for Huya's transformation could be.

First, from the perspective of user scale, Huya's monthly active user base is relatively small and shows a trend of slow growth, which may limit the market ceiling for game services and advertising businesses.

During the reporting period, Huya's mobile MAU reached 84 million. It was 86 million in the third quarter of 2023, a year-on-year decline but a quarter-on-quarter increase compared to 83.5 million in the second quarter of this year.

How does this performance look? Compared horizontally with the industry, as of the third quarter of last year, Bilibili, which is also focused on the gaming business, had a total MAU of 341 million, and Kuaishou had an MAU of 685 million, far exceeding Huya's.

Compared vertically with the past, media statistics show that as of the end of 2021, Huya Live's mobile MAU was 80.9 million, 84.3 million in 2022, and 84.1 million in 2023.

Obviously, Huya's monthly active user base has not grown much in the past three years, suggesting it may have reached a ceiling for platform traffic.

This means that even if Huya's game services are currently experiencing strong growth momentum, due to the constraints of user traffic scale and slowing growth, its future value imagination may be extremely limited.

Perhaps realizing this, a while ago, Huang Junhong, Co-CEO and Senior Vice President of Huya, stated: "We have begun to selectively distribute live streaming and video content from the Huya platform to other platforms, thereby further enhancing the influence of Huya content and reaching a broader user base..."

Honestly, Huya's approach is sound, but the final effect remains to be seen.

Normally, after distributing game content to other platforms, Huya should direct users back to its platform. However, now that Douyin and Bilibili also have game live streaming businesses, Huya's content acquisition effect will be continuously diverted.

After all, if users are only interested in game live streaming, Bilibili also holds the event rights to many popular games, making it a viable alternative. As for Huya's self-produced events, such as the "Honor of Kings Anchor League," they are often jointly organized by multiple platforms, further reducing Huya's content acquisition effect.

In the end, only users who "like" Huya anchors themselves through content are likely to follow them across platforms to Huya.

But after all these twists and turns, how much of Huya's cross-platform user acquisition "pie" will be left?

Second, the increased risk of top anchors leaving may significantly impact Huya's game service "sales" capabilities.

Huya's game-related services mainly encompass three areas: game distribution, game advertising, and game item sales.

The growth potential of the first two is related to Huya's user base, while the latter is related to anchors.

Put simply, Huya needs "middlemen," leveraging fans' trust in top anchors to guide "sales."

However, one issue is that perhaps due to Huya's cost reduction and efficiency enhancement efforts in recent years, or the desire for higher platform exposure, many top game anchors, such as Zhang Daxian and Sao Nan, have turned to platforms like Douyin after their contracts expired.

At the end of last year, Wang Zherong, also known as Zhang Daxian, the top streamer for Honor of Kings, left Huya for Douyin. While on Huya, Zhang Daxian accumulated over 30 million fans. However, within just over half a year on Douyin, Zhang Daxian now has over 55 million fans.

While some of these fans undoubtedly followed Zhang Daxian from Huya to Douyin, the nearly doubled fan base is enough to make more Huya anchors aware of the traffic disparity between the two platforms. The corresponding commercialization ceilings are naturally not comparable.

This is actually the current embarrassment for Huya. Even though Huya mentioned in its "Hu Yi Plan" this year that it plans to cultivate over a thousand top anchors across the industry and allocate 10 billion yuan to game commercialization anchors in the next three years, the traffic growth that Douyin and Bilibili can capture right now is likely more filling than this future "pie in the sky."

Moreover, competition among anchors is fiercer on established game live streaming platforms like Huya, so leaving for Douyin or Kuaishou is not a bad option.

In other words, platforms like Douyin and Bilibili don't even need to actively cultivate anchors; their traffic scale alone seems sufficient to siphon away Huya's professional anchor talent...

02

Tencent steps in, is Huya saved?

Of course, regardless of the uncertainty surrounding the future of "game-related services, advertising, and other" businesses, this is the only way for Huya to break the deadlock. Therefore, Huya's general direction of cross-platform collaboration is likely to remain unchanged.

Fortunately, with the further development of interconnection and interoperability, Huya's multi-platform cooperation approach is gradually aligning with its major shareholder Tencent's renewed demand to "connect everything" within its game ecosystem.

Perhaps for this reason, in May last year, Tencent Vice President Lin Songtao became the Chairman of Huya. Subsequently, Huang Junhong, Senior Vice President of Huya, and Wu Xin, Vice President of Finance, were appointed as Acting Co-CEOs of Huya. The former was previously responsible for the management and R&D of QQ, Tencent Docs, and Tencent Cloud's basic products.

Then, some time ago, Huya announced that according to the new agreement, its license fees for broadcasting the League of Legends with Tencent Esports have decreased from 300 million yuan for 2024-2025 to 230 million yuan, a reduction of 70 million yuan over two years for Huya.

Overall, it is essentially providing people and "money" while helping to accelerate resource integration and collaborative efforts.

If this cannot reverse Huya's decline, then Huya may be in "danger." After all, many investors have previously analyzed that under the circumstances of Huya's continuously sluggish stock price, the optimal solution for Tencent's equity is privatization, followed by low-price buybacks, with cash dividends yielding the lowest returns...

However, the embarrassing reality is that while Huya can indeed leverage the Tencent ecosystem to widely distribute high-quality content to various product lines such as Video Numbers, Tencent Video, and QQ, ultimately, Tencent is only a powerful channel for promotion and reaching users. Whether Huya can attract new users depends on the performance of the distributed content.

However, as mentioned earlier, there is competition and overlap between Huya and platforms like Douyin and Bilibili in terms of game live streaming content. As for anchors, it is uncertain whether Huya can retain its core anchor resources in the future...

Therefore, whether for long-term growth or to avoid being "abandoned" by Tencent, I believe Huya should not put all its eggs in one basket and needs to seek a third growth curve.

Just like Bilibili, which not only acts as a game distribution and sales channel but also develops games itself, seeking opportunities for "instant wealth."

It is worth noting that SOHU relied on the game Tian Long Ba Bu, and Bilibili relied on the exclusive agency of "Fate/Grand Order" and "Azur Lane" eight years ago, both of which sustained them for several years. Even now, many investors are focusing on Bilibili's new attraction, the SLG (strategy game) "Three Kingdoms: Strategize the World," released some time ago.

It is evident that a hit game can change Huya's fate.

However, in this regard, game development is the main battlefield of major shareholder Tencent. Whether Huya can break away from its position as a game channel depends on Tencent's intentions.

After all, Tencent has been providing people and resources but does not seem to be focusing on Huya's game development efforts. Is there some strategic consideration behind this? We do not know.

But even if large-scale games are out of reach, I believe Huya can still moderately develop small games.

On the one hand, the market and growth potential for small games are not actually "small." According to the "China Game Industry Report for January-June 2024," mobile mini-game revenues reached 16.603 billion yuan from January to June, a year-on-year increase of 60.5%.

On the other hand, as a game live streaming platform, Huya should be more sensitive to users' game preferences. If this can be leveraged for reverse inference, it may add another more stable and imaginative growth curve for Huya.

In summary, while it is not wrong for Huya to focus on game-related services, advertising, and other businesses amidst the cooling of the live streaming business, it gives a sense of all-in betting.

This is understandable since even if Huya's transformation fails, it still has Tencent as a backstop, and there is even the possibility of a merger with Douyu in the future.

However, this "all-in" approach undoubtedly becomes a "high-stakes gamble" with no winners for the capital market and investors...

Disclaimer: This article is based on the company's statutory disclosures and publicly available information for commentary, but the author does not guarantee the completeness or timeliness of this information. Additionally, the stock market is risky, and investors should proceed with caution. This article does not constitute investment advice, and investors must make their own judgments regarding investments.