"The healer cannot heal himself"? Chen Qiangbing aims to "reduce costs and increase efficiency" for UFIDA Network

![]() 11/18 2024

11/18 2024

![]() 709

709

UFIDA Network's third-quarter report, not surprisingly, was "disappointing" again.

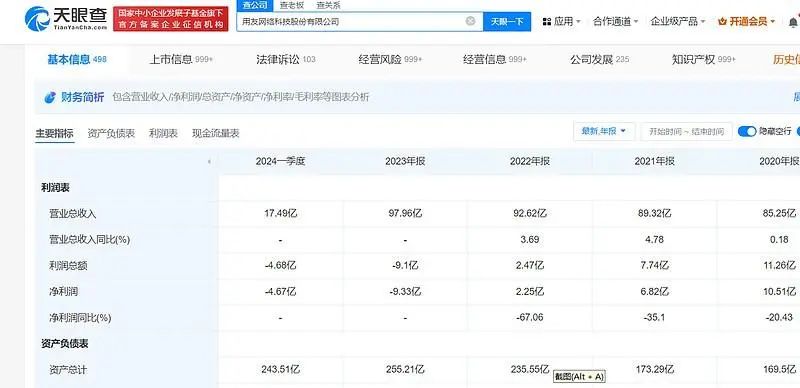

In the third quarter, UFIDA Network achieved revenue of 1.933 billion yuan, a year-on-year decrease of 17.3%, with a net loss of 661 million yuan, turning from profit to loss compared to the same period last year.

Looking at the entire first three quarters, the performance also seems unoptimistic. Revenue for the first three quarters of 2024 was 5.738 billion yuan, with a year-on-year increase of only 0.5%, and a net loss attributable to shareholders of 1.455 billion yuan, a year-on-year increase of 41.24%.

On the surface, the loss issue is a major problem based on the financial report.

The financial report explained that the loss in the third quarter was mainly due to the slowdown in year-on-year growth of operating revenue and the increase in amortization of capitalized intangible assets and severance pay.

In other words, the business is not profitable, and due to previous layoffs, personnel costs have increased in the short term. As for the amortization of capitalized intangible assets, it can be understood as a portion of the technical assets developed depreciating in value, requiring financial amortization.

In summary, the reason is still the same: unprofitable business coupled with high cost expenditures, making the loss less surprising. After this wave of 1.45 billion yuan net loss in the first three quarters, can the company's business undergo qualitative changes?

This question deserves deep exploration.

01

"The healer cannot heal himself", and costs have "dragged down" UFIDA's performance?

Whether doing SaaS or cloud business, a major selling point of ToB software companies is "cost reduction and efficiency increase". But these days, the story of B-end cost reduction and efficiency increase is becoming harder to tell.

On the one hand, for the enterprise side, most companies now understand that growth issues do not lie on the cost side but rather a lack of effective market demand.

On the other hand, for ToB companies like UFIDA Network, due to the necessary increase in R&D investment for business growth, cost control has become the top issue.

Aiming to reduce costs for enterprises, one ends up facing cost control issues first, somewhat akin to a healer who cannot heal himself.

If we look at UFIDA Network's third-quarter reports for the past three years, it is not difficult to find that the issue of costs eroding profits has always existed.

From 2022 to the third quarter of 2024, UFIDA Network's total operating costs were 6.366 billion yuan, 7.006 billion yuan, and 7.322 billion yuan, respectively. The highest revenue for the first three quarters of these three years was in 2024, but it was only 5.73 billion yuan.

This year's third-quarter report is actually worse than last year's.

In terms of revenue growth, the first three quarters of last year fortunately still had a growth rate of 2%, but this year it dropped directly to 0.53%, with growth almost stagnant. At the same time, total costs increased by 2.26% year-on-year, and profit pressure is greater than last year.

Objectively speaking, there are cost expenses related to layoffs, which are indeed short-term, but the problem is that third-quarter performance is also not optimistic, with revenue decreasing by 17.3% year-on-year.

The quality of the third-quarter report greatly influences the company's performance throughout the year. It will be difficult to surprise in the upcoming fourth quarter and alleviate the pressure on full-year profits.

The reason for such high profit pressure may lie in ineffective cost control.

In terms of marketing expenses, from the first three quarters of 2020 to 2024, UFIDA Network's sales expenses were 1.537 billion yuan, 2.027 billion yuan, 2.235 billion yuan, and 2.743 billion yuan, respectively. From 2021 to 2024, marketing expenses in the first three quarters increased by 31.65%, 10.26%, 22.70%, and 2.25% year-on-year.

In other words, the little revenue growth in these years relied heavily on a large marketing budget. With such poor effectiveness of marketing expense investments and such a large annual increase in budget, it is no wonder that the business has been under profit pressure.

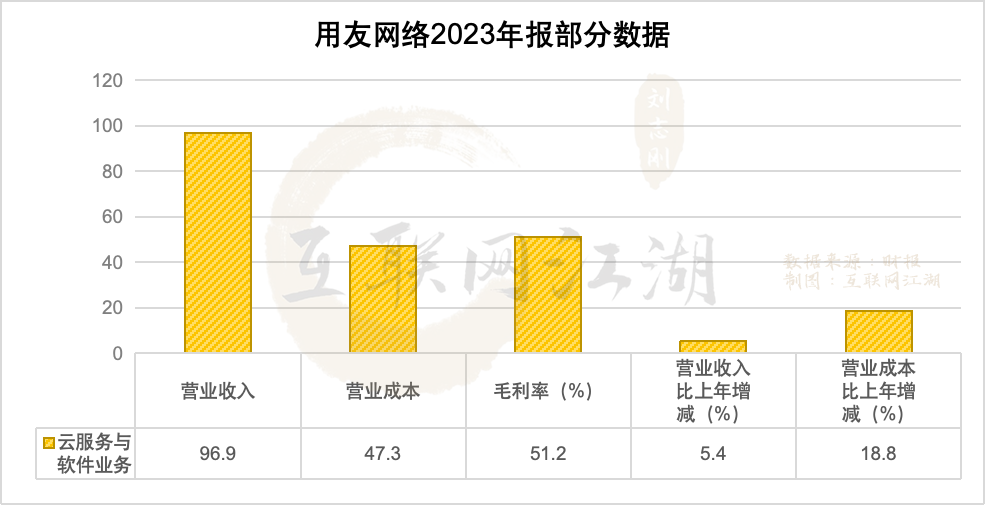

The poor performance may also be related to UFIDA Network's less successful transformation into cloud business initially.

For UFIDA Network, transforming into cloud business is not about tapping into incremental markets but transforming existing ones, which brings more cost expenditures and reduces gross profit margins.

From the first three quarters of 2021 to 2024, UFIDA Network's cloud service business revenue share rapidly increased from 20% to 74.71%, while the sales gross profit margin dropped from 61.05% to 48.83%. Obviously, the growth of the cloud business has not increased profit margins but rather compressed the upper limit of gross profit margins.

Why is it so difficult to increase profits?

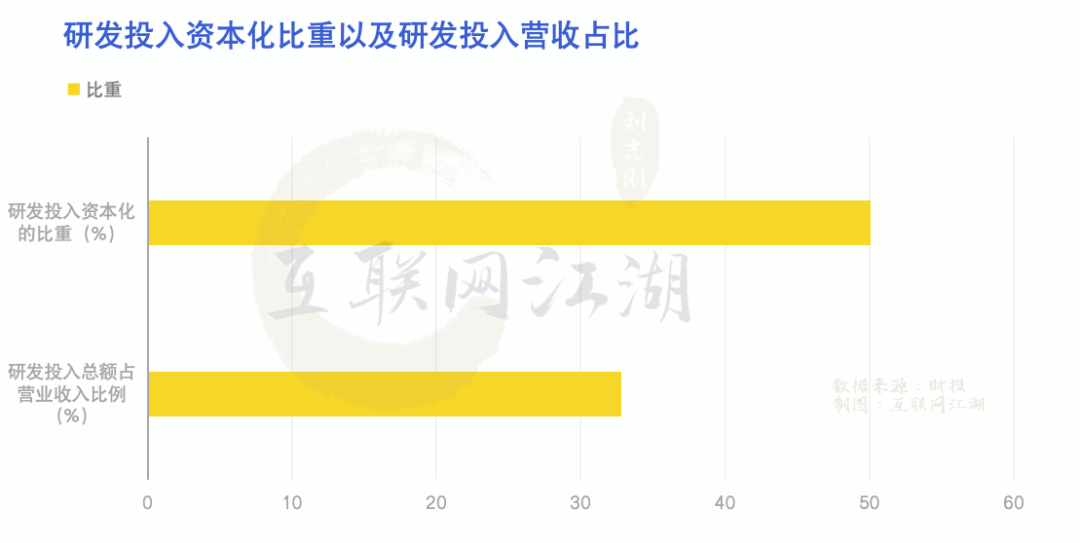

It's still the issue of capitalized R&D investments turning into intangible asset amortization that erodes profits. Generally speaking, there is no problem with software companies capitalizing R&D investments and then amortizing them year by year as intangible assets.

However, the annual amortization of intangible assets affects current profit performance.

According to Tianyancha APP, from 2021 to 2023, UFIDA's R&D investments were 2.354 billion yuan, 2.93 billion yuan, and 3.215 billion yuan, accounting for 26.4%, 31.6%, and 32.8% of total revenue, respectively. Correspondingly, as of the end of 2023, UFIDA had 8,951 R&D personnel, accounting for 35.9% of the company's total headcount.

During the same period, UFIDA's R&D capitalization rate increased from 35.9% to 50.1%.

Looking at amortization, UFIDA's intangible asset amortization was 334 million yuan in 2021, 432 million yuan in 2022, and increased by 710 million yuan in 2023. By the first half of this year, the amortization amount reached 488 million yuan, higher than the entire year of 2022. Notably, in the first three quarters of this year, the amortization amount of capitalized intangible assets increased by 220 million yuan year-on-year.

With so much amortization, it is no wonder that the financial report's profit performance is so poor.

It is expected that future pressure on the company's R&D investments will still exist. On the one hand, as the ToB software industry enters the era of large-scale AI, both Kingdee and UFIDA need to maintain sufficient R&D investments to maintain their competitiveness. On the other hand, with limited market demand growth, capitalized R&D investments entering the amortization phase may further drag down future profit performance.

02

Layoffs cannot solve the cost dilemma, so how can Chen Qiangbing increase efficiency?

On October 29 this year, the IPO of UFIDA Finance, a subsidiary of UFIDA Network, on the Beijing Stock Exchange, which had been planned for three years, was officially terminated. Since then, UFIDA Network's plan to spin off its subsidiaries for IPO on the Beijing Stock Exchange has failed.

UFIDA Network issued an announcement withdrawing the IPO based on comprehensive considerations of strategic development and changes in the market environment.

From an external perspective, by seeking an IPO for its subsidiary on the Beijing Stock Exchange, UFIDA seemed to want to "hedge its bets" for future financing and operations. After all, given its own situation, there seems to be little room for significant business improvement.

Judging from the company's cash flow, the company's free cash flow situation has been deteriorating since 2022.

Data shows that the company's free cash flow was -1.257 billion yuan in 2022, -1.58 billion yuan in 2023, and further deteriorated to -5.424 billion yuan in the first three quarters of 2024.

The change in data seems to indicate that the current environment is becoming increasingly severe, enterprise customers are becoming more cautious, and the company's ability to generate cash from its business is weakening.

This is also reflected in bad debts. In the first half of this year, the company's bad debt provision was 973 million yuan. What does this mean? In other words, among projects that have not yet been settled, about a quarter of the payments may be difficult to collect.

Bad debts in the software industry are delicate. It could be due to customers being unsatisfied with the product and thus not paying the final installment, or it could be due to issues with the customer company's payment ability. In summary, such a bad debt rate may affect the company's revenue to some extent.

How to solve this problem? Either improve product delivery satisfaction or continue to improve personnel efficiency.

In terms of products, it is still the issue of costs. It is a dilemma to control costs while ensuring customer satisfaction. The most direct approach is to improve personnel efficiency.

To improve business conditions, UFIDA chose to transform while reducing personnel size.

Data shows that in the first half of 2023, UFIDA Network had 25,795 employees, which decreased to 22,658 by the company's interim report this year. Revenue per capita increased from 130,600 yuan to 167,900 yuan.

The strategy of layoffs to reduce costs is necessary and correct, not only to correct the rapid growth of the past few years but also to free up hands to embrace the next stage of the ToB industry.

However, such an increase in personnel efficiency is clearly insufficient.

On the one hand, with increasing uncertainty in the market environment, enterprises also need more innovation and flexibility in their businesses. Without increasing R&D and market investments, can new software products bring more customer growth after being launched into the market?

On the other hand, the first half of the software industry was digitalization, and the second half will definitely be GPT-ization. Empowering various industries with large AI models is a path that the software industry cannot miss.

Under such industry changes, whether revenue per capita is 130,000 yuan or 160,000 yuan makes no fundamental difference. It is still difficult to create new profit margins and free up hands to plan and prepare for the industry's entry into the next stage in advance.

How to seize opportunities in AI and large models when the industry window arrives is a question that President Chen Qiangbing needs to consider.

From January 2016 to January 2019, Chen Qiang served as Executive President of UFIDA Network. Wang Wenjing resumed his concurrent presidency in January 2021, and in January this year, Wang Wenjing stepped down as president, with Chen Qiangbing taking over.

Over the years, Chen Qiangbing has been under pressure, and there have always been doubts from the outside.

Especially in recent years, the company's revenue growth rate has experienced a cliff-like decline, falling from 21.44% in 2018 to 10.46%. Subsequently, in 2020, its net profit growth rate even began to decline, reaching -16.7%.

Next, can Chen Qiangbing stand on his own and lead UFIDA into the next growth stage? This is a question worthy of attention.

The market environment is constantly changing, and the ToB industry is also constantly evolving. From the ERP era to the cloud era and then to the AI era, the digitalization industry has been on a continuous transformation path.

One day in the future, enterprise managers will enter the true AI era, where GPT can bring about productivity changes not only in dark factories but also in every office building. By then, the valuation logic of companies like UFIDA Network may undergo significant changes.

At that time, as the "number one software company" in China, what kind of results can UFIDA Network produce and what kind of changes can it bring to the enterprise service market? It is worth looking forward to continuously.