'Chip giant' Jinghua Microelectronics under investigation by CSRC, share price plummets causing losses for retail investors

![]() 11/19 2024

11/19 2024

![]() 542

542

Produced | Bullet Finance

Designed | Qianqian

Reviewed | Songwen

On November 15, chip company Jinghua Microelectronics was placed under investigation by the China Securities Regulatory Commission (CSRC) for suspected information disclosure violations, sparking concern in the capital market.

As a chip company, Jinghua Microelectronics has attracted significant attention from investors over the past period. Its share price surged from a low of 16.18 yuan per share on September 18 to a high of 38.88 yuan per share.

Recently, while the company's share price has retreated somewhat, it was still up over 80% from September 18 before the investigation was announced on November 15. Affected by the news of the investigation, Jinghua Microelectronics' share price fell 15.32% by the close of November 18, closing at 25 yuan per share.

Objectively speaking, Jinghua Microelectronics' performance has not been impressive since 2021. The current investigation by the CSRC has further worried investors, with some even expressing concerns on stock forums, such as 'Don't be complacent about listed companies under investigation' and 'Jinghua Microelectronics has done great harm.'

1. Former largest customer funded by Lv Hanquan

An announcement kept Jinghua Microelectronics shareholders up all night.

On November 15, Jinghua Microelectronics announced that it was under investigation by the CSRC for suspected information disclosure violations. Many shareholders feared a sharp drop in the company's share price due to this news.

Even before the formal investigation by the CSRC, Jinghua Microelectronics and its management had been in constant trouble. In October 2023, the Zhejiang Securities Regulatory Bureau decided to issue warning letters to Jinghua Microelectronics and Lv Hanquan, among others, and record them in the securities and futures market integrity files.

One of the reasons for being recorded in the file was the inaccurate disclosure of fund transfers between the company and its affiliates with Jinyun Zhihe Electronic Technology Co., Ltd. (hereinafter referred to as 'Zhihe Electronics'). It is reported that Zhihe Electronics has always been a major customer of Jinghua Microelectronics.

Founded in 2018 by Zheng Genhua, Lu Lixiao, and Yang Minrong, all former employees of Jinghua Microelectronics' major customer Weichuang Electronics, Zhihe Electronics faced funding constraints when it was established. Lv Hanquan, the actual controller of Jinghua Microelectronics, provided financial assistance to Zhihe Electronics and had his employee's family member Chen Xiaoling hold 40% of Zhihe Electronics' shares on his behalf.

Notably, Zhihe Electronics was initially registered with a capital of 3 million yuan, with Chen Xiaoling holding 40% and fully paying the corresponding registered capital of 1.36 million yuan. Additionally, Lv Hanquan, the actual controller of Jinghua Microelectronics, provided a loan of over 7 million yuan to Zhihe Electronics for the purchase of machinery and equipment.

In September 2020, Lv Hanquan transferred all of his 40% stake to the aforementioned individuals and exited, with the loan fully repaid to him.

It is worth noting that in the year of its establishment, Zhihe Electronics became Jinghua Microelectronics' fourth-largest customer, with sales amounting to 2.9731 million yuan.

(Image / Shutterstock, based on VRF agreement)

From 2019 to 2021, Jinghua Microelectronics' sales to Zhihe Electronics were 8.4736 million yuan, 12.1234 million yuan, and 27.7804 million yuan, accounting for 14.16%, 6.14%, and 16.02% of total sales, ranking as the largest, third-largest, and largest customer, respectively.

With the help of related transactions with Zhihe Electronics, Jinghua Microelectronics' revenue began to grow significantly. In 2018, Jinghua Microelectronics' operating revenue was 50.28 million yuan, which increased to 197 million yuan by 2020.

Against the backdrop of significant revenue growth, Jinghua Microelectronics launched an IPO on the STAR Market in 2021 and successfully listed on the Shanghai Stock Exchange's STAR Market in July 2022.

Interestingly, Zhihe Electronics' ending inventory levels for products purchased from Jinghua Microelectronics were higher than those of major distribution customers during the reporting period. In response, regulators requested an explanation from Jinghua Microelectronics. Jinghua Microelectronics stated that Zhihe Electronics sold all its accumulated inventory within the following three months, with no significant hoarding or unsold inventory.

Apart from higher inventory levels than major distribution customers, the chip prices sold by Jinghua Microelectronics to Zhihe Electronics were significantly lower than the unit prices of healthcare SoC chips in each period.

For example, from 2018 to the first half of 2021, the unit sales prices of Jinghua Microelectronics' healthcare SoC chips were 0.6651 yuan, 0.7208 yuan, 1.2751 yuan, and 0.8538 yuan per chip, respectively.

During the same period, the unit sales prices of smart health scale SoC chips sold by Jinghua Microelectronics to Zhihe Electronics were 0.4022 yuan, 0.4090 yuan, 0.4239 yuan, and 0.5729 yuan per chip, respectively. These prices were significantly lower than the company's normal external sales prices, which Jinghua Microelectronics attributed to different product sales structures.

In October 2023, regulators took supervisory measures by issuing warning letters to Jinghua Microelectronics and Lv Hanquan, among others, due to inaccurate disclosures of fund transfers between Jinghua Microelectronics, its affiliates, and Zhihe Electronics.

From the current investigation by the CSRC for suspected information disclosure violations, it seems that the transactions between Jinghua Microelectronics and Zhihe Electronics, a company funded by a loan from Lv Hanquan, the actual controller of Jinghua Microelectronics, may not be as straightforward as they appear. The exact relationship between Jinghua Microelectronics and Zhihe Electronics will only become clear after the CSRC investigation concludes.

2. Post-IPO performance decline and slow progress of fund-raising projects

Where Jinghua Microelectronics' information disclosure violations lie will only become apparent after the regulatory investigation. However, it is undeniable that Jinghua Microelectronics' performance has taken a turn for the worse since its IPO.

Data shows that in 2020, Jinghua Microelectronics' revenue reached 197 million yuan for the first time, with net profit attributable to shareholders exceeding 100 million yuan. Since then, the company's performance has declined.

From 2021 to 2023, Jinghua Microelectronics' operating revenues were 173 million yuan, 111 million yuan, and 127 million yuan, respectively. During the same period, the company's net profits attributable to shareholders were 77.35 million yuan, 22.13 million yuan, and -20.35 million yuan, respectively.

In the first three quarters of 2024, the company's net profit attributable to shareholders turned from profit to loss, amounting to a loss of 7.158 million yuan, a year-on-year decrease of 260.34%.

From Jinghua Microelectronics' main business perspective, its primary sales products are industrial control and instrumentation chips and healthcare SoC chips, which together account for over 98% of the company's revenue.

Its healthcare SoC chips are used in infrared thermometers, body fat scales, blood pressure monitors, pulse oximeters, and other devices. As smart health monitoring devices, body fat scales have been popular among young people in recent years, experiencing robust growth.

According to Prospect Research Institute data, the body fat scale market was worth 6.78 billion yuan in 2020 and grew to 11.227 billion yuan in 2022, with a cumulative growth rate of 65.59% over two years. The blood pressure monitor and pulse oximeter markets have also maintained steady growth.

Despite such strong downstream demand, Jinghua Microelectronics' healthcare SoC chip revenue has declined significantly.

In the first half of 2021, Jinghua Microelectronics' healthcare SoC chip operating revenue was 71.5 million yuan, which dropped to only 27.73 million yuan in the first half of 2024, with the gross margin falling from 63.34% to 36.60%.

In response, Interface News·Bullet Finance attempted to inquire with Jinghua Microelectronics about the significant decline in its healthcare SoC chip operating revenue and gross margin despite strong downstream demand. However, no response was received as of press time.

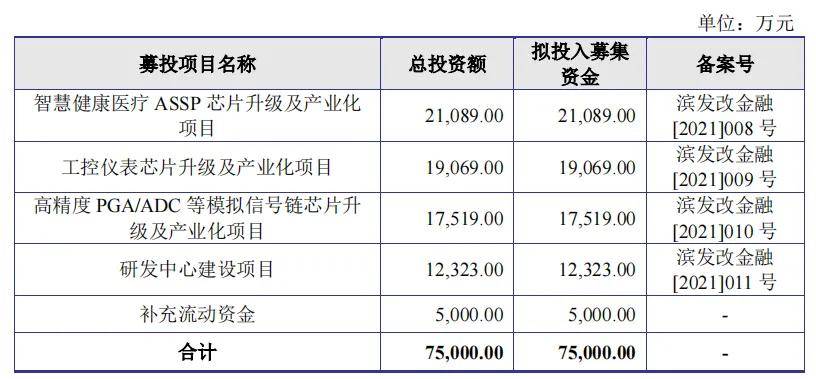

Previously, in its IPO fund-raising projects, Jinghua Microelectronics planned to raise 211 million yuan for the upgrade and industrialization of smart healthcare ASSP chips.

According to the project plan, the company's smart healthcare ASSP chip upgrade would be invested in over three years, with an annual investment of no less than 55 million yuan. Jinghua Microelectronics successfully listed on the STAR Market in July 2022, but as of June 30, 2024, the project investment amounted to only 29.6801 million yuan, significantly lower than expected.

Additionally, the company's other fund-raising projects, excluding the 60% completion of working capital replenishment, have progressed extremely slowly. The average project completion rate is around 11%, with the core business project for the upgrade and industrialization of industrial control and instrumentation chips achieving a completion rate of only around 7%.

In response, the Shanghai Stock Exchange issued an inquiry letter to Jinghua Microelectronics, requesting an explanation for the slow project progress. Jinghua Microelectronics responded that the sluggish progress was due to weak downstream demand.

However, the market size of smart body fat scales indicates that downstream consumer demand is not weak. The significant decline in the company's core business sales revenue and the extremely slow progress of planned upgrade and expansion projects suggest that Jinghua Microelectronics' current operating condition is worrying. The exact reasons will require further detailed responses from the company.

3. Sponsor earns nearly 100 million yuan, leaving investors in the lurch after share price breaks issue price

Although Jinghua Microelectronics has performed poorly since its successful IPO, its financial position remains healthy.

As of September 30, 2024, Jinghua Microelectronics had cash and cash equivalents of 556 million yuan and tradable financial assets of 403 million yuan. During the same period, the company's total assets were only 1.29 billion yuan.

This means that apart from cash and cash equivalents and funds used for financial management, Jinghua Microelectronics' total assets were just over 300 million yuan. During the same period, the company's total liabilities were only 21.79 million yuan.

The substantial cash and cash equivalents have generated considerable interest income for Jinghua Microelectronics. In the first three quarters of 2024, the company's 556 million yuan in cash and cash equivalents generated 2.33 million yuan in interest income, while its 403 million yuan in tradable financial assets generated 10.3 million yuan in investment income.

(Image / Shutterstock, based on VRF agreement)

In the first three quarters of this year, the cash proceeds of over 12.6 million yuan were significant for Jinghua Microelectronics, which only had operating revenue of 96.74 million yuan during the same period. It was precisely due to these over 12.6 million yuan in financial management income that Jinghua Microelectronics' profitability appeared less unsightly.

Jinghua Microelectronics' financial management funds primarily came from its IPO fund-raising, which raised 1.048 billion yuan, exceeding the planned amount by 170 million yuan. As Jinghua Microelectronics' sponsor and underwriter, Haitong Securities received 99.5588 million yuan in sponsorship and underwriting fees.

Apart from Jinghua Microelectronics itself and its sponsor Haitong Securities earning substantially from the IPO, Jinghua Microelectronics' core employees also benefited significantly from the company's listing.

In September 2020, shortly before Jinghua Microelectronics submitted its IPO application, the company established an employee stock ownership platform, Jingning Jingyinhua Enterprise Management Partnership (Limited Partnership) (hereinafter referred to as 'Jingning Jingyinhua'), with over 20 participants, including senior executives and core technical personnel.

For example, Zhao Shuanglong, the company's deputy general manager and non-independent director, holds a significant share in this stock ownership platform.

As of September 30, 2024, Jingning Jingyinhua held 6.3567 million shares of Jinghua Microelectronics, accounting for 6.84% of the company's total share capital, making it the third-largest shareholder. Based on the company's current share price, the equity value of this stock ownership platform is 158 million yuan.

Jinghua Microelectronics' actual controllers, Lv Hanquan and his wife Luo Luoyi, also stand to benefit significantly from the company's listing. As of September 30, Lv Hanquan and his wife directly held 54.15% of Jinghua Microelectronics' shares, with an equity value exceeding 1.25 billion yuan.

From a profit perspective, Jinghua Microelectronics, as a listed company, has obtained financing and sufficient funds to maintain its daily operations. It can also earn substantial interest income annually from the funds raised through its IPO. Haitong Securities earned nearly 100 million yuan in sponsorship fees from sponsoring Jinghua Microelectronics' listing, and the relevant sponsorship personnel also received considerable bonus income.

However, since its listing, Jinghua Microelectronics' share price has remained subdued due to its underwhelming performance.

Its IPO issue price was 62.98 yuan per share, followed by a 10-for-4 stock split and a dividend of around 10 million yuan. After rights adjustment, its issue price was around 45 yuan per share.

As of the close of November 18, Jinghua Microelectronics' share price was only 25.00 yuan per share, indicating that the company is still in a broken issue price phase, and investors who subscribed to Jinghua Microelectronics' shares at the time are still incurring losses.

As a high-tech enterprise, it is understandable to raise funds through an IPO to meet operational and R&D needs. However, the 'performance turnaround' after listing, the receipt of regulatory letters within two years of listing, and the current CSRC investigation have indeed raised concerns among investors.

What will be the outcome of Jinghua Microelectronics' CSRC investigation? Will its performance and share price show signs of improvement? Interface News·Bullet Finance will continue to keep a close watch.

*The lead image in this article is from Shutterstock, based on the VRF agreement.