Ctrip Group, completely blown up!

![]() 11/19 2024

11/19 2024

![]() 587

587

Produced by | Different View Finance

Author | Yacha Baixue

Currently, the online travel industry is showing a strong growth momentum. With the lingering shadows of the "mask" period dissipating, people's sustained release of travel demand, and policy support, the online travel industry is taking off.

As a leading OTA, Ctrip has become one of the biggest beneficiaries of retaliatory tourism consumption. On the one hand, it has achieved both profit and revenue, raking in huge profits. On the other hand, Ctrip's market value has soared, even surpassing Baidu, attracting market attention.

How strong is Ctrip's profit-making ability?

On November 19, Beijing time, online travel service provider Ctrip (Nasdaq: TCOM; Hong Kong Stock Exchange: 9961) released its third-quarter 2024 earnings report.

Revenue for the single quarter was 15.9 billion yuan, up 15.6% year-on-year and 24.3% quarter-on-quarter.

The financial report shows that in the third quarter of 2024, Ctrip's revenue was 15.9 billion yuan, up 16% year-on-year. The third quarter, being the peak tourist season, saw strong tourist demand driving the overall growth of Ctrip's revenue.

Ctrip's revenue mainly comes from five segments: Accommodation reservation, Transportation ticketing, Packaged Tours, Corporate travel, and Others.

Accommodation reservation and transportation ticketing are Ctrip's largest sources of revenue, contributing over 70% of Ctrip's revenue. In the third quarter, benefiting from seasonal factors, Ctrip's accommodation reservation and packaged tour businesses grew the fastest.

Among them, accommodation reservation revenue was 6.8 billion yuan, up 22% year-on-year and 32% quarter-on-quarter, accounting for 42.8% of total revenue; packaged tour revenue was 1.6 billion yuan, up 17% year-on-year and 52% quarter-on-quarter, accounting for only 4.1% of total revenue.

Transportation ticketing is Ctrip's second-largest source of revenue. In the third quarter, the group's transportation ticketing revenue was 5.7 billion yuan, up 5% year-on-year and 16% quarter-on-quarter, accounting for 35.5% of total revenue. This segment was the slowest-growing among all business segments.

Net profit for the single quarter was 6.8 billion yuan, with a net profit of 15 billion yuan in the first three quarters, exceeding the total for the entire year of 2023.

The financial report shows that in the third quarter of 2024, Ctrip's net profit was 6.8 billion yuan, up 47% from the same period last year and 75% from the previous quarter. The total net profit for the first three quarters of this year exceeded 15 billion yuan, while the net profit for the entire year of 2023 was 10 billion yuan.

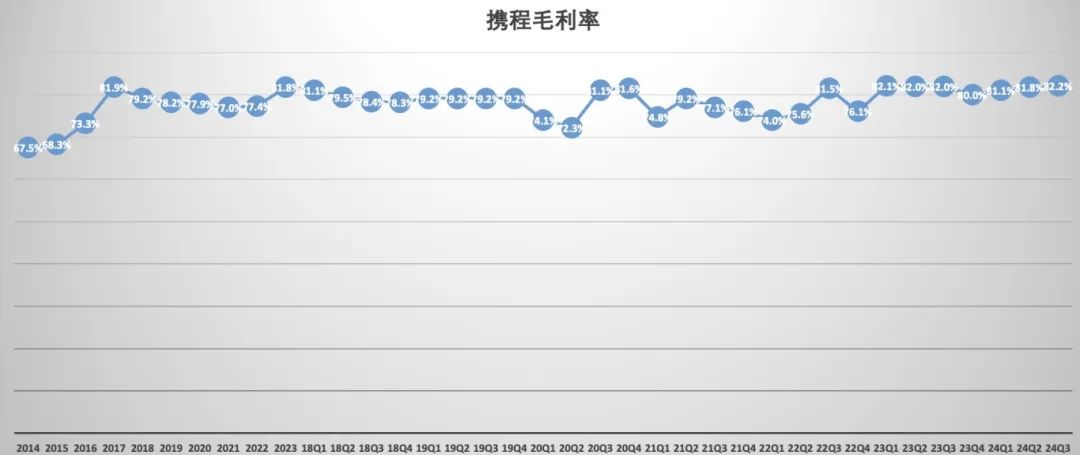

Generally speaking, the higher a company's gross profit margin, the stronger its profitability and the greater its profits. From the perspective of gross profit margin, Ctrip's gross profit margin hit a record high of 82.2% in the third quarter of this year. It should be noted that even during the most severe years of the pandemic in 2020 and 2021, Ctrip's gross profit margin exceeded 77%.

There are two reasons why Ctrip is so profitable.

From a business perspective, accommodation reservation is Ctrip's largest source of revenue. In the hotel and travel sector, although Ctrip faces competitive pressure from multiple platforms such as Meituan, Flying Pigs, and Douyin, the hotels Ctrip cooperates with are mainly high-end hotels with higher unit prices and greater profit margins.

Additionally, Ctrip has done a good job of controlling operating costs and expenses. The financial report shows that Ctrip's operating costs in the third quarter were 2.8 billion yuan, up 13.5% year-on-year, slightly lower than the 16% revenue growth rate.

Operating expenses in the third quarter were 8.1 billion yuan, up 9.5% year-on-year. Among them, R&D expenses were 3.6 billion yuan, up 1.8% year-on-year, with an R&D expense ratio of 23%; sales and marketing expenses were 3.4 billion yuan, up 22.6% year-on-year, with an expense ratio of 21%; and administrative expenses were 1 billion yuan, up 1.7% year-on-year, with an expense ratio of 7%.

What challenges and opportunities does Ctrip face in the future?

In an era of stock competition, Ctrip faces both challenges and opportunities.

While Ctrip is raking in huge profits, it seems increasingly difficult for domestic hotels to make money. The strong pricing and excessively high commission rates of OTA platforms have increased pressure on hotels and travel agencies. Many mid- to high-end hotels are actively reducing their dependence on OTAs by expanding their chain rates and strengthening direct sales through membership systems.

Survey data from Guosen Securities shows that in the first and second quarters of this year, RevPAR (revenue per available room) in the hotel industry decreased by 9% and 12% year-on-year, respectively; ADR (average daily rate) decreased by 3% and 8% year-on-year, respectively.

According to data released by the Ministry of Culture and Tourism, the average room rate of five-star hotels nationwide in the second quarter of 2024 was 601.62 yuan per night, down 2.7% year-on-year; the average occupancy rate was 58.25%, down 3.34 percentage points year-on-year.

Earlier, Marriott International announced that starting in 2024, Marriott Greater China will no longer provide free lounges, double breakfasts, upgrades, and other membership benefits to Platinum Card members and above who make reservations through third parties. In fact, similar regulations have previously been in place for high-star international hotel brands such as InterContinental, Hyatt, and Hilton, where high-tier members who make reservations through third parties cannot enjoy membership benefits or accumulate hotel points.

OTA platforms need to find a balance between their interests and those of hotels and travel agencies.

Currently, the domestic online travel market is highly competitive, with Ctrip facing competition from Flying Pigs, Meituan, Douyin, and others.

Taking Flying Pigs as an example, it has been continuously improving and deepening its cooperation with major global tourism enterprises and destination tourism bureaus for several years. The number of members in Flying Pigs' "Billion Dollar Club" has increased to 22. The sales volume of products for this year's Double 11 event exceeded 100 million yuan for 22 brands, including Shanghai Disneyland Resort, Universal Beijing Resort, and Chimelong Tourism Resort. The number of "Billion Dollar Club" members increased by 8 compared to last year's Double 11, setting a new record for Flying Pigs' promotional sales.

This year, the number of consumers on Flying Pigs' Double 11 increased by 40% year-on-year, with about one-third being new users. This year's Flying Pigs Double 11 sold nearly 1 million "Fly Anytime" and airline ticket secondary cards, nearly 3 million hotel packages, and over 1.1 million theme park tickets and entertainment packages, all setting new records.

Outbound travel may become a new growth point for Ctrip in the future. As early as the end of October 2019, Ctrip proposed a globalization strategy. According to previous financial data released by Ctrip, in the second quarter of 2019, Ctrip's international business revenue accounted for over 35% of the group's total revenue, with international hotel and international air ticket business growth rates exceeding twice that of China's outbound tourism growth rate.

However, the continuous spread of the global pandemic has hindered Ctrip's globalization strategy, impeding the development of related businesses. The revenue contribution from Ctrip's international market is still small. The prospectus reveals that in 2018, 2019, and 2020, Ctrip's total revenue from the international market accounted for 10%, 13%, and 7% of its total revenue, respectively. According to the 2023 financial report, Ctrip's revenue outside of Greater China accounted for about 13%.

Cross-border travel has become a highlight of this year's tourism market. Some of the latest visa-free policies have provided strong support for the development of outbound travel. The list of countries offering visa-free or visa-on-arrival entry to Chinese passport holders is constantly being updated, such as Albania, Angola, and Armenia, providing outbound travelers with more destination options. Some countries have extended visa-free periods or relaxed visa-free conditions, such as Kazakhstan and the Svalbard Islands in Norway, further promoting the development of outbound travel.

In the first half of the year, the number of outbound travelers in China reached 60.71 million, recovering to 74.7% of the level in 2019. According to the Ctrip platform, outbound air tickets and hotel bookings in Q3 have fully recovered to 120% of the same period in 2019.

Ctrip also faces competition in outbound travel.

Flying Pigs data shows that sales of outbound travel products during Double 11 increased by 30% year-on-year in terms of sales volume. In terms of consumer orders, Hong Kong, Japan, Macau, Thailand, and South Korea are popular destinations, while Iceland, Turkey, Cambodia, Fiji, and France have emerged as dark horses, with the fastest year-on-year growth rates.

Ctrip's international OTA platform, Trip.com, has maintained revenue growth, but the growth rate has slowed down. In the first quarter of this year, Ctrip's revenue from Trip.com increased by 80% year-on-year, slowing down to 70% in the second quarter and further to 60% in the third quarter. Ctrip's globalization strategy still has a long way to go.