OTA's invariance cannot adapt to ever-changing circumstances

![]() 11/21 2024

11/21 2024

![]() 636

636

Written by Wu Kunyan

Edited by Wu Xianzhi

Compared to entrepreneurs who rise from humble beginnings and are willing to sacrifice everything, scholars-turned-entrepreneurs often have a stronger sense of direction. Although they may not be considered "prophets," they often make their own forward-looking judgments on the situation, enabling them to change course ahead of time.

Since last year, Liang Jianzhang, who has led Ctrip to consolidate platform resources and emphasize self-operated and standardized services, is undoubtedly a typical example of such entrepreneurs.

Since entering 2024, the cyclical tourism industry has emerged from a narrative of "revengeful" recovery. Ctrip, which has been a "model student" among Chinese stocks for more than a year, particularly needs to explore stock price support beyond revenue scale and growth rate: self-operation and overseas expansion.

Ctrip's approach to strengthening self-operation is to roll up its sleeves and get involved, outputting standardized SOPs to ensure service delivery capabilities on the supply side and reduce decision-making costs on the demand side. The steady growth in performance demonstrates the effectiveness of its increased investment in self-operation. Moreover, this defensively oriented move is actually also mining the value of existing assets, combating the slowdown in revenue growth through efficiency improvements and profit increases.

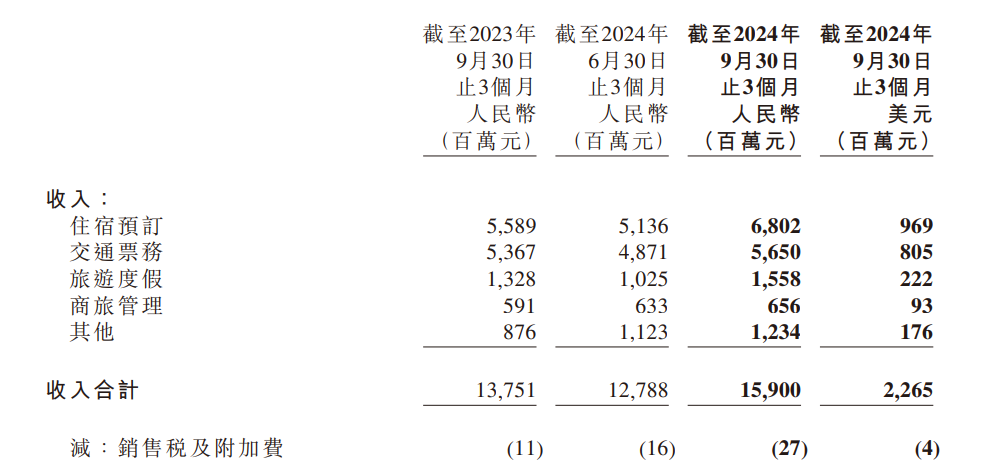

In Ctrip's third-quarter financial report released on November 19, it is not difficult to see the positive factors brought about by strengthening self-operation. The report shows that Ctrip's net operating revenue was 15.9 billion yuan, an increase of 16% year-on-year. Compared to revenue, the boost to profits from self-operation was even more remarkable. This quarter, Ctrip's net profit was 6.8 billion yuan, an increase of 47.8% year-on-year, and the operating profit margin reached a record high of 31.5%.

However, Ctrip's overseas business, which bears the responsibility of its "second curve," did not disclose specific financial performance in this report.

Having prepared in advance, Ctrip met the capital market's expectations for its profit-making machine this quarter. After moving beyond the narrative of scale growth, its new challenge lies in the fluctuations brought about by self-operation to ecological stability and when the increment of globalization can be presented to the capital market.

Self-operation encounters bottlenecks

It was a rainy autumn in Zigong during the National Day holiday. Xiao Chen, who was waiting for a car at a large hotel chain, wanted to find a charging port in the lobby's work area when she unexpectedly received a chat from the hotel manager.

During their casual conversation, the manager asked for Xiao Chen's WeChat and phone number, hoping she would prioritize booking hotels through the hotel chain's membership system. He also emphasized, "Starting from our gold membership level, prices are generally lower than those on online platforms, and there is a certain priority during peak hours."

Shortly afterward, Xiao Chen's car arrived. This guaranteed cross-city "shuttle" service is locally led, with transportation fees within adjacent counties costing only 15 yuan per person and supporting two refunds or changes, making it far more cost-effective than intercity high-speed rail bookings on OTA platforms.

Xiao Chen, who bid farewell to the hotel manager leisurely, did not realize that the two services she experienced were actually new changes arising from the recovery of tourism consumption. They are not evident in the overall market growth but implicitly pose a threat to two businesses of OTA platforms like Ctrip.

The accommodation booking business bears the brunt, as it has been Ctrip's "compass" since its growth phase. The aforementioned chat with the hotel manager can be interpreted as the hotel chain group recommending its membership system to users, guiding them to book accommodations through the chain's own channels rather than OTAs at lower prices. Over time, the impact on Ctrip's core business is easy to imagine.

As we all know, the domestic hotel chain industry started late compared to the internet. The uncertainty on the user side brought about by the "black swan" event before the recovery of tourism consumption further exacerbated the hotel chain groups' dependence on OTAs. The logic behind this is clear: OTAs are one of the most important sales channels for hotel chain groups, and the platform can also protect the groups' rights and interests to a certain extent, such as cancellations and refunds.

However, since the explosion of travel demand, the chain membership system, which once became "historical dust," has been put back on the agenda for chain groups. They are not only vigorously developing membership numbers but also strengthening lean operations targeting high-net-worth users and accelerating the monetization of points. Taking Jinjiang Hotels as an example, since February of this year, it has begun to implement small-amount point cash-ins and allows members to use points to directly pay for room fees.

As of the end of last year, the membership numbers of Jinjiang, Huazhu, and BTG, representing the first tier of local hotel groups, reached 194 million, 228 million, and 151 million, respectively. Although there is inevitable overlap in memberships among users, high-net-worth members of high-end hotel chains have not been counted.

An industry insider told Photon Planet that in the past, especially during special periods, chain groups struggled with a lack of direct user engagement capabilities. They not only needed platform resource tilt in marketing but also had to "borrow channels" for service delivery. This led to OTAs having a strong voice in hotel chain groups.

Now, with the diversification of channels and increased demand certainty, hotel chain groups are eager to break this cycle.

The financial report shows that Ctrip's Q3 accommodation booking revenue was 6.8 billion yuan, an increase of 22% year-on-year and 32% quarter-on-quarter, accounting for 42.8% of total revenue. Admittedly, Ctrip's current accommodation booking business is still performing robustly, but this may just be a continuation of inertia under previous pricing. Furthermore, it is precisely the continuous increase in self-operation under OTA's consideration of strengthening profit performance that has sparked the aggressiveness of hotel chain groups in their membership systems.

Moreover, as tourism demand accelerates diversification, county tourism and the lower-tier markets it represents are important areas of competition for OTA platforms and also where OTA self-operated package tour products are placed – intercity and county shuttles organized locally cannot be ignored. The convenience and cost-effectiveness of travel narrow the information asymmetry of county tourism on the user side. More importantly, this corresponds to the growing demand for independent travel on the user side.

Whether it is the "battle for the microphone" as hotel chains regain control of their memberships or the increasing number of users choosing independent travel solutions, neither is good news for Ctrip's increased investment in self-operation.

The unopened "black box"

Both Ctrip CEO Jane Sun and Liang Jianzhang have repeatedly mentioned business globalization during earnings calls, but from an outside perspective, going overseas is still an undeniable "black box."

It is undeniable that international tourism is still in a growth cycle at a critical moment when domestic tourism growth is slowing down. However, before Ctrip discloses specific financial data, the market still has limited visibility into Ctrip's overseas progress. Judging solely from the operational aspects disclosed in this financial report, Ctrip's international business growth has to some extent outpaced the overall market.

The financial report mentions that Ctrip's overseas hotel and air ticket bookings have fully recovered to 120% of pre-pandemic levels in 2019, and international OTA platform hotel and air ticket bookings have increased by more than 60% year-on-year. In contrast, in the first three quarters of 2024, inbound tourist arrivals are expected to reach 95 million, an increase of 55.4% year-on-year, recovering to 93.4% of the same period in 2019.

Regarding the recovery of the inbound tourism market, the implementation of the 144-hour visa-free transit policy must be mentioned. In April of this year, Ctrip launched the "Shanghai Express" project for "half-day inbound tours," targeting business travelers with no specific arrangements during transit in Shanghai. By providing free services such as transportation, attraction tickets, internet access, and foreign language guides, it strengthens users' perceptions.

Judging from the specific operational routes, although riding on the inbound tourism wave, Ctrip, which generally lacks user touchpoints overseas, is still in the stage of "burning money to make a noise."

It should be noted that Ctrip cannot fully replicate its domestic tourism experience in developing inbound tourism. Overseas users' perception of China largely comes from content platforms such as TikTok and YouTube, giving inbound tourism a strong sense of uncertainty and the allure of discovery and avoidance. Ctrip faces a business paradox between open-loop conversion and closed-loop self-operation.

A British backpacker and YouTube blogger named Mike told Photon Planet that when facing a completely unfamiliar country, they tend to make decisions through content platforms and travel independently. Mike himself is a typical example. Apart from inbound transportation, he not only did not use OTAs for domestic travel but also chose to hitchhike randomly, bypassing most internet-related channels.

Regarding outbound tourism, Ctrip, which attempts to replicate its past successful experience, faces more obstacles in expanding domestically in terms of how to provide domestic users with a standardized experience similar to domestic tourism. This is reflected in the specific action of "buying when possible." Since 2015, Ctrip has successively acquired the UK aviation platform Travelfusion, travel search website Skyscanner, India's largest OTA platform MakeMyTrip, and Dutch ticket sales service provider Travix.

However, the impact of the "black swan" event has obviously interrupted Ctrip's international expansion pace and to some extent affected its progress on the overseas supply side. A strong piece of evidence is that Ctrip's expansion style has changed significantly since the end of 2022 compared to before. Unlike the counter-cyclical acquisition of Travix in 2020, Ctrip is now much more cautious in its investments.

For example, it invested in the Vietnamese shared accommodation and OTA platform M Village in 2023, as well as Vntrip, which was invested in by Ctrip co-founder Fan Min.

The characteristics of these two companies are that their businesses highly overlap with Ctrip, facilitating the output of standardized SOPs. Considering that the revenue growth rate of international OTA platforms in the Asia-Pacific region led the pack at 76% in the previous quarter, it is not difficult to see that Southeast Asia is gradually becoming the core area of Ctrip's global influence.

In contrast, looking at the established giants that Ctrip has to face in globalization, Expedia focuses on the North American market, while Booking dominates the European continent. Although their business models differ, this does not affect the oligopoly formed in these relatively mature markets. These two hard nuts can be tackled slowly, and it is undoubtedly a more realistic choice to prioritize the decentralized and less online-penetrated Southeast Asian market.

Perhaps only when Ctrip has basically secured the Southeast Asian market and re-enters Europe and the United States can we truly open its globalization "black box." Additionally, the promotion of cross-selling of international tourism products by communities and content elements cannot be ignored, meaning that in addition to meta-search, the contentization of Ctrip overseas is also time to be put on the agenda.

Does online tourism need an "iOS"?

On the morning of Ctrip's financial report release, Apple, the epitome of a closed-loop ecosystem, rarely announced the earnings of Chinese developers and the App ecosystem on its Chinese official website, citing research by a Shanghai University of Finance and Economics professor to indirectly respond to the controversial "Apple tax" issue surrounding iOS.

Compared to iOS, where relationships within the ecosystem are more inclined towards positive-sum games, Ctrip, which strengthens self-operation, and third parties represented by hotel chain groups may be more inclined towards cooperation and competition. In particular, Huazhu and Yaduo, which have relatively mature membership systems, have crossed the delicate balance between self-built channels and third parties. Huazhu's central reservation ratio increased by 9% year-on-year to 62.6% last year.

Even Apple needs to justify the pressure its commissions place on ecosystem partners, and the same is true for Ctrip.

Moreover, the focus of the offline consumer economy will never stop at the online realm; offline clues are equally important. Being unable to afford a ground force with sufficient coverage on the cost side is also a consideration for Ctrip in outputting standardized SOPs. This was already evident during Ctrip's previous scale expansion.

As early as the rise of the group-buying economy, Ctrip made significant investments and acquisitions in players in the sector, including Qunar and Tongcheng, retaining their brands and operating rights but gaining a supply fulfillment network. Due to economies of scale, Ctrip once became an oligopoly with a complete supply side, saving labor costs for offline business development and cultivating an unchallenged pricing power, to the extent that hotel chains needed to include their ratings in performance evaluations.

An industry insider told Photon Planet that in 2015, Ctrip's ground force responsible for business development had a thousand members serving 100,000 hotels, or about 100 hotels per person on average. However, this number was limited by the physical radius, which was the core reason why Ctrip could not capture the additional 300,000 low-star hotels through its ground force at that time.

With the diversification of tourism demand, OTA platforms are collectively expanding into lower-tier markets. It remains uncertain how long Ctrip can rely on its supply-side assets. In the long run, the diversification of demand also poses a challenge to Ctrip's standardized products.

Various indications show that strengthening self-operation is undoubtedly a powerful tool for capturing short-term profits but may not guarantee the long-term sustainability of the platform ecosystem. The winds have changed, and it is time for Liang Jianzhang to prepare in advance once again.