Pinduoduo can't compete with JD.com

![]() 11/21 2024

11/21 2024

![]() 475

475

My colleague is a heavy drinker but is afraid of buying fake alcohol. A bottle of Remy Martin that originally costs 600 yuan is reduced by 200 yuan without any discount on Pinduoduo, making it psychologically burdensome to purchase. In contrast, JD.com's self-operated store sells it for 520 yuan, which looks more appealing, providing both a discount and reducing psychological stress, thereby increasing purchasing motivation.

In terms of genuine product guarantees and better consumer experience, Pinduoduo still lags behind JD.com.

Over the past few years, the retail e-commerce industry has been characterized by 'questioning Pinduoduo, understanding Pinduoduo, and imitating Pinduoduo.' In this round of imitation, JD.com was once criticized for blindly following suit, with 'price competition' making it difficult for consumers to feel at ease with purchases and undermining the platform's positioning as a high-quality product provider.

However, times have changed. In the competition for low prices, traffic, and market share among e-commerce platforms, JD.com has achieved revenue and profitability growth at its own pace, slapping the face of doubters.

1. Different Low Prices

Amidst the economic chill of recent years, Pinduoduo has been making inroads both domestically and internationally with products like 9-mao garbage bags and 4.6-yuan cotton slippers. Initially, people believed this was just a temporary surge in growth for a newcomer with a small base, posing no threat to the industry.

However, when Pinduoduo's market value surpassed Alibaba, everyone realized that the industry's internal competition and stagnation, fueled by Pinduoduo's rise, were not just cyclical events but an inevitable historical trend.

Due to insufficient domestic demand and export obstacles, excess production capacity, expanded earlier due to optimistic expectations, remains unused, leading to a buildup of social inventory that is still being cleared. The era of booming real estate has also passed, manifesting in weak consumer spending and decreased purchasing power.

Pinduoduo's white-label merchants are among the most severely affected by overcapacity. Under the platform's traffic-equalizing price comparison system, they do not need to incur excessive store operating costs, motivating them to offer 'the lowest price on the entire network' close to cost.

Merchants need to clear inventory, while consumers are short on money. Pinduoduo provides a trading platform, making it a perfect match for all three parties.

However, as platforms relentlessly pursue low prices without baseline , the already slim profits of merchants gradually disintegrate, with shoddy products becoming increasingly common.

For consumers, the original mindset of 'as long as the price is low enough, losses and flaws are insignificant' has been undermined by the worsening phenomenon of shoddy products, lowering the consumption experience.

A paradoxical phenomenon is that while consumers set alarms to snatch up packages of tissue for one yuan, they also learn frame-by-frame on Xiaohongshu how to identify toxic tissues.

What seems like a bargain becomes a consumer headache, and the demand for 'relatively cheap and safe enough' products begins to resurface.

Due to the platform's initial disadvantage of higher average order value, JD.com faced risks of no growth amid the industry's sluggish growth. From the perspective of GMV and revenue, JD.com had reached its peak scale.

However, high-quality demand in society has not completely disappeared but has been suppressed. Stimulated by the national 'trade-in subsidy' policy, this demand has been unleashed once again.

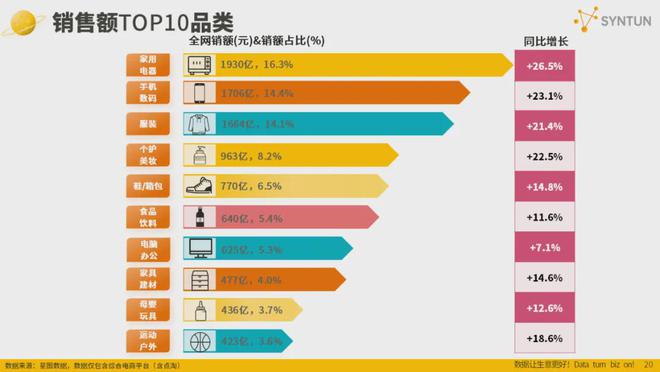

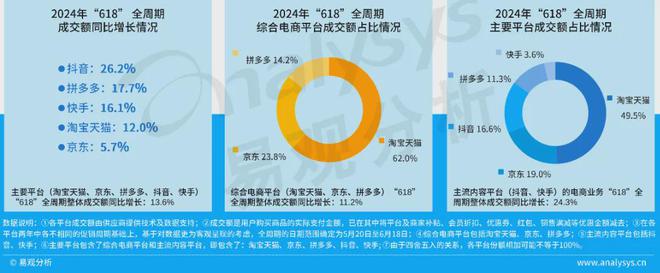

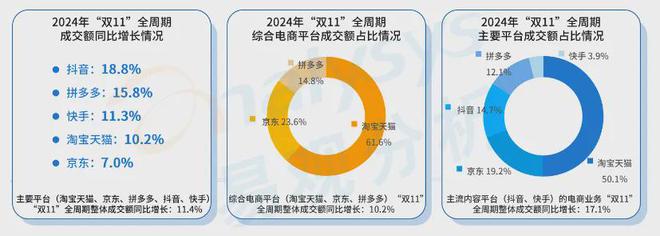

This year's Double 11 saw cumulative sales of 1.4418 trillion yuan across platforms, a year-on-year increase of 26.6%. Among the top 10 sales categories, household appliances ranked first.

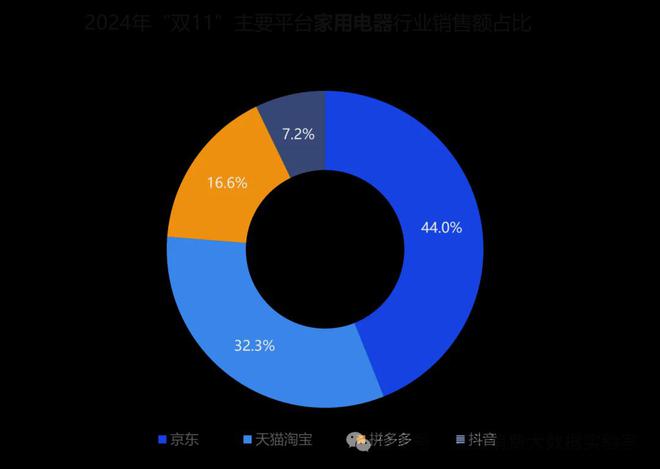

Due to its dominant position in 3C and home appliance categories, JD.com is expected to be the platform that benefits the most from the trade-in policy, something Pinduoduo can't compete with.

Source: Fudan Consumption Big Data Laboratory

During this year's Double 11 on JD.com, the number of shopping users increased by over 20% year-on-year, and the number of purchase and sales live streaming orders increased by 3.8 times. Among them, transactions in 519 home appliance and furnishing categories increased by 200% year-on-year.

When JD.com first implemented its low-price strategy, some believed it would directly compete with platforms like Pinduoduo and Douyin. However, the industry soon realized that JD.com's low-price strategy was unique.

The platform offers a one-stop, fully managed service where self-operated stores handle pricing, marketing, transactions, after-sales, and almost all other aspects. By delving deep into the supply chain and cooperating directly with factories, JD.com minimizes intermediate costs, creating more room for price reductions.

This is akin to Sam's Club's exclusive large packs of potato chips.

Bulk procurement helps reduce procurement costs per unit product, achieving economies of scale. The platform's selected bestsellers also have a sales base, allowing merchants to stock up in advance or continuously produce to improve production efficiency per unit time. This model allows factories to focus on production, letting professionals do what they do best.

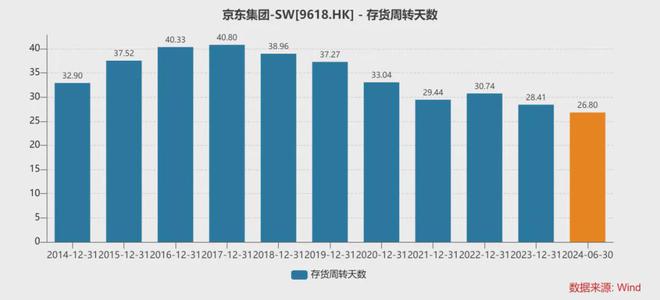

At the same time, it also accelerates JD.com's inventory turnover, further improving its operational efficiency.

The integrated purchase and sales business strategy helps merchants reduce costs and increase efficiency, allowing the platform to directly control product quality, providing users with a shopping experience that is both affordable and high-quality, making it a perfect match for all three parties.

As of September this year, JD.com's quarterly active user count and user shopping frequency have maintained double-digit year-on-year growth for three consecutive quarters.

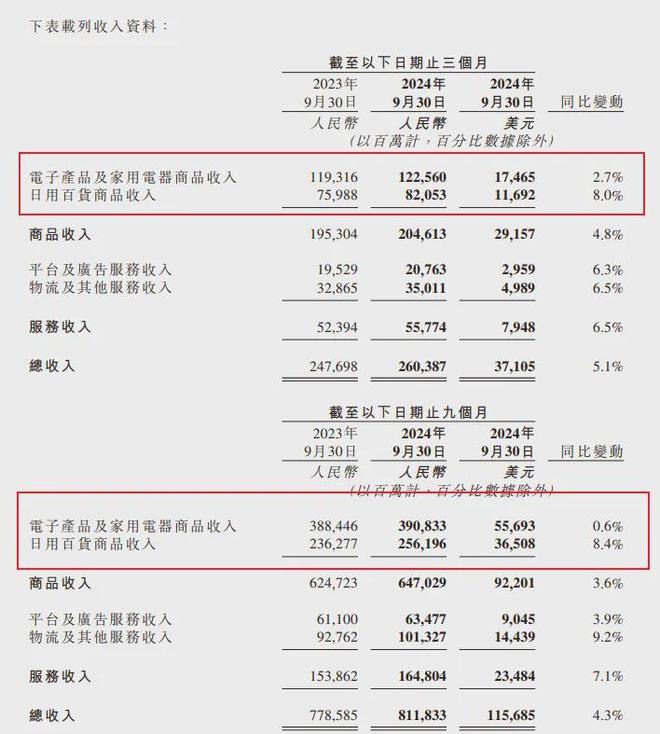

In terms of performance, JD.com's revenue in Q3 this year was 260.4 billion yuan, an increase of 5.1% year-on-year. Among them, the retail segment achieved revenue of 224.986 billion yuan, a year-on-year increase of 6.1%.

Profit performance was even more impressive. The gross profit margin increased year-on-year to a record high of 17.3%, operating profit reached 12 billion yuan, an increase of 29.5% year-on-year, with an operating profit margin of 4.6%. Non-GAAP net profit was 13.2 billion yuan, an increase of 23.9% year-on-year, with a net profit margin reaching 5.1% for the first time.

This is the result of in-depth supply chain involvement, procurement process optimization, and cost reduction, leading the enterprise into a profit release phase.

Compared to the platform model that earns advertising revenue through person-to-product matching, as a unique heavy-asset platform player in the industry, JD.com's self-operated business is premised on scale advantages and efficiency supremacy, requiring deeper involvement in the supply chain and operational details to ensure its own profits while also benefiting merchants.

This low-price model, which does not harm the interests of third parties, also lays the groundwork for JD.com to eliminate its disadvantages and achieve a turnaround against the odds.

2. Eliminating Disadvantages

Alibaba and Pinduoduo are the two largest platforms in terms of advertising revenue in the e-commerce industry, with this revenue accounting for 30% to 50% of their total revenue.

In contrast, JD.com's dependence on advertising is much smaller, consistently stabilizing at 7-8%, which is quite unique.

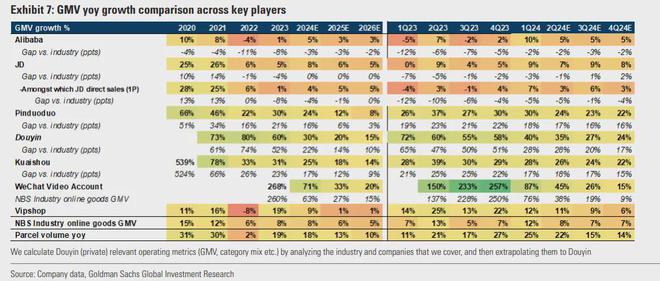

In Q1 and Q2 this year, the growth rates of advertising revenue for Alibaba and Pinduoduo both declined. CMR, a subsidiary of Taobao Group, reported revenues of 63.6 billion yuan and 80.1 billion yuan in Q1 and Q2, respectively, with year-on-year growth rates falling from 5% to 0.6%, and Pinduoduo's year-on-year growth rate falling from 131% to 86%.

However, from Q4 last year to Q3 this year, the growth rate of JD.com's platform and advertising services revenue has been accelerating, at -4%, 1.2%, 4.1%, and 6.3%, respectively. This growth rate was achieved despite a 20.5% year-on-year decrease in internet advertising spending by advertisers in the first half of this year and a reduction in advertising budgets across the industry.

This performance is attributed to the returns from investments in 3P businesses. More importantly, third-party merchants are willing to invest in JD.com because price differences between platforms have narrowed, and JD.com's unique advantages in quality positioning and logistics timeliness have been amplified once again.

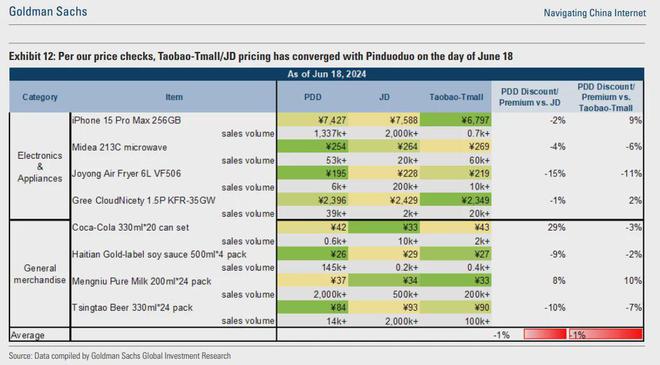

On June 18th this year, the pricing of multiple SKUs on the three major platforms was basically the same, with none having the advantage of 'the lowest price on the entire network,' meaning that JD.com's early price disadvantage began to dissipate.

Without a price advantage, superior service becomes more competitive.

With the lowest profit margin among the three major platforms, JD.com has become an evergreen in the e-commerce industry, relying on its differentiated positioning in service quality and user experience.

As long as pricing converges, JD.com still has irreplaceable value in terms of quality positioning and logistics advantages.

However, it should also be noted that for JD.com, as the largest single retailer in China with a scale of trillions, growth has become difficult to achieve.

In a recent report, Goldman Sachs predicted that JD.com would not outperform the industry's growth rate over the next three years.

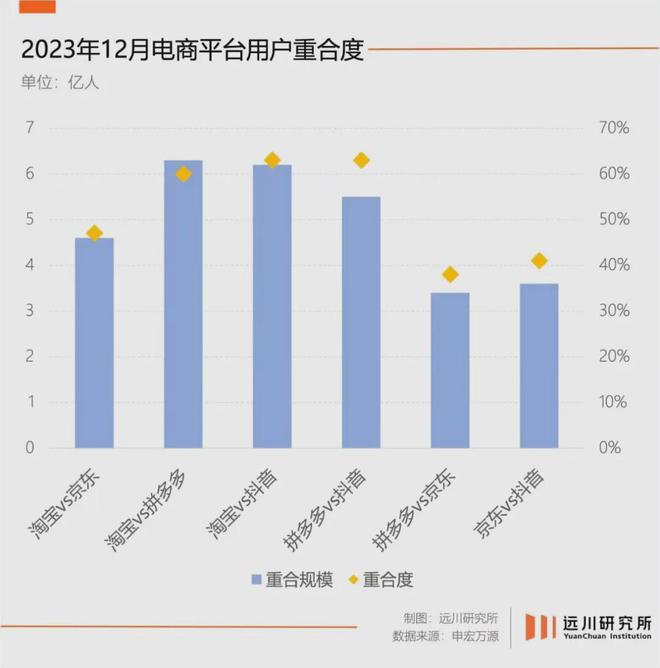

However, it can also be seen that live streaming e-commerce, which had strong momentum earlier, has slowed down. Following this trend, JD.com, which has a high degree of overlap with live streaming e-commerce customers, will welcome the return of some consumers. Even if it is difficult to outperform the industry, maintaining the existing market should not be a problem.

Compared to shelf e-commerce, the fatal flaw of interest-based e-commerce is the lack of supply chain and logistics speed advantages. The low prices established on this basis are not sustainable, and the costs will ultimately be passed on to consumers.

The key to retail lies in the long-term sustainability of repeat purchases. Traffic advantages alone are insufficient; consumers who have been exploited will still return to traditional shelf e-commerce.

Judging from the two major sales promotions this year, JD.com's current situation is improving, and its market share is gradually stabilizing, detaching from the risk of decline.

Born in the era of consumption upgrading, JD.com early on occupied the high ground of average order value and purchasing power with its 3C digital and self-operated model. Even as Pinduoduo emerged as a dark horse in the lower-tier market, it did not shake JD.com's faith in 'consumption upgrading.'

However, in different eral contexts, consumption upgrading has different meanings, which JD.com has demonstrated through practical actions.

But merely preserving the existing share and consolidating the brand image are not enough for valuation remodeling . JD.com's valuation pressure also comes from the macroeconomic environment.

3. Overwhelming Valuation Pressure

Double 11 is an annual event, and even with trade-in subsidies this year, it may not significantly exceed JD.com's annual performance expectations.

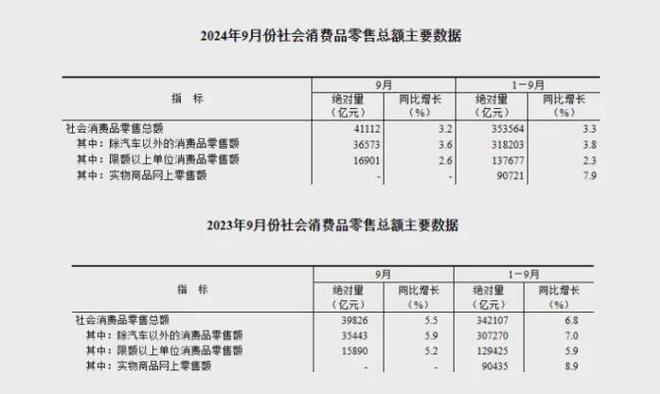

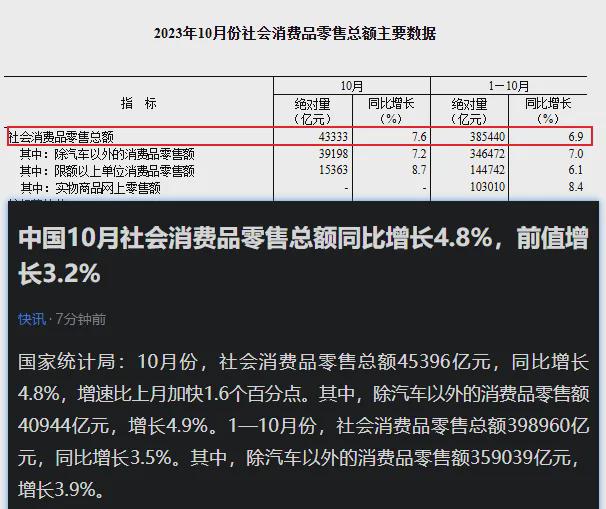

The e-commerce industry is closely linked to retail sales and the economy. However, as of September this year, the year-on-year growth rate of online retail sales was negative, and as of October, retail sales growth was also slowing down, with no significant recovery in the consumer economy.

From the breakdown of e-commerce revenue, JD.com's original and dominant electronics and home appliance categories have regained growth momentum. Revenue from daily necessities categories has maintained high single-digit year-on-year growth for three consecutive quarters, exceeding the industry average. Revenue from supermarkets and clothing categories has achieved double-digit year-on-year growth.

Currently, JD.com's revenue consists of multiple businesses such as JD Logistics, JD Health, Dada, etc., but they have almost all been spun off for separate listings. Simply investing in these businesses should choose the stocks of these subsidiaries. JD.com stocks focus more on the development of the core e-commerce business.

Judging by the latest e-commerce revenue, JD.com's current stock price-to-earnings ratio, which is far below the industry average, seems to be underestimated. However, such a valuation discount is obviously related to the current macroeconomic environment, reflecting reasonable concerns that the company may not be able to overcome long-term macroeconomic pressures.

Nevertheless, entering the profit release phase also allows for the prospect of higher shareholder returns from JD.com.

In the first half of this year, JD.com made significant shareholder returns, repurchasing $3.3 billion in shares, reducing its total share capital by 7%. In August, it announced a new share repurchase plan worth up to $5 billion (including American Depositary Shares), an increase of nearly $2 billion from the previous $3.3 billion. Strong repurchases to support fundamentally sound stocks should eventually stabilize.

Conclusion

Referring to positive examples like Costco and negative examples like Target in the U.S. stock market, a low profit margin in the retail industry serves as a moat and long-term growth potential. A high profit margin, underpinned by a high markup rate, inevitably leads to a competitive disadvantage.

China's retail industry is generally undervalued, with the PE ratios of the three major e-commerce platforms all around 10. The entire market still fails to recognize the stability and countercyclical nature of retail stocks.

However, everyone is aware of the valuation pressures faced by these companies. In today's consumer environment and fierce competition, JD.com still faces difficulties.

Nationally, corporate performance was generally poor in the third quarter. Among the constituents of the MSCI China Index, nearly one-third of companies reported earnings below market expectations; 34% of A-share companies also fell short. In terms of revenue, nearly 34% of companies in the MSCI China Index and close to 40% of A-share companies reported revenue below market expectations.

Amidst an economic downturn, people's preference for quality has decreased, while their pursuit of low prices has increased. If stimulus policies fail to significantly boost consumer confidence, JD.com will lack momentum, and maintaining revenue at the trillion-yuan scale would be considered successful, necessitating a conservative valuation for its growth.

If further valuation enhancement is desired, clear signs of China re-entering a reflationary phase must be observed. Until then, investors are advised to remain on the sidelines.