Former 'Forbes Rich List' member faces removal bid by Bengbu state-owned assets, founder of Taifu Technology loses control

![]() 11/27 2024

11/27 2024

![]() 490

490

Produced by | Bullet Finance

Art Director | Qianqian

Editor | Songwen

On November 15, leading global filter manufacturer Taifu Technology announced significant news: its controlling shareholder, Anhui Peitian Investment Group Co., Ltd. (hereinafter referred to as 'Peitian Group'), filed a motion at the shareholders' meeting to remove Sun Shangchuan, the company's former actual controller, from his position as a director. Notably, the motion was not passed due to opposing votes from directors Sun Shangchuan, Tong Endong, Xiao Jing, and Qian Nankai.

As the former actual controller of Taifu Technology, why did Sun Shangchuan face a removal bid from the current controlling shareholder? And why couldn't the motion proposed by Bengbu state-owned assets, behind Peitian Group, pass smoothly?

Furthermore, as a leading global filter manufacturer, Taifu Technology has seen a continuous decline in performance in recent years. Will this removal of the former actual controller's director position by the controlling shareholder impact the company's daily operations?

1. Former Forbes rich list member faces removal bid, founder loses corporate control

Public records show that Taifu Technology was founded in 2001. At that time, domestic mobile communications had just started, and the market size was rapidly expanding.

With an engineering background, Sun Shangchuan focused on communication base station filters. Initially, he primarily manufactured filter components as an OEM for Forem, an established Italian mobile communication base station filter company.

After years of development, Taifu Technology evolved from an initial foreign filter component OEM to the first domestic company to independently develop and produce base station filters.

Driven by Taifu Technology, the price of base station filters plummeted. Before 2006, the average price of base station filters exceeded 6,000 yuan, but by 2010, this price had dropped to 300 yuan, with Taifu Technology playing a significant role in this decline.

It's no exaggeration to say that Taifu Technology, to some extent, drove the development of China's mobile communications industry. At its peak, Taifu Technology was the world's largest filter manufacturer and supplier, holding 80% of the patents in this field and accounting for more than 20% of the global market share. As a result, Sun Shangchuan made it onto the 2011 Forbes Rich List.

In 2016, with a dominant position in the filter sector, Taifu Technology contemplated a transformation. Sun Shangchuan set his sights on consumer electronics and automotive components, raising 3.513 billion yuan at a price of 30.63 yuan per share for OLED display modules.

During this private placement, Peitian Group, controlled by Sun Shangchuan, and shareholders participating in the private placement signed a guarantee agreement for 'principal + 6% annualized yield' or 'principal + 8% annualized yield.'

Due to business adjustments, Taifu Technology's performance in 2017 did not meet expectations, and the company's share price fell continuously. According to the agreement, private placement shareholders sued Peitian Group and Sun Shangchuan for compensation for investment funds, interest, and other expenses. As a result, Peitian Group faced a debt crisis.

(Image / Shutu.cn, based on VRF Agreement)

With the help of Bengbu state-owned assets and China Cinda, Peitian Group successfully resolved its debt crisis. However, after multiple rounds of negotiations, on October 16, 2024, Peitian Group became 100% owned by the Bengbu state-owned asset platform, and the actual controller of Taifu Technology changed from Sun Shangchuan to the Bengbu State-owned Assets Supervision and Administration Commission, with the founder Sun Shangchuan 'out of the game.'

Shortly after acquiring Peitian Group's shares, on November 5, Peitian Group proposed convening an extraordinary general meeting of shareholders, one of the proposals being the removal of Sun Shangchuan, the former actual controller and chairman, from his position as a director, with additional directors to be appointed.

At the latest board meeting, due to opposition from four directors, the removal motion was not passed. In response, Bullet Finance from Interface News inquired with Taifu Technology via email whether the controlling shareholder would continue to apply for the removal of the former actual controller's director position. As of press time, no response had been received from Taifu Technology.

2. Bengbu state-owned assets' removal of the founder met with management team resistance, and debt disputes continue

As the soul of Taifu Technology, Sun Shangchuan's influence on the company is comprehensive. He single-handedly built Taifu Technology from a small company into one with a market value exceeding 10 billion yuan, establishing its position as a leading filter manufacturer.

Furthermore, most of the company's current directors and management team were promoted by Sun Shangchuan. For example, Tong Endong, the current vice chairman and chief engineer, joined Taifu Technology in 2006 and rose from technical director to vice chairman and chief engineer.

Xiao Jing, the company's director and rotating CEO, also joined Taifu Technology in 2010, progressing from R&D manager to director and rotating CEO. Notably, most of the company's senior executives have served at Taifu Technology for many years and have close relationships with Sun Shangchuan.

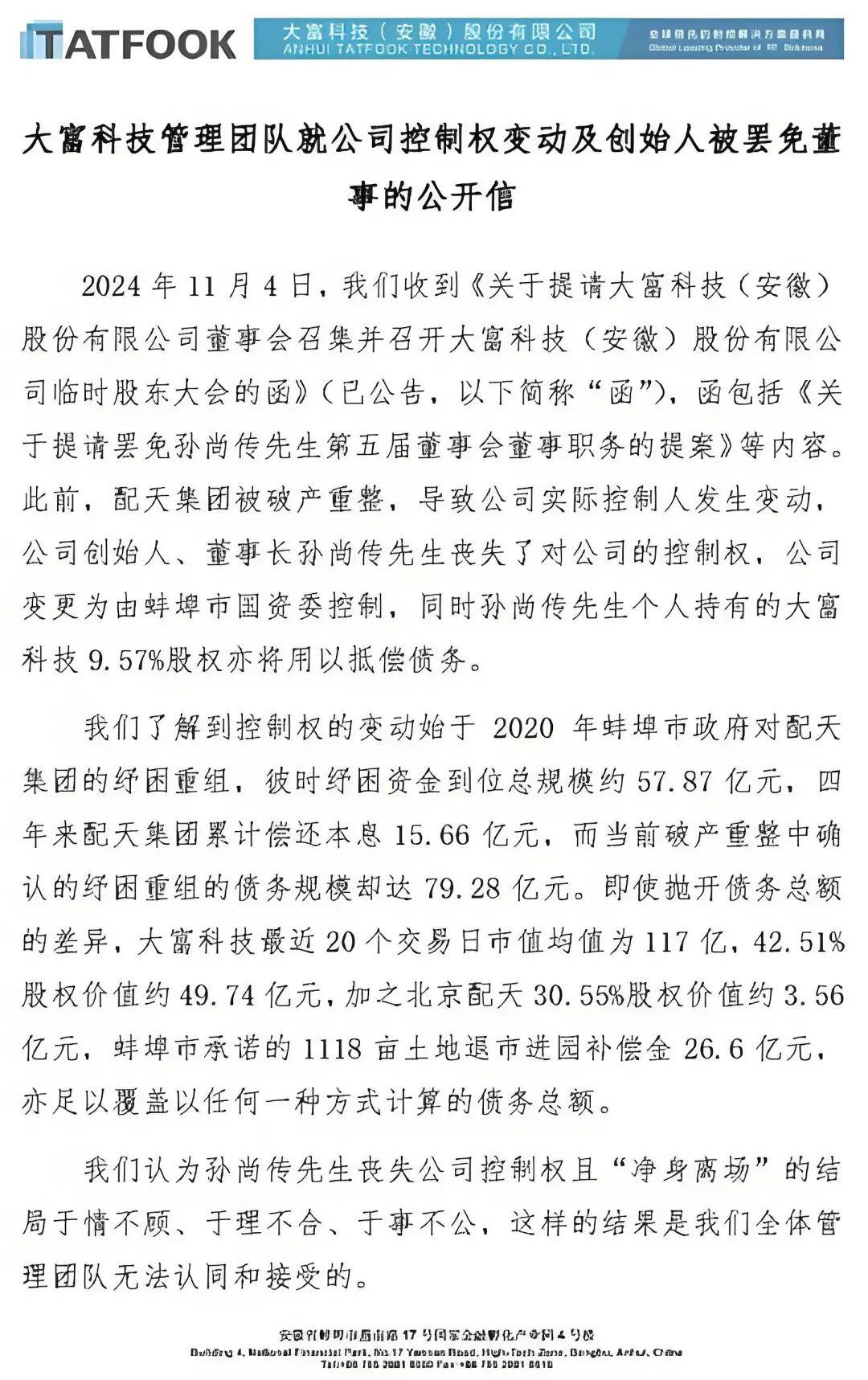

Previously, Taifu Technology's official WeChat account 'TATFOOK' published an open letter from the management team regarding changes in corporate control and the removal of the founder as a director. The letter detailed the entire process of the change in control of Taifu Technology.

On April 12, 2024, Bengbu Yuanda Venture Capital, one of Peitian Group's creditors, applied to the court for Peitian Group's bankruptcy reorganization, citing Peitian Group's inability to repay the due debts to Bengbu Yuanda Venture Capital and its obligation to repay 1.898 billion yuan of restructured debt principal and corresponding restructured grace period compensation by April 7, 2024, clearly demonstrating a lack of solvency.

On April 26, the Yuhui District Court announced the appointment of the Peitian Group's liquidation group as the bankruptcy administrator. Since then, Peitian Group has also made it clear that such a fast-paced bankruptcy reorganization is unprecedented in national bankruptcy reorganization cases and is not normal.

On June 7, the court ruled on the substantive merger and reorganization of five companies, including Peitian Group. On September 6, 2024, the court approved the "Draft Merger and Reorganization Plan." On October 10, the court ruled that 100% of Peitian Group's equity would be transferred to Bengbu Investment Group Co., Ltd., with the transfer completed on October 12.

The open letter stated that in 2020, Peitian Group encountered a debt crisis, and Bengbu state-owned assets provided relief and reorganization to Peitian Group with a relief fund of 5.787 billion yuan. In the following four years, Peitian Group repaid a total of 1.566 billion yuan of principal and interest.

In this round of Peitian Group's bankruptcy reorganization, the debt scale reached 7.928 billion yuan. Additionally, Taifu Technology's average market value over the past 20 trading days was 11.7 billion yuan, and the equity value held by Peitian Group and the 2.66 billion yuan compensation for the withdrawal of 1,118 mu of land promised by Bengbu City were sufficient to cover any debts. However, the relevant content has since been deleted.

(Image / Open Letter Circulated Online)

To support the company's former actual controller and chairman, Sun Shangchuan, against removal, 13 core executives, including Director and CEO Xiao Jing, Vice Chairman and Chief Engineer Tong Endong, General Manager of Taifu Fangyuan Sun Hu, and Deputy General Manager Shi Jincheng, announced their solidarity with founder Sun Shangchuan.

Subsequently, according to multiple media reports, following this incident, the company's internal staff became unstable, and many have been looking for opportunities outside.

Currently, Taifu Technology's management does not recognize the debt amounts confirmed by China Cinda and Bengbu. Previously, according to NBD News, Taifu Technology was unable to ascertain the specific calculation methods for related debts and interest during the bankruptcy reorganization process.

(Image / Shutu.cn, based on VRF Agreement)

Currently, both parties do not recognize each other's debt plans, and only the parties involved know the truth. Regardless, the actual controller of Taifu Technology has changed from Sun Shangchuan to the Bengbu State-owned Assets Supervision and Administration Commission.

Historically, when the control of a listed company changes, its core positions, such as the chairman, inevitably change. Therefore, after acquiring control of Taifu Technology, the new actual controller removed Sun Shangchuan from his position as a director, citing reasons such as his unavailability and inability to be contacted.

However, the removal of Sun Shangchuan as a director was not achieved due to opposition from some Taifu Technology directors. In response, Bengbu authorities stated that the company's management team, as professional managers, should be loyal to the company rather than individuals.

Xiao Jing, the rotating CEO, stated that Sun Shangchuan is the founder and soul of the company, and that the company's middle and senior management were trained and promoted by Sun Shangchuan, who also provided internal employees with freedom to perform.

With the Taifu Technology management team solidifying their solidarity with Sun Shangchuan, it will not be easy for the new actual controller to remove him from the company.

3. Frequent failed foreign investments, with a cumulative non-deductible net profit loss of over 1.7 billion yuan in five years

There are many contradictions between the new and old actual controllers of Taifu Technology, and the company's operations are not ideal.

Since 2016, Taifu Technology's performance has been extremely unstable, which is related to the company's frequent ineffective foreign investments.

As a leading global filter manufacturer, leveraging the wave of domestic mobile communications development, Taifu Technology developed rapidly after 2010, especially after the popularization of 4G networks. In 2014, Taifu Technology's net profit attributable to shareholders reached 536 million yuan, a record high.

With the basic completion of 4G base station construction, Taifu Technology's operating performance began to decline. Taifu Technology was also actively seeking a second growth curve, for which it engaged in various foreign mergers and acquisitions.

(Image / Shutu.cn, based on VRF Agreement)

Wind data shows that from 2014 to 2018, Taifu Technology invested over 1.7 billion yuan in foreign investments. During the merger and acquisition process, Taifu Technology pursued whatever was hot at the time.

In 2015, new materials led by graphene were all the rage, and the share prices of graphene companies like Fangda Carbon and Tongfang Optoelectronics soared. In May 2015, Taifu Technology announced the establishment of Dasheng Graphene New Materials Co., Ltd. in a joint venture with other companies with a cash investment of 600 million yuan, with Taifu Technology holding a 49% stake.

Subsequently, due to the unsuccessful operation of the graphene subsidiary and its subpar performance, Wind data shows that Taifu Technology made impairment provisions of 75 million yuan, 78 million yuan, and 343 million yuan respectively for its equity investments in this subsidiary from 2017 to 2019.

Afterward, Taifu Technology successively acquired driverless and OLED flexible screen enterprises, but the actual results were not ideal. For example, the camera enterprise Dali Ling Industrial, which the company acquired, eventually went bankrupt.

According to incomplete statistics, through continuous foreign mergers and acquisitions and capital increases in subsidiaries, Taifu Technology has successively involved itself in hot fields such as virtual reality, the Internet of Things, graphene, polymer new materials, OLED, and driverless technology. Basically, it pursued whatever was hot at the time, but none of these ventures were successful.

With the downturn in the main business of filters and the successive failures of acquired assets, the company continuously made asset impairments. Under this influence, from 2016 to 2021, Taifu Technology's non-deductible net profit was almost in the red every year.

Roughly calculated, from 2016 to 2021, the company's non-deductible net profit loss exceeded 1.7 billion yuan. This loss amount even surpassed the total non-deductible net profit since the company's listing.

(Image / Shutu.cn, based on VRF Agreement)

If it weren't for Taifu Technology's completion of a 3.513 billion yuan private placement in 2016, just this 1.7 billion yuan operating loss would have been devastating for Taifu Technology.

Due to continuous losses, Taifu Technology's share price was below 10 yuan per share for a long time, compared to a peak price of over 50 yuan per share.

Even now, Taifu Technology has yet to emerge from its continuous loss dilemma. In the first three quarters of 2024, Taifu Technology's non-deductible net profit loss was 236 million yuan.

As the company's founder, Sun Shangchuan single-handedly built Taifu Technology into a leading global filter manufacturer. However, under his leadership, Taifu Technology made frequent decision-making errors, leading to round after round of failed foreign investment and mergers and acquisitions, plunging the company into a continuous loss dilemma.

Now, with the new controlling shareholder in place, how will the company's management change, and can Taifu Technology's operations return to normal? Bullet Finance from Interface News will continue to pay close attention.

*The lead image in the article is from: Taifu Technology's official website.