How Many 'Roadblocks' Does Caocao Chuxing Face in Its Second IPO Attempt?

![]() 11/21 2024

11/21 2024

![]() 641

641

Strengthen Foundations Before Running

Editor: Cola

Fengpin: Shiwan

Source: Rhodium Wealth - Rhodium Wealth Research Institute

Going public is a marathon that tests both endurance and strength.

On October 30, Caocao Chuxing updated its Hong Kong IPO prospectus, marking the second submission within the year.

However, on November 19, according to the Shanghai Stock Exchange website, Geely's Caocao Chuxing's 8-12th phase asset-backed special plan (carbon neutrality) project was terminated. The project, with a planned issuance amount of 7 billion yuan, was accepted on June 12, 2024.

As one of the giants in the transportation industry, Caocao Chuxing, backed by the Geely Group, has not been quick in its march towards going public. In contrast, much smaller competitors like Dida and Ruqi Chuxing have already achieved their long-cherished goals. They say that good things come to those who wait, but is that really the case? What are the bottlenecks? And what are the odds of success in this second IPO attempt?

01

Continuous Losses, Concerning Financial Health

Can an IPO Solve It?

The perennial challenge of "increasing revenue but not profits" should be the primary consideration.

As one of the three major travel giants, Caocao Chuxing has impressive revenue-generating capabilities. From 2021 to the first half of 2024, its revenues were 7.153 billion yuan, 7.631 billion yuan, 10.668 billion yuan, and 6.16 billion yuan, respectively.

However, it has been mired in losses. The losses for the same periods were 3.007 billion yuan, 2.007 billion yuan, 1.981 billion yuan, and 778 million yuan, respectively, totaling 7.773 billion yuan over three and a half years. Although the loss in the latest half-year period narrowed, it still stood at over 700 million yuan, which is not insignificant.

Due to the continuous losses, the company's financial health is concerning. Firstly, the company is burdened with debt. From 2021 to the first half of 2024, the company's short-term debt and the short-term portion of long-term debt were 2.4 billion yuan, 3.5 billion yuan, 5.2 billion yuan, and 5.6 billion yuan, respectively, while the long-term portion of long-term debt was 1.4 billion yuan, 2.1 billion yuan, 2.4 billion yuan, and 2.9 billion yuan, respectively. As of the end of June 2024, the latest prospectus revealed that Caocao Chuxing's borrowings (including interest) amounted to 8.832 billion yuan, with a total liability of 12.623 billion yuan.

The prospectus candidly stated, "We may issue new asset-backed securities and asset-backed notes from time to time in the future and obtain bank loans to support our business operations. Our debt may make us more susceptible to adverse developments in the overall economy or industry conditions (such as a significant rise in interest rates) and limit our flexibility in planning or responding to business or industry changes, adversely affecting us."

This is not an exaggeration. According to Lanjing Finance, as of the end of February 2024, Caocao Chuxing's cash and cash equivalents on its books were only 899 million yuan, while its short-term borrowings for the same period amounted to 5.176 billion yuan, resulting in a funding gap of 4.277 billion yuan and posing significant challenges to its operating liquidity. As of the end of June 2024, cash and cash equivalents stood at 1.5 billion yuan. Caocao Chuxing stated that the company may face the risk of insufficient liquidity in the future.

Ultimately, the company's own weak blood-making ability and high expenses force it to maintain business operations through borrowings, struggling under a heavy load.

To make matters worse, the financing environment is no longer lenient. According to Lanjing Finance, Caocao Chuxing has undergone three rounds of domestic financing, with the most recent Series B funding occurring in August 2021, raising 1.8 billion yuan, over three years ago.

Considering all factors, it is evident that going public has become a "lifeline" to alleviate debt pressure, and there is logic behind this persistent push for an IPO. Focusing on this IPO, part of the fundraised funds will be used to repay three bank loans with principal amounts of 200 million yuan, 300 million yuan, and 200 million yuan, respectively, all with a loan term of one year and repayment dates in November and December of this year and April 2025.

However, going public is also a show of strength. Even if the IPO is successfully navigated, capital is not a panacea. To achieve long-term and healthy development, improving the company's own blood-making ability is a major "roadblock" for the IPO. Blindly burning money for growth and sacrificing quality for scale is undoubtedly a dangerous game.

02

Scale vs. Quality

Beware of the Hidden Risks of Third-Party Dependence

Fortunately, the travel market remains robust, and Caocao Chuxing has benefited greatly from this growth.

In the first half of 2024, the company further accelerated its city expansion, operating in 83 cities and newly entering 32 cities. From 2021 to 2023 and the first half of 2024 (hereinafter referred to as the reporting period), Caocao Chuxing's service revenue accounted for 96.3%, 97.9%, 96.6%, and 93.2%, respectively.

City expansion led to revenue growth, as well as an increase in order volume, active users, and drivers. During the reporting period, the company processed 370 million, 383 million, 448 million, and 255 million orders, respectively. The average monthly active user count reached 24.2 million in the first half of 2024, compared to 18.3 million in the same period of 2023; the average monthly active driver count reached 361,000, compared to 284,000 in the same period of 2023.

However, behind this prosperous growth lurks hidden concerns. For example, the rapid increase in order size is mainly dependent on third-party aggregation platforms. According to the prospectus, from 2021 to 2023, the gross transaction value (GTV) of orders obtained by Caocao Chuxing through third-party aggregation platforms reached 3.9 billion yuan, 4.4 billion yuan, and 8.9 billion yuan, accounting for 43.8%, 49.9%, and 73.2% of the total GTV for the same periods, respectively. In just a few years, Caocao Chuxing has shifted from over half of its orders coming from self-operated channels to over 70% coming from aggregation platforms. In the first half of 2024, this figure further climbed to 5.9 billion yuan, accounting for 82.6% of the total GTV for the same period, indicating a deepening concentration of dependence.

According to Yangtze Business Daily, Caocao Chuxing stated that it has significantly increased cooperation with aggregation platforms since 2023 as this helps the company acquire a large user flow and allows it to devote more management effort to improving service quality and brand awareness.

That being said, the rising costs associated with these platforms are also an important variable in the company's losses. Taking sales and marketing expenses as an example, they increased from 506 million yuan in 2021 to 836 million yuan in 2023. The commissions paid to third-party aggregation platforms during this period reached 277 million yuan, 322 million yuan, and 667 million yuan, respectively, with a continuous increase to 440 million yuan in the first half of 2024. According to Yangtze Business Daily, from 2021 to the first half of 2024, the commissions paid by the company to third-party aggregation platforms accounted for 7.1%, 7.3%, 7.5%, and 7.4% of the GTV facilitated by these platforms, respectively.

In the view of industry analyst Wang Yanbo, a development model that relies heavily on third-party platforms in the long term is a double-edged sword. While it brings a huge user flow, it also incurs significant expenses, easily plunging the enterprise into a dilemma of balancing scale and quality. On a deeper level, long-term dependence on third-party platforms may reduce the company's core competitiveness and operational stability. Vigilance is needed against issues such as policy changes or termination of cooperation with third-party platforms that could "choke" the business. Additionally, excessive dependence requires caution against weakening the brand image and hindering the cultivation of user loyalty, thereby leaving hidden dangers for the company's long-term stable development.

How to overcome this double-edged sword and minimize hidden risks and sequelae while enjoying the benefits is the second "roadblock".

03

Interviews, Complaints

Over 40,000 Vehicles Without Transportation Licenses

Public information shows that Caocao Chuxing's main business includes online car-hailing and ride-sharing. Among them, online car-hailing is divided into preferred services and chauffeur services. According to Ecns, as of June 30, 2024, Caocao Chuxing's customized fleet size exceeded 33,000 vehicles, ranking first in China.

This B2C model of "public transportation + certified drivers" has the core advantage of greater control over drivers and vehicles, which is regarded as a differentiating feature of Caocao Chuxing.

However, every coin has two sides, and this model also has the drawback of being "asset-heavy," subsequently imposing significant cost pressure on operations. The prospectus reveals that Caocao Chuxing's cost of sales includes income subsidies to ride-hailing service drivers, depreciation expenses, vehicle service costs, and commissions paid to transportation partners. Most of these costs are spent on driver income and subsidies.

How high is the proportion? During the reporting period, Caocao Chuxing's cost of sales amounted to 8.899 billion yuan, 7.97 billion yuan, 10.052 billion yuan, and 5.732 billion yuan, respectively. Notably, in 2021 and 2022, these costs even exceeded revenues for the same years, while in 2023 and the first half of 2024, they accounted for 94.2% and 93% of revenues, respectively.

From 2021 to the first half of 2024, the "income and subsidies" paid by Caocao Chuxing to drivers accounted for 100.67%, 82.36%, 76.36%, and 73.02% of revenues, respectively. According to CNR, the company has paid over 34 billion yuan in service remuneration to drivers since its inception.

In stark contrast, Dida Chuxing, which operates with light assets, has already achieved profitability despite having a smaller revenue scale (ranging from 570 million yuan to 820 million yuan from 2021 to 2023) compared to Caocao Chuxing. From 2021 to 2023, its net profits were 1.73 billion yuan, -190 million yuan, and 300 million yuan, respectively.

How to reduce operating costs and improve profitability as soon as possible is another "roadblock" for Caocao Chuxing's IPO.

On another note, the compliance and safety of the travel industry have always been of great concern. Gong Xin, CEO of Caocao Chuxing, once stated that while Caocao Chuxing may not be the cheapest or fastest platform for hailing a ride, it is certainly the best in terms of service. The official website of Caocao Chuxing also showcases its slogan - "Dedicated to Serving the Nation's Travel Needs."

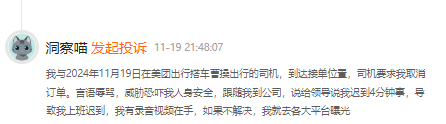

However, listening to some user feedback, it seems that there is still a long way to go before achieving the best service and dedicated service. Browsing complaints on Heimao, as of November 20, 2024, there have been a total of 8,644 complaints related to Caocao Chuxing. These complaints mainly focus on disputes over driver deductions and untimely customer service responses.

For example, on November 19, Complaint No. 17377674498 shows that a consumer claimed that on November 19, 2024, when hailing a Caocao Chuxing driver through Meituan Travel, upon reaching the pickup location, the driver requested the consumer to cancel the order, verbally abused them, threatened their personal safety, followed them to their workplace, and caused them to be late for work by informing their leader that they were four minutes late. The consumer had audio and video recordings...

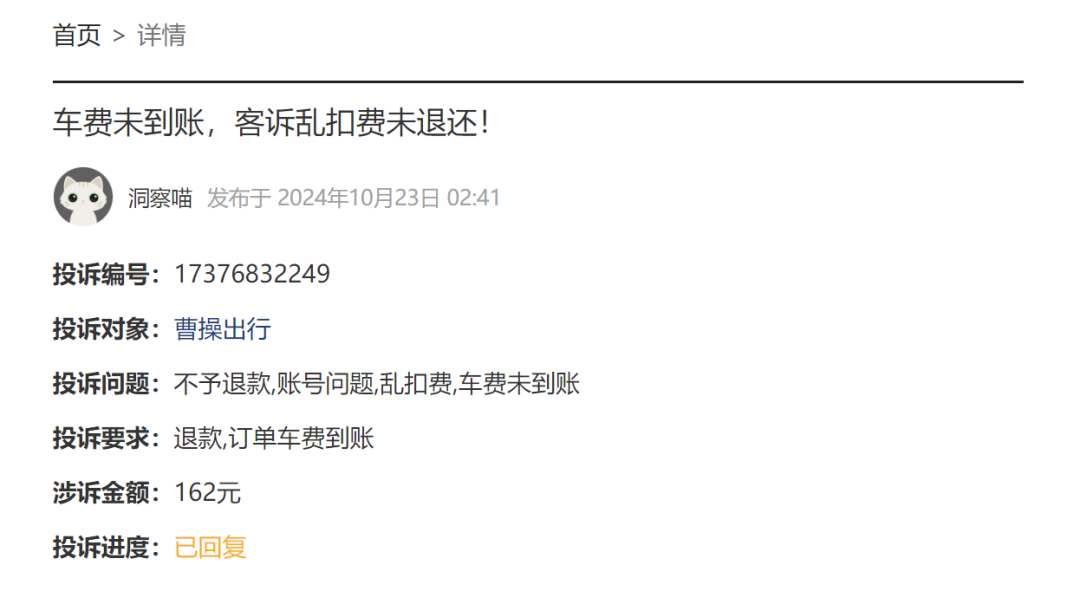

Another example is from October 23, 2024, with Complaint No. 17376832249 showing that a consumer claimed that it was already irregular to deduct 100 yuan. Moreover, the consumer had completed 200 orders as required, and there were no customer complaints within those 200 orders. However, customer complaints arose after completing the 200 orders, and after consulting customer service, there was no response, resulting in forced deductions. The consumer demanded a refund of the 62.45 yuan order fare and the irregularly deducted 100 yuan.

(All the above complaints have been reviewed by the platform)

Admittedly, user satisfaction varies, and it is unrealistic to expect everyone to be satisfied. The above complaints may have biased or one-sided aspects. However, as the saying goes, a weak foundation can lead to instability. Product experience and user reputation are the cornerstones of a company's development. At the IPO stage, it is always advisable for Caocao Chuxing to identify and rectify deficiencies, strengthen constraints, and reduce the uncertainty of non-compliance.

According to ECNS, on November 1, the main responsible persons of Zibo branches of Hangzhou Youxing Technology Co., Ltd. (Caocao Chuxing), Nanjing Lingxing Technology Co., Ltd. (T3 Chuxing), Yan'an Chuangwei Technology Co., Ltd. (Youe Chuxing), and Shandong Xiaomai Chuxing Technology Co., Ltd. (Kuamadudu) were jointly interviewed by the Zibo Comprehensive Administrative Law Enforcement Detachment of Transportation and the Zibo High-tech Zone Transportation Department.

At the interview meeting, the regulatory authorities notified the four online car-hailing platforms, including Caocao Chuxing, of the presence of non-compliant vehicles and drivers, seriously pointed out suspected irregularities such as dispatching orders to unlicensed vehicles and drivers, and the high complaint rate among passengers. They demanded that the platforms expedite the removal of non-compliant vehicles and drivers, set a timeline for the removal of issues listed in the problem inventory, and ensure that the platforms operate with licenses and in accordance with the law.

Indeed, the greater the scale, the greater the responsibility. From 2021 to the first half of 2024, Caocao Chuxing had 230,000, 213,500, 305,100, and 467,800 active drivers, respectively. How to manage this huge group and strengthen product quality control and risk management is an important aspect of business operations and another major "roadblock" for Caocao Chuxing's IPO.",

This is attractive enough for Caocao Mobility, and the company is also full of energy. According to the prospectus, the proceeds from this IPO will be used to continue investing in mobility technology to enhance participation in the field of autonomous driving. Just on the 14th of last month, Gong Xin announced the Robotaxi strategic plan for the next five years. The company will launch fully customized Robotaxi models within two years and build an automated operating system covering all scenarios. The application will be launched in 2025 and officially opened in 2026.

Focusing on online car-hailing and betting on AI, the strategic determination and trend positioning are worthy of recognition. From this perspective alone, Caocao Mobility has the confidence to break through.

However, there is often a gap between ideal and reality that needs to be bridged. From the above analysis, if Caocao Mobility wants to successfully list and even get a good valuation, there are still many challenges to be solved, whether in terms of compliance or growth, from products to channels, from user experience to driver management.

Before running, we must first consolidate the foundation and achieve a leap in value. Is Caocao Mobility ready?

This article is originally created by Rhodium Wealth.

Please leave a message if you need to reprint it.