NetEase Cloud Music "stabs" Tencent Music, what happened?

![]() 11/27 2024

11/27 2024

![]() 550

550

Produced by | Yiguan Finance

Author | Tianqian Mingwang

The online music market, which has been calm for a long time, has stirred up waves again. On November 25, NetEase Cloud Music posted a long image on its official Weibo account titled "To QQ Music: Less Follow-Up 'Updates', More Genuine Innovation," accusing QQ Music of plagiarism and calling on QQ Music to immediately stop plagiaristic 'innovation.' NetEase Cloud Music pointed out that QQ Music plagiarized its music player's 'DIY function' and has been continuously plagiarizing NetEase Cloud Music for many years, demanding that QQ Music immediately stop its long-standing plagiaristic 'innovation,' imitative 'creativity,' and follow-up 'updates.'

Subsequently, in the afternoon of November 25, in response to NetEase Cloud Music's call-out to QQ Music, KuGou Music, which belongs to the same Tencent Music Entertainment Group as QQ Music, responded on Weibo: "Isn't the DIY function for customizing the player background something I did first? I also held a DIY player contest. What kind of innovation is this? In fact, this is not the first dispute between the two. In their history of disputes, the most memorable should be the copyright dispute between them in 2019 over Jay Chou's works. In the domestic online music market, Tencent Music Entertainment Group, with its strong financial advantages, has successively acquired the exclusive copyrights of the world's largest record companies such as Universal, Sony, and Warner, firmly occupying the top spot in the domestic online music market. However, under regulatory pressure, Tencent Music had to abandon exclusive copyrights. In the 'post-music copyright era,' competition for copyrights in the online music market has cooled down. How to enhance product experience to attract and retain more users has become the key to competition among online music platforms. From the user's perspective, most users do not care who 'plagiarized' whom. Users care more about who can let them hear more songs and who can provide a better experience, and then they will choose that platform. So, which is stronger, Tencent Music or Cloud Music?

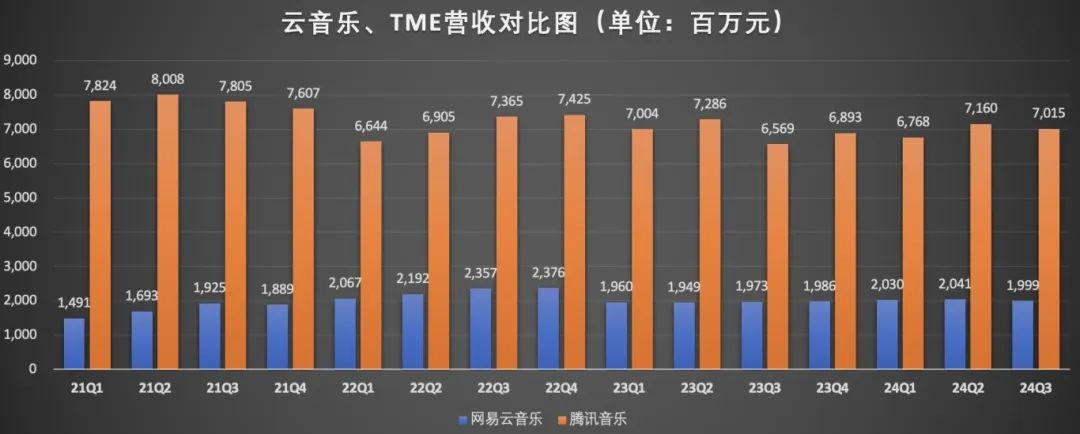

1. Tencent Music's revenue volume far exceeds that of NetEase Cloud Music

In the third quarter of 2024, Tencent Music achieved a total revenue of 7.02 billion yuan, while NetEase Cloud Music's net revenue was 2 billion yuan. Tencent Music's revenue volume is more than three times that of Cloud Music.

2. In terms of subscription membership scale, Tencent Music far exceeds Cloud Music, and Tencent Music users have stronger paying ability

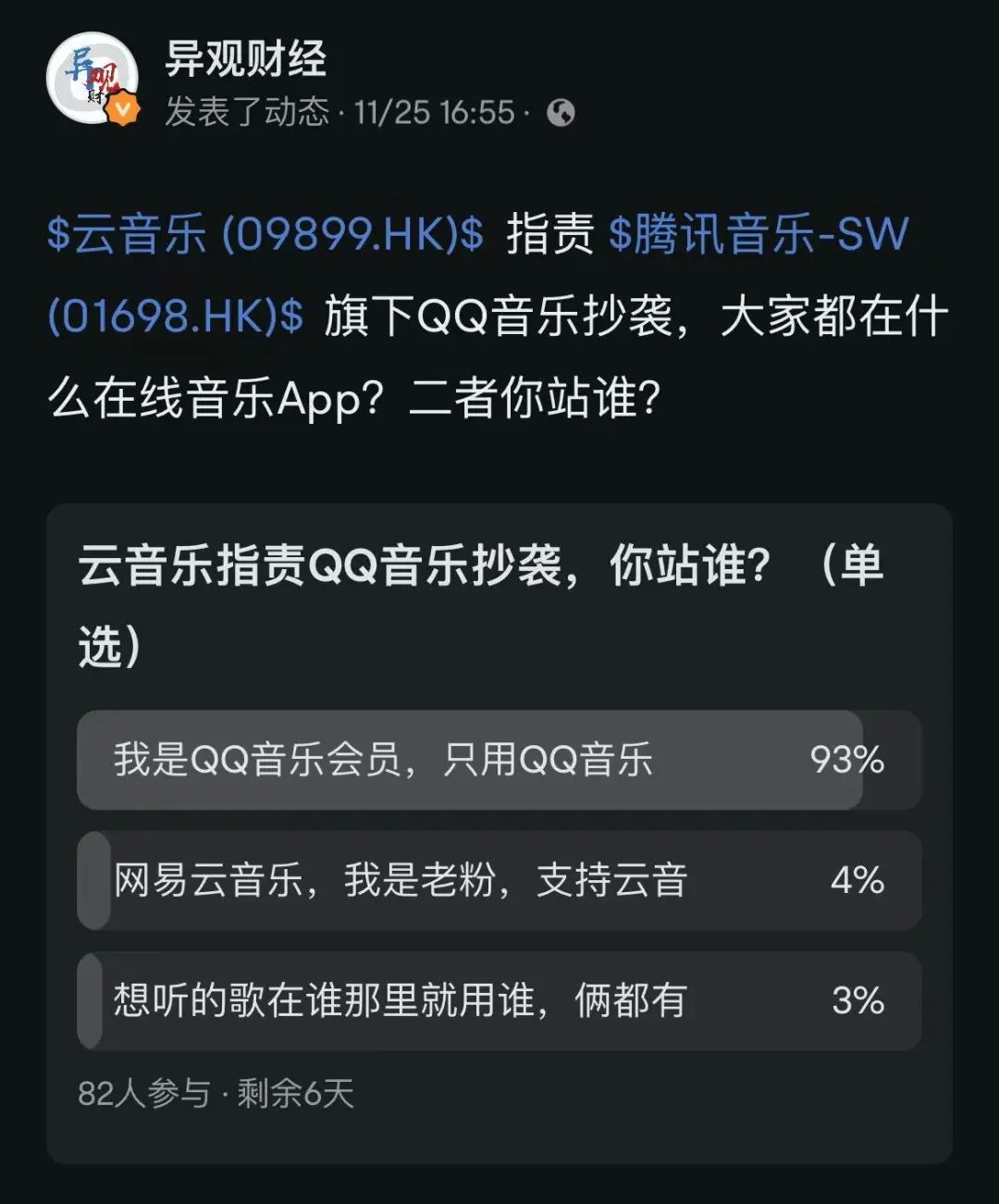

The financial report shows that in the third quarter, the number of paid online music users of TME increased by 15.5% year-on-year to 119 million, with a net increase of 2 million quarter-on-quarter. As of the end of 2023, Cloud Music had 44.12 million monthly paid online music users. In the third quarter, the average monthly revenue per paid online music user of TME increased by 4.9% year-on-year to 10.8 yuan. In 2023, the monthly revenue per paid online music user of NetEase Cloud Music was 6.8 yuan. Yesterday, Yiguan Finance conducted a simple test quiz with a small group of people. Surprisingly, 93% of the 82 participants supported QQ Music, making them "hardcore fans" of QQ Music.

Some of these users switched from Cloud Music to QQ Music because they felt that QQ Music's overall interface design was well-designed, easy to operate, rich in music copyright resources, and provided a good experience in car audio. Long-term use of QQ Music has fostered a sense of dependence and brand loyalty. Tencent Music has QQ Music, KuWo Music, KuGou Music, and WeSing, covering users with different needs. It is inevitable that their user base and spending power are higher than those of Cloud Music.

3. TME's online music subscription revenue far exceeds that of NetEase Cloud Music

The revenue sources of the two are very similar, basically coming from two parts: online music service revenue and social entertainment service revenue. Amid stricter regulation, both are currently scaling back their social entertainment services and returning to the "music" mainstay. In the third quarter, TME's online music subscription revenue increased by 20.3% year-on-year to 3.84 billion yuan. In 2023, TME's online subscription revenue was 12.1 billion yuan, while Cloud Music's membership subscription sales revenue for the entire year of 2023 was only 4.35 billion yuan. TME's revenue is nearly three times that of Cloud Music.

4. TME's profitability is stronger than that of Cloud Music, and TME's third-quarter net profit is 900 million yuan more than Cloud Music's half-year net profit

TME's third-quarter net profit was 1.71 billion yuan, a year-on-year increase of 35.3%. In contrast, Cloud Music's net profit for the first half of this year was only 810 million yuan. In terms of gross margin, Cloud Music's gross margin was 32.8% in the third quarter of this year, lower than TME's 42.6%. Currently, in addition to conventional paid services such as paid music packages and black vinyl VIP, Cloud Music's innovative models such as its points mall also provide some support for profitability. In addition, profit channels are expanded through brand collaborations and offline events.

5. Cloud Music pays more attention to the construction of an original ecological system and is the largest platform for domestic original music

In the "post-music copyright era," the competition between NetEase Cloud Music and Tencent Music in the field of original music has intensified. In the field of original music, Cloud Music has more advantages. Restricted by music copyright, NetEase Cloud Music launched a musician support program as early as 2016 to cultivate its own musicians and enrich the platform's music content by supporting independent musicians. As of June 2024, over 732,000 independent musicians were registered on the Cloud Music platform, uploading approximately 3.6 million music tracks. As of the end of 2023, the number of registered musicians on the Tencent Musician Platform was 480,000, far fewer than the number of independent musicians on the Cloud Music platform. Cloud Music has created a unique user experience with its "music + social" model. Features such as music reviews, personalized playlists, and today's recommendations, as well as music discovery and sharing methods centered around playlists, enhance interaction and emotional exchange among users, resulting in high user stickiness. Recently, Cloud Music's DAU/MAU has remained above 30%.

It is evident from the latest quarterly financial reports of TME and Cloud Music that online music platforms are facing revenue slowdowns. Meanwhile, the competition in the current online music market is not limited to that between Cloud Music and Tencent Music. As short videos become popular on the internet, short video platforms such as Douyin, which occupy a significant portion of users' time, are emerging as new challengers in the online music industry. The ecosystem and competitive landscape of the online music industry are also changing accordingly. Douyin launched Spark Music in 2022. As of the publication of this article by Yiguan Finance, it ranks first in the free music APP rankings on the App Store, with an overall rating of 4.9, higher than the 4.6 ratings of Cloud Music and TME's QQ Music. As music and short videos become increasingly intertwined, online music platforms such as TME and Cloud Music should not only delve deeper into paid memberships but also explore more new scenarios to overcome the current revenue growth dilemma and achieve sustainable development.