Meituan's Q3 Report: Continued Investment in Merchant and Rider Ecosystem Leads to Steady Growth

![]() 12/02 2024

12/02 2024

![]() 683

683

In the third quarter, as Hong Kong stocks entered a period of adjustment, market sentiment gradually turned cautious. As the last major tech company to release its financial report and one closely related to the local consumption sector, Meituan naturally became the focus of market attention.

As we all know, this year, it seems like everyone around us is talking about consumption downgrade. But have our needs for food, entertainment, and leisure really decreased? Even if one doesn't go out to eat, they still need to buy groceries or order takeout. People still need to eat and eat healthily.

As one investor in our group rightly pointed out, 'Many people of our parents' generation aspired to having enough to eat. Now, having enough to eat is seen as the bare minimum. In other words, for most people, the cost of food has long been met, leaving ample room to explore structured demand. Grasping this opportunity will lead to growth.

Therefore, here is our viewpoint: For platforms providing local services, regardless of macroeconomic changes, the increase or decrease in structured consumption is unlikely to have a negative impact. This is the core logic behind our optimism about Meituan.

Summary:

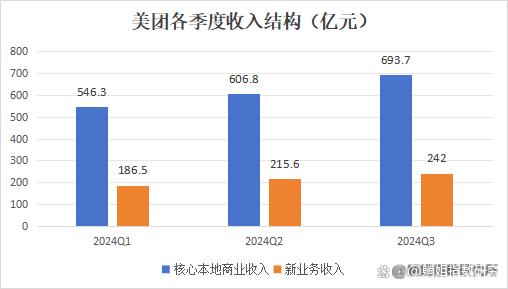

1. In the third quarter of this year, Meituan's financial report highlighted four key figures: revenue, adjusted net profit, core local business revenue, and new business revenue, all of which exceeded market expectations. From any perspective, the growth was steady, the fundamentals were healthy, and the good performance of previous quarters continued. Against the backdrop of the third-quarter peak season and gradually recovering consumer confidence, Meituan remained resilient in both on-site and home delivery services.

2. The driving forces behind the steady performance come from two sources: merchant trust and consumer trust. The number of annual transacting users, annual active merchants, and average annual transaction frequency of annual transacting users all continued to grow healthily, reaching new highs. The number of instant delivery orders, which we value most, increased by 14.5% year-on-year to 7.1 billion, with the growth rate accelerating compared to Q2, indicating significant potential.

3. In the third quarter, coinciding with the Olympics, the European Championships, and summer vacation, coupled with recovering consumer confidence, all enterprises aiming to excel in the local business sector must seize this opportunity to capture consumer mindshare and achieve growth. For Meituan, which is already in a leading position, there are various ways to maintain its competitiveness. Focusing on the merchant and rider ecosystem is key to long-term success.

Since the beginning of this year, many companies listed in Hong Kong have undergone significant self-reforms, and Meituan is no exception. The company's organizational restructuring since the beginning of the year aims to reduce internal friction and unnecessary competition among different business segments and enhance synergies. Since the release of the second-quarter report, the market has voted with confidence in a series of changes at Meituan, which has also been reflected in the company's share price performance.

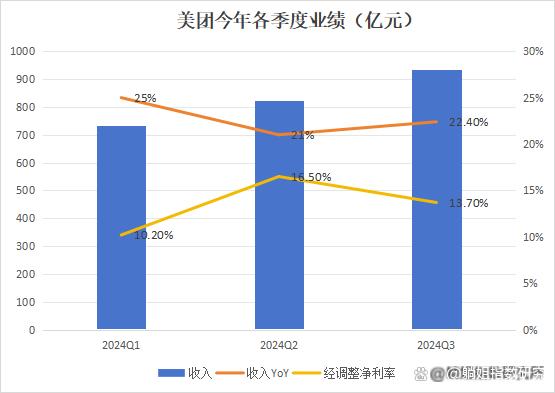

In this third-quarter report, Meituan recorded revenue of RMB 93.6 billion, a year-on-year increase of 22.4%. Adjusted net profit was RMB 12.83 billion, a significant year-on-year increase, with an adjusted net profit margin of 13.7%, which, although improved year-on-year, narrowed by less than 3 percentage points quarter-on-quarter. Overall, Meituan's performance in the third quarter was quite robust.

Specifically, all business segments contributing to revenue showed impressive growth. Core local business (including on-site and takeout services) revenue was RMB 69.37 billion, a year-on-year increase of 20%, while new business (including flash sales) revenue was RMB 24.2 billion, a year-on-year increase of 29%. Both business segments demonstrated strong growth potential in terms of revenue and profit. Operating profit for the core local business increased by 44% year-on-year, with an operating profit margin of 21%. The new business segment achieved a significant 80% year-on-year reduction in losses.

In terms of expenses, sales costs increased by about 15%, and marketing expenses expanded by 6%. Facts have proven that during peak seasons like the third quarter of this year, which coincided with the Olympics, European Championships, and summer vacation, Meituan maintained a disciplined increase in expenses while achieving solid revenue and profit growth. This demonstrates that, under the continuous organizational restructuring this year, Meituan's fundamental efficiency and stability have withstood the test.

In fact, including Q3, Meituan has achieved steady growth in every quarter this year. This is because the pursuit of certainty is deeply ingrained in the company's business DNA.

Meituan's locally rooted business is characterized by high frequency, rigid demand, and resistance to economic cycles. It also places high demands on timeliness and overall plan stability, such as immediate consumption and use for takeout services and stable verification and quality for on-site hotel and travel services. This requires the platform to provide highly certain supply. Compared to purely online business models, the competition in the entire local business sector lies in who is more stable.

This is what consumers expect. Choosing to purchase products from Meituan means having prior knowledge of the products and expecting them to arrive home as soon as possible. When consumers make purchases at stores, they expect to see more cost-saving coupons on Meituan that can be used anytime.

It is known that offline merchants are widely dispersed with varying levels of digitization. For a single company to achieve efficient control over all aspects from product procurement to delivery necessarily means higher costs and lower efficiency. To avoid such outcomes, reliance on the power of an ecosystem is essential. In other words, the competition in the local business sector is not about who has more attractive content but who has stronger fulfillment capabilities and a more stable ecosystem.

A mature and stable ecosystem must benefit all participants and the platform itself to achieve greater stability.

On the merchant side, in the third quarter of this year, Meituan actively strengthened internal collaboration within the platform, completing full coverage of various consumption scenarios for its "God Member" program, which integrates food, entertainment, and leisure services, in July. The program was further upgraded and expanded nationwide, resulting in increased traffic and transaction volumes for participating merchants. In November, Meituan Delivery once again upgraded its "Prosperity Plan" for the catering industry, investing billions of subsidies to support catering merchants focused on product innovation and exploration.

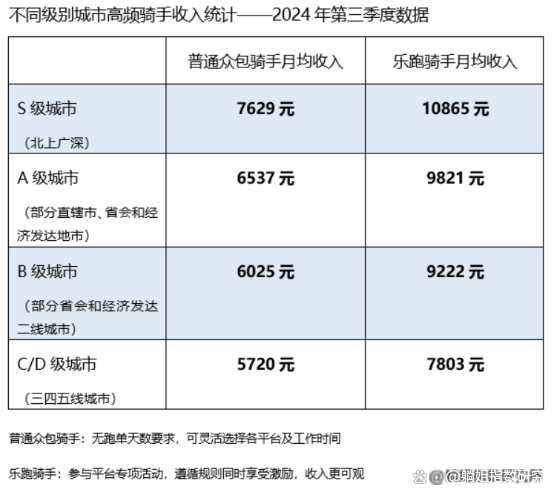

On the rider side, management disclosed detailed rider income levels at this earnings call.

In the third quarter of this year, the average monthly income of high-frequency riders nationwide ranged from RMB 5,720 to RMB 10,865. Among them, the average monthly income of high-frequency LePao riders in third-, fourth-, and fifth-tier cities was RMB 7,803, an increase of 8.42% month-on-month from June; the average monthly income of high-frequency ordinary crowd-sourced riders was RMB 5,720, an increase of 2.86% month-on-month from June.

In terms of average income across regions, high-frequency riders earned slightly more than the local average resident income. In terms of income growth, compared to June this year, the average income of riders in high-tier cities remained basically the same, while the average income of riders in low-tier cities increased significantly.

In fact, continued investment in the merchant and rider ecosystem is the cornerstone of long-term growth and stability, which is also the source of certainty for investing in Meituan.

Looking around, in the Hong Kong stock market this year, there are very few large-scale tech stocks that have achieved high growth rates. The local services sector has the advantages of high frequency, rigid demand, and resistance to cyclical fluctuations. Maintaining a stable and substantial moat in this sector is the source of Meituan's long-term value.