Final Conjecture on Amazon: Retail as a Cloak, Advertising as the Soul?

![]() 12/19 2024

12/19 2024

![]() 577

577

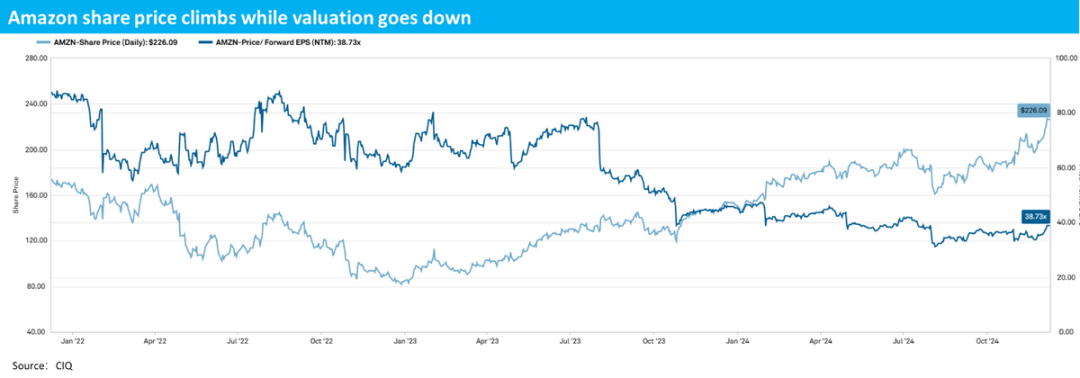

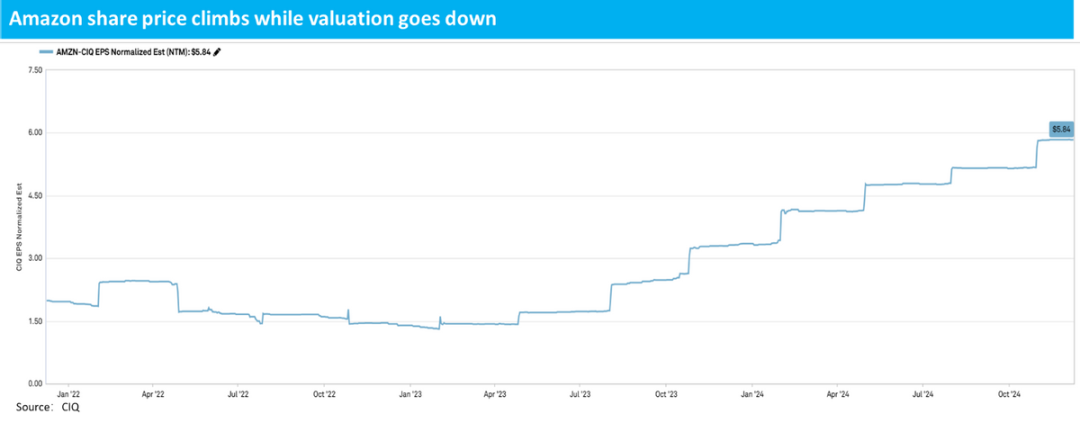

Reviewing Amazon's performance from 2023 to date, its stock price has surged over 180% since its 2022 low, while the S&P 500 Index has risen around 76% during the same period, indicating that Amazon has significantly outperformed the broader market. Notably, as the stock price has risen, Amazon's forward P/E ratio has been declining, from a peak of over 80x PE to less than 40x currently, presenting an atypical scenario where "the higher it rises, the cheaper it gets."

Regular readers of Dolphin Research's quarterly reviews will be familiar with the fact that one of the main drivers behind this surge and valuation adjustment has been the rapid turnaround and continuous improvement in the profit margins of Amazon's retail business. This business segment suffered significant losses in 2022 but has since rebounded sharply. However, what are the reasons behind this phenomenon? What factors have primarily contributed to the rapid reversal in retail business profit margins? In this article, Dolphin Research delves into these questions.

Below are the details:

I. Review of Amazon's "Surge History": What Makes Amazon Strong?

1. Retail Business Net Profit Continuously Revised Upwards, AWS

Regular readers of Dolphin Research's quarterly reviews will know that the main reasons behind Amazon's strong gains and declining valuation over the past two years include:

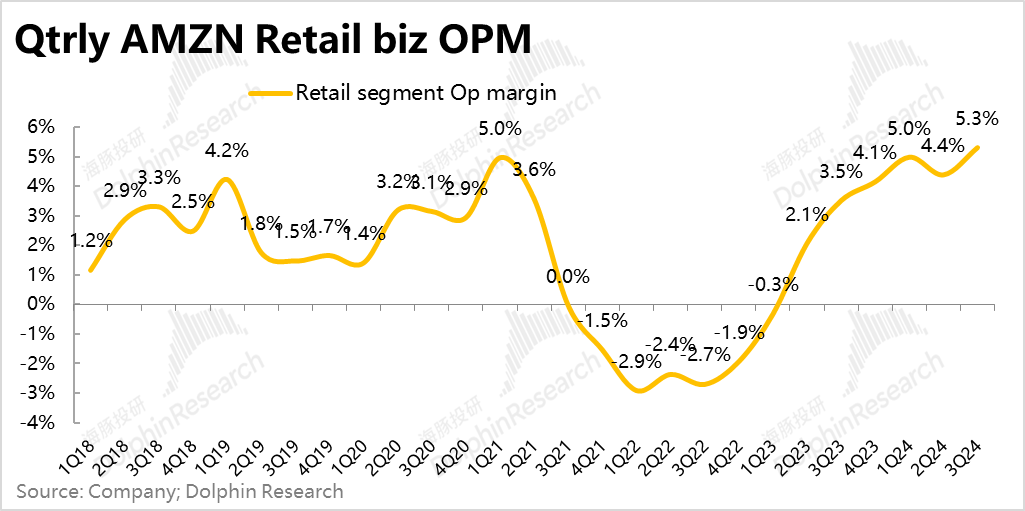

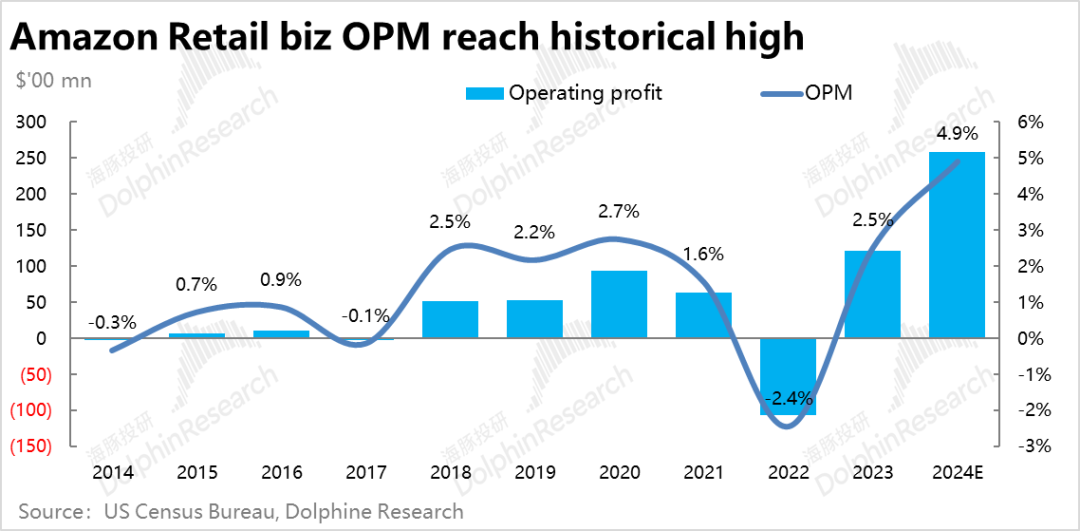

① Most importantly, there has been a significant release of profits and continuous upward revisions of profit margins in the retail business. As seen in the chart below, after the trough in 2022, Amazon's retail business operating profit margin has continued to increase, rising rapidly from a low of nearly -3% to a high of 5%. Historically, such a high profit level was briefly achieved only in the first quarter of 2021, during the post-pandemic rebound.

Looking at a longer time horizon, Amazon's retail business profit margins were still struggling around the breakeven point before 2017, fluctuating within a low single-digit range of 1.6% to 2.7% from 2018 to 2021. In fiscal year 2024, it is expected to stand firm (not just briefly touch) at an operating profit margin of around 5% for the first time, nearly doubling from the past average.

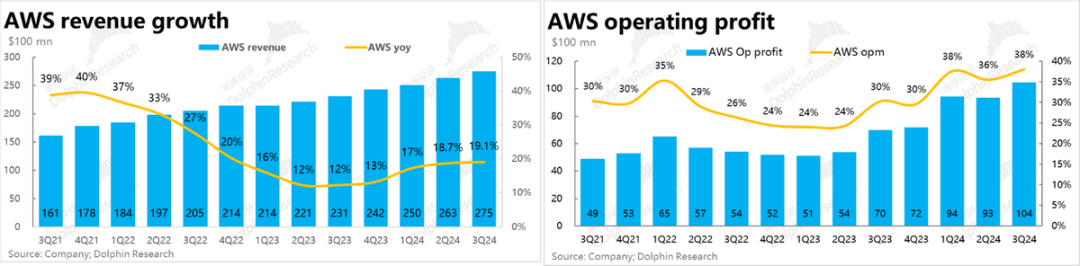

② Another reason is that the AWS business has benefited from the advent of the AI wave and the end of the cloud computing usage optimization cycle. After a rapid decline in growth rates, it has shown a gradual recovery trend in the past two quarters. At the same time, with the depreciation period of servers extended from 5 years to 6 years and other cost/product structure optimizations, AWS's operating profit margin has also surged from around 30% to stabilize above 35% in the past two quarters.

③ As seen above, due to the simultaneous increase in profit margins in both the retail and AWS segments, the market's expectations for Amazon's rolling net profit for the next year have been continuously revised upwards since the first quarter of 2023, rising nearly 3x from the low point. This is higher than the stock price increase of around 2x during the same period, thus presenting the phenomenon of "the higher it rises, the cheaper it gets".

2. Review Summary

In summary, the essential driving factors behind Amazon's recent stock price surge are primarily two points: ① the continuous breaking of past profit margins and the resulting profit release in the retail business, and ② in the AI wave, AWS has finally shown a marginal increase in growth (although modest), while profit margins have also continued to rise.

Therefore, looking forward, whether Amazon's stock price can perform further mainly depends on whether the profit margins of the retail segment and the growth acceleration of AWS can continue to deliver above-expectations results.

In this article, Dolphin Research will focus on the first point - the space and probability for further improvement in retail business profit margins. Further breakdown shows that the two main factors driving the improvement in retail business profit margins are: one is the revenue generation end, specifically how much room for improvement there is in Amazon's incremental monetization rate (primarily advertising), and the other is the cost end, specifically how much room there is for optimization and improvement in logistics and distribution efficiency to enhance unit economics. In this article, we will primarily focus on the revenue generation end.

II. A Brief History of Amazon Advertising

1. History of Advertising Development

A brief review of the development history of Amazon's advertising business:

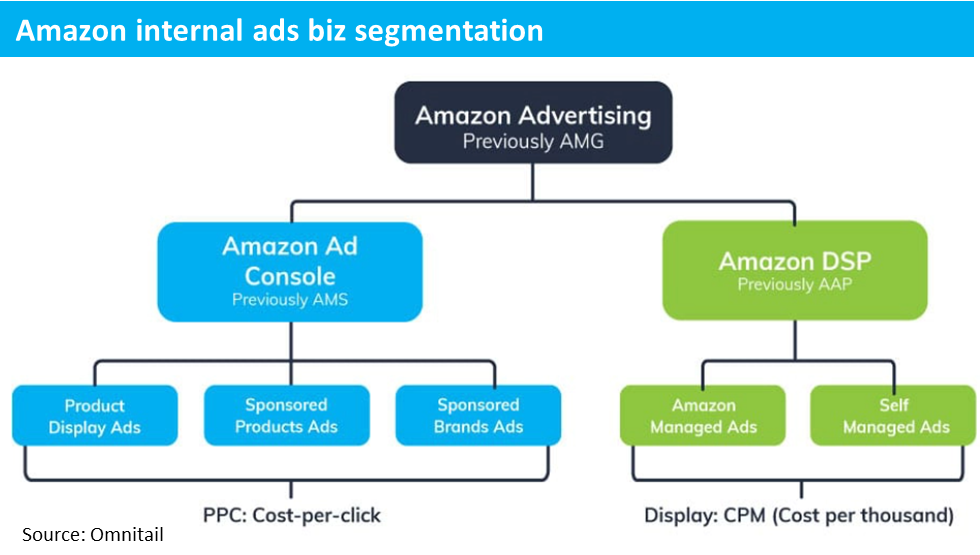

① As early as 2012, Amazon officially established its advertising business unit, Amazon Media Group (AMG), which included two business lines: performance advertising (CPC) and brand advertising (CPM).

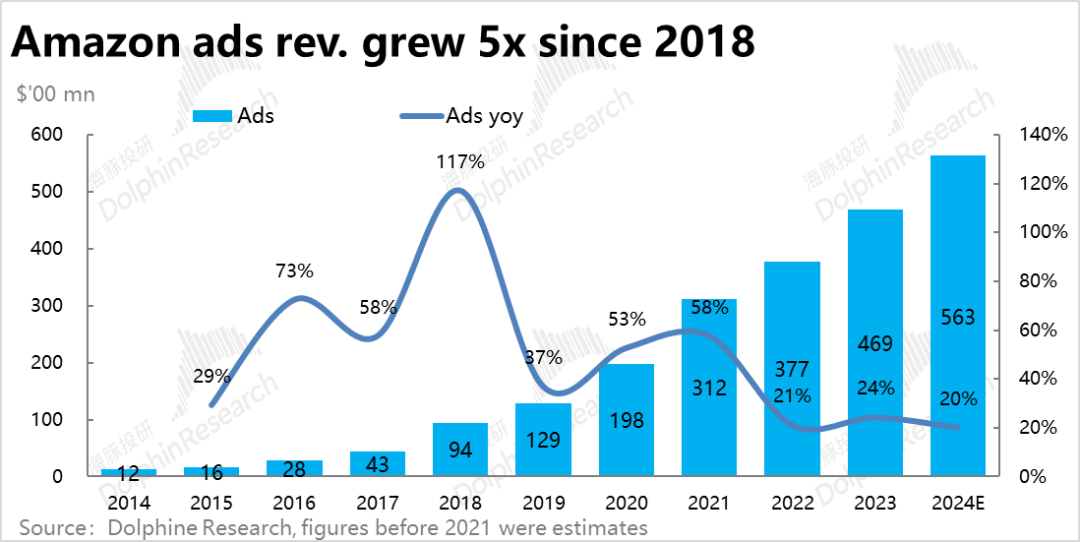

However, in hindsight, Amazon did not vigorously promote the penetration and monetization of its advertising business in the early years from 2012 to 2017. Advertising revenue was only $4.3 billion in 2017, accounting for only 2.4% of total revenue for that year.

② In 2018, Amazon reorganized its entire advertising business unit (the specific structure is shown in the chart below) and launched a new ad placement portal (Dashboard), simplifying and optimizing the process for merchants to place ads. The same year, it also introduced new ad formats: video ads and sponsored display ads.

Following these optimizations, Amazon's advertising business entered a period of explosive growth, with advertising revenue surging 117% to $9.4 billion in 2018. By 2024, it is expected to achieve approximately $56 billion in advertising revenue, accounting for nearly 10% of total revenue.

2. Types of Amazon Advertising

As of now, Amazon's advertising products primarily include five types: product ads, sponsored brands, sponsored display ads, streaming TV ads, and voice ads (as shown in the table above).

Specifically, these five products can be roughly divided into two categories, which are also internally categorized under Amazon Ad console and Amazon DSP departments at Amazon:

① The first category includes product ads, sponsored brands, and sponsored display ads, which belong to the Ad console department. Among them, product and sponsored brand ads are more inclined towards performance advertising, primarily displayed by 1P vendors and 3P sellers within Amazon's web pages or apps in search results and product pages.

Sponsored display ads have both performance and brand advertising characteristics, placed by 1P vendors and 3P sellers on Amazon sites, Twitch, and third-party media platforms.

② Streaming and voice ads are more inclined towards brand advertising and belong to the Amazon DSP department. They can be placed by anyone (regardless of whether they sell products on Amazon). The primary media for placement are Amazon's streaming service Amazon Prime Video, as well as Twitch, Amazon Music, and other supported third-party media.

Among them, Prime Video ads were officially launched at the end of 2023 and are currently one of the main sources of incremental revenue that the market is focusing on, which will be discussed in detail later.

III. Is Advertising the Key to Affecting Amazon's Profitability and Valuation?

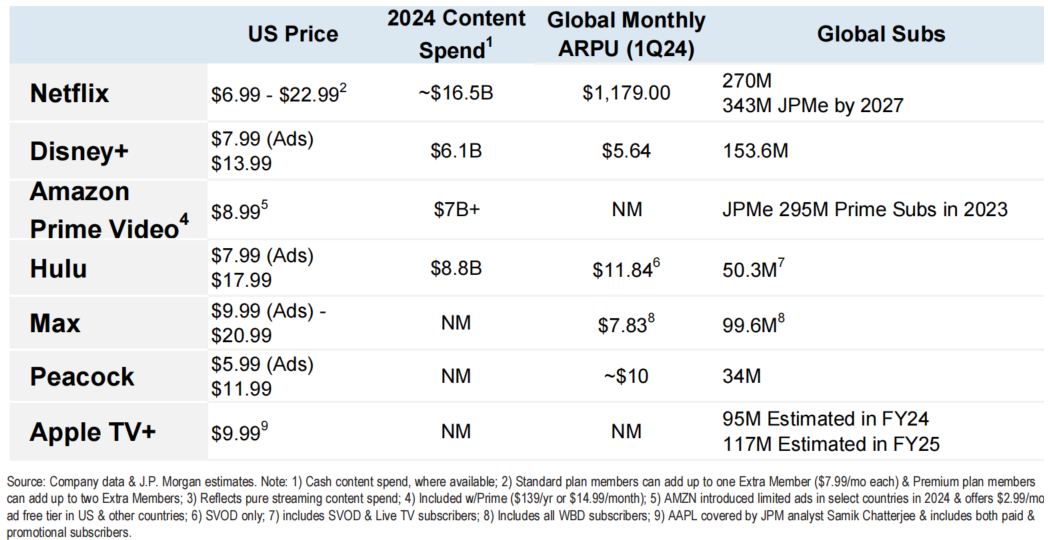

Looking ahead, how can we qualitatively and quantitatively understand the growth potential of Amazon's current advertising business, which generates approximately $56 billion in revenue annually? As one of the world's largest e-commerce platforms, Amazon's current advertising revenue is primarily composed of highly converting performance advertising (or e-commerce advertising). However, with the introduction of advertising services based on streaming media, audio, and other media platforms since the beginning of 2024, Amazon can also generate additional advertising revenue.

First, let's look at the growth potential of e-commerce advertising. Dolphin Research approaches this issue from two perspectives: ① From a macro perspective, how much room for improvement is there in Amazon's share of the overall advertising market in Europe and the United States? ② From a micro perspective, how much room for improvement is there in the advertising monetization rate that merchants can bear?

1. How Much Advertising Share Should Amazon Capture?

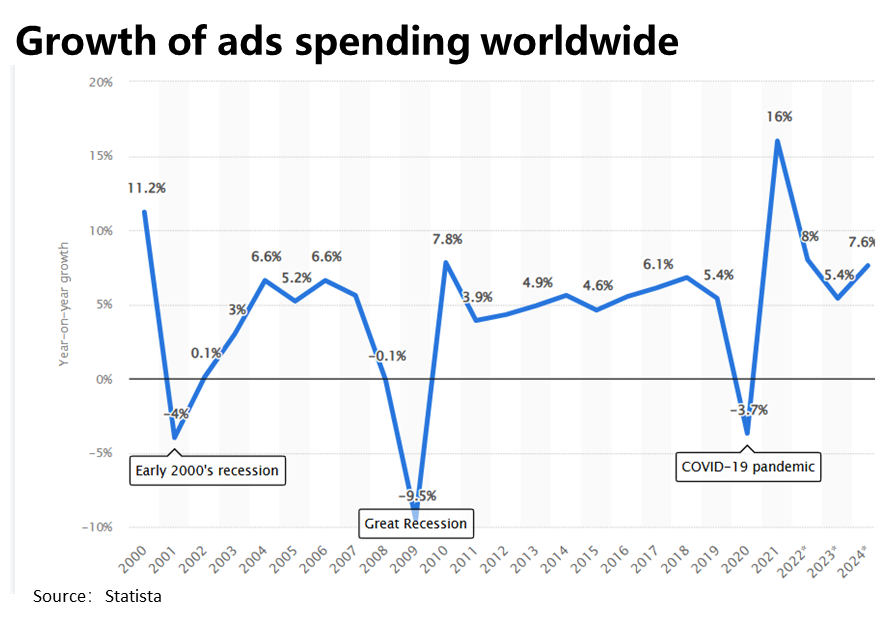

First, from a top-down perspective, advertising is a mature cyclical industry that is highly correlated with macroeconomic changes. Except during periods immediately before and after major crises, the overall growth of the advertising industry is generally equal to or slightly higher than global GDP growth, within a range of approximately 4% to 8%.

Therefore, for any company (especially a leading company) to achieve significant growth in advertising revenue, it essentially means capturing market share from other channels.

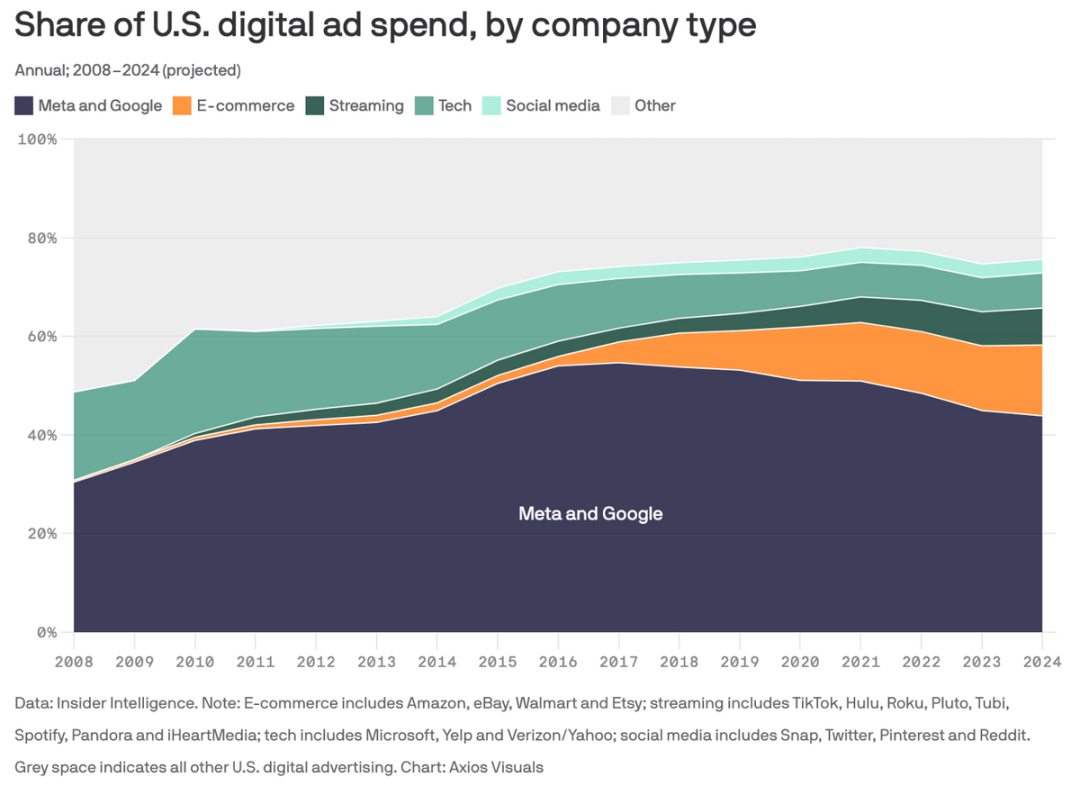

As seen in the chart below, over 40% of advertising expenditure in the United States is shared by Meta and Google. The advertising share of e-commerce platforms is currently just over 10%. In terms of trends, the share of e-commerce platforms was nearly negligible before 2017 but has expanded rapidly since then, making it the biggest "share gainer" of the past decade, with Meta and Google being the biggest "share losers".

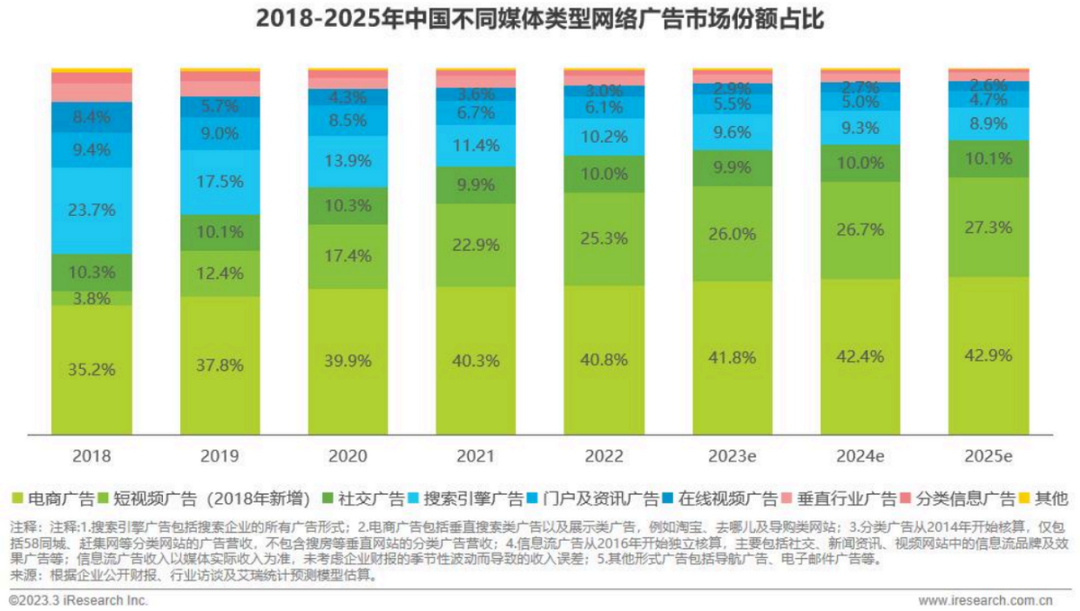

When comparing the domestic advertising market with that of the United States, unlike the United States, domestic e-commerce platforms have always occupied the largest share of advertising (currently over 40%), and this share has continued to increase slightly over the years. However, similar to the United States, it is primarily search advertising that has lost share in China.

So, can e-commerce channels led by Amazon continue to show significant growth? Comparing the advertising market shares of e-commerce channels in China and the United States, which are approximately 40% and 10%, respectively, it logically suggests that there is considerable room for improvement in the advertising share of e-commerce platforms in the United States.

However, Dolphin Research has always been skeptical of "simplistic" cross-market benchmarking, which overly simplifies and ignores the similarities and differences between the Chinese and American markets. Taking a closer look, from the perspective of matching advertising demand and supply:

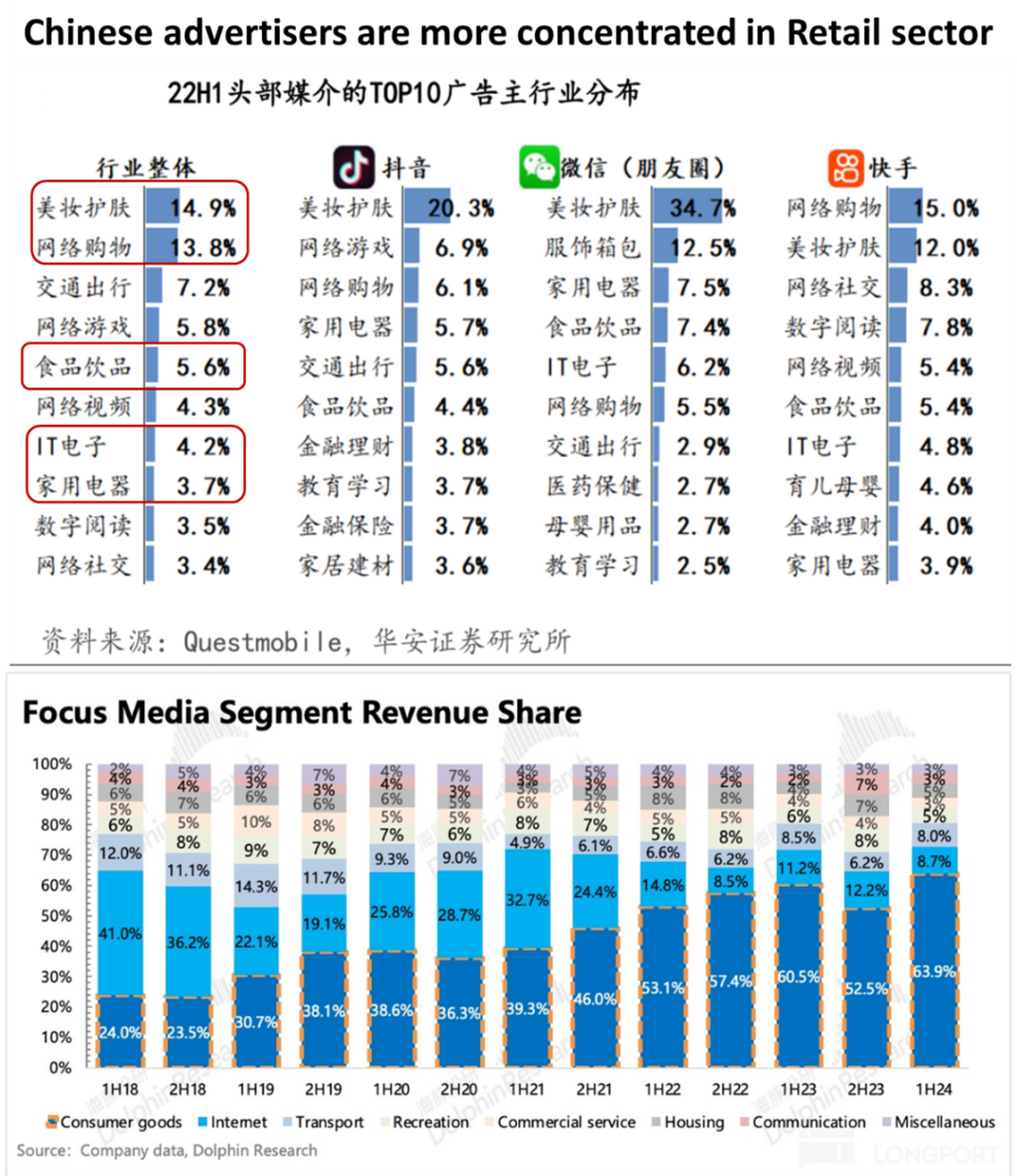

① In the domestic advertising market, taking Douyin and Kuaishou as examples, approximately 42% of advertisers on these leading online platforms come from retail-related industries (of which approximately 14% are advertising demand from e-commerce platforms themselves). Similarly, over half of the advertisers on offline advertising channels, represented by Focus Media, also come from the consumer goods industry. It can be seen that both online and offline, the consumer/retail industry is the primary source of advertising demand in China, accounting for a significant proportion (40% to 50%). This proportion roughly matches the over 40% of advertising expenditure on e-commerce platforms on the supply side.

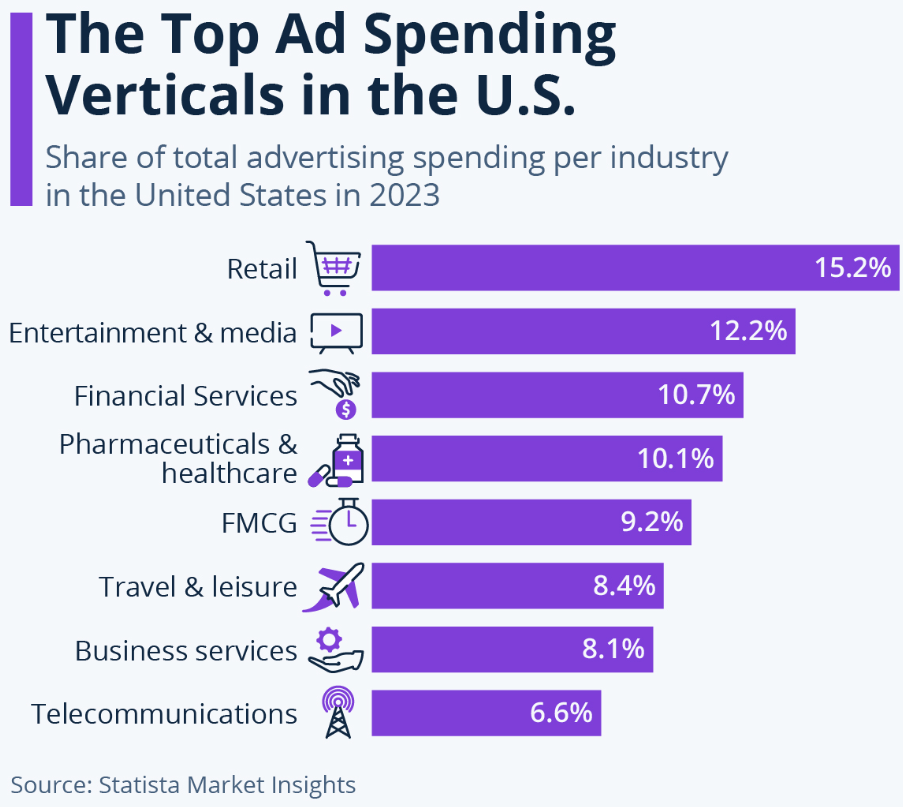

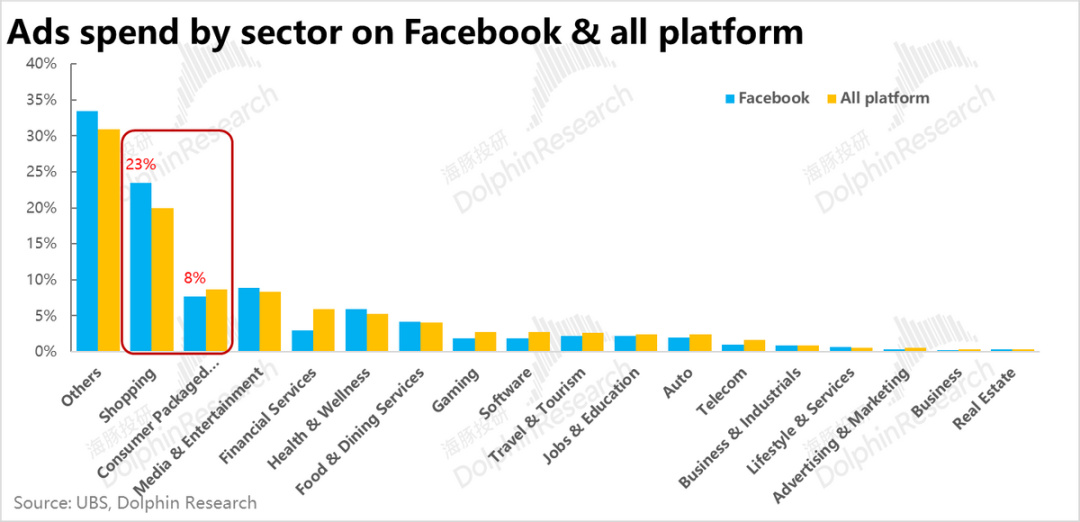

② Unlike the domestic advertising market, where both demand and supply are highly concentrated in the consumer and retail sectors, according to Statista's survey, advertising demand sources in the United States are significantly more diversified. While the retail and fast-moving consumer goods (FMCG) industries rank first and fifth, respectively, in advertising expenditure, together accounting for approximately 26% of total advertising expenditure and remaining the largest advertisers, five other industries each account for around 8% to 12% of the market. It can be seen that retail and consumer goods do not have the absolute leading position in the U.S. advertising market that they do in China.

From the supply side perspective, another important difference between the Chinese and American internet ecosystems is that online shopping in China is almost entirely dominated by platform e-commerce. In contrast, a significant proportion of online shopping in the United States is through independent e-commerce websites, and the advertising demand from these merchants is not reflected in the advertising demand of e-commerce platforms. In other words, unlike domestic advertising platforms, Meta and Google in the United States also have some e-commerce platform functions - so-called social commerce, which can directly generate conversions and sales.

How much of the advertising share on non-e-commerce platforms such as Google and Meta is accounted for by high-conversion e-commerce-like ads? According to UBS statistics, approximately 31% of Meta's advertising revenue comes from the retail and consumer goods industries. This proportion is higher than the 26% reported by Statista across all industries.

Assuming Meta's advertising proportion applies universally across all social, search, and streaming platforms, and given that the ratio of e-commerce-like ads to non-e-commerce ads placed by retail and consumer goods companies on these non-e-commerce platforms is 6:4, it can be roughly estimated that the share of e-commerce-like advertising on social, search, and streaming platforms in the United States accounts for approximately 13% of the total advertising market.

③ In this context, what is the growth potential for the advertising market share held by e-commerce platforms, primarily led by Amazon? By comparing the approximate 23% share of retail and consumer goods industries (the primary demanders of e-commerce advertising) on the advertising demand side, the e-commerce platforms' own advertising share of about 10%, and the approximately 13% share of e-commerce-like advertising occupied by non-e-commerce media platforms, it becomes evident that, in the most optimistic scenario, the advertising market share of e-commerce platforms has the potential to double (essentially recapturing all e-commerce-like advertising shares currently held by non-e-commerce platforms).

However, under a neutral assumption, if the proportion of e-commerce-like advertising in the overall U.S. advertising market is approximately X, and Amazon accounts for roughly 40% of the U.S. e-commerce GMV, then Amazon's neutral expected share of the U.S. advertising market should be 23% * 40% = 9.2%. This figure aligns closely with survey results indicating that Amazon holds approximately 10% of the U.S. advertising market, with roughly 80%~85% focused on conversion-driven e-commerce advertising. In other words, following years of rapid growth, Amazon's advertising share (at least in the U.S.) may have reached a neutral equilibrium.

④ Nevertheless, the assessment that Amazon's (U.S.) advertising share has reached a neutral level is based on a simplified and static perspective and does not preclude further growth. Firstly, the calculations involved numerous uncertainties and assumptions. Secondly, logically, several factors could continue to propel the growth of Amazon's advertising share, such as:

- An increase in the proportion of advertising budgets from retail or consumer goods industries that prefer placing e-commerce ads in the overall advertising market.

- Retail or consumer goods advertisers favoring performance-based ads, as evidenced by the rising ratio of performance ads to brand promotion ads.

- Advertisers preferring Amazon over other e-commerce advertising channels, thereby capturing e-commerce advertising share from platforms like Meta and Google.

More qualitatively, Amazon's subsequent growth in e-commerce advertising may not be as "effortless" as in the past.

2. How substantial are the platform fees borne by Amazon merchants?

Above, we analyzed the macro perspective, specifically how much growth potential Amazon has within the overall e-commerce market share. From a micro perspective, or from the merchants' standpoint, what burden do the current various commissions and advertisements on Amazon impose?

Similarly, since the company does not disclose GMV figures or the breakdown of 3P merchant service revenue, the following are illustrative calculations based on major foreign banks' forecasts, which may not perfectly align with actual conditions but provide trends worth considering.

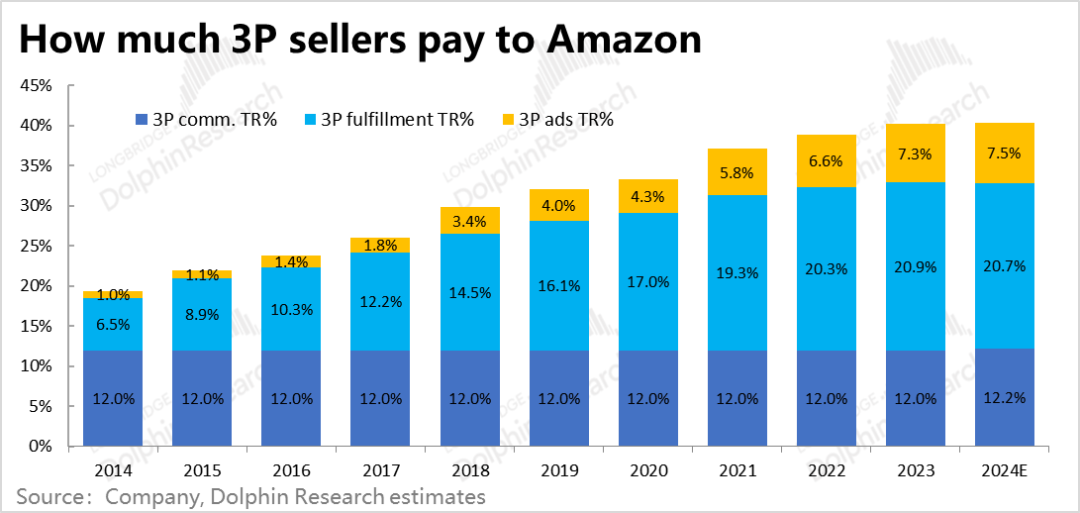

As evident from the figure below, for 3P merchants, commissions and fulfillment fees represent relatively rigid revenue streams, accounting for over 30% of their sales in recent years. Additionally, the proportion of e-commerce advertising revenue to GMV has climbed to over 7% in recent years. (Notably, our calculations reveal that the e-commerce advertising monetization rate in 2024 increased by only 0.2 percentage points compared to the previous year, significantly lower than previous growth rates, which could be another indicator that Amazon's e-commerce advertising market share or monetization level has approached a neutral equilibrium?)

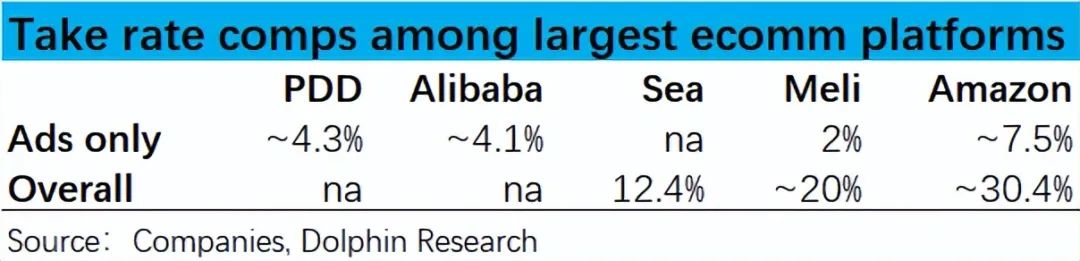

In a horizontal comparison, Amazon's current advertising monetization rate of over 7% is already higher than the 4%~4.5% monetization level of leading domestic e-commerce platforms. From an overall monetization standpoint (commissions + fulfillment + advertising), Amazon's over 30% monetization rate is also notably higher than Southeast Asian leader Sea's rate of slightly above 12% and South American leader Mercado's rate of slightly above 20%.

However, Dolphin Investment Research does not believe that Amazon's overall monetization rate is excessively high and lacks significant room for growth. Currently, there is insufficient evidence to support such an alarmist assessment. After all, as long as the platform genuinely aids merchants in generating substantial sales, there is considerable operational leeway for merchants to either raise prices or continue transferring profit margins to the platform.

3. Video Advertising

Beyond offering e-commerce advertising through its platform, Amazon also owns Prime Video (video streaming), Prime Music (music), Audible (audiobooks), Twitch (live streaming), Prime Gaming (gaming), and other robust entertainment and media platforms and services.

Initially, many of these were perhaps viewed merely as "supplemental benefits" beyond Prime members' shopping privileges. However, after years of development, Amazon disclosed in early 2024 that Prime Video has at least over 200 million subscribers. These entertainment media platforms can also provide Amazon with incremental non-e-commerce advertising space.

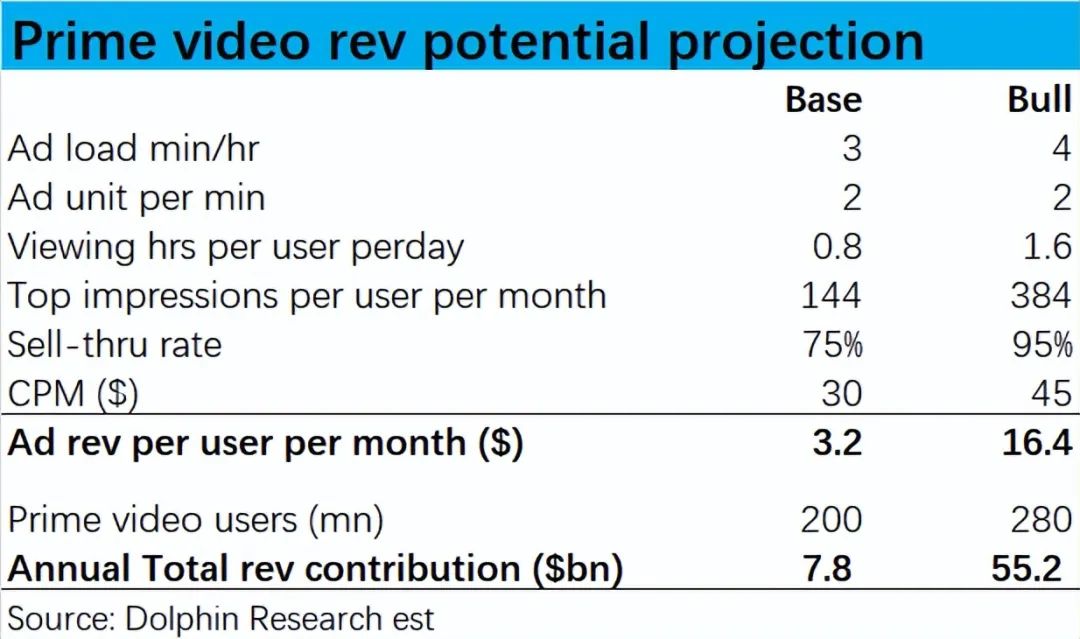

So, what is the potential revenue volume that Prime Video advertising can generate in a stable state? Firstly, a straightforward and perhaps "guaranteed" calculation method is:

① Prime Video users can opt to pay an additional $2.99 per month for an ads-free experience, avoiding most advertisements. According to Amazon's disclosure in early 2024, Prime Video advertising can reach approximately 200 million users globally (in fact, it is predicted that the total global Prime membership should be around 300 million, but not all Prime members have activated the streaming service).

Under the extreme assumption that all regular Prime Video users choose to upgrade their subscription for an ads-free experience, 200 million members paying an additional annual membership fee of roughly $36 per year can generate approximately $7.2 billion in additional revenue annually. Although this is an extreme scenario unlikely to occur, the $36 annual additional fee for ads-free viewing implies a neutral to conservative estimate of Amazon's own calculation of the average revenue per user (ARPU) for Prime Video advertising.

② A more conventional forecasting method is to analogize Netflix to estimate the potential advertising revenue volume, using the formula and key assumptions: Ads revenue = ads per hour * viewing hours per user * user numbers * sell-thru rate * CPM.

Under a conservative expectation for a stable state, assuming Amazon has an ad load of 3 minutes per hour (industry average is approximately 4~6 minutes per hour), with each ad being 30 seconds, there are effectively 6 ad slots per hour;

The average viewing time per user, referencing industry leader Netflix, is approximately 2 hours per day. Assuming the per capita viewing time on Prime Video in a medium-term stable state is 40% of that on Netflix; the user base is 200 million, as disclosed by the company;

The sell-thru rate, or advertising fill rate, is 75% under a neutral assumption;

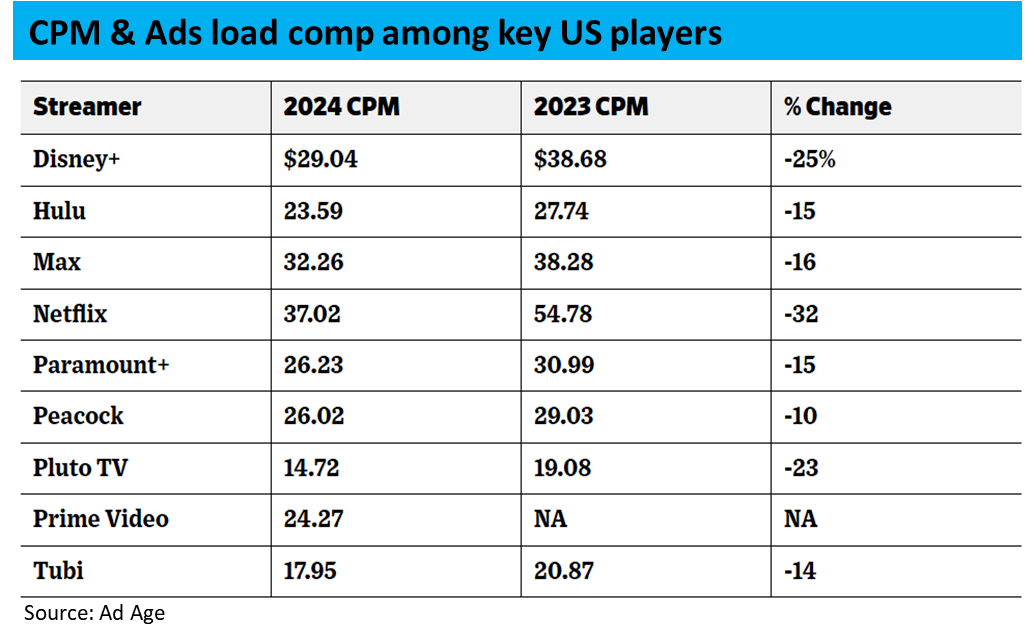

Combining news reports and market expectations, the initial CPM (cost per thousand impressions) for Prime Video advertising is approximately $30 (currently around $25), expected to reach $30 in the medium term. However, as shown in the table below, CPM can fluctuate significantly with economic conditions;

Based on the above assumptions, under a neutral to conservative expectation, the potential advertising revenue for Prime Video is approximately $7.8 billion, with an average revenue per user per month of approximately $3.2, slightly higher than Amazon's own pricing of an additional $2.99 per month, which is essentially consistent.

Under an optimistic expectation, by benchmarking each key forecast to industry leaders, the ceiling for Prime Video advertising revenue is estimated at approximately $55 billion, equivalent to doubling Amazon's total advertising revenue in 2024. It is evident that the upper limit of advertising increment contributed solely by Prime Video is also substantial.

However, even if this optimistic scenario materializes, it will take at least 3 to 5 years to reach this volume. Moreover, this optimistic assumption does not consider the limitations of the total advertising market and competition among advertising giants, so it should only be viewed as a reference for the upper volume limit.

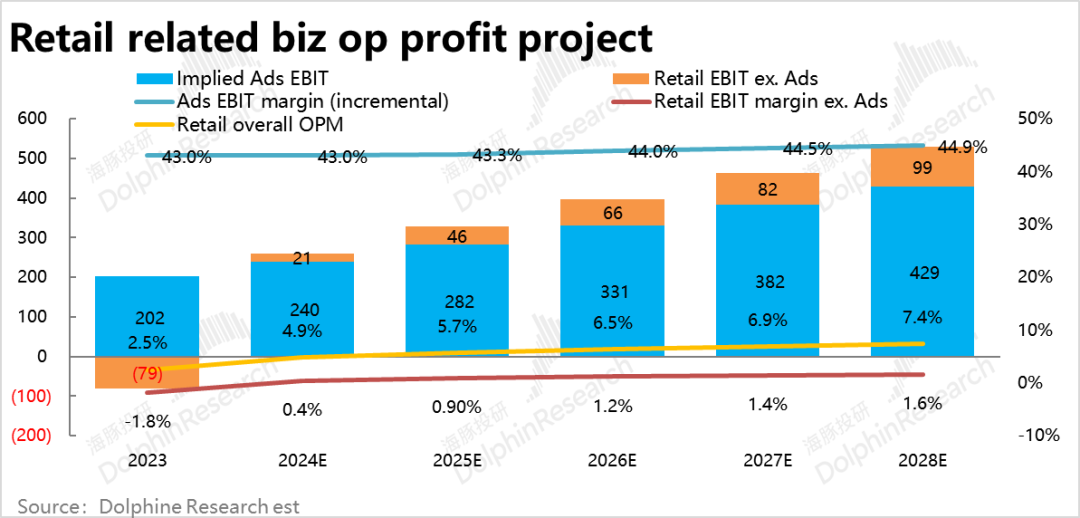

III. How significant is the impact of the advertising business on Amazon's profits?

Above, we extensively discussed the growth potential of Amazon's advertising business. So, why does advertising have a profound impact on Amazon's performance, and what is the significant correlation with the continuous upward revision of Amazon's earnings expectations over the past year mentioned earlier? The logic is straightforward: compared to the asset-heavy, low-margin retail and delivery business, which demands significant effort for minimal profit, advertising is a highly profitable business model offering substantial profit elasticity.

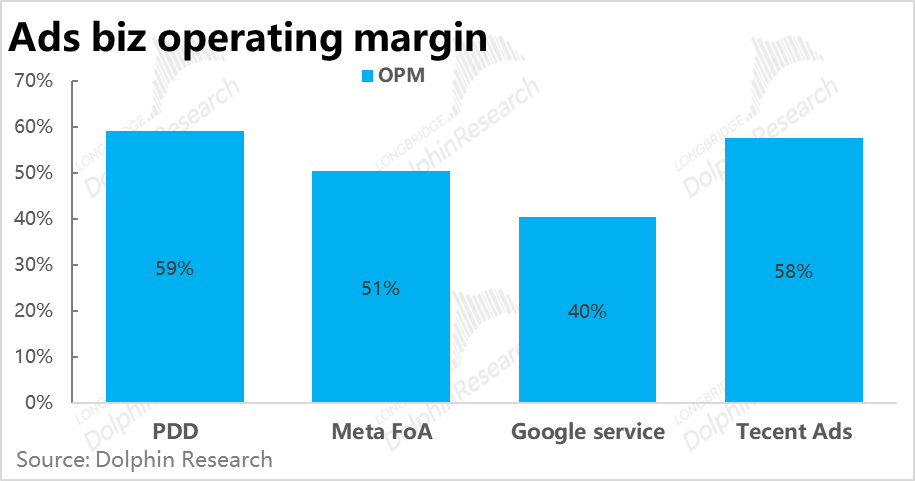

As illustrated in the figure below, the profit margins of e-commerce advertising and other entertainment and social advertising businesses generally range from 40%~60%. In contrast to Amazon's overall retail business's single-digit profit margins, advertising can contribute nearly ten times the profit leverage.

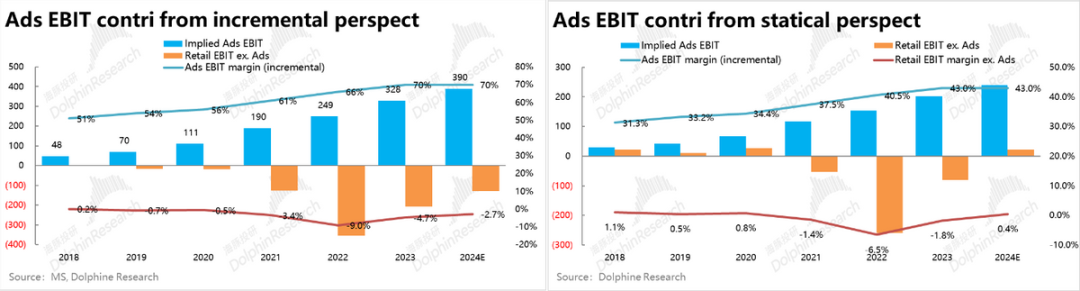

Quantitatively, how significant is the actual contribution of the advertising business to Amazon's retail business profits? Due to the lack of official data, there are two primary understandings when assessing the profit contribution of advertising in the market. One perspective focuses on marginal increment, believing that the marginal operating profit margin of e-commerce advertising revenue can reach as high as 70% or even higher. The other perspective is more holistic, assuming Amazon's advertising profit margin is roughly comparable to its peers, ranging from 40%~50%.

Both perspectives have merit. The former logic, simply put, is that even without the advertising business, operational, customer acquisition, fulfillment, and other costs must still be incurred. The incremental costs and expenses required for adding a light-asset business like advertising are theoretically quite low.

The latter logic posits that Amazon's advertising business cannot exist independently of its asset-heavy retail business. Without the barriers established by high-cost self-operated businesses, marketing, fulfillment services, etc., Amazon would not have the prerequisites to attract merchants to place ads.

However, from both perspectives, it is evident that as the advertising business scales, the proportion of operating profits contributed by advertising in the overall pan-retail segment has steadily increased in recent years, accounting for nearly all profits in 2024. The difference between the marginal and holistic perspectives lies primarily in that under the marginal perspective, the pan-retail business excluding advertising has consistently incurred losses, whereas under the holistic perspective, except for significant losses during the high logistics investment period from 2021 to 2023, the pan-retail business excluding advertising has maintained an operating profit margin of approximately 1% in most years (including 2024).

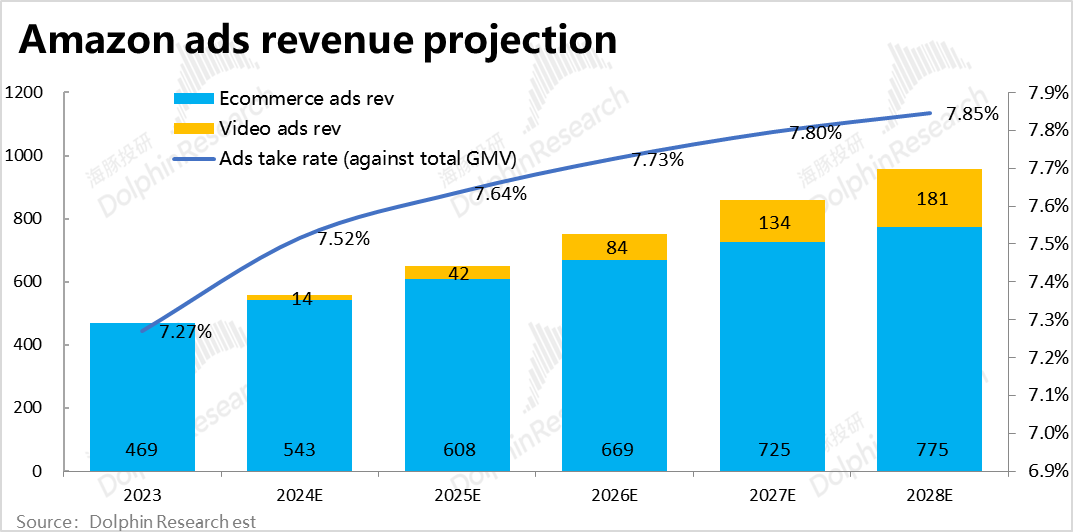

From the above analysis, it is clear that the improvement in Amazon's pan-retail segment profit margin primarily depends on the increase in the monetization rate of high-profit channels such as advertising (including 3P commissions). Based on Dolphin Investment Research's assessment that Amazon's share of e-commerce-like advertising has generally reached a neutral level, we anticipate Amazon's e-commerce advertising monetization rate to increase more slowly in the coming years, with advertising revenue growth converging towards GMV growth. Nevertheless, Prime Video advertising will take over to provide incremental revenue, reaching a neutral expected revenue of approximately $10 billion in about 2 to 3 years.

In terms of profit forecasts, as the growth of e-commerce advertising will gradually slow down in the future, the primary increment will stem from video advertising. However, unlike e-commerce advertising, which theoretically does not generate significant incremental costs, video advertising is a relatively high-cost business, entailing considerable expenses for continuously producing high-quality video content or purchasing sports event rights, among others. For example, Netflix's annual content cost reaches $16.5 billion, and Amazon's content cost in 2024 also surpassed $7 billion.

Consequently, Dolphin Investment Research maintains that, logically, given that future advertising revenue growth will predominantly stem from video advertising and its associated incremental content costs, video advertising may not significantly bolster Amazon's overall advertising business profit margin. Hence, we adopt a cautious outlook for the enhancement of the advertising business's operating profit margin in the forthcoming years.

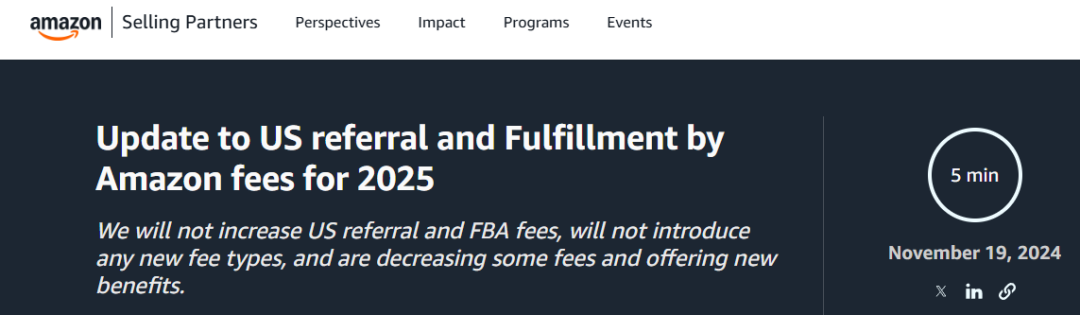

Regarding the profitability enhancement of Amazon's broader retail business, excluding advertising, it partly hinges on whether the company will elevate commission or fulfillment fee rates (the straightforward approach) and partly on improvements in Amazon's operational efficiency (the challenging path). Regarding the former, despite several increases in FBA-related fees in recent years, Amazon recently announced that it would not raise commissions or fulfillment fees in the United States in 2025 nor introduce any new fees, instead aiming for reductions or subsidies. This underscores the company's awareness of the detrimental impact of excessively high or frequent monetization hikes on the seller ecosystem.

In essence, over the next 1-2 years, the profitability enhancement of the retail business (excluding advertising) may solely rely on efficiency gains (i.e., the challenging path). Thus, it is unlikely to witness a substantial increase in operating profit margins surpassing the previous high of 1.1% in the ensuing 1-2 years.

- END -

// Reprint Authorization This article is originally created by Dolphin Investment Research.

// Disclaimer and General Disclosure This report is solely intended for general data use, enabling general browsing and data reference by users of Dolphin Investment Research and its affiliates. It does not consider the specific investment objectives, product preferences, risk tolerance, financial status, or unique needs of any individual receiving this report. Investors making investment decisions based on this report must consult with independent professional advisors. Any individual making investment decisions based on or referencing the content or information in this report assumes all associated risks. Dolphin Investment Research shall not be held liable for any direct or indirect responsibilities or losses that may arise from the use of the data contained herein. The information and data presented are sourced from publicly available information and are provided for reference only. Dolphin Investment Research endeavors but does not guarantee the reliability, accuracy, or completeness of the relevant information and data.

The information or opinions expressed in this report should not be construed as an offer to sell securities or an invitation to buy or sell securities in any jurisdiction. They do not constitute recommendations, inquiries, or promotions regarding relevant securities or related financial instruments. The information, tools, and materials contained in this report are not intended for distribution, publication, provision, or use in any jurisdiction where doing so would violate applicable laws or regulations or require Dolphin Investment Research and/or its subsidiaries or affiliates to comply with any registration or licensing requirements in that jurisdiction.

This report solely reflects the personal views, opinions, and analysis methods of the relevant creative personnel and does not represent the position of Dolphin Investment Research and/or its affiliates.

This report is produced by Dolphin Investment Research, and its copyright is exclusively owned by Dolphin Investment Research. Without the prior written consent of Dolphin Investment Research, no organization or individual may (i) produce, copy, reproduce, duplicate, forward, or create any form of copies or reproductions in any manner, and/or (ii) directly or indirectly redistribute or transfer to other unauthorized individuals. Dolphin Investment Research reserves all relevant rights.