Top Ten Conjectures About E-commerce in 2025

![]() 01/09 2025

01/09 2025

![]() 605

605

By James the Historian. 2024 was a challenging year for e-commerce, marked by the fall of top live-streamers, rampant fraud through "refund only" policies, merchants struggling to sell, and added uncertainty with Trump's election as US President. Amidst these challenges, players actively sought change. WeChat Pay and JD Logistics entered Taobao and Tmall, Alipay ventured into JD.com, and interconnectivity became a priority for growth. Ali appointed Jiang Fan to revitalize its e-commerce division and consolidated Intime and RT-Mart. JD grappled with traffic issues while exploring the female market. Pinduoduo expanded overseas while Douyin experimented with various strategies, and Kuaishou maintained a relaxed approach. Xiaohongshu prioritized live streaming, and "buyer e-commerce" gained momentum.

Image source: Internet

Overall, 2024 saw fewer tactics, weaker power dynamics, and less destructiveness in e-commerce battles. Amidst a tough environment, peace became a shared aspiration. Rather than pursuing significant progress, players focused on defending their territories. However, strategic changes were quietly taking effect. In this context, instant retail emerged as a bright spot, as other e-commerce areas became increasingly reliant on macroeconomic and policy shifts.

In an era of declining consumer tolerance for platforms and live-streamers, changes in the e-commerce landscape in 2025 will continue to impact the industry, despite the current stability.

01

Will the Price Wars Reignite?

In 2024, the price wars in e-commerce finally came to an end.

Taobao, Douyin, JD.com, and even Pinduoduo prioritized GMV growth over pricing power. Low prices traditionally attract traffic, but in today's era of stock competition, they lead to profit losses and intense competition. It was better for players to tacitly agree to earn within their respective bases. Currently, none can eliminate the others. However, will macroeconomic factors reignite these wars? In November 2024, the core CPI increased by only 0.3% year-on-year, and the year-on-year growth rate of total retail sales of consumer goods fell from 4.8% to 3.0%.

Image source: National Bureau of Statistics

In an era of limited spending power, who doesn't love low prices? Even Xiaohongshu, known for its premium offerings, sprinted towards new e-commerce GMV highs with low-priced white-label products. In a saturated e-commerce market, what can attract customers more than a price advantage?

Redefining pricing rights will remain a key focus for e-commerce players in 2025.

02

Continue to Make Concessions to Merchants, or Return to Users?

2024 marked the first year that the "refund only" policy became an industry standard.

This policy gave rise to fraudsters who sold "fraud" courses online. These shady operations led to endless merchant complaints. Platforms prioritized user benefits, leaving merchants as the disadvantaged party. This attracted regulatory scrutiny. Subsequently, major platforms adjusted their policies.

Image source: Internet

Starting August 7, Pinduoduo imposed restrictions on "refund only." After a consumer initiates a request, merchants have 36 hours of self-service processing rights, during which Pinduoduo customer service will not intervene. Taobao also revised its policy, and starting August 9, for merchants with a comprehensive store experience score greater than 4.8, platform customer service will not intervene in "refund only" cases. Kuaishou terminated its "refund without return" service on December 2, requiring merchant consent for "refund only"...

However, market trends may still force platforms to choose. Facing consumers who tasted the benefits of "refund only" but tightened their wallets this year, how should platforms proceed?

03

Should We Defend Our Basic Disk or Attack the Enemy's Territory?

In 2024, e-commerce consumption continued to diversify, making it difficult for platforms to meet all consumer needs.

National Bureau of Statistics data shows that cosmetics consumption plummeted by 26.4% year-on-year in November, while "household appliances and audio equipment" consumption surged by 22.2%. These products often correspond to female and male consumption, respectively. Under female CEO Xu Ran's leadership, JD achieved countertrend growth in beauty consumption. Ali's CEO Wu Yongming, with a programmer background, made Taobao's 3C digital and home appliance growth rates the highest on the network during the Double 11 shopping festival.

Image source: Fudan Consumption Big Data Laboratory

Simultaneously, JD and Douyin promoted their clothing businesses, demonstrating their determination with "true 50% off" deals and in-app traffic allocation. To influence consumer mindsets, platforms intensified marketing efforts. JD's Yang Li endorsement incident highlighted the risks of breaking through traditional circles. Let's see how e-commerce platform leaders adjust in the new year.

04

For Traffic, Will Liu Qiangdong Personally Take the Field?

Shelf e-commerce platforms, represented by JD, remain deeply trapped in traffic anxiety.

Last year, JD launched digital avatars of Liu Qiangdong and Xu Ran. When the conflict between Dong Yuhui and Sun Dongxu erupted, JD contacted Dong Yuhui, then a pillar of East Study Selection. JD managed to grab the 20 million-follower Douyin influencer Thurman Cat Cup but faced backlash due to the "Paris Elementary School Workbook" incident. Perhaps due to overexertion, the Yang Li endorsement incident and the Zhang Zetian Illuminati rumor during the Double 11 shopping festival severely damaged JD's male user base.

Weibo screenshot

JD's former CEO Xu Lei embodied the typical straight male aesthetic. Now that he has retired, perhaps only Liu Qiangdong personally taking the field can reshape JD's image among male users. The content traffic issue isn't limited to JD. In 2025, let's see who each platform invites to live stream and sell goods.

05

Who Can Ultimately Tame Young People's Consumption Choices?

Xiaohongshu is undoubtedly the most popular app among young women aged 25 to 35 in first- and second-tier cities. It is also actively breaking out of its niche, targeting male users and the lower-tier market to become the "first search platform most commonly used by young people."

2024 was crucial for Xiaohongshu's full-scale e-commerce development, reportedly achieving sales of over 100 billion yuan. From Dong Jie, Zhang Xiaohui, to Li Dan, more and more celebrity live-streamers have become benchmarks, drawing young buyers into live streaming rooms. To achieve its goal of 300 million daily active users in 2025, Xiaohongshu must further break out of its niche and make significant progress in commercialization, which may dilute the experience of core users. How can sophisticated young people trust platform buyer output?

Image source: Internet

Furthermore, the decline in female consumption, such as cosmetics, in 2024 was like a dark cloud on the horizon. On the other hand, the enthusiasm of boss ladies on Xiaohongshu even ignited interest in 1688, a 2B platform, and the culture of alternative consumption surged. Generation Z, whose "wallets haven't swelled up yet," and the new middle class, whose "wallets are empty," became active 1688 users. But how long can this enthusiasm last? At the same time, young people are ushering in their fourth consumption era. To a certain extent, the concept of second-hand consumption is continuously spreading and gaining influence among young people, signaling the true golden age of Xianyu.

Whether it's Xiaohongshu becoming more comprehensive, 1688 conforming to the current consumption environment and raising the banner of "alternatives," or Xianyu betting on the eve of the second-hand consumption boom, all three may reach a watershed in 2025.

06

Will the Sword of Damocles for Going Overseas Fall?

At the end of last year, Trump won the election and became the 47th President-elect of the United States.

He vowed to break decades of "free trade" principles and revert the US and the world to an era of protectionism. This was a shock, as going overseas is the fastest-growing business for many platforms. However, TikTok, which faced the "sell or ban" bill signed by Biden last April, seems to have turned a corner. Trump filed a request with the US Supreme Court on December 27 to suspend the forced sale order for TikTok.

Image source: Internet

Trump, viewing TikTok as an important channel for expanding his influence, may target TEMU, as this overseas e-commerce platform completely violates his trade philosophy. In fact, in Pinduoduo's market valuation, the TEMU business is already worth zero. Investors have accepted its fate.

More and greater unknowns await players from all walks of life.

07

Will the Double 11 and 618 Shopping Festivals Become Longer?

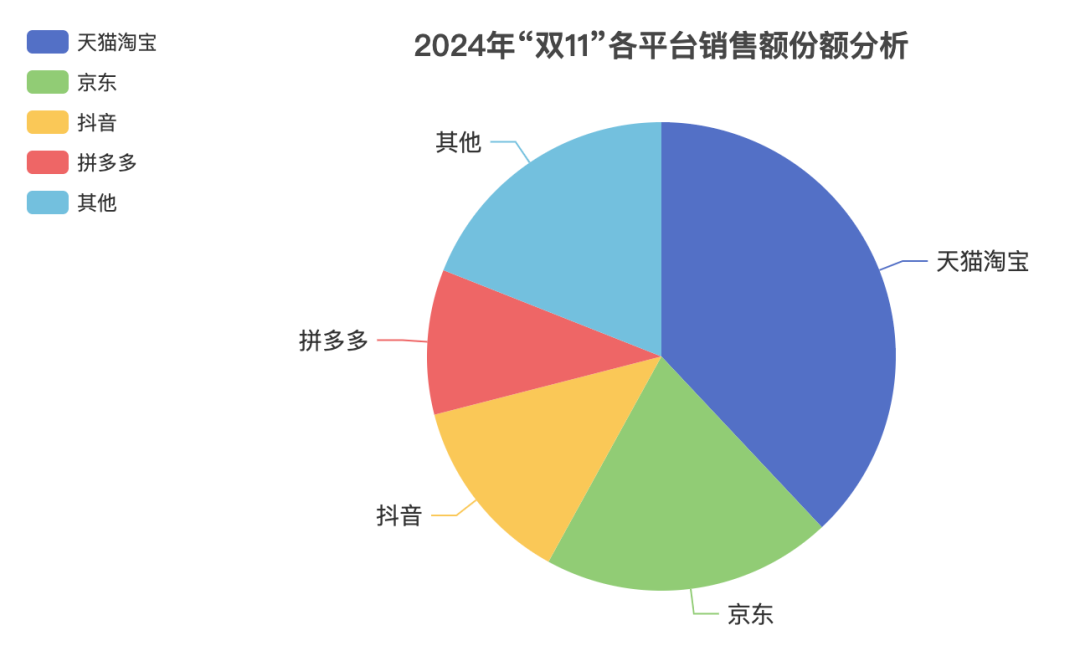

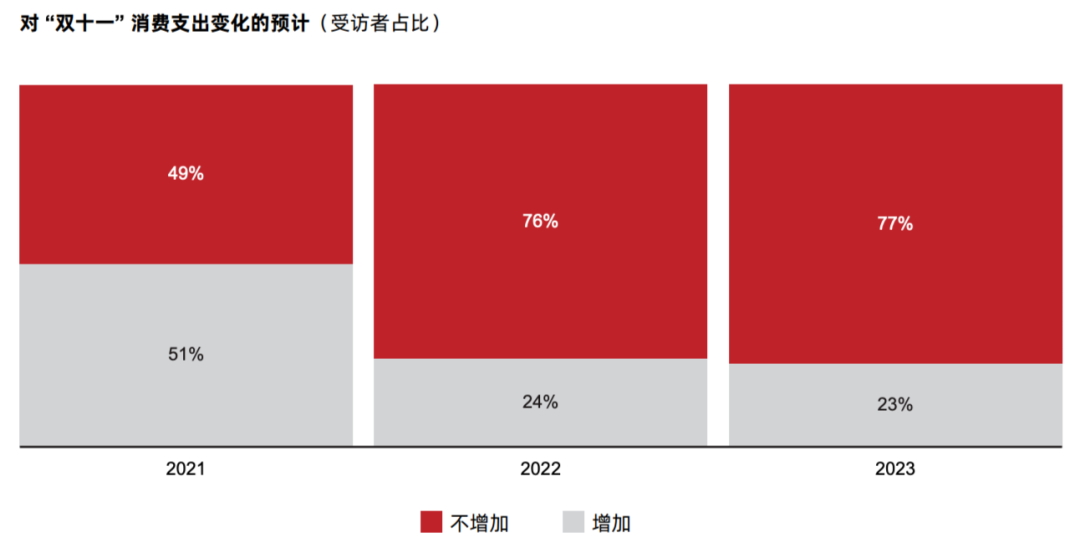

The 2024 Double 11 shopping festival was the longest in history, with the earliest pre-sale. It moved in the opposite direction of last year's "simplified rules" and "pricing power first." Due to the prolonged promotion period, year-on-year sales data lost reference value.

Tmall's battle report highlighted brand and 88VIP performance, while JD focused on user numbers and procurement and sales orders. Players haven't published sales figures since 2021, and consumer behavior has become routine. Bain & Company data shows that the proportion of consumers willing to increase spending on Double 11 in the past three years has dropped from over 75% to 23%.

Image source: Bain & Company

In 2023, L'Oréal Paris' daily sales accounted for 28% of its e-commerce sales in China, increasing to 44% in 2024, proving the rise in daily consumption's proportion.

So, will shopping festivals be extended again this year until they truly become "Double 11 every day"?

08

Which Top Live-Streamer Will Collapse Next?

2024 was a challenging year for top live-streamers.

Xiaoyangge collapsed due to the mooncake incident. He may have sensed this coming early, transitioning to micro-dramas from the beginning of the year, but couldn't escape his fate. Xinba's account was unblocked twice just before 618 and Double 11. He pointed out Xiaoyangge and announced his gradual exit from live streaming to open a supermarket, consulting Pangdonglai for this purpose. Dong Yuhui went independent, establishing "Yuhui Tongxing," transforming from a bullied worker to a big capitalist earning hundreds of millions annually. He is no longer pitied, and his fatherly demeanor and lack of knowledge have become drawbacks.

Screenshot of Yuhui Tongxing live stream

Li Jiaqi, who repaired his reputation on "Picking Brothers," continued selling in the live streaming room and became the only remaining big winner. It's no wonder JD procurement and sales have been constantly trying to overtake him after the Haishi incident. Meanwhile, Xiang Zuo, who set new live-streaming sales records with abstract hot topics, and Huang Zitao, becoming increasingly close to Yaowang Technology, also aim to become top live-streamers. Wei Xue, a first-generation internet celebrity, surpassed East Study Selection with monthly total sales over 300 million yuan. The mindset of emerging top live-streamers can be summarized with a line from "Listening to the Spring and Appreciating Treasures": "I won't go to the top of the mountain anymore; whoever wants to go can go."

Who will be the next top live-streamer to collapse?

09

Which Will Explode Completely: Douyin Mall or WeChat Gift-Giving?

In 2024, the harsh realities for top live-streamers drove Douyin into shelf e-commerce.

In March 2024, Douyin introduced the Douyin Mall APP, which, according to QuestMobile data, witnessed a remarkable monthly compound growth rate of 42.8% in active users from March to November of the preceding year. By December, it had ascended to the top of the App Store's free shopping chart in China, as per NetEco Society rankings. Nonetheless, all merchandise within Douyin Mall originates from Douyin stores, offering users an identical shopping experience to that found on the Douyin APP. This underscores that Douyin's shelf e-commerce still heavily relies on live e-commerce. However, Douyin's approach of fostering miracles through strategic traffic management continues to prove effective, exemplified by the success of the Hongguo APP. Thus, the anticipated traffic surge for Douyin Mall remains a distant prospect.

Source: The Internet

While the direction of Douyin's shelf e-commerce, such as a focus on instant retail, remains uncertain, WeChat has accelerated its e-commerce endeavors. On December 19, 2024, WeChat Store introduced the "Gift Giving" feature, maintaining Allen Zhang's signature elegant product design. Reports suggest that WeChat may integrate mini-program e-commerce, with an annual transaction volume exceeding 2 trillion yuan, into the WeChat Store. If this materializes, Douyin, with its annual transaction volume of 2.6 trillion yuan, will likely emerge as WeChat e-commerce's primary target for catch-up.

Simultaneously, the Taobao app has also quietly rolled out the "Gift Giving" feature on a limited scale. This Spring Festival, it is highly plausible that utilizing "gift giving" as a strategy will become the first buzzworthy topic in the e-commerce industry for 2025.

10

Will front warehouses and the "store-warehouse integration" model determine the victor?

At the tail end of 2024, Meituan's "Xiaoxiang Supermarket" chose Saudi Arabia as its inaugural overseas location, signifying the successful validation of Xiaoxiang's business model in China.

However, among the players in the instant retail market, all except Meituan adopt the "store-warehouse integration" model, including Sam's Club, Hema, and 7FRESH. Conversely, Meituan continues to expand into lower-tier cities. Xiao Kun, Vice President of Meituan and Head of the Flash Purchase Business Unit, believes that any town with established takeout services presents an opportunity for Flash Warehouse instant retail. With Meituan's expansion into lower-tier cities and overseas markets, the rivalry between these two models in the instant retail sector is poised to reach a conclusion in 2025. Additionally, there is a lingering concern in the new retail market regarding the ultimate fate of Hema.

Source: The Internet

Alibaba's "New Retail" strategy has been fully supplanted by a focus on "returning to the Internet." Following the transactions involving Intime Retail and Sun Art Retail Group, Hema stands as the sole remaining focal point. Hou Yi, the founder and CEO of Hema, retired in March of last year, handing over the reins to Yan Xiaolei, Hema's CFO. Daniel Zhang's initial plan for 2023 was to list Hema within 6 to 12 months, but possibly due to an unfavorable valuation, Alibaba announced the postponement of Hema's IPO on November 16, 2023. According to media reports, Hema has been actively seeking new strategic investors and has inquired about pricing with COFCO. On December 31, 2024, Yan Xiaolei noted in an internal letter that "Hema has achieved overall profitability over the past 9 months," with aspirations to "reach a scale of 100 billion yuan and become China's leading retail brand."

Whether "Alibaba will sell Hema" remains a question mark, with more developments expected to unfold in 2025.