KE Holdings Faces Equity Structure 'BUG': A Tough Problem

![]() 01/16 2025

01/16 2025

![]() 702

702

This article is written based on publicly available information and is intended for information exchange only and does not constitute any investment advice.

Eugene Fama's Efficient Market Hypothesis, proposed in the 1970s, is widely recognized as the cornerstone of modern capital market operations: in a well-functioning stock market, all valuable information, including the current and future value of the enterprise, is reflected in stock price movements. However, from a micro perspective, the vast majority of market targets worldwide are constantly fluctuating in transactions. In essence, investors' subjective judgments inevitably influence stock volatility, leading to a cognitive divergence between the information disclosed by enterprises and their market value. Over the past few years, China's largest real estate agent, KE Holdings (NYSE: BEKE), has exhibited a "surprising" market performance—performing exceptionally well in 2023, swiftly turning losses into profits, yet failing to gain market recognition, with its current valuation significantly below its initial listing valuation. Nevertheless, in the recently concluded 2024, among the top ten Chinese internet companies by market value, KE Holdings was the sole company to maintain positive market value growth despite negative revenue growth. Today, we delve into the following two questions:

1. Why can KE Holdings maintain growth despite a relatively pessimistic industry outlook?

2. Why has its market value performance been unsatisfactory despite relatively optimistic business performance?

01 A Challenging Business

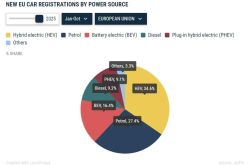

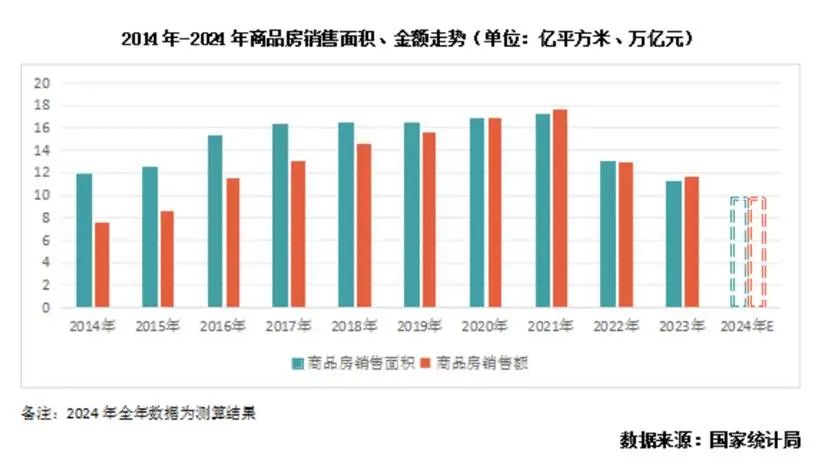

Echoing Zuo Hui's famous adage, "Do difficult but right things," the real estate agency industry, and the intermediary industry as a whole, is typically characterized by being a challenging yet correct business. Let's first discuss the challenges, which are stratified into three levels: Firstly, the most evident impact is that real estate agents, as the grassroots industry most reliant on real estate transactions, are undoubtedly the biggest victims of real estate cycles. Despite the frequent favorable policies in the real estate industry over the past two years, it is evident that the current real estate market requires a sufficiently long period to further digest these policies. According to statistics from EC.com.cn, the sales area of commercial housing in 2024 fell to the lowest range in nearly a decade, and sales were far below those in 2016.

Chart: Sales area and amount trends of commercial housing from 2014 to 2024, Source: EC.com.cn

The most intuitive impact is that the overall revenue scale of the real estate brokerage service sector, led by KE Holdings, I Love My Home, and World Union Properties, has declined by 20.89% over the past three years. Temporarily having no business to do is the first challenge encountered by real estate agents. Secondly, the contraction of the industry scale has accelerated the clearance of the real estate agency industry. Since the 1990s, the commercial housing market and financial market have gradually been liberalized, and the rapid expansion of the insurance market and real estate market has widened the corresponding talent gap. The concept of universal agents has been deeply ingrained in people's minds, transforming everyone from newly graduated college students to retired homemakers into so-called agents. Obviously, the current market size is difficult to support such a large group of practitioners. According to data from Anjuke Research Institute, taking the first half of last year as the benchmark, there were 11 months out of the past 12 where the average number of people per store declined month-on-month.

Chart: Changes in the average size of national online real estate brokerage firms, Source: Anjuke Research Institute

Losing one's job is a more dire situation than having no business. Finally, the uncertainty brought about by rapid fluctuations in the short term has meant that for a long time, the real estate agency industry has not established a complete transaction order, making it difficult for practitioners and investors to recognize the value of intermediaries. As mentioned earlier, unlike the mature and professional real estate agents in European and American markets, China's real estate market has expanded too rapidly, and the entry threshold for the agency industry is relatively low. The huge number of practitioners has led to excessive unprofessionalism. Consumers' negative perceptions of the agency industry have become increasingly serious. Coupled with the imperfections of financial tools and the real estate market in earlier years, negative public opinion has persisted, creating a natural distrust of the agency industry among the general public. As for why agents often seem aggressive and constantly harass customers, besides compensation, another issue is that the market's trading system is also imperfect, and buyers and sellers are unwilling to follow trading rules, leading to an increasing number of transactions bypassing agents. In the book "Crazy for Houses: Oral Histories of 16 Real Estate Agents" published last year by Liu Qingsong, the most distressing problem encountered by real estate agents is generally order bypassing. As agents rely on commissions for their livelihood, their only KPI is to close deals, and all previous efforts are hardly reasonably quantified. Therefore, extreme agents may even buy a tent to live in front of a customer's home to demand payment after encountering order bypassing, or be willing to spend several years finding the customer who bypassed the order for an explanation, appearing quite aggressive externally. The insufficiently stable income trend further leads to excessive turnover of practitioners and a further decline in professionalism. According to data from Anjuke's "2024 Survival Report of Million Real Estate Agents," only about 15% of practitioners who can engage in real estate agency business for a long time (more than 10 years) account for this proportion, and most practitioners regard agency as a career springboard. The lack of long-term professional talent and practitioners' inability to see a future, combined with an excessive focus on immediate interests, has led to slow professional development in the agency industry, which is the deepest challenge.

02 A Correct Business

Although agents are synonymous with the rapid expansion of the market economy and emerging professions in the universal worldview, they are also synonymous with instability. However, by examining historical records, we find that the agency industry is actually a rigidly demanded industry with strong professionalism and a long history. Since the Western Zhou Dynasty, there has been the profession of agency. According to "Zhou Li Di Guan Zhi Ren," it is recorded: "The Zhi Ren manages the goods and currencies in the market: people, cattle and horses, weapons, and precious items. All sellers and buyers use Zhi Ren as intermediaries." Zhi Ren has the functions of both managing the market and brokering transactions. The development of the agency industry to the Eastern Han Dynasty saw its professionalism increasingly strengthened. The term "Zang Kui" frequently appeared in literature, describing people who made a living by brokering transactions. By the Tang Dynasty, there had already been officially endorsed professional real estate agents called "Ya Ren." During the Later Tang Dynasty of the Five Dynasties and Ten Kingdoms period, there were folk intermediary associations called Ya Hang, with house-selling agents called Zhuangzhai Ya Hang, livestock-selling agents called Wuchu Ya Hang, and slave-selling agents called Shengkou Ya Hang. The most famous "Ya Ren" was An Lushan. Emperor Mingzong of the Tang Dynasty once ordered that if anyone wanted to buy or sell a house, livestock, or slave, they must go through the relevant intermediary. The criminal law of the Song Dynasty was even more stringent, with the "Song Xing Tong" clearly stipulating that transactions of fields and houses must be conducted through Ya Bao, and violators would be punished as thieves. Since then, a real estate agency system similar to Ya Hang has persisted into modern times.

Chart: Sample of "Song Xing Tong," Source: Internet

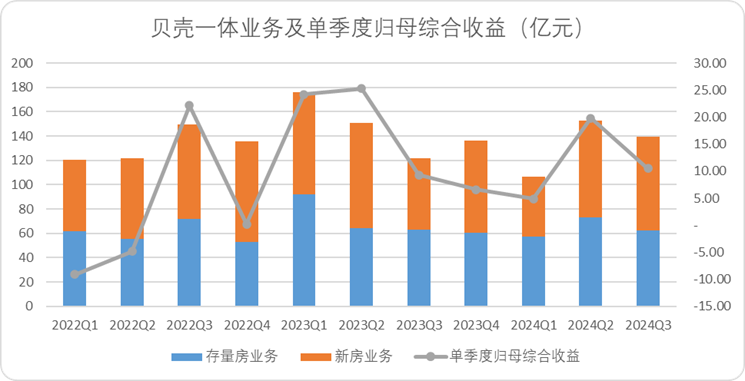

Since the Western Zhou Dynasty, the saying "Major matters rely on Zhi Ren and minor matters rely on Ji" has actually established the industry value of the agency profession: for both parties to the transaction, the completion of "major matters" relies on information transparency to ensure relative fairness in capital expenditure, and information transparency is in the hands of intermediaries. For managers, as a gathering center for transactions, centralized management of agencies helps to obtain transaction data, which can maintain the stability of the transaction market and the comprehensive coverage of deed taxes. These two core capabilities have laid the foundation for the agency industry as a rigidly demanded service industry. Then, if an enterprise can solve the most fundamental difficulties of this business, it can capture profits under rigid demand. Clearly, the grassroots-born Zuo Hui has achieved this. Zuo Hui is undoubtedly one of the few entrepreneurs in China's business history who possess both entrepreneurial spirit and management philosophy. Although Zuo Hui had many management philosophies and ingenious ideas, we believe that the core wealth he brought to Lianjia and KE Holdings was facing the challenge of professionalism and choosing to rise to the occasion. Regarding Zuo Hui's entrepreneurial and management philosophy, there are many references available, so we will not elaborate further here. We will only mention the two most core changes that drive the industry forward: Facing the problem of professionalization of real estate agents, Zuo Hui promoted the ACN cooperative network model and the agent professional training system, which to some extent solved the difficulties faced by professional agents at this stage. Facing the issue of market trust, from tripartite agreements to genuine listings, Zuo Hui promoted the standardized development of the industry and gradually reversed market perceptions. By solving these two core problems, even in the face of a downward industry cycle, KE Holdings has demonstrated to the market the rigid demand characteristics and potential of the agency industry: · Over the past three years, the income from KE Holdings' core business of existing homes and new homes has stabilized at between 12 billion and 18 billion yuan per quarter, with little impact from industry fluctuations. · Since Q3 2022, KE Holdings' quarterly consolidated net income attributable to shareholders has always been able to maintain above 1 billion yuan, with a relatively sufficient safety cushion for net profit.

Chart: KE Holdings' "One Body" business revenue and consolidated net income attributable to shareholders, Source: Corporate financial report, Jinduan analysis

Crises and opportunities coexist. After industry clearance, KE Holdings' market share increased from 5.5% to 14.6%, demonstrating to the market that the reputation accumulated over many years in the agency industry is a valuable intangible asset.

Chart: KE Holdings' market share trend, Source: China Merchants Bank Research Institute

Despite the cyclical downturn facing the industry, KE Holdings' performance has proven that agency is a solid rigid demand business. This is also why, despite a decline in growth rate throughout last year, KE Holdings' market value still increased.

03 KE Holdings' Trade-offs

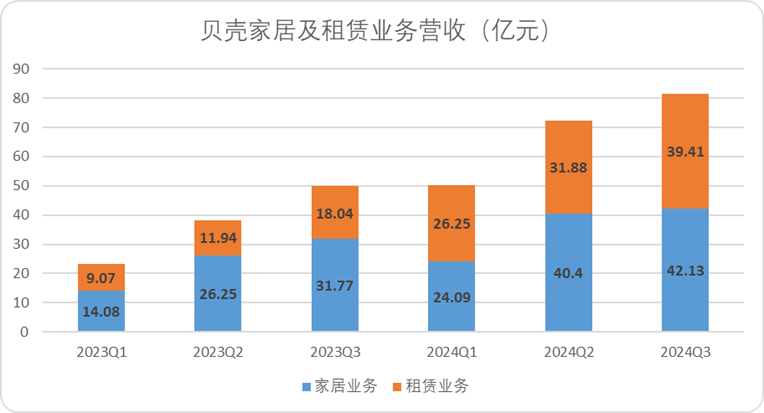

KE Holdings' business performance has demonstrated to the outside world the rigid demand for "housing" as a basic element of human survival. However, in the long run, since Zuo Hui's passing, although KE Holdings' business performance has recovered, its market value has still fallen by nearly 70%. The second question we need to clarify is: Why does the market, while affirming KE Holdings' business, refuse to give it a higher valuation? Some investors believe that the main reason for the pressure on KE Holdings' valuation is the unclear overall outlook for the real estate sector, which may continue to bottom out in the future, leading to increased pressure on KE Holdings' performance. Some investors believe that KE Holdings' second growth curve is currently unstable and requires a new narrative before a higher valuation can be justified. Admittedly, these two reasons are quite convincing and have some merit, after all, when the ground is slippery, people's first reaction is that it has just rained. But if we take a closer look at KE Holdings' business performance, besides the fact that even in a downward cycle, KE Holdings can still contribute more than 1 billion yuan in profit and 12 billion yuan in revenue per quarter, as mentioned earlier, the completion of its "One Body and Three Wings" strategic objective is actually not bad: Although the "third wing" C2M new business is currently not discernible, the first two wings, home decoration and affordable housing, have performed well. Since Q1 2023, rental business revenue contributions have grown from 907 million yuan per quarter to 3.941 billion yuan, and home furnishing business revenue has grown from 1.408 billion yuan to 4.213 billion yuan, both of which have compensated for the growth rate difference of the "One Body" business.

Chart: KE Holdings' home furnishing and rental business revenue, Source: Corporate financial report, Jinduan analysis

Furthermore, with its market share gradually increasing, KE Holdings exhibits immense potential during the post-cycle recovery phase. Currently, the company boasts over 15 billion yuan in cash equivalents on its balance sheet, ample to support countercyclical expansion. The ground's slickness, however, may not solely be attributed to rain. In our opinion, the answer might be straightforward—securing a high valuation is not KE Holdings' primary objective at this juncture. Rather, since the passing of Zuo Hui, KE Holdings' corporate governance has encountered certain challenges. For instance, as of the latest annual report, Chairman Peng Yongdong holds a 5.1% stake with 22.8% voting rights, Dan Yigang holds 2.8% with 10.3% voting rights, the Zuo Hui family trust holds the largest stake of approximately 23.7% with 17.2% voting rights (currently entrusted to management), and Tencent holds approximately 11.4% with 8.3% voting rights.

Chart: KE Holdings' Equity and Voting Rights Structure, Source: Corporate Financial Report, Choice Financial Client, Jinduan Analysis

Evidently, KE Holdings' grassroots-level management is well-versed in the pitfalls of the capital market, having learned from the hard lessons of its predecessor, Vanke. Currently, KE Holdings' management firmly holds the reins of the company's decision-making (Propitious has submitted an irrevocable letter of entrustment), with Peng Yongdong and Dan Yigang collectively wielding 50.3% of the voting rights. However, from a profit distribution perspective, the equity structure is relatively decentralized. The largest beneficiary, Propitious, does not participate in operations, the second largest is Tencent, introduced as a "financial investor," and the management team that actively engages in operations holds less than 10% of profit distribution. Therefore, balancing external investments with internal profit distribution is paramount for KE Holdings' management, who must navigate significant internal and external regulatory pressures. Post-Zuo Hui, KE Holdings' capital expenditure has notably declined, contrary to market expectations, as increased expenditure during countercyclical periods could expedite industry consolidation.

Consequently, KE Holdings has been relatively frequent in paying special dividends and conducting buybacks over the past two years, with a shareholder return rate of 7.3% for 2023 and an anticipated rate exceeding 5% in 2024.

Concurrently, management must also consider the interests of major shareholders who do not participate in operations. Currently, no shareholder holds more than 30% of KE Holdings' shares. The demand for share reductions from family trusts and financial investors is minimal, and the management's shareholding ratio is too low to engage in excessive market value management.

From a shareholding structure and corporate governance standpoint, management lacks incentive to sustain market value but has reasons to assure authorized major shareholders that, while maintaining management independence, they fully consider the interests of major shareholders and also address the immediate concerns of shareholder employees. Perhaps for this reason, after weighing various factors, management chose to prioritize current profit distribution over longer-term market value management. It may be this balancing act among various stakeholders that has contributed to KE Holdings' underwhelming market value performance.