Asian Auto Market | India June 2025: Mahindra Ascends to Second Place

![]() 07/18 2025

07/18 2025

![]() 460

460

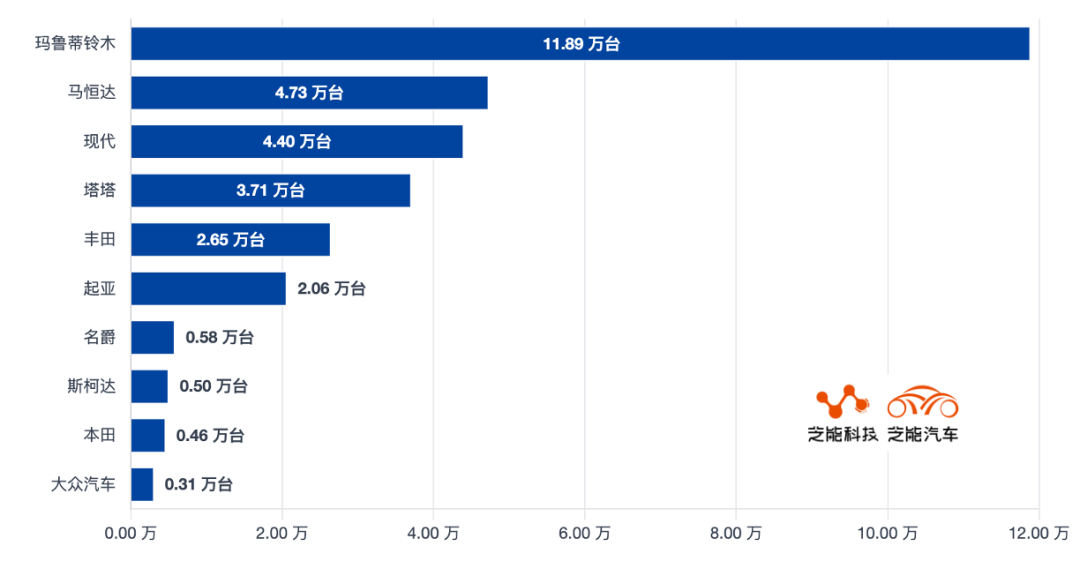

Amidst economic slowdown, seasonal downturn, and waning consumer confidence, the Indian automotive market nonetheless registered a modest growth in the first half of 2025. Mahindra emerged as the standout performer, vaulting to second place due to its robust product line and market adaptability, thereby disrupting the long-standing rivalry between Hyundai and Tata. While Maruti Suzuki retains its dominance, its market share has noticeably diminished.

Amidst the turbulent shifts in brand rankings and product updates, the Indian market is transitioning into a new phase, characterized by a shift from joint venture dominance to local independent brands driving growth.

01 Rise of Indigenous Brands: Mahindra Defies Trends, Maruti Suzuki Loses Momentum

In the first half of 2025, India's new car market expanded by a mere 1.3%, reaching 2.189 million units, but the brand landscape is quietly evolving.

◎ Long-time leader Maruti Suzuki, for the first time during a growth cycle, lagged behind the market, experiencing a year-on-year decline of 2.2% and a drop in market share from 41.6% to 40.1%.

This decline stems not only from waning popularity of its traditional models but also from its sluggish progress in the SUV segment. Models like the Wagon R, Dzire, and Vitara Brezza remain at the top of sales charts, but their outdated platforms and designs are gradually losing appeal, and their electrification and intelligence initiatives are lagging.

◎ In contrast, Mahindra surged ahead of Hyundai and Tata with a year-on-year growth rate of 20.3%, climbing to second place in sales.

Its robust growth is fueled by a surge in product strength, particularly the Thar and Scorpio models, which achieved year-on-year growth rates of 60.1% and 3.5%, respectively, underscoring its unique strengths in the mid-to-high-end off-road and multi-purpose vehicle markets.

The XUV series also maintained its strong performance, with the XUV300/3X0 and XUV700 witnessing year-on-year growth of 37.1% and 4.6%, respectively, addressing Mahindra's shortcomings in the urban SUV and family car segments.

Notably, Mahindra's new energy models, the XEV 9e and BE 6, have also made their mark on the sales charts, signaling its integration of new energy vehicles into its future product lineup.

◎ Hyundai and Tata failed to keep pace with market dynamics, experiencing declines of 7.7% and 7.9%, respectively. Despite the Hyundai Creta retaining the sales crown in June and celebrating its 10th anniversary in the Indian market, its sales still declined by 3.1% year-on-year. On the other hand, the Punch, Tata's top-selling model in 2024, plummeted by 23.3% in the first half of 2025 and by 42.7% year-on-year in June, highlighting the risks of relying on a single hit model.

◎ Skoda and MG surged ahead with the launch of new models. Skoda benefited from the introduction of the Kylaq, recording an impressive year-on-year growth rate of 134.1%, while MG achieved an 18.6% increase through models like the Windsor. These European and Chinese-backed brands are competing fiercely for market share with precise product positioning.

02 Intensified Product Landscape Dynamics: SUV Surge, Compact Sedans Hold Steady, Joint Venture Brands Face Constraints

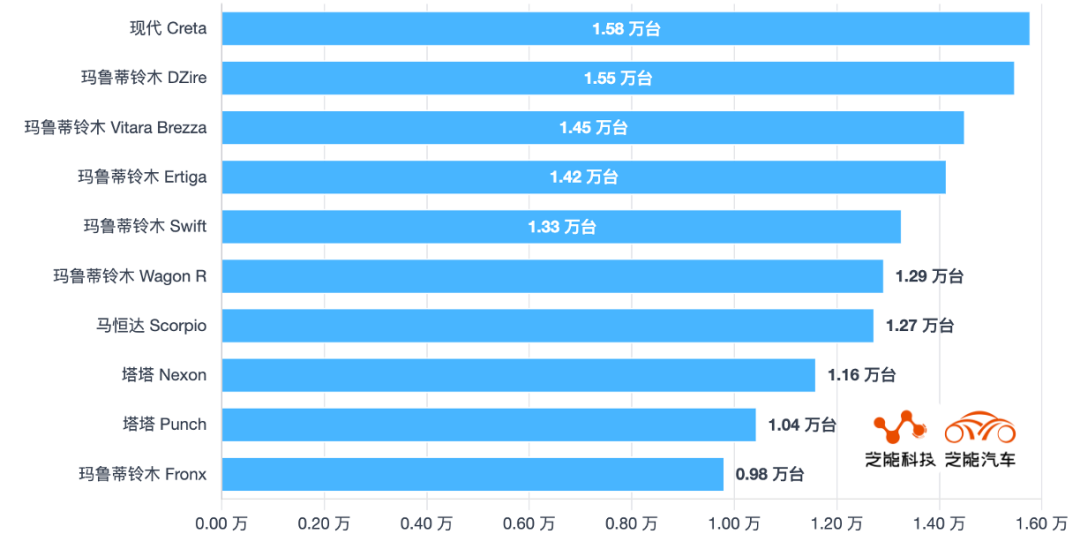

At the model level, consumption trends in the Indian market continue to favor compact cars and SUVs, with consumers becoming increasingly responsive to updates and replacements. While classic models like the Wagon R and Dzire remain popular, rankings are highly volatile.

For instance, despite the Creta winning the sales crown in June, its sales for the year were still slightly lower than those of the Wagon R; the new-generation Dzire, with its design upgrades and configuration improvements, soared to first place in May and remained in second place in June, reflecting Indian consumers' positive reception of "revitalized classics".

The SUV market remains the most competitive.

◎ Although several Maruti Suzuki models, including the Vitara Brezza, Ertiga, Swift, and Fronx, showed modest growth, their overall performance paled in comparison to Mahindra's.

◎ The Thar surged by 77.5% year-on-year in June, successfully entering the top 15, while the Scorpio and XUV300/3X0 also demonstrated stable growth. Especially in the price range above 150,000 rupees, Mahindra models offer differentiated competitiveness in terms of configuration, off-road capability, and brand perception.

◎ Kia maintained steady performance, with the Syros emerging as the most popular new model recently. Despite an overall sales decline of 3.2%, it still held a substantial market share.

◎ Toyota maintained positive growth with models like the Hyryder and Innova.

◎ In contrast, joint venture brands such as Renault, Nissan, Honda, and Jeep experienced sales declines exceeding 20% due to aging products, slow updates, and weak distribution channels. Notably, Nissan and Renault saw poor performance from their core models like the Kiger, Magnite, and Triber, which were even marginalized.

The Indian auto market is undergoing structural adjustments:

◎ Local brands are increasingly accurately grasping market demand, making significant inroads in both low-to-mid and mid-to-high price ranges;

◎ On the other hand, consumers have heightened expectations for model configurations, exterior design, and intelligence levels. Relying solely on brand appeal and cost-effectiveness is no longer sufficient to sustain a competitive edge.

Summary

In the first half of 2025, the internal structure of the Indian auto market is undergoing rapid transformation. From a brand perspective, Mahindra has achieved a significant milestone, with its dual-pronged strategy of off-road and family SUVs solidifying its footing in the space vacated by joint venture brands; while Maruti Suzuki, despite retaining the top spot, is witnessing slower growth, exposing its sluggish response to emerging market segments. Hyundai and Tata, on the other hand, must expedite adjustments in product renewal and price band strategy.