Asian Auto Market | Turkey June 2025: Tesla and BYD Dominate the EV Market

![]() 07/18 2025

07/18 2025

![]() 663

663

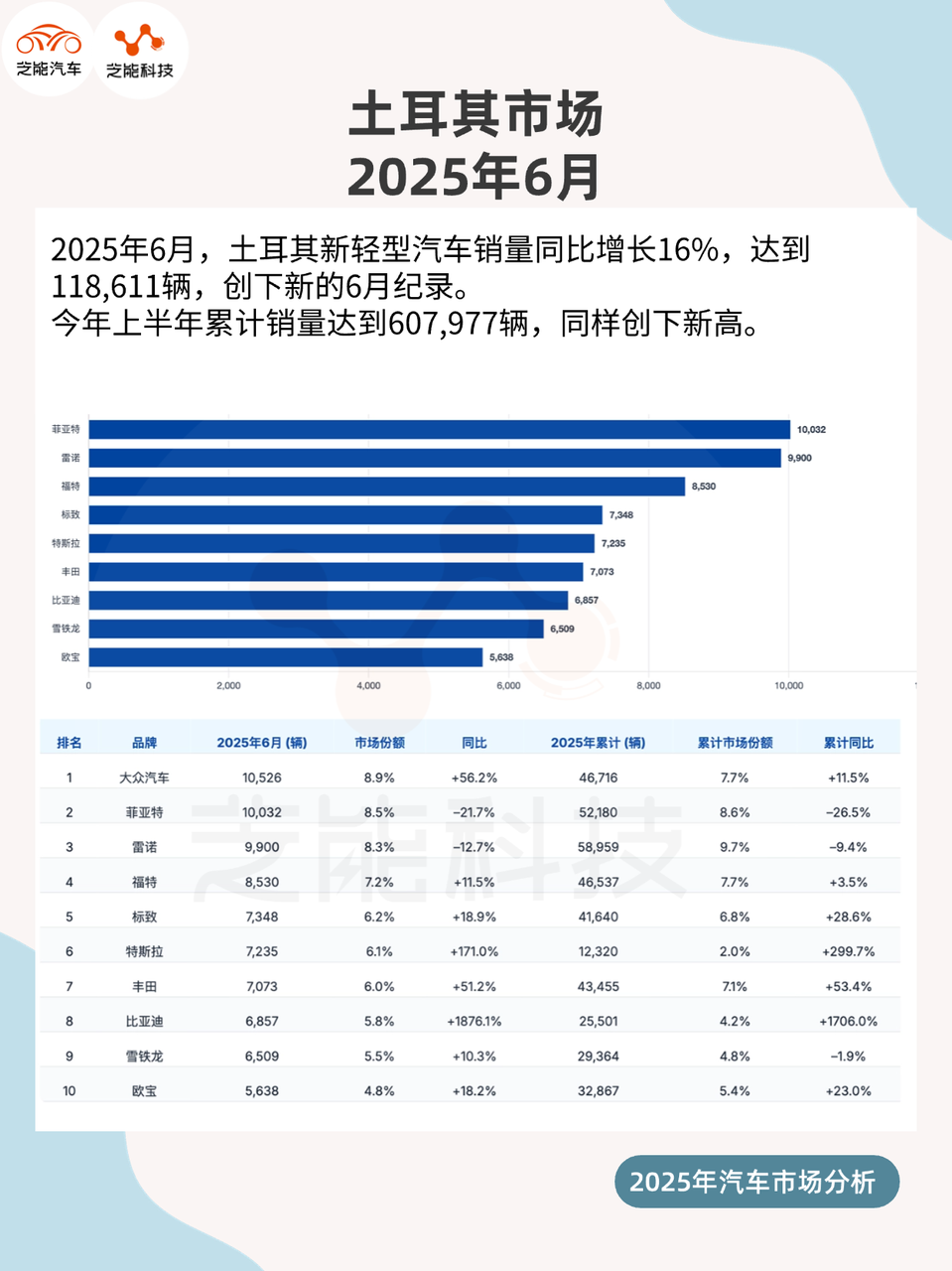

In June 2025, Turkey's light vehicle market soared to new heights, with sales of 119,000 units marking a fresh June record, up 16% year-on-year.

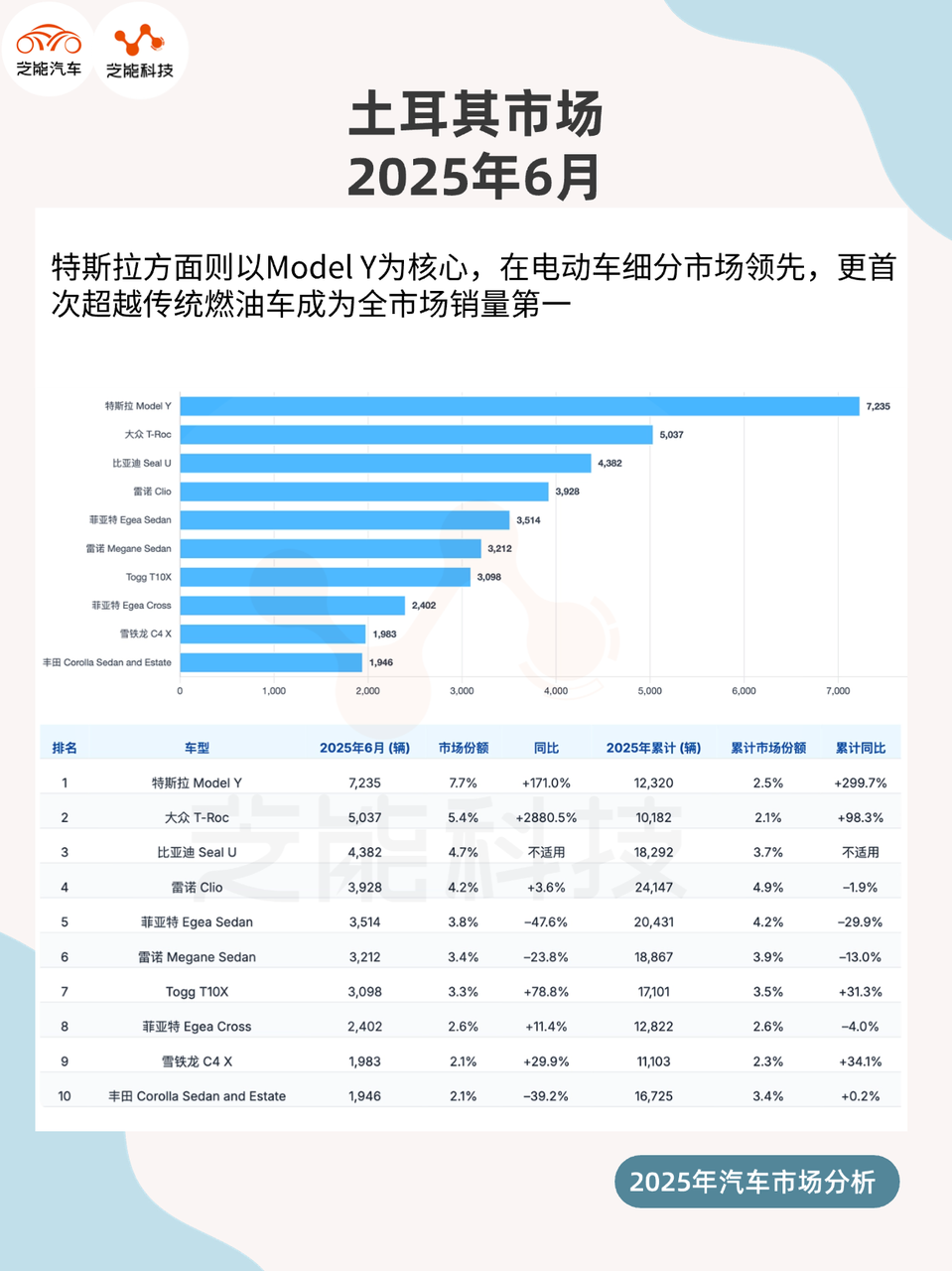

Amid this robust growth, new energy vehicles (NEVs) shone brightly, with Tesla and BYD firmly establishing themselves in the top 10 sales list. Notably, Tesla's Model Y ascended to the top spot for the first time, becoming the market's best-selling model.

Traditional powerhouses such as Volkswagen, Fiat, and Renault faced stiff competition, while Chinese brands swiftly expanded their influence in this evolving landscape.

01 Market Dynamics in Turkey: Electrification Drives Record Sales

In June 2025, Turkey's light vehicle sales reached 118,611 units, surging 16% year-on-year to set a new monthly record. This not only eclipsed last June's figures but also propelled the first-half sales total to over 600,000 units for the first time, reaching 607,977 units, indicative of robust growth momentum.

Brand Performance:

◎ Volkswagen reclaimed the top spot with a stellar 56.2% year-on-year growth, selling 10,526 units. This marked its first monthly championship since January 2020.

◎ Fiat and Renault, traditional mainstays, declined by 21.7% and 12.7%, respectively, placing second and third. However, Renault maintained its cumulative lead for the year.

Electric vehicle brands Tesla and BYD exhibited remarkable growth rates.

◎ Tesla's sales soared 171% year-on-year to 7,235 units, capturing a 6.1% market share and surging to sixth place, surpassing many traditional brands.

◎ BYD achieved a staggering 19-fold year-on-year increase, selling 6,857 units and securing a 5.8% market share, vaulting to eighth place and nearly matching Toyota (6.0%) and Peugeot (6.2%).

Model Performance:

◎ Tesla's Model Y, as its flagship model, not only led the EV segment but also surpassed traditional gasoline vehicles to become the overall market leader. As a pure electric brand, Tesla's strengths in product focus, user reputation, and software services were amplified in emerging EV markets like Turkey.

◎ Volkswagen's T-Roc leaped from 20th place last month to second, with sales surging nearly 29 times year-on-year, highlighting the SUV segment's strong appeal.

◎ BYD's Seal U ranked third, outpacing long-time market dominators Renault Clio and Fiat Egea.

Changes in powertrain structure underscored the electrification trend. Electric vehicle brands like Tesla, BYD, and Togg witnessed significant growth, while traditional gasoline models like Fiat Egea and Toyota Corolla faced declines, with some models dropping by over 30% year-on-year.

02 Chinese Brands Accelerate Penetration: BYD Leads, Chery Under Pressure

Among Chinese brands, BYD emerged as the most prominent growth benchmark in Turkey during the first half of 2025.

In June, BYD's total sales reached 6,857 units, a breathtaking 1876.1% year-on-year increase, placing it eighth in the brand rankings, surpassing multiple European, American, Japanese, and Korean brands including Hyundai, Opel, and Skoda.

Cumulative sales from January to June this year hit 25,501 units, marking a year-on-year growth of over 17 times, a remarkable achievement.

Model Highlights:

◎ BYD's Seal U surged to third place in the overall market with 4,382 units, trailing only Tesla's Model Y and Volkswagen's T-Roc. This mid-size pure electric SUV is gradually becoming BYD's strategic flagship in overseas markets.

In addition to Seal U, BYD's Seal and Dolphin also began to gain mainstream traction. Specifically, Seal sold 897 units in June, entering Turkey's top 30 for the first time. Dolphin, though not in the top 40, is expected to gain market share in the small EV segment with the launch of subsequent versions.

◎ In contrast, Chery, which performed impressively in 2024, faced a significant correction in 2025.

Sales in June amounted to only 2,807 units, a year-on-year drop of 62.6%. Sales of its Tiggo 8 Pro Max were 1,404 units, down 55.6% year-on-year, while Tiggo 7 Pro Max declined to 1,103 units, marking a year-on-year drop of over 60%.

After a surge in 2024, Chery's momentum faltered in 2025, facing pressures from model updates, price competition, and brand recognition.

Jaecoo 7 sold 802 units in June, quickly ranking 27th in the brand list as a newcomer, showcasing Chinese brands' expanding presence in niche segments and varied product positioning.

◎ Additionally, Foton's commercial vehicles achieved sales of 325 units, exploring breakthroughs in the local light commercial vehicle market.

◎ Turkey's local EV brand Togg sold 3,098 units in June, up 78.8% year-on-year, ranking 14th. Its flagship model, T10X, placed seventh in the market, demonstrating strong local competitiveness. Togg's consistent performance indicates that Turkish consumers are increasingly embracing locally produced pure electric vehicles.

Collectively, Chinese brands have transcended the "cost-effectiveness" label, building a more systematic competitiveness in product quality, electrification technology, intelligent functions, and channel construction.

BYD's technological prowess and global system, Chery's overseas layout and multi-brand synergy, along with the entry of new force brands, are jointly propelling Chinese brands to achieve multiple breakthroughs in Turkey.

Summary

In the first half of 2025, Turkey's market exhibited strong signs of transformation in sales growth, brand dynamics, and powertrain evolution. Pure electric brands, led by Tesla and BYD, not only gained market share but also earned the trust of local consumers.

Turkey's market holds potential as a bridgehead for pure electric vehicles in Central and Eastern Europe: market size continues to expand, consumer acceptance improves, the policy environment remains stable, and the electrification momentum driven by local brand Togg provides fertile ground for the mutual growth of Chinese and foreign brands. For Chinese automakers, Turkey serves as both a strategic outpost to Europe and a promising market in its own right.