New energy vehicles that do not meet battery life standards will be subject to vehicle and vessel tax, effective from July!

![]() 06/11 2024

06/11 2024

![]() 809

809

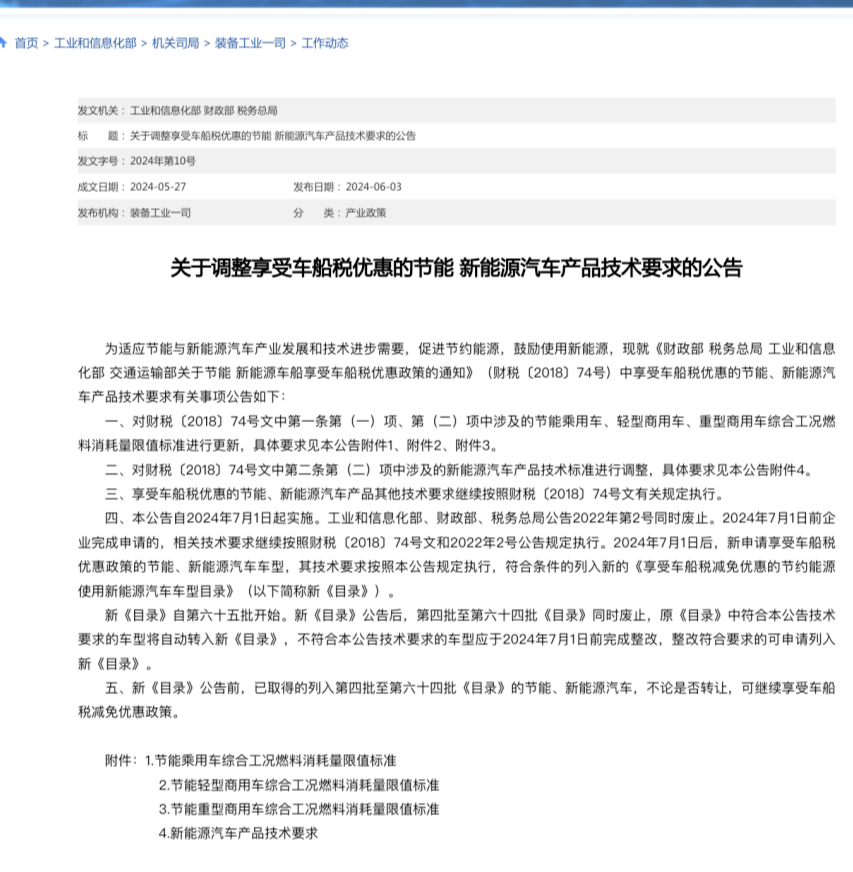

As energy conservation and emission reduction have become a global consensus, relevant departments in China have also continuously introduced measures to promote green travel. On June 5, 2024, the Ministry of Industry and Information Technology officially announced that, starting from July 1, 2024, the Ministry of Industry and Information Technology, the Ministry of Finance, and the State Taxation Administration will jointly adjust the technical requirements for products eligible for tax incentives for energy-saving and new energy vehicles.

In the future, energy-saving and new energy vehicles must meet a series of new conditions to enjoy tax incentives. What impact will the new policy have on the automotive consumer market? Will consumers' vehicle purchase costs increase? Let's discuss it.

Why do new energy vehicles have vehicle and vessel tax?

Some people may wonder, do new energy vehicles also pay vehicle and vessel tax? New energy vehicles are exempt from vehicle and vessel tax, and the use of new energy vehicles that are exempt from vehicle and vessel tax includes pure electric commercial vehicles, plug-in hybrid vehicles, and fuel cell commercial vehicles. At the same time, pure electric passenger cars and fuel cell passenger cars do not fall within the scope of vehicle and vessel tax and are not subject to vehicle and vessel tax. However, starting from July this year, new energy vehicles need to meet certain requirements to be exempt from purchase tax.

In the new energy vehicle market, battery life not only relates to the driving radius of the vehicle on a single charge but also determines the charging frequency, which is a decisive factor affecting the willingness to purchase new energy vehicles. In recent years, whether it is the early national and local subsidy standards or the adjustment of the vehicle and vessel tax policy, enhancing vehicle battery life and eliminating range anxiety have been considered long-term goals. The core assessment target of this policy adjustment is driving range.

For plug-in hybrid and extended-range passenger cars, according to the latest regulations, the pure electric driving range of plug-in hybrid passenger cars must be no less than 43 kilometers under conditional equivalent all-electric range. Looking back at the plug-in hybrid models on the market, they basically meet this standard, so the policy adjustment has almost no impact on these types of new energy vehicles.

For plug-in (including extended-range) and pure electric buses, the corresponding pure electric driving range must not be less than 50km and 200km, respectively. For plug-in (including extended-range) and pure electric trucks, the corresponding pure electric driving range must not be less than 50km and 80km, respectively. For hydrogen fuel cell commercial vehicles, the pure hydrogen driving range is required to be no less than 300km.

Although the adjustment of this preferential policy seems small, it hides玄机 and reflects the country's emphasis on the development and technological progress of the new energy vehicle industry. Every policy adjustment for new energy vehicles is based on the direction and standards proposed by market development trends, which can fully reflect the pain points in the consumption market's usage process and is more conducive to seizing new focus points. Therefore, although the adjustment of the vehicle and vessel tax preferential policy is a negative factor for some car owners, in the long run, it is a significant positive factor for environmental protection, industrial upgrading, and consumer rights.

The role and significance of vehicle and vessel tax?

Many people may wonder if it is necessary to start collecting taxes on new energy vehicles that have been exempted from taxes for many years. Before answering the question, let's first understand the definition and role of vehicle and vessel tax. Vehicle and vessel tax refers to a tax that the owner or manager of a vehicle or vessel within the territory of the People's Republic of China should pay in accordance with the Law of the People's Republic of China on Vehicle and Vessel Tax. Vehicle and vessel tax is paid annually and can be paid by insurance companies on behalf of the vehicle owner or directly by the vehicle owner to the local tax department, but it is usually paid together with the compulsory traffic insurance. If the vehicle is inspected, the vehicle and vessel tax will also be checked, and the vehicle owner needs to pay the tax before the inspection.

The imposition of vehicle and vessel tax on new energy vehicles is also a natural trend. After years of market cultivation, the consumer market has a basic understanding of new energy vehicle products. Compared with more mature traditional fuel vehicles, new energy vehicles in a period of rapid technological improvement enrich people's new vehicle usage scenarios while consumers also have higher requirements for the overall strength of the vehicle.

The state stipulates that every vehicle must pay vehicle and vessel tax according to regulations, and the tax is charged based on the size of the vehicle's exhaust capacity. The purpose of collecting vehicle and vessel tax is to further control resource shortages, protect the environment, and increase local fiscal revenue. If a vehicle owner fails to pay vehicle and vessel tax, the local tax authority will stop handling vehicle registration, inspection, and other motor vehicle-related businesses for the unpaid vehicle, which will undoubtedly cause great inconvenience to the vehicle owner's work and life. The consequences of a vehicle owner not paying vehicle and vessel tax on time are very serious, so it is better for the vehicle owner to pay on time rather than paying late fees and fines after being caught.

Fuel vehicles have always been paying vehicle and vessel tax, while new energy vehicles do not. However, in the era of new energy, it is an indisputable fact that the market share of fuel vehicles continues to decline. The market share of fuel vehicles is getting smaller and smaller, but they still support various additional taxes and fees for road maintenance, which is not practical in the long run.

The market share of new energy vehicles continues to increase, gradually reaching the time node for paying road tolls. The current trend in the new energy vehicle market is that subsidies for new energy vehicles are becoming fewer and fewer, and subsidies are intended to support the new energy industry. Once it reaches a certain level of development, it will start harvesting. Therefore, some substandard new energy vehicle models have also started to impose vehicle and vessel tax this year, which is the general trend and advocates equal rights for oil and electricity.

On the other hand, after years of market cultivation, the consumer market has a basic understanding of new energy vehicle products. Compared with more mature traditional fuel vehicles, new energy vehicles in a period of rapid technological improvement enrich people's new vehicle usage scenarios while consumers also have higher requirements for the overall strength of the vehicle. Automobile manufacturers can only attract users by launching models that meet market demand, which requires automobile manufacturers to continuously improve their research and development capabilities. Therefore, in the long run, the imposition of vehicle and vessel tax on new energy vehicles has greater significance.

People's Car Evaluation

According to my understanding, electric power resources are not renewable like fossil energy sources such as petroleum. With the progress of ultra-high voltage, numerous power resources in the west can continuously supply the entire country, bringing income to the local area while also alleviating China's energy pressure. Industrial equipment is also attracted by preferential electricity prices, achieving a transition from oil to electricity. Therefore, the development process of new energy is completely irreversible.

As new energy vehicles rapidly develop, the market share of fuel vehicles continues to decline, so the vehicle and vessel taxes collected by local departments are also decreasing, which is not conducive to local fiscal revenue and construction. Therefore, it is the general trend for relevant departments to start collecting vehicle and vessel taxes on new energy vehicles. Although the conditions for taxing new energy vehicles are relatively lenient now, it is estimated that they will become stricter in the future.