"Trade-in and Upgrade of Automobiles: Unleashing Potential, Enhancing Quality | Cover Story: A New Journey of Automobile Trade-in (Part One)

![]() 06/12 2024

06/12 2024

![]() 638

638

Editor's Note

Recently, the national and local governments have successively issued policies on automobile trade-in and upgrade, and automobile enterprises have also followed suit, sharing the benefits of policy packages. Under the guidance of the government and with the market as the mainstay, the trade-in and upgrade of automobiles, supported by policy synergies, will greatly unleash the potential of automobile consumption, promote the qualitative improvement and upgrading of the automobile industry, and have a profound impact on the new round of development of the automobile industry. Focusing on this round of trade-in and upgrade, "Auto Industry Review" has specially made this "Cover Story" special report. This special report consists of 5 articles, and the first article is released today. Please pay attention.

The subsidy policy for automobile trade-in and upgrade can be enjoyed simultaneously with the reduction of new energy vehicle purchase tax, financial credit support for vehicle purchase, and enterprise supporting discounts, forming a package. The combined effect of policies will unleash the potential of automobile consumption and promote the qualitative improvement and upgrading of the automobile industry.

On May 21, 2024, the spokesperson of the National Development and Reform Commission stated that since the introduction of the policy on large-scale equipment renewal and consumer goods trade-in, the central government has increased its support for equipment renewal and recycling projects, clarified the subsidy policy for automobile trade-in and upgrade, and set up a 500 billion yuan reloan for technological innovation and technological transformation; It also urged local governments to take prompt action. Twenty-seven provinces and cities, including Beijing, have issued implementation plans, introducing policies such as manufacturing loan interest subsidies, trade-in subsidies, and consumption coupons tailored to local conditions. The promotion of equipment renewal and consumer goods trade-in should adhere to the principle of market-orientation and government guidance, supporting various business entities to actively participate. The demand for equipment renewal and consumer goods trade-in is continuously being released. According to incomplete statistics from relevant parties, some home appliance and automobile companies have announced trade-in subsidy plans exceeding 15 billion yuan; multiple e-commerce platforms have cooperated with manufacturers to invest over 10 billion yuan in trade-in promotion activities.

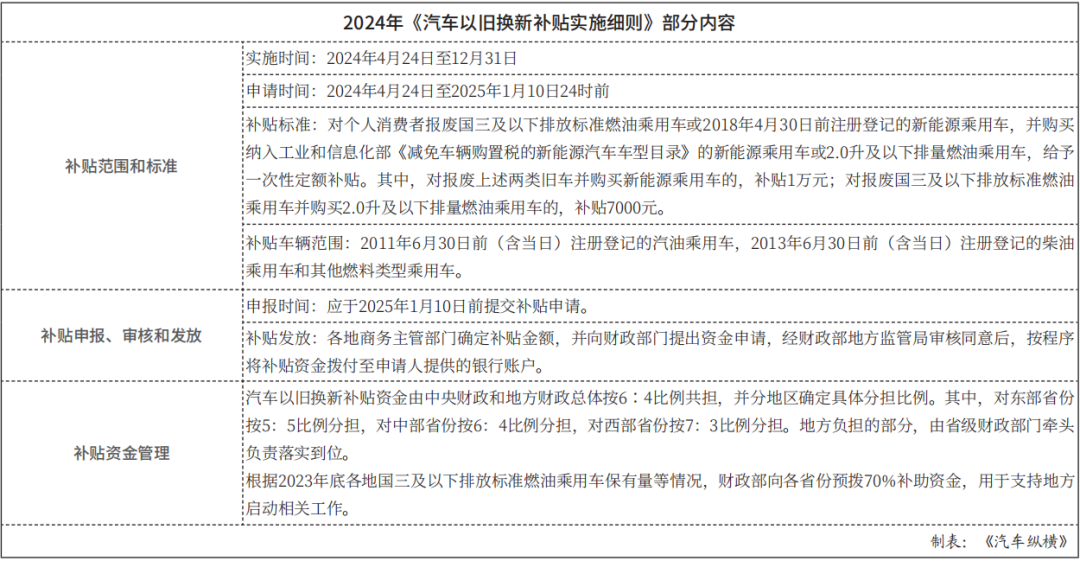

On April 26, the Ministry of Commerce, the Ministry of Finance, and six other departments jointly issued the "Detailed Implementation Rules for Automobile Trade-in and Upgrade Subsidies," implementing the spirit of the "Notice of the State Council on Printing and Distributing the Action Plan for Promoting Large-scale Equipment Renewal and Consumer Goods Trade-in" issued on March 13, 2024, and complying with the requirements of the "Notice of the Ministry of Commerce and 13 Other Departments on Printing and Distributing the Action Plan for Promoting Consumer Goods Trade-in" issued on April 12, 2024, to better implement the automobile trade-in and upgrade subsidy policy. The State Administration for Market Regulation and six other departments have also jointly issued the "Action Plan for Promoting Equipment Renewal and Consumer Goods Trade-in Through Standards Improvement" and other documents. Subsequently, various provinces and cities have successively issued measures related to automobile trade-in and upgrade. From the national to the local level, the combined effect of policies on automobile trade-in and upgrade will further unleash the potential of automobile consumption and promote the qualitative improvement and upgrading of the automobile industry. According to media reports on May 19, the first batch of national automobile trade-in and upgrade subsidies have been issued.

A relevant notice released on May 31 showed that the Ministry of Finance has allocated 6.44 billion yuan in central fiscal pre-allocated funds for automobile trade-in and upgrade subsidies in 2024. 2024 is the "Year of Consumption Promotion," and the action of automobile trade-in and upgrade is one of its implementation measures. The automobile market has a large volume and strong driving effect, with tremendous potential for renewal and upgrade. Trade-in and upgrade are important levers for promoting automobile consumption. The "Action Plan for Promoting Consumer Goods Trade-in" pointed out that promoting automobile "energy" replacement focuses on all aspects of the automobile's life cycle, including new cars, used cars, scrapped cars, and the automotive aftermarket, to unblock circulation bottlenecks, strengthen reform and innovation leadership, and promote automobile trade-in and upgrade across the entire chain. On May 9, He Yadong, the spokesperson of the Ministry of Commerce, introduced that the Ministry of Commerce focuses on several aspects in the policy design and implementation of the "Detailed Implementation Rules for Automobile Trade-in and Upgrade Subsidies": one is overall consideration.

Adhere to the integrated promotion of scrapping, renewal, and replacement. The central government financially supports scrapping and renewal, and encourages qualified localities to support automobile replacement. In policy design, domestic and foreign capital, as well as "local and nonlocal," are treated equally, and both new energy vehicles and fuel vehicles can enjoy preferential policies. The second is combined efforts. Coordinate support for all links in the entire chain of automobile consumption. The subsidy policy for automobile trade-in and upgrade can be enjoyed simultaneously with the reduction of new energy vehicle purchase tax, financial credit support for vehicle purchase, and enterprise supporting discounts, forming a package, striving to provide more benefits to the people. This round of automobile trade-in and upgrade actions is unprecedented in scale and is bound to have a profound impact on the development of the automobile market.

How Big is the Cake of the Automobile Trade-in and Upgrade Market

The atmosphere of the automobile trade-in and upgrade market is gradually taking shape. Undoubtedly, there is tremendous potential for automobile renewal and upgrade, but how big a market can it form? According to statistics from the Ministry of Public Security, as of the end of 2023, China's car ownership reached 336 million vehicles, of which new energy vehicle ownership reached 20.41 million, accounting for 6.07% of the total car ownership, while pure electric vehicle ownership was 15.52 million, accounting for 76.04% of new energy vehicle ownership. A portion of older vehicles will enter a period of concentrated renewal. Weber Consulting predicts that by around 2025, China will usher in a peak in the retirement of new energy vehicles and power batteries. Since 2020, the number of used car transactions registered nationwide has exceeded the number of new car registrations for four consecutive years. The automobile market has entered a new era of both increment and stock.

The "Action Plan for Promoting Large-scale Equipment Renewal and Consumer Goods Trade-in" states that by 2027, the amount of scrapped car recycling will double compared to 2023, and the transaction volume of used cars will increase by 45% compared to 2023. The "Action Plan for Promoting Consumer Goods Trade-in" proposes to strive to achieve accelerated elimination of passenger cars with emission standards of National III and below by 2025, with an increase of 50% in scrapped car recycling compared to 2023. The National Information Center estimates that in 2024, the demand for car replacement in China's automobile market accounts for 44% of the total demand, and is expected to increase to about 48% by 2025. On April 11, 2024, Zhao Chenxin, the Deputy Director of the National Development and Reform Commission, stated that there is tremendous market space for large-scale equipment renewal and consumer goods trade-in, focusing on durable consumer goods such as automobiles, home appliances, and furniture. The demand for replacement of automobiles and home appliances is in the trillions of yuan level.

According to motor vehicle insurance data, as of the end of 2023, there were approximately 13.708 million fuel passenger cars with emission standards of National III and below, and approximately 837,000 new energy passenger cars with a vehicle age of over 6 years. The number of eligible older cars is approximately 14.545 million. As of the end of 2023, there were over 8 million older vehicles with a vehicle age of over 15 years. Liu Bin, the chief expert of the China Automobile Center and the deputy director of the China Automobile Strategy and Policy Research Center, predicts that this round of scrapping and renewal can bring about an incremental scale of about 1 million to 2 million vehicles to the domestic market, accounting for approximately 4.5% to 9.1% of the domestic passenger car market share, including 400,000 to 800,000 new energy passenger cars and 600,000 to 1.2 million fuel passenger cars. The scale of replacement and additional purchases has reached 6 million to 7 million vehicles, with a replacement and additional purchase rate of about 30%.

Minsheng Securities believes that the automobile industry, with its main line of complete vehicle products, covers many fields upstream and downstream, specifically divided into three major links: production, circulation, and after-sales service, playing an important role in driving the economic chain and absorbing employment. The proportion of replacement and additional purchases in the passenger car market is gradually increasing, with the first-time purchase proportion declining from 70% in 2016 to 44% in 2023, the replacement proportion increasing from 23% in 2016 to 45% in 2023, and the additional purchase proportion increasing from 7% in 2016 to 11% in 2023. In 2023, the combined proportion of replacement and additional purchases reached 56%. According to the "China Recycled Resources Recovery Development Report," in 2022, the number of scrapped motor vehicles recovered nationwide was approximately 3.991 million, representing a year-on-year increase of 32.9% compared to the 3.002 million recovered in 2021. It is estimated that by 2027, the number of scrapped motor vehicles nationwide is expected to reach 10 million. Obviously, trade-in and upgrade are conducive to expanding domestic automobile demand and promoting the transformation and upgrading of the automobile industry.

Policies Focus on Four Action Directions

The 2024 automobile trade-in and upgrade action is rich and systematic in content. Specifically, the "Action Plan for Promoting Large-scale Equipment Renewal and Consumer Goods Trade-in" (hereinafter referred to as "the Action Plan") proposes to implement four major actions: equipment renewal, consumer goods trade-in and upgrade, recycling and utilization, and standards improvement.

In terms of equipment renewal, the Action Plan proposes to continuously promote the electrification of urban buses, support the renewal of old new energy buses and power batteries, and accelerate the elimination of diesel cargo vehicles with emission standards of National III and below. In terms of trade-in and upgrade, the Action Plan proposes to unblock circulation bottlenecks and promote tiered consumption and renewal consumption of automobiles. Organize and carry out national automobile trade-in and upgrade promotion activities, encourage automobile manufacturers and sales companies to carry out promotion activities, and guide the industry to compete in an orderly manner. Strictly enforce the regulations on mandatory scrapping standards and vehicle safety and environmental protection inspection standards, and eliminate old cars that meet the mandatory scrapping standards according to laws and regulations. Optimize car purchase restriction measures tailored to local conditions and promote the construction of an information exchange system for the entire life cycle management of automobile use. In terms of recycling and utilization, the Action Plan proposes to optimize the layout of scrapped car recycling and dismantling enterprises and promote the door-to-door car pick-up service model.

Intensify the remanufacturing of traditional equipment such as auto parts, construction machinery, and machine tools. Accelerate the research and development of residual life assessment technology for products and equipment such as power batteries, and orderly promote the graded utilization of products, equipment, and key components. Timely improve the import standards and policies for retired power batteries. The "Action Plan for Promoting Consumer Goods Trade-in" also proposes to improve the scrapped car recycling and dismantling system. Guide enterprises to enhance recycling service levels, facilitate car owners to deliver their cars, and promote the door-to-door car pick-up service model.

Optimize the layout of scrapped car recycling and dismantling industries tailored to local conditions, encourage scrapped car recycling and dismantling enterprises to improve the comprehensive utilization level of high-value resources. Regulate the business conduct of scrapped car recycling and dismantling enterprises, and investigate and punish illegal acts such as illegal dismantling according to laws and regulations. For used cars, the Action Plan proposes to continuously optimize the management of used car transaction registration and promote convenient transactions. The "Action Plan for Promoting Consumer Goods Trade-in" also proposes to continuously implement facilitation measures such as "reverse invoicing" for used car sales and cross-regional transaction registration, eliminating various hidden obstacles. Promote the open use of non-confidential and non-private information in the automobile sector, enhance the operational quality and efficiency of independent third-party used car information inquiry platforms, and support the construction of platforms for testing and valuing power batteries in new energy used cars. The "Action Plan for Promoting Consumer Goods Trade-in" also proposes to cultivate and expand used car business entities.

Support the transition of used car sales from brokerage to dealership, encourage automobile manufacturers to carry out used car replacement, factory certification, and other businesses, encourage used car dealerships to provide vehicle warranty services, encourage localities to carry out graded and classified management of used car dealerships, and promote the branding and scale development of used cars. The Action Plan proposes to vigorously develop the export business of used cars. The "Action Plan for Promoting Consumer Goods Trade-in" also proposes to implement management measures for used car exports, improve the quality of used car exports, enhance the international business capabilities of used car export enterprises, and support them in continuously expanding overseas markets. In terms of standards improvement, the Action Plan proposes to accelerate the improvement of energy consumption, emission, and technical standards.

Benchmarking international advanced levels, accelerate the revision of a batch of mandatory national standards for energy consumption limits, product equipment energy efficiency, dynamically update the advanced level, energy-saving level, and access level of energy efficiency for key energy-consuming products and equipment, and accelerate the improvement of energy-saving indicators and market access thresholds. For example, focus on bulk consumer goods such as automobiles, accelerate the upgrading of standards related to safety, health, performance, environmental protection, and testing. Establish and improve a mechanism for tracking and transforming international standard consistency, and continuously improve the conversion rate of international standards. The "Action Plan for Promoting Equipment Renewal and Consumer Goods Trade-in Through Standards Improvement" puts forward requirements from multiple aspects: First, promote the transformation and upgrading of automobile standards. Revise the safety standards for electric vehicle power batteries, increase the supply of safety and charging/swapping standards for new energy vehicles, strengthen the research and development of intelligent connected vehicle technology standards such as autonomous driving and lidar. Improve automobile after-sales service and maintenance standards. Accelerate the upgrading of energy consumption limits for passenger cars, heavy commercial vehicles, and other vehicles.

Secondly, promptly formulate energy consumption limit standards for lithium battery anode and cathode materials. Formulate electromobility standards for construction machinery such as excavators, loaders, and dump trucks. Thirdly, formulate a series of standards for the disassembly and traceability of reusable parts from scrapped motor vehicles. Accelerate the improvement of standards for the recycling, sorting, dismantling, and recycling of products such as automobile tires. Improve and perfect the standards for the recycling and utilization of new energy vehicle batteries. Finally, focus on key consumer goods such as new energy vehicles, increase defect investigation and recall efforts. Explore the establishment of a "sandbox supervision" system for product quality and safety for new technologies and products such as intelligent driving.

The "Action Plan for Promoting Consumer Goods Trade-in" also proposes to strictly enforce the requirements of motor vehicle scrapping standards and vehicle safety and environmental protection inspection standards, eliminate old cars that meet the mandatory scrapping standards according to laws and regulations, and formulate and implement relevant standards for the evaluation of old car values, the circulation of reusable parts from scrapped motor vehicles, and the identification of traditional classic cars. On April 11, 2024, Liu Hongsheng, the Director of the Standards and Technology Management Department of the State Administration for Market Regulation, stated that it will accelerate the iterative upgrading of standards for electric vehicles, intelligent connected vehicles, and automobile after-sales services, and issue standards such as used car valuation. In this round of trade-in and upgrade actions, specific standards and requirements for subsidies have also been proposed, covering both new energy vehicles and fuel vehicles, with new energy vehicle subsidies higher than those for fuel vehicles. Liu Bin stated that based on 2023 passenger car sales data, 93% of new cars are eligible for subsidies. According to motor vehicle insurance data, in 2023, domestic traditional fuel passenger car sales reached 14.652 million, of which 13.692 million were 2.0-liter and below displacement fuel passenger cars, accounting for 93.4%. According to calculations by the China Automotive Policy Research Center, the models included in the "Catalog of New Energy Vehicle Models Eligible for Vehicle Purchase Tax Reduction" account for approximately 93% of new energy vehicle models. In addition, the "Detailed Implementation Rules for Automobile Trade-in and Upgrade Subsidies" proposes to implement supervision and management over the subsidy funds for automobile trade