EU Tariff Increases Loom, but You Can't Have Your Cake and Eat It Too

![]() 06/12 2024

06/12 2024

![]() 626

626

Introduction

Introduction

No matter how the EU imposes tariffs on Chinese electric vehicles, I believe these actions cannot change China's determination to take root locally.

Author: North Shore

Editor-in-Charge: Cao Jiadong

Editor: He Zengrong

At a crucial juncture when the EU is considering imposing additional tariffs on Chinese cars, Turkey has announced a significant news: the country plans to increase tariffs on vehicles imported from China to 40%, and the relevant decision will take effect after 30 days.

According to information published in the Turkish "Official Gazette," the new tariffs apply to all fuel-powered vehicles, with an additional tariff of at least $7,000 per vehicle, equivalent to approximately 50,000 yuan in Chinese currency.

In fact, as early as 2023, Turkey imposed a 40% tariff on electric vehicles imported from China. With the introduction of the new tariff regulations, it means that all cars imported from China, including fuel vehicles, will be subject to an additional tariff of up to 40%.

From Turkey's perspective, taxing Chinese electric vehicles is not enough, as 78% of the cars imported from China are fuel vehicles. The Turkish Ministry of Commerce emphasized in a statement that the purpose of the new tax is to curb imports, increase the market share of domestically produced vehicles, and reduce the government's current account deficit.

Cui Dongshu, the secretary-general of the China Passenger Car Association, recently told domestic media that Turkey's tariff increase is mainly due to the country's government's perception of "trade imbalance".

However, in reality, Turkey is not the only country or region that believes that China's electric vehicle cross-border trade is "unbalanced." As early as last October, the EU announced an anti-subsidy investigation into electric vehicles imported from China and will subsequently decide whether to impose anti-dumping tariffs.

Previously, foreign media reported that June 5 would be the deadline for the EU to make a decision, but according to Hong Kong's "South China Morning Post," temporary tariffs will take effect on July 4. Considering the five-yearly European Parliament elections, the EU has postponed its previous decision on Chinese auto tariffs scheduled for early June.

One Move Affects the Whole

The relationship between the European automotive industry and China is very special, especially for established automotive powers like Germany, which has a long history of "two-way" collaboration with Chinese automakers. Many policies often affect the whole system. Therefore, even if the EU intends to restrict Chinese cars, there are significant differences among the core member states on the issue of increasing tariffs.

German Chancellor Olaf Scholz is one of the opponents of EU tariff increases.

Scholz has repeatedly spoken out publicly, saying that increasing taxes on Chinese electric vehicles is a "bad idea." In his view, after the outbreak of the Ukraine-Russia conflict, the German economy has faced unprecedented challenges. Against this backdrop, the EU should not "follow the US's footsteps" in terms of electric vehicles. It must consider the overall situation and protect the interests of overall business transactions.

Manufacturers such as Volkswagen, BMW, and Mercedes-Benz, which belong to the German camp, have also vocally opposed the EU imposing higher import tariffs.

Volkswagen's chief financial officer even sharply criticized the increase in tariffs as a very short-sighted move that will only bring temporary relief. In the long run, European automakers should reduce costs, improve their internal capabilities, and maintain competitiveness. The most realistic result is that the EU's additional tax barriers may provoke severe retaliatory actions.

Carlos Tavares, the CEO of Stellantis, also expressed his position on this matter, stating that imposing excessively high tariffs is a "trap." For the EU, it will not avoid competition and challenges from Chinese automakers. His view is consistent with Volkswagen's. The top priority for European automakers is to strengthen cost competitiveness, "but many European countries do not want to face this reality."

As early as March this year, Ola Källenius, the chairman of the board of Mercedes-Benz, made a clear statement. In his view, the EU should never seek wealth in protectionism, which is a wrong path. "The EU should reduce tariffs on Chinese electric vehicles because short-sighted protectionism will bring immeasurable and irreparable losses to European car manufacturing."

Before this, the Biden administration also imposed new tariffs on China, but the actual impact of the new European tax policy on China's electric vehicle industry is much higher than that of the US White House.

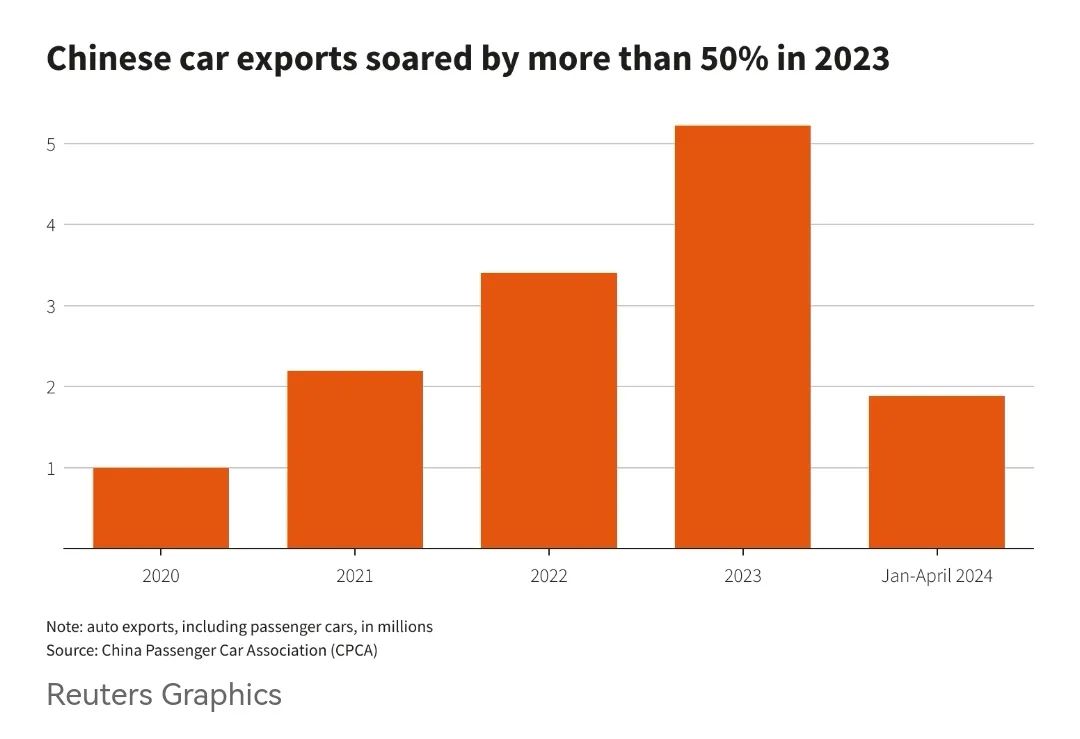

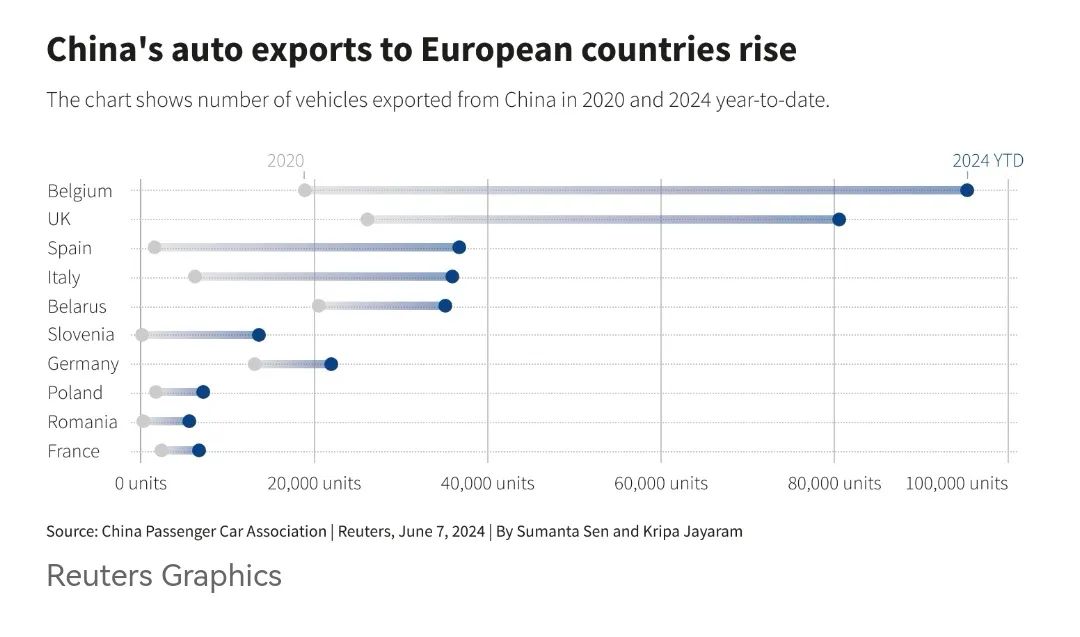

According to data released by the US government, China's auto exports to the US were $1.45 billion in 2021, which shrank to $368 million in 2023, accounting for only 1.08%. However, the proportion exported to Europe in 2023 has reached as high as 40%.

According to data from the consulting firm Alix Partners, the sales of Chinese brand cars accounted for about 4% of the European market share in 2023 and are expected to reach 7% by 2028.

You Can't Have Your Cake and Eat It Too

European governments need to consider more complex factors when formulating new tax policies. The EU is wary of Chinese electric vehicles, fearing that cars from China are cheaper and more competitive, gradually抢占本土制造商的市场蛋糕。

On the other hand, the EU has to consider the investment and employment opportunities that Chinese cars bring to the local area. While investigating Chinese auto subsidies and considering imposing higher tariffs on imported cars, EU governments are also formulating their own incentives to attract Chinese automakers to invest and build factories locally.

Hungary is a typical case of European countries "embracing China." The country's new car production reached approximately 500,000 vehicles in 2023, receiving BYD's first factory investment in the European market, which was described by the Hungarian Foreign Minister as "one of the greatest investments in Hungarian history."

In the past few years, Hungary has also attracted a 7.3 billion euro battery factory from CATL and investments from multiple automakers' component bases. According to BYD's latest plans, the company is also considering building a second European factory in Hungary in 2025.

European media have also reported that Budapest has negotiated with Great Wall Motors to provide investment policies for its first European factory, creating more local job opportunities.

Spain is the second-largest automaker in Europe after Germany. In April this year, Chery Automobile signed a cooperation agreement with Spanish company Ibermotor, and the two parties will establish a joint venture locally to start producing electric vehicles in the fourth quarter of this year. The annual production capacity is expected to expand to 150,000 vehicles by 2029.

Reuters reported that SAIC Motor aims to establish two factories in Europe. Insiders revealed that the first factory will be based on existing facilities and may be announced as early as July this year, with an annual production capacity of up to 50,000 vehicles.

For the second European factory, SAIC Motor plans to build it from scratch, producing up to 200,000 cars per year. Sources revealed that Germany, Italy, Spain, and Hungary are all on SAIC Motor's candidate list.

Of course, according to consulting firm statistics, a 15,000-euro car produced in China, if sold in Europe, requires transportation and logistics costs of 500 to 3,000 euros.

Northern Europe has high labor costs and limited competitiveness, while Italy and Spain, further south, strike a balance between labor costs and manufacturing standards, making them the preferred locations for China's high-end cars. On the other hand, Eastern Europe and Turkey are more attractive to low-cost vehicles.

Currently, the EU imposes a 10% tariff on Chinese electric vehicles, and experts predict that this ratio may increase to 20% to 30%.

According to the latest report from the Kiel Institute for The World Economy, a German economic research institute, if the EU imposes a 20% tariff on Chinese electric vehicles, the number of Chinese electric vehicles imported into the EU will decrease by 25%, worth nearly $4 billion (equivalent to approximately 29 billion yuan in Chinese currency).